Risk Manager Resume Guide

Risk Managers are responsible for identifying, assessing and mitigating risks associated with an organization’s activities. They analyze the potential impact of risk on a business or industry and develop strategies to help minimize negative outcomes. Risk Managers work closely with other departments to identify areas that need improvement in order to reduce overall exposure to risk.

Your expertise in risk management is unparalleled. But hiring managers don’t know about your skills and experience yet, so you must write a resume that highlights these qualities to make yourself stand out from the competition.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

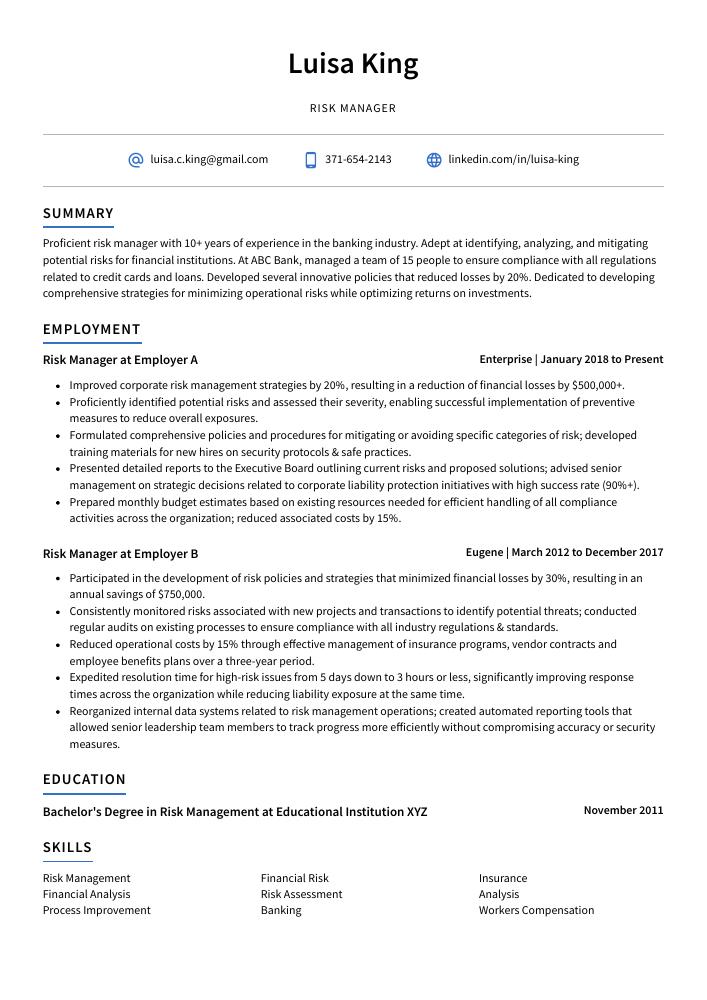

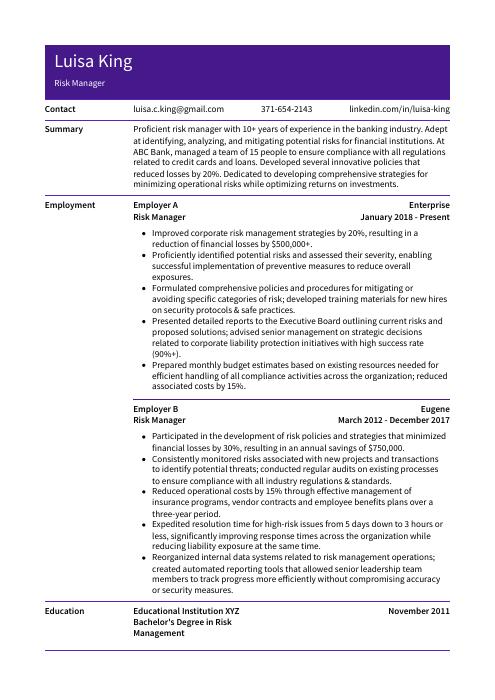

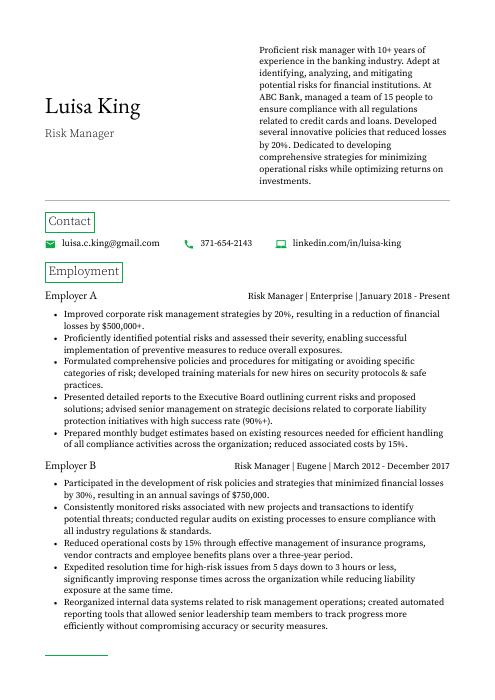

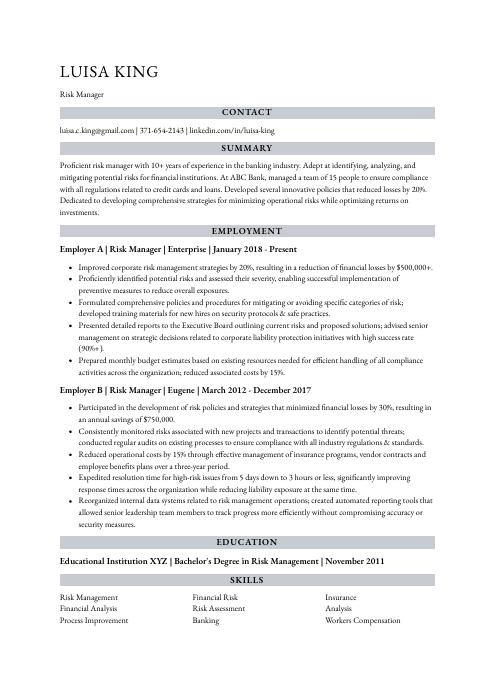

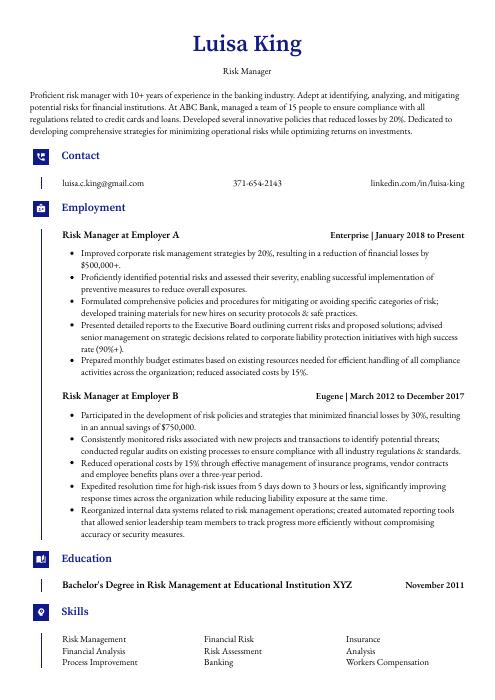

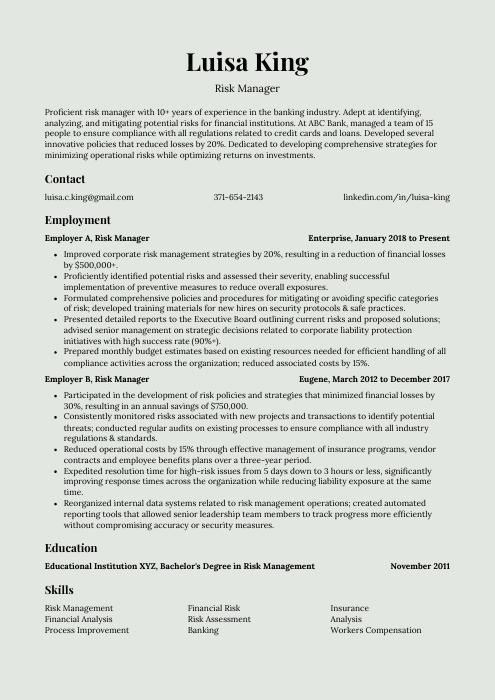

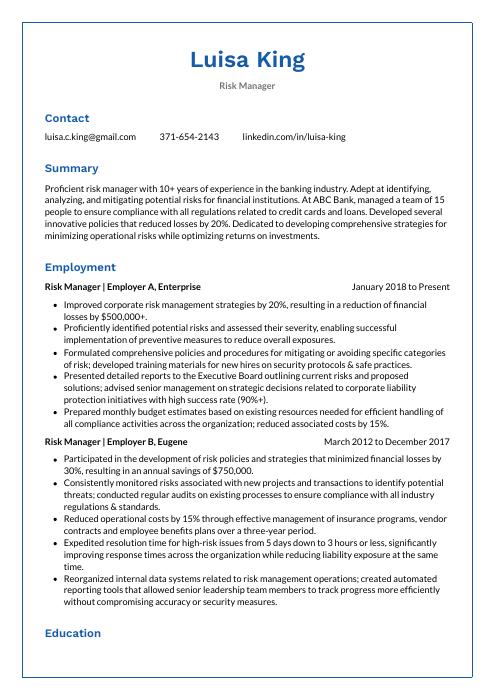

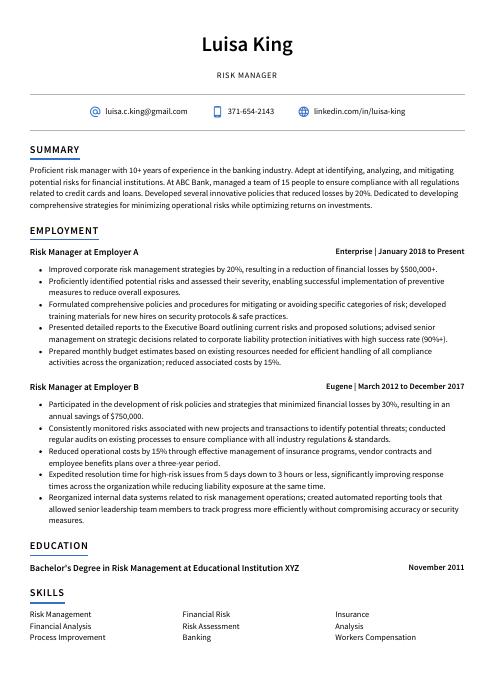

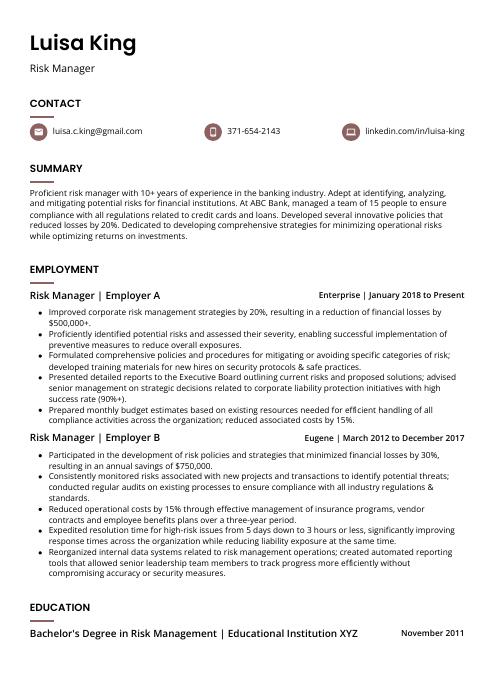

Risk Manager Resume Sample

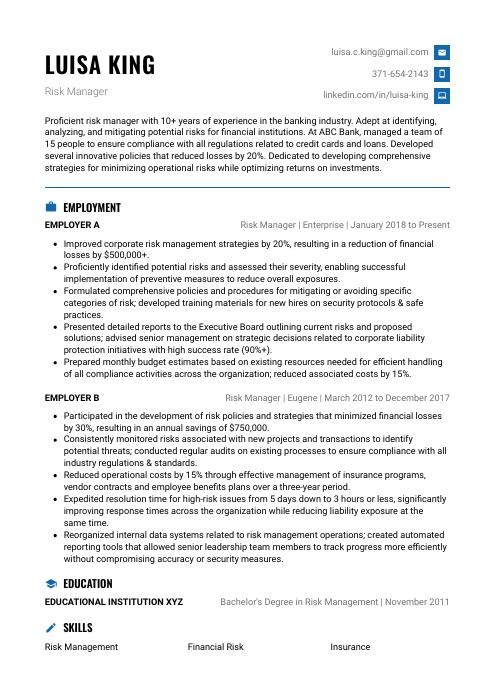

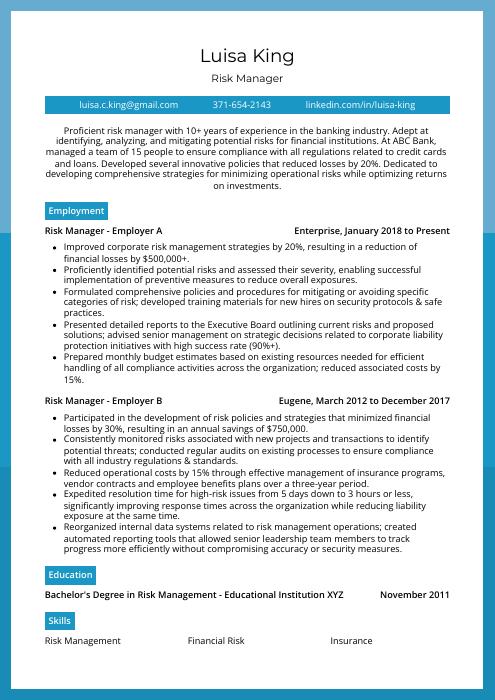

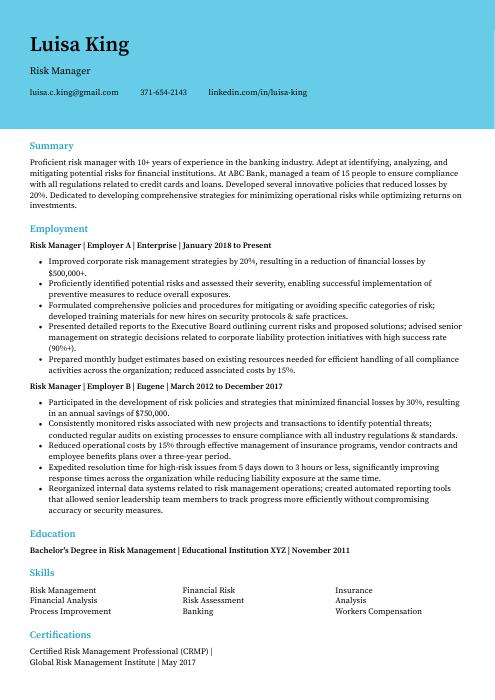

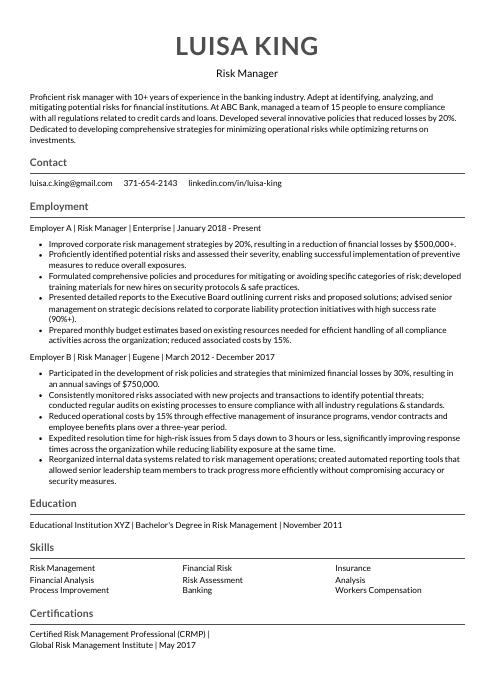

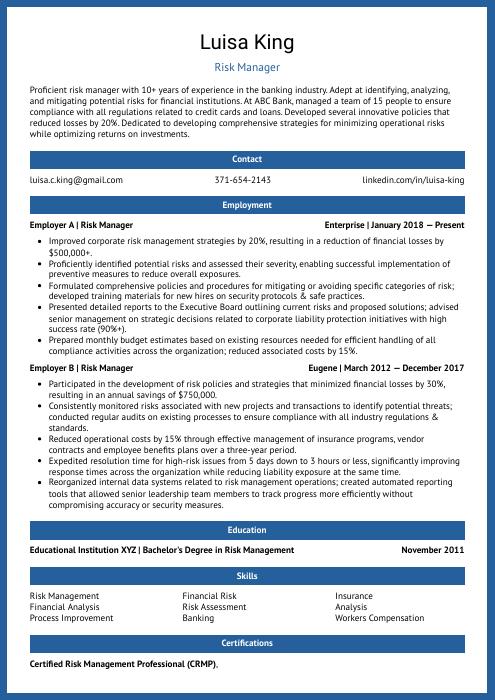

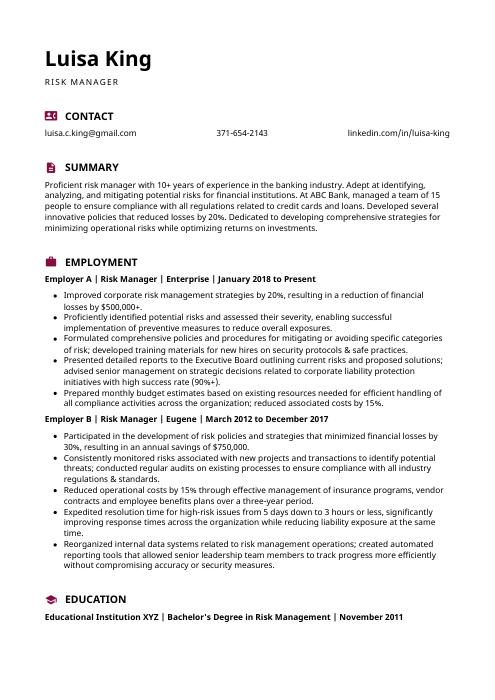

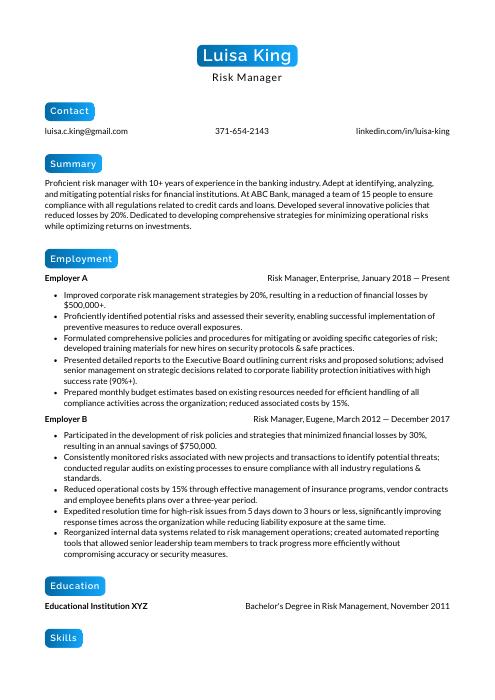

Luisa King

Risk Manager

[email protected]

371-654-2143

linkedin.com/in/luisa-king

Summary

Proficient risk manager with 10+ years of experience in the banking industry. Adept at identifying, analyzing, and mitigating potential risks for financial institutions. At ABC Bank, managed a team of 15 people to ensure compliance with all regulations related to credit cards and loans. Developed several innovative policies that reduced losses by 20%. Dedicated to developing comprehensive strategies for minimizing operational risks while optimizing returns on investments.

Experience

Risk Manager, Employer A

Enterprise, Jan 2018 – Present

- Improved corporate risk management strategies by 20%, resulting in a reduction of financial losses by $500,000+.

- Proficiently identified potential risks and assessed their severity, enabling successful implementation of preventive measures to reduce overall exposures.

- Formulated comprehensive policies and procedures for mitigating or avoiding specific categories of risk; developed training materials for new hires on security protocols & safe practices.

- Presented detailed reports to the Executive Board outlining current risks and proposed solutions; advised senior management on strategic decisions related to corporate liability protection initiatives with high success rate (90%+).

- Prepared monthly budget estimates based on existing resources needed for efficient handling of all compliance activities across the organization; reduced associated costs by 15%.

Risk Manager, Employer B

Eugene, Mar 2012 – Dec 2017

- Participated in the development of risk policies and strategies that minimized financial losses by 30%, resulting in an annual savings of $750,000.

- Consistently monitored risks associated with new projects and transactions to identify potential threats; conducted regular audits on existing processes to ensure compliance with all industry regulations & standards.

- Reduced operational costs by 15% through effective management of insurance programs, vendor contracts and employee benefits plans over a three-year period.

- Expedited resolution time for high-risk issues from 5 days down to 3 hours or less, significantly improving response times across the organization while reducing liability exposure at the same time.

- Reorganized internal data systems related to risk management operations; created automated reporting tools that allowed senior leadership team members to track progress more efficiently without compromising accuracy or security measures.

Skills

- Risk Management

- Financial Risk

- Insurance

- Financial Analysis

- Risk Assessment

- Analysis

- Process Improvement

- Banking

- Workers Compensation

Education

Bachelor’s Degree in Risk Management

Educational Institution XYZ

Nov 2011

Certifications

Certified Risk Management Professional (CRMP)

Global Risk Management Institute

May 2017

1. Summary / Objective

Your resume summary is the first thing a potential employer will read, so it’s important to make sure you capture their attention. As a risk manager, your summary should highlight your ability to identify and mitigate risks in an organization. You could mention any certifications or qualifications that demonstrate this skill set as well as how you have successfully managed projects with tight deadlines and budgets. Additionally, if there are any awards or recognition for which you’ve been honored due to your work in risk management, include those here too!

Below are some resume summary examples:

Diligent risk manager with 8+ years of experience in analyzing and mitigating various types of risks. Proven success introducing risk management processes to organizations, reducing the cost of losses by 20%. Skilled at utilizing quantitative methods for evaluating risk levels and developing action plans to reduce them. Track record includes successfully managing projects related to compliance, financial stability, legal liability, operational efficiency and much more.

Professional risk manager with 5+ years of experience in assessing, mitigating and monitoring risks. Expertise in developing strategies to reduce exposure to financial liabilities and prevent losses from occurring. Proven success in designing an effective compliance program that reduced the company’s exposure to regulatory penalties by 50%. Seeking a Risk Manager role at ABC Company where I can use my skillset for continued growth and development.

Energetic and analytical risk manager with 5+ years of experience helping organizations make informed decisions on investments, compliance, and operational risks. At XYZ Corporation, identified potential areas of financial loss that saved the company $1 million in losses over three years. Proven track record of using advanced data analysis to improve efficiency while reducing operational costs by 15%. Looking to join ABC Company as a Risk Manager.

Skilled risk manager with 7+ years of experience in assessing and mitigating risks to organizational assets. At XYZ, managed a team of 10 administrators responsible for developing and implementing effective strategies to reduce financial losses related to operational activities. Successfully reduced the rate of workplace accidents by 35%. Possess strong leadership skills and adept at cultivating relationships with stakeholders across all levels.

Dependable risk manager with 8+ years of experience monitoring and assessing risks to help organizations achieve their business objectives. Proven track record in identifying, mitigating, and managing potential threats while providing solutions that are cost-effective, compliant with regulations, and beneficial for the company’s long-term success. Looking to leverage my expertise at ABC Company to ensure all operations are conducted safely.

Accomplished risk manager with 10+ years of experience assessing and mitigating financial risks in a wide range of industries. Proven ability to identify potential threats, develop sound strategies for minimizing them, and ensure organization compliance with applicable laws. Seeking to join ABC Corporation as the next Risk Manager where I can make use of my expertise in corporate governance and risk management processes.

Seasoned risk manager with 8+ years of experience in risk identification, assessment, and mitigation. At XYZ company, led implementation of a risk management system which reduced losses by 25%. Skilled at developing strategies to identify potential risks and create plans for mitigating those risks. Experienced working with both internal teams and external stakeholders to ensure successful delivery of projects on time.

Detail-oriented risk manager with 5+ years of experience in the finance industry. Expertise in identifying, analyzing and mitigating risks to ensure compliance with applicable regulations. At XYZ Bank, developed an innovative risk management system that reduced operational losses by 20%. Proven track record for improving financial performance and reducing exposure to potential risks.

2. Experience / Employment

For the experience section, you should list your work history in reverse chronological order. This means that the most recent job is listed first.

Stick to bullet points when describing what you did; this allows for a quick read and makes it easier to digest the information. You want to provide detail, explaining what tasks were completed and any results achieved from them.

For example, instead of saying “Identified potential risks,” you could say, “Analyzed financial statements using Monte Carlo simulations to identify potential risk factors associated with investments.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Mentored a team of 3 junior Risk Managers, providing guidance on risk assessment techniques and developing their analytical capabilities; reduced evaluation errors by 40%.

- Developed a comprehensive corporate risk management framework that addressed both operational & financial risks; successfully implemented the framework across the organization, mitigating potential losses to $400K in the first year.

- Successfully identified and analyzed key areas of business vulnerability through regular reviews of policy documents, internal processes and external market data; minimized exposure to high-risk issues with an accuracy rating of 95%.

- Introduced a series of proactive measures designed to minimize unforeseen disruptions such as natural disasters or unplanned personnel changes; optimized performance at all levels for 5 consecutive quarters without any major incidents arising from non-compliance issues.

- Optimized the company’s disaster recovery plans by introducing more stringent testing procedures which significantly improved response time should an emergency occur – reducing downtime from 8 hours to 4 hours in less than 6 months.

- Coordinated with cross-functional teams to evaluate and identify potential risk areas, resulting in the successful implementation of a new safety protocol which reduced accident rates by 25%.

- Effectively implemented loss control measures that minimized financial losses from business operations by over $1M within two years.

- Achieved significant cost savings for the organization through strategic planning and improved operational processes; saved $200K annually in insurance premiums alone.

- Represented the company at industry conventions, trade shows and seminars related to risk management topics; raised awareness of key risks among more than 500 professionals during each event attended.

- Demonstrated strong knowledge of legal compliance requirements across multiple jurisdictions when developing policies related to data privacy, fraud prevention, security protocols & occupational health & safety standards; successfully passed all regulatory audits with zero deficiencies noted.

- Compiled over 300 risk management reports and monitored over 500 key risk indicators, resulting in a reduction of financial losses by 18%.

- Revised current system controls to mitigate potential risks, improved operational efficiency by 15%, and implemented new internal policies to minimize any future threats.

- Advised C-level executives on best practices for managing enterprise-wide risks while ensuring compliance with all applicable laws & regulations; successfully passed four external audits without fail.

- Structured customized insurance plans to protect company assets from unexpected losses; saved an estimated $500K+ annually through strategic planning and intelligent coverage selection tactics.

- Accurately assessed the impact of business decisions on overall organizational risk levels using quantitative models & analytics tools; identified areas for improvement within existing processes that reduced liability exposures by 12%.

- Confidently assessed and managed risk across all business units, including operations, finance and marketing; identified potential risks before they occurred to reduce losses by 25%.

- Streamlined existing processes for identifying, measuring and monitoring operational risk levels; successfully eliminated 75% of previously unknown threats to the organization’s profitability.

- Utilized data analysis techniques such as Pareto Analysis/80-20 rule to identify key areas where proactive steps could be taken in order to minimize potential exposures or mitigate existing ones.

- Spearheaded a cross-functional team of 4 employees tasked with developing strategies for mitigating financial & legal risks associated with new products/services; reduced product launch timeline by 2 months while maintaining quality standards & regulatory compliance requirements.

- Developed an actionable checklist containing best practices that should be followed when evaluating investment opportunities; saved $50K+ per year in preventable losses due to bad investments decisions.

3. Skills

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may be looking for someone with a background in financial risk management, while Organization XYZ might require experience in operational risk.

Given that many companies now use applicant tracking systems to scan resumes for specific keywords before passing them on to human recruiters, it is essential that you tailor the skills section of your resume to each job you are applying for. This will help ensure that your CV passes through this initial stage and reaches the right people.

Once listed here, you can further elaborate on these skills by discussing them more thoroughly in other areas of your resume such as the summary or experience sections.

Below is a list of common skills & terms:

- Analysis

- Auditing

- Banking

- Business Analysis

- Business Process Improvement

- Change Management

- Claim

- Claims Management

- Commercial Insurance

- Contract Management

- Contract Negotiation

- Credit

- Credit Analysis

- Credit Risk

- Data Analysis

- Derivatives

- Enterprise Risk Management

- Finance

- Financial Analysis

- Financial Modeling

- Financial Risk

- Financial Services

- General Insurance

- Healthcare

- Healthcare Management

- Hospitals

- Insurance

- Internal Audit

- Legal Liability

- Liability

- Operational Risk

- Operational Risk Management

- Operations Management

- Patient Safety

- Policy

- Portfolio Management

- Process Improvement

- Professional Liability

- Program Management

- Project Planning

- Property and Casualty Insurance

- Risk Assessment

- Risk Management

- Stakeholder Management

- Strategy

- Team Leadership

- Teamwork

- Time Management

- Underwriting

- Workers Compensation

4. Education

Mentioning your education section on your resume will depend on the amount of experience you have in the field. If you are just starting out and don’t have much work history to showcase, include a brief summary of your educational background below your resume objective. However, if you already have years of risk management experience under your belt, an education section might not be necessary at all.

If including an education section is appropriate for this role, try to focus on courses or qualifications relevant to risk management that can help demonstrate why you would make a great candidate for the job.

Bachelor’s Degree in Risk Management

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your knowledge and proficiency in a particular field. They show that you have been tested by an accredited organization, which can give employers confidence in your abilities.

Including certifications on your resume is especially beneficial when applying for jobs where the job description requires certain skills or qualifications. If you are certified in any of these areas, be sure to include them so that potential employers know what sets you apart from other applicants.

Certified Risk Management Professional (CRMP)

Global Risk Management Institute

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Luisa King, this would be Luisa-King-resume.pdf or Luisa-King-resume.docx.

7. Cover Letter

Attaching a cover letter to your job application is a great way to make yourself stand out from the crowd. It allows you to express more about who you are and why you’re an ideal candidate for the role.

Cover letters usually consist of 2-4 paragraphs, separate from your resume, that provide further information on how you meet the employer’s requirements. Writing one isn’t always necessary but it can be a great tool in helping recruiters get to know more about who you are as an individual and what sets apart from other candidates applying for the same position.

Below is an example cover letter:

Dear Marco,

I am writing in response to your posting for a Risk Manager. With more than 10 years of experience managing risk in both the private and public sector, I am confident I can be an asset to your organization.

In my most recent role as Risk Manager for the city of New York, I was responsible for identifying, assessing, and mitigating risks associated with the city’s operations. This included developing and implementing risk management policies and procedures, conducting risk assessments, overseeing insurance coverage, and investigating incidents. My work helped to protect the city from potential liabilities and saved millions of dollars in costs related to claims and litigation.

Prior to that, I worked as a Risk Manager for a large financial institution where I managed risks associated with the bank’s lending activities. In this role, I developed risk mitigation strategies that reduced losses due to loan defaults by more than 25%.

I have attached my resume detailing my experience managing risk in both the public and private sector. I can be reached anytime via phone or email at [your contact information]. Thank you for your time and consideration; I look forward to speaking with you about this opportunity soon.

Sincerely,

Luisa

Risk Manager Resume Templates

Cormorant

Cormorant Lorikeet

Lorikeet Bonobo

Bonobo Echidna

Echidna Rhea

Rhea Jerboa

Jerboa Dugong

Dugong Pika

Pika Quokka

Quokka Numbat

Numbat Gharial

Gharial Saola

Saola Markhor

Markhor Axolotl

Axolotl Fossa

Fossa Indri

Indri Ocelot

Ocelot Hoopoe

Hoopoe Kinkajou

Kinkajou Rezjumei

Rezjumei