Treasury Manager Resume Guide

Treasury managers oversee the financial activities of an organization, including cash management, investments and budgeting. They handle capital funds and ensure that there are sufficient liquidity levels to meet operational needs while maximizing investment returns.

You have the experience and financial acumen to manage any treasury department, but potential employers don’t know who you are. To make them aware of your capabilities, create a resume that highlights all of your accomplishments in the field.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

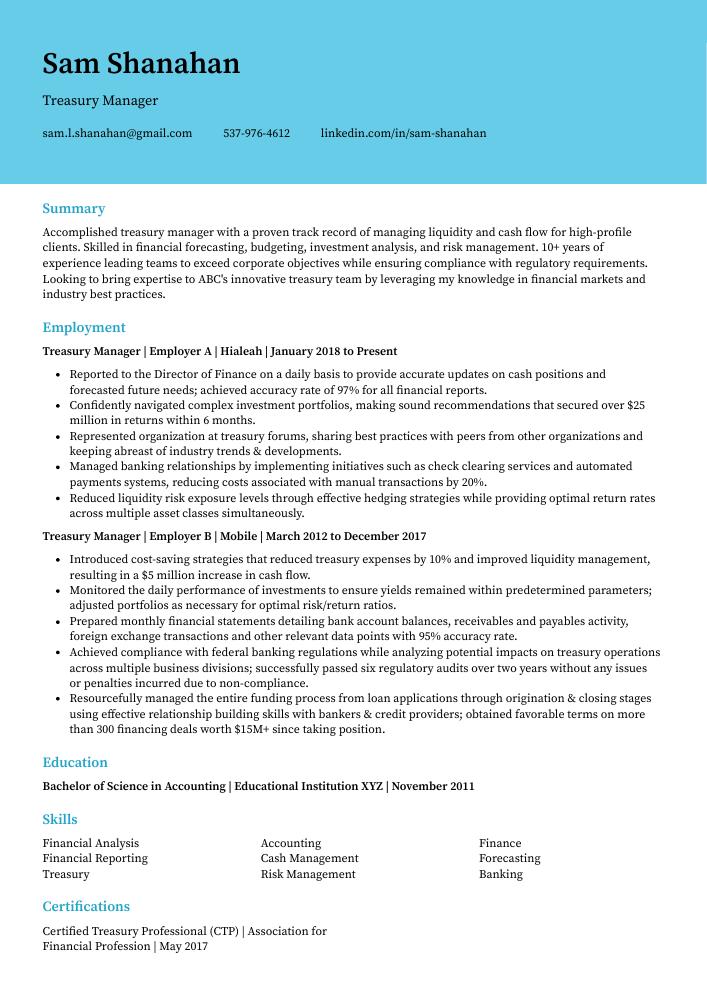

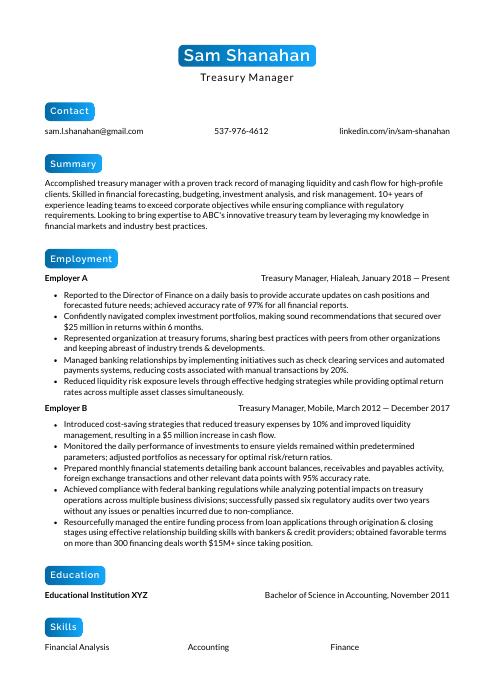

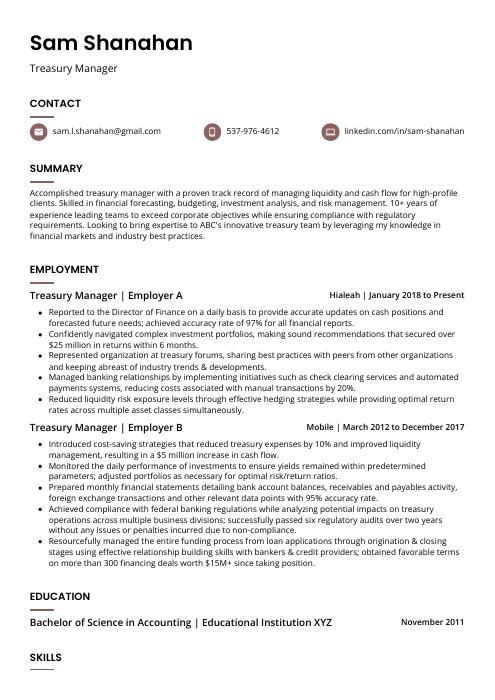

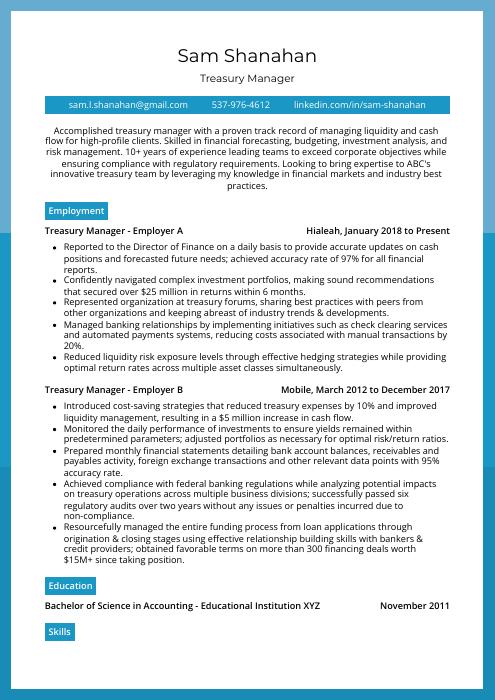

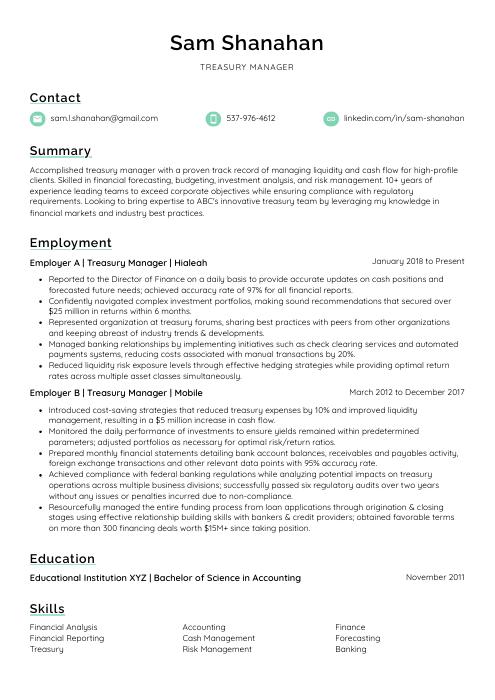

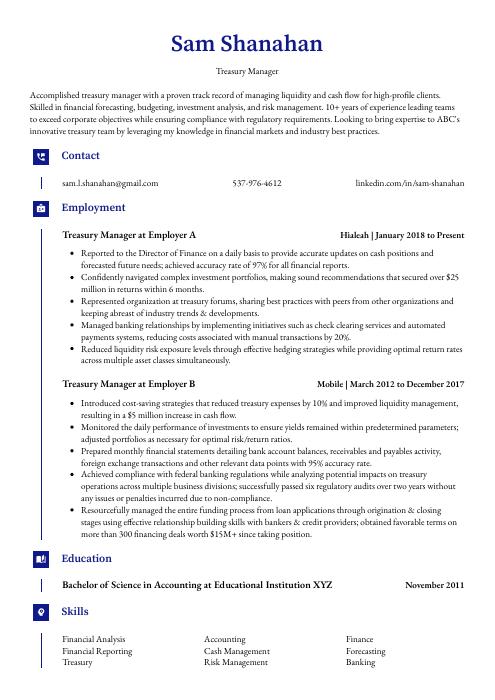

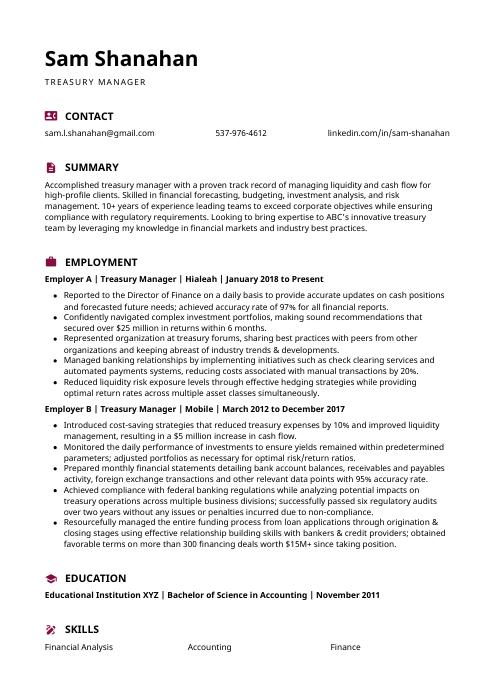

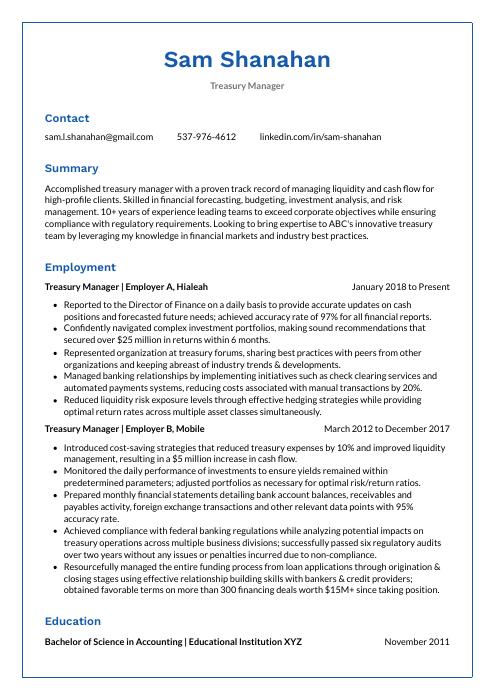

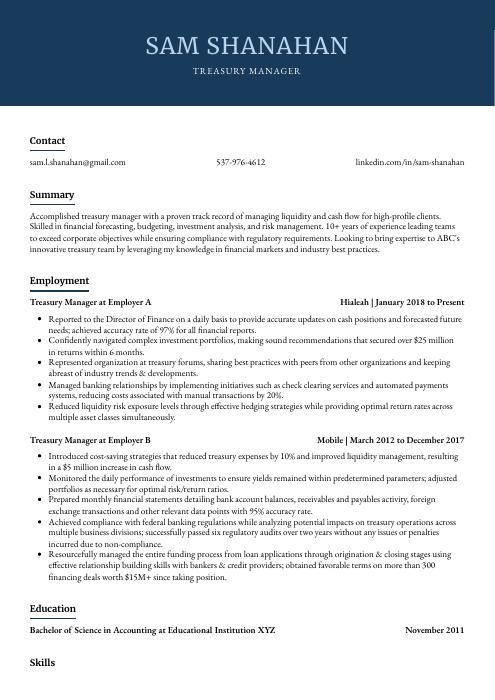

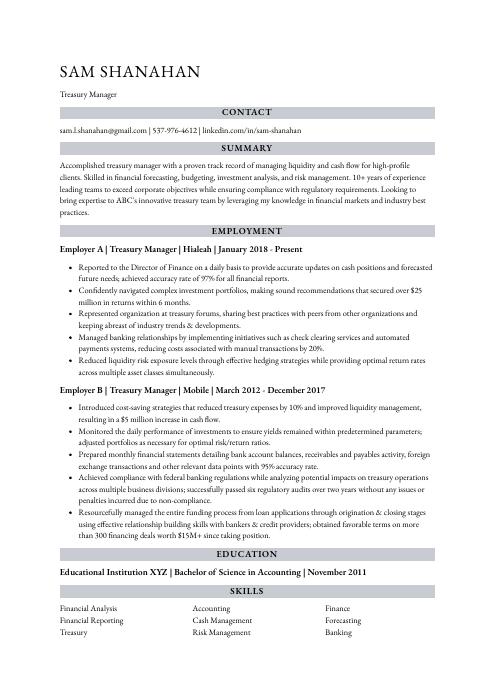

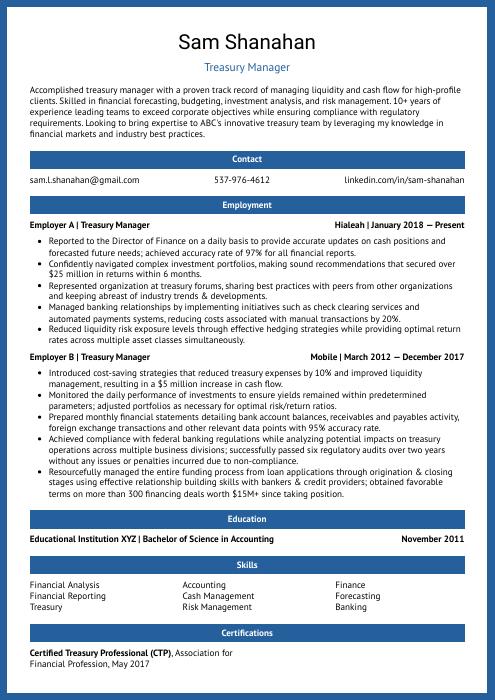

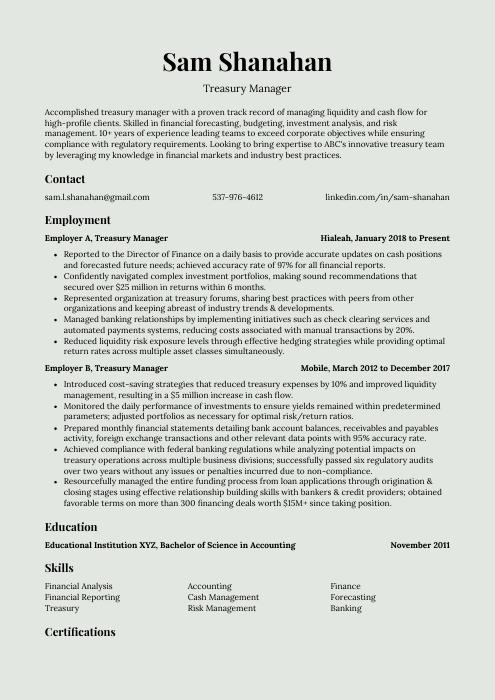

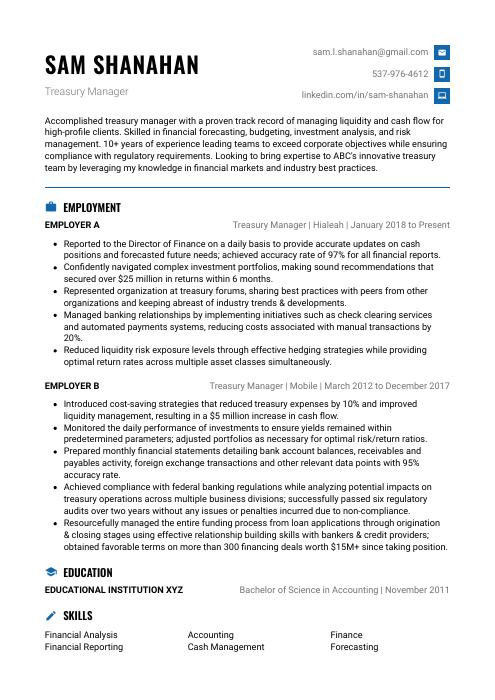

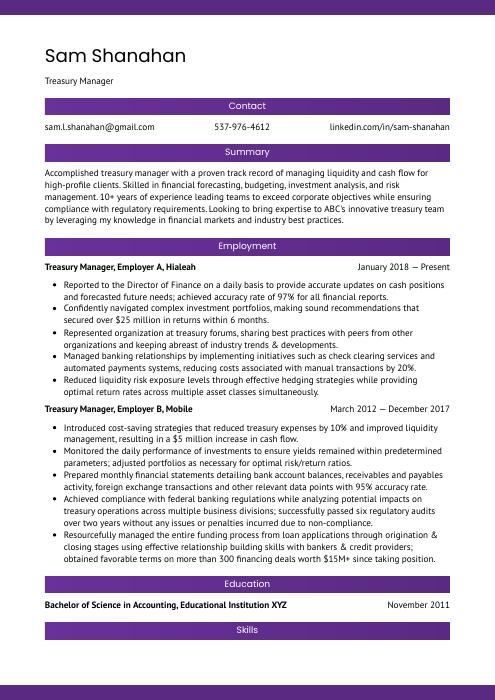

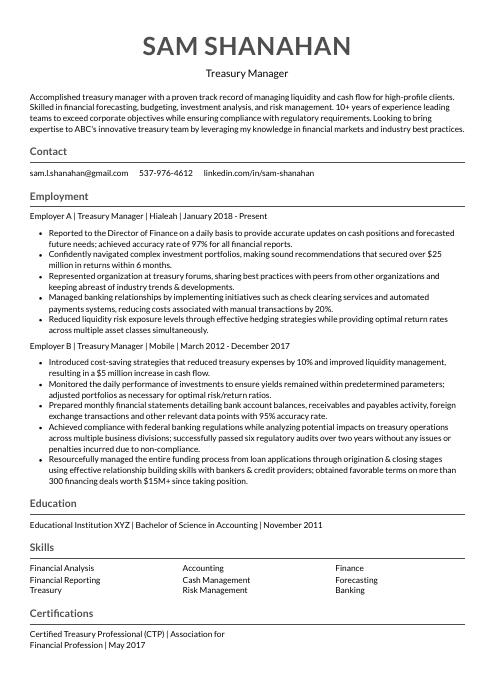

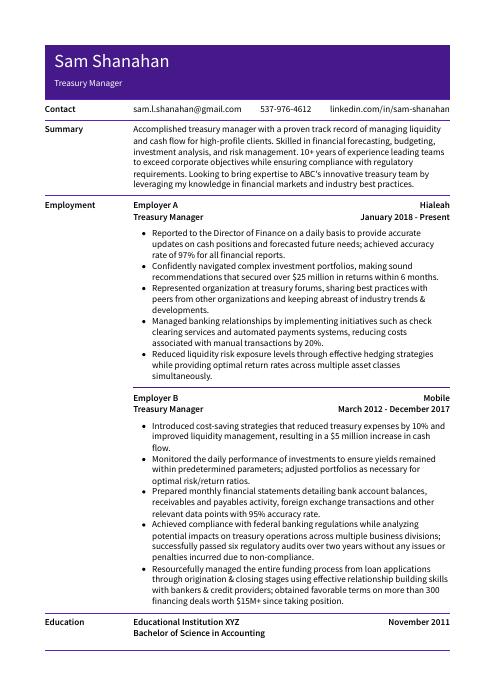

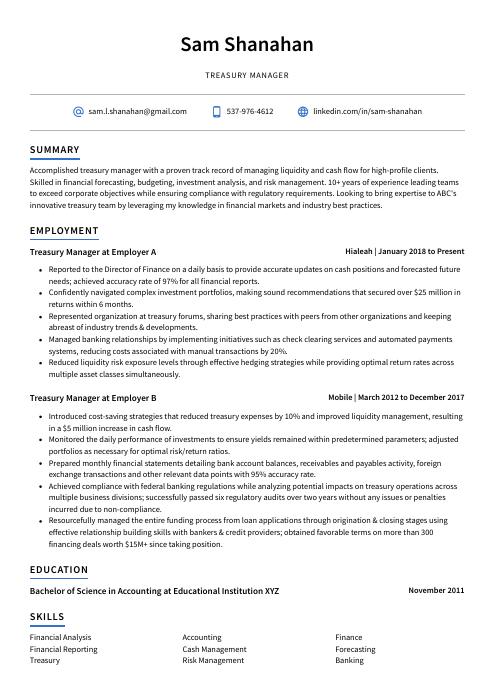

Treasury Manager Resume Sample

Sam Shanahan

Treasury Manager

sam.l.shanahan@gmail.com

537-976-4612

linkedin.com/in/sam-shanahan

Summary

Accomplished treasury manager with a proven track record of managing liquidity and cash flow for high-profile clients. Skilled in financial forecasting, budgeting, investment analysis, and risk management. 10+ years of experience leading teams to exceed corporate objectives while ensuring compliance with regulatory requirements. Looking to bring expertise to ABC’s innovative treasury team by leveraging my knowledge in financial markets and industry best practices.

Experience

Treasury Manager, Employer A

Hialeah, Jan 2018 – Present

- Reported to the Director of Finance on a daily basis to provide accurate updates on cash positions and forecasted future needs; achieved accuracy rate of 97% for all financial reports.

- Confidently navigated complex investment portfolios, making sound recommendations that secured over $25 million in returns within 6 months.

- Represented organization at treasury forums, sharing best practices with peers from other organizations and keeping abreast of industry trends & developments.

- Managed banking relationships by implementing initiatives such as check clearing services and automated payments systems, reducing costs associated with manual transactions by 20%.

- Reduced liquidity risk exposure levels through effective hedging strategies while providing optimal return rates across multiple asset classes simultaneously.

Treasury Manager, Employer B

Mobile, Mar 2012 – Dec 2017

- Introduced cost-saving strategies that reduced treasury expenses by 10% and improved liquidity management, resulting in a $5 million increase in cash flow.

- Monitored the daily performance of investments to ensure yields remained within predetermined parameters; adjusted portfolios as necessary for optimal risk/return ratios.

- Prepared monthly financial statements detailing bank account balances, receivables and payables activity, foreign exchange transactions and other relevant data points with 95% accuracy rate.

- Achieved compliance with federal banking regulations while analyzing potential impacts on treasury operations across multiple business divisions; successfully passed six regulatory audits over two years without any issues or penalties incurred due to non-compliance.

- Resourcefully managed the entire funding process from loan applications through origination & closing stages using effective relationship building skills with bankers & credit providers; obtained favorable terms on more than 300 financing deals worth $15M+ since taking position.

Skills

- Financial Analysis

- Accounting

- Finance

- Financial Reporting

- Cash Management

- Forecasting

- Treasury

- Risk Management

- Banking

Education

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Treasury Professional (CTP)

Association for Financial Profession

May 2017

1. Summary / Objective

Your resume summary should be a concise and compelling overview of your treasury management experience. In this section, you can highlight the financial strategies you have implemented in previous roles that resulted in increased profits or cost savings. You could also mention any awards or certifications related to treasury management, such as CTP (Certified Treasury Professional) certification. Finally, emphasize how your expertise has helped organizations achieve their goals and objectives with respect to cash flow optimization and risk mitigation.

Below are some resume summary examples:

Diligent treasury manager with 8+ years of experience in cash management, budgeting and forecasting, financial analysis and reporting. Proven track record of success in developing strategies to optimize the use of capital resources while minimizing risk. At XYZ Company, successfully managed a portfolio worth $200 million and reduced debt-to-equity ratio by 33%. Adept at dealing with complex banking regulations and offering best practices for treasury operations.

Seasoned treasury manager with 10+ years of experience in financial management and cash flow analysis. Skilled at formulating strategies to reduce costs, optimize capital utilization, and maximize returns on investments. At XYZ Corporation, managed the development of a $3 million budget for the entire organization while reducing expenses by 8%. Experienced in both domestic and international banking operations as well as risk management techniques.

Amicable and experienced treasury manager with 7+ years of experience managing complex financial portfolios. Adept in risk management, forecasting cash-flow needs, preparing budgets, and organizing investments to maximize returns. At XYZ Company reduced costs by 15% through effective implementation of strategies such as hedging against currency fluctuations. Looking to join ABC Corp’s team as a Treasury Manager for their global operations.

Well-rounded treasury manager with 10+ years of experience in cash management, financial risk analysis and hedging. Proven track record in successfully creating efficient treasury operations that minimize liquidity risks and improve the overall financial health of organizations. Seeking to leverage my expertise at ABC Corporation to develop cost-effective strategies for managing corporate funds while meeting compliance requirements.

Passionate and experienced treasury manager with 8+ years of experience in financial risk management. Skilled at managing cash flow, forecasting liquidity needs, and overseeing investments. At XYZ Corporation managed a portfolio of $50 million in assets while achieving 2% return on investment over 3-year period. Consistently identified opportunities to improve processes that resulted in cost savings for the organization.

Talented treasury manager with 8+ years of experience in financial management and accounting. Developed effective strategies to optimize cash flow, reduce risk exposure and improve liquidity at XYZ Corporation. Experienced in managing a high volume of transactions while maintaining compliance standards. Possesses working knowledge of IFRS and US GAAP accounting principles as well as excellent problem-solving skills.

Determined treasury manager with 8+ years of experience in global financial management. Highly adept at developing and executing cash flow strategies, managing foreign exchange risk, overseeing treasury operations & investments, and mitigating liquidity risks. Successfully managed the Treasury Department for XYZ Corporation, securing a 20% reduction in borrowing costs through strategic hedging initiatives.

Detail-oriented treasury manager with 5+ years of experience in the banking industry. Skilled at financial analysis, risk management, and forecasting to maximize cash flow while minimizing costs. Proven record of success reducing operational costs by 15% through careful budgeting and strategic investments. Seeking to contribute expertise as ABC’s next treasury manager.

2. Experience / Employment

In the experience section, you should list your employment history in reverse chronological order. This means that the most recent job is listed first.

When writing out what you did at each role, stick to bullet points; this makes it easier for the reader to take in all of the information quickly and efficiently. You want to provide detail when crafting these bullets, explaining what tasks were completed and any quantifiable results obtained from them.

For example, instead of saying “Managed treasury department,” you could say, “Successfully managed a team of five staff members within the treasury department while overseeing daily operations and ensuring compliance with banking regulations.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Monitored

- Reconciled

- Forecasted

- Analyzed

- Managed

- Optimized

- Administered

- Evaluated

- Reported

- Researched

- Developed

- Implemented

- Negotiated

- Audited

- Streamlined

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Structured

- Utilized

Below are some example bullet points:

- Optimized company’s cash flow by managing $5M+ treasury portfolio, forecasting and balancing liquidity needs with market opportunities to achieve maximum return on investments.

- Formulated long-term financial plans for the organization in accordance with business goals; developed strategies to minimize risk exposure while maximizing returns over a 3 year period.

- Thoroughly monitored all financial instruments such as bonds, stocks, mutual funds and derivatives that were held within the portfolios; reduced overall portfolio costs by 10%.

- Improved processes related to day-to-day operations of treasury management including accounts receivable/payable collection activities, foreign currency exchange transactions and credit card processing systems; decreased operational expenses by 15% annually.

- Negotiated favorable terms with banks on behalf of the client for lines of credit and overdraft facilities at competitive rates; ensured compliance with banking regulations throughout every transaction process cycle.

- Effectively managed and directed treasury operations to ensure efficient cash flow, increasing profits by $450,000 in the last year.

- Researched market trends and conducted financial analysis of current investments to inform sound investment decisions resulting in a 10% return on equity over six months.

- Presented detailed reports to senior management outlining financial performance metrics for better decision making; received commendation from company CEO for accuracy & clarity of data presented.

- Developed an automated system that improved operational efficiency by 40%, eliminating manual processing errors while reducing time spent preparing payments by 25%.

- Spearheaded cost control initiatives that reduced overhead costs across departments by 15%, enabling reinvestment into more profitable areas of the business.

- Facilitated the daily cash management of the organization, monitoring and replenishing all accounts to ensure sufficient funds were available for business operations; decreased operating costs by 8%.

- Reconciled bank statements with general ledger entries on a monthly basis, investigating irregularities and resolving discrepancies accurately within established deadlines.

- Efficiently administered payments and collections in multiple currencies while optimizing liquidity levels across all global entities; reduced payment delays by 17%.

- Administered banking activities such as setting up new accounts, wire transfers & foreign currency exchange transactions; increased efficiency of treasury processes by 12%.

- Compiled detailed financial reports that reviewed current positions, cash flow projections & risk assessment scenarios for senior executives’ review on a quarterly basis.

- Utilized various financial strategies to manage upwards of $25 million in cash and securities, increasing liquidity by 18%.

- Streamlined treasury operations through the implementation of automated systems for forecasting, budgeting and risk management; decreased operational costs by 10%.

- Evaluated corporate credit ratings on a daily basis to ensure that investments met risk parameters; minimized losses from bad investments by 15%.

- Reorganized existing processes and procedures around treasury functions, resulting in improved internal controls that saved the company over $50K annually.

- Independently handled all aspects of cash flow planning including capital calls & distributions as well as debt payments; reduced late payment fees & penalties by 50% within first 6 months of tenure.

- Forecasted and managed company cash flow by actively monitoring banking accounts, anticipating shortfalls and surpluses to optimize liquidity; increased savings by $400,000 in the last year.

- Structured hedging strategies for a portfolio of investments worth over $20 million while minimizing risk exposure; successfully reduced currency losses by 10% during market volatility periods.

- Analyzed financial statements & credit ratings with attention to detail before presenting recommendations on capital projects or acquisitions that achieved an average Return On Investment (ROI) of 15%.

- Actively monitored global macroeconomic trends and regulatory changes to ensure compliance with applicable laws; completed 7 AML/KYC reviews within tight deadlines without any errors reported from auditors.

- Participated in strategic planning sessions with senior management team as well as weekly meetings with investment bankers, brokers & fund managers; identified 3 cost-saving opportunities through negotiation which saved the firm up to 5% annually on financing costs.

- Proficiently managed and balanced treasury accounts to the tune of $15 million, ensuring that all transactions were accurately recorded.

- Implemented financial planning strategies for a portfolio of 15 companies, decreasing risk exposure by 25%.

- Expedited liquidity management processes while overseeing day-to-day cash flow operations; reduced payment delays by 35% within three months.

- Audited loan agreements and capital investments on an ongoing basis to ensure compliance with organizational policies; identified discrepancies resulting in cost savings worth $50,000 annually.

- Advised senior executives on hedging techniques to mitigate interest rate risks as well as foreign exchange fluctuations across multiple currencies; increased profits by 10% year over year for two consecutive years.

- Diligently managed a company’s treasury operations, including cash flow forecasting, debt and equity management and investment activities; reduced liquidity risk exposure by 25%.

- Coordinated with accounting teams to ensure accurate invoicing for all customers and vendors; achieved over 95% payment accuracy rate in month-end reports.

- Mentored three junior Treasury Managers on best practices within the department while developing new strategies to optimize financial performance; raised overall team productivity by 17%.

- Revised internal controls within the treasury function to adhere strictly to Sarbanes-Oxley Act requirements, as well as other applicable laws/regulations related to finance & investments; improved compliance rate from 75% up to 99%.

- Assessed potential opportunities for investing surplus funds into fixed income securities or stocks that would generate higher returns than cash deposits alone, resulting in an additional $500K profit over 6 months period of time.

3. Skills

The skillset employers require in an employee will likely vary, either slightly or significantly; skimming through their job adverts is the best way to determine what each is looking for. One organization may require the candidate to be proficient in financial modelling, while another might need them to have experience with cash flow forecasting.

It is important that you tailor your skills section of your resume for each job application; this will help ensure it passes through any applicant tracking systems used by employers. Furthermore, elaborating on key treasury management skills in other sections such as summary or experience can also give a better impression of yourself and make sure you stand out from the crowd.

Below is a list of common skills & terms:

- Access

- Account Reconciliation

- Accounting

- Accounts Payable

- Accounts Receivable

- Analysis

- Auditing

- Bank Reconciliation

- Banking

- Bloomberg

- Budgeting

- Business Analysis

- Business Process Improvement

- Business Strategy

- Capital Markets

- Cash Flow

- Cash Flow Forecasting

- Cash Management

- Corporate Finance

- Credit

- Data Analysis

- Derivatives

- FX Options

- Finance

- Financial Accounting

- Financial Analysis

- Financial Modeling

- Financial Reporting

- Financial Risk

- Financial Services

- Financial Statements

- Fixed Income

- Forecasting

- GAAP

- General Ledger

- Internal Audit

- Internal Controls

- Investments

- Liquidity Management

- Managerial Finance

- Mergers and Acquisitions

- Payments

- Payroll

- Portfolio Management

- Process Improvement

- Risk Management

- SAP

- Strategic Financial Planning

- Team Leadership

- Teamwork

- Time Management

- Treasury

- Treasury Management

- Variance Analysis

4. Education

Mentioning your education section on a treasury manager resume depends on how far along you are in your career. If you have just graduated and don’t have much work experience, include an education section below your resume objective. However, if you have been working as a treasury manager for years and want to showcase that experience instead of focusing on academics, it is perfectly fine to omit the education section altogether.

If including an education section, try to mention courses or subjects related to the job role such as finance management or accounting principles.

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your expertise in a certain field. It shows potential employers that you have taken the time and effort to become certified by an accredited organization, which can be very impressive for hiring managers.

If you have any certifications related to the job role you’re applying for, make sure they are included on your resume as it could give you an edge over other applicants who don’t possess such credentials.

Certified Treasury Professional (CTP)

Association for Financial Profession

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Sam Shanahan, this would be Sam-Shanahan-resume.pdf or Sam-Shanahan-resume.docx.

7. Cover Letter

Including a cover letter in your job application can be a great way of making yourself stand out from the crowd. It serves as an opportunity to introduce yourself, explain why you’re interested in the role and how you’d be an excellent fit for it.

Cover letters are typically made up of 2 to 4 paragraphs and should include information that doesn’t already appear on your resume. Although not always required by employers, writing one is highly recommended as it gives recruiters more insights into who you are and what value you could bring to their organization.

Below is an example cover letter:

Dear Korbin,

I am writing in response to your Treasury Manager job posting. With more than 10 years of experience in treasury management, I am confident that I would make a valuable addition to your team.

In my current role as Treasury Manager for ABC Corporation, I oversee all aspects of the company’s cash management, including disbursements, collections, investments, and borrowing activities. I have successfully implemented numerous process improvements that have resulted in increased efficiencies and cost savings. In addition, I have developed strong relationships with banks and other financial institutions that have resulted in favorable terms for the company.

I am knowledgeable about a variety of treasury management software applications and have experience leading teams of treasury professionals. My analytical skills enable me to quickly identify issues and develop solutions that are aligned with the company’s strategic objectives. I am also an excellent communicator and have presented complex financial information to senior executives on multiple occasions.

I believe my qualifications make me an ideal candidate for the Treasury Manager position at XYZ Corporation. Please find attached a copy of my resume for your review; I will follow up next week to discuss any questions you may have or to schedule an interview at your convenience. Thank you for your time and consideration; I look forward to hearing from you soon!

Sincerely,

Sam

Treasury Manager Resume Templates

Kinkajou

Kinkajou Fossa

Fossa Rhea

Rhea Lorikeet

Lorikeet Gharial

Gharial Cormorant

Cormorant Dugong

Dugong Hoopoe

Hoopoe Markhor

Markhor Bonobo

Bonobo Quokka

Quokka Numbat

Numbat Ocelot

Ocelot Saola

Saola Echidna

Echidna Jerboa

Jerboa Indri

Indri Pika

Pika Axolotl

Axolotl Rezjumei

Rezjumei