Risk Management Analyst Resume Guide

Risk management analysts work to identify, assess, and prioritize risks posed by various activities in order to develop strategies for mitigating them. They analyze a wide range of data sources such as financial statements, regulatory requirements, and industry trends to understand the potential impact of different risks on an organization. They then create risk mitigation plans that include specific steps or actions designed to reduce these threats.

You have a knack for identifying and mitigating risk, something any financial institution would benefit from. But hiring managers need to know who you are before they can recognize your talent. To make them aware of your qualifications, you must compose an outstanding resume.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

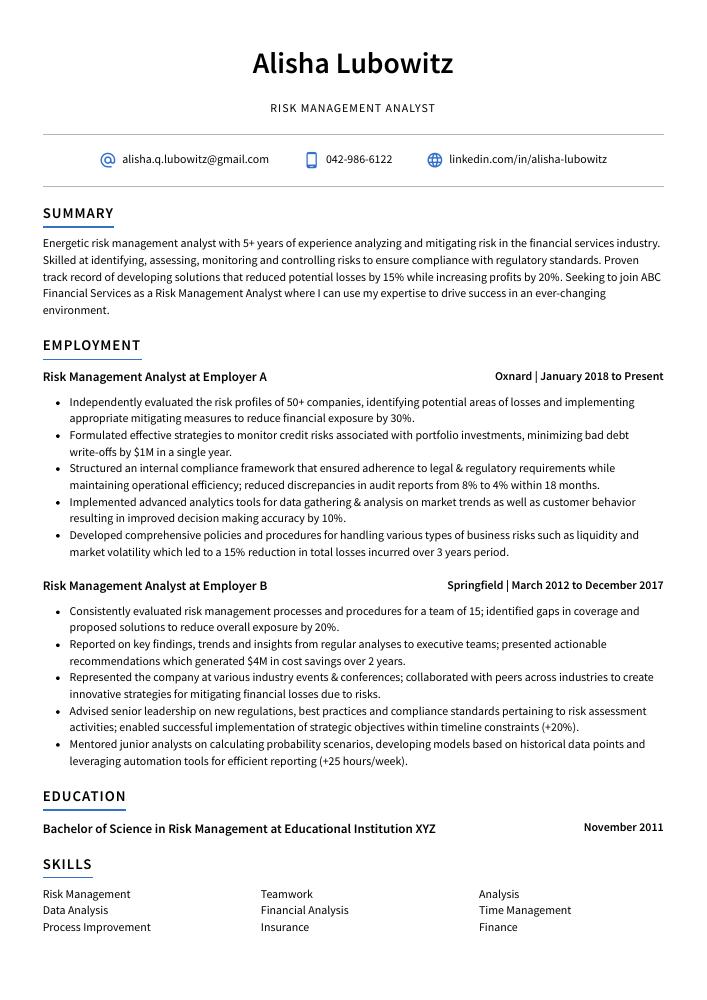

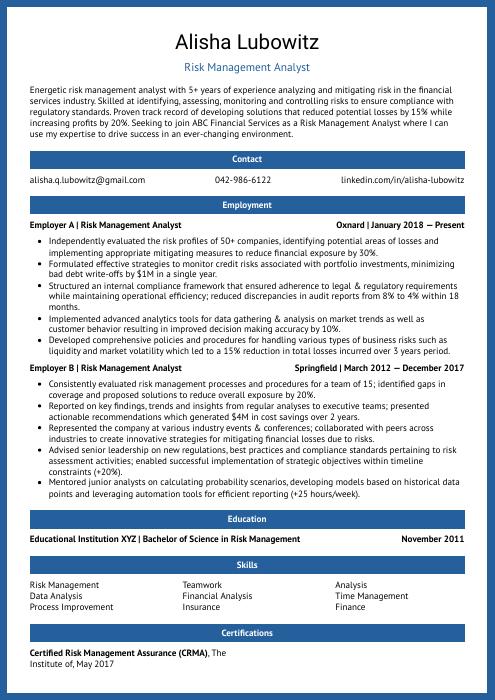

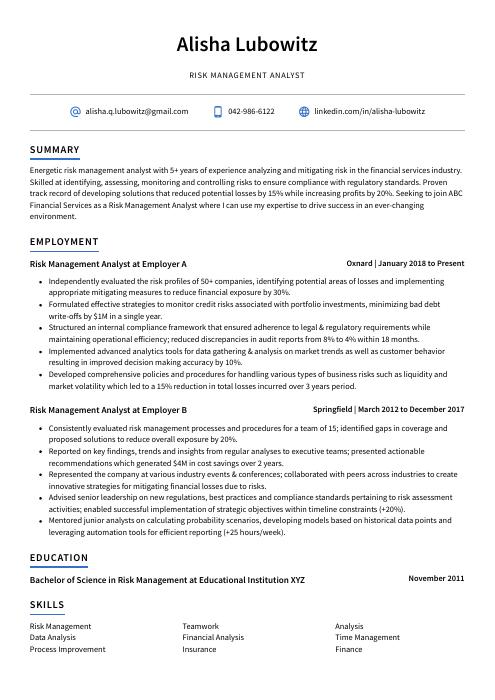

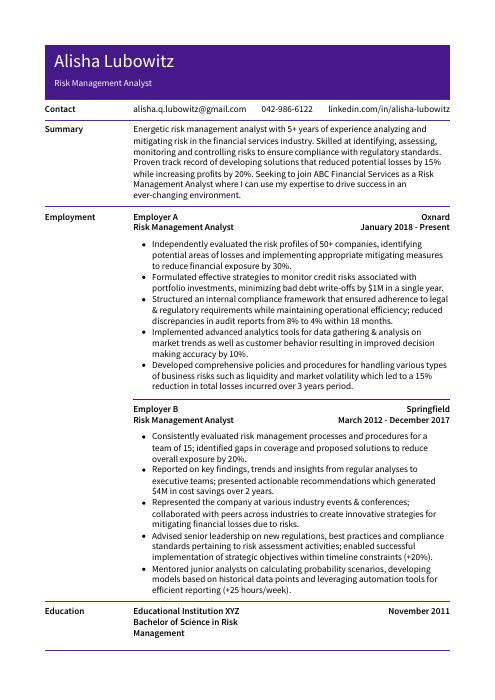

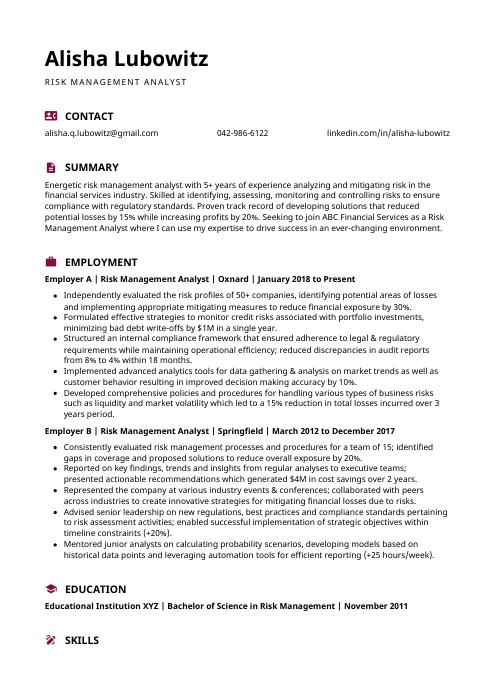

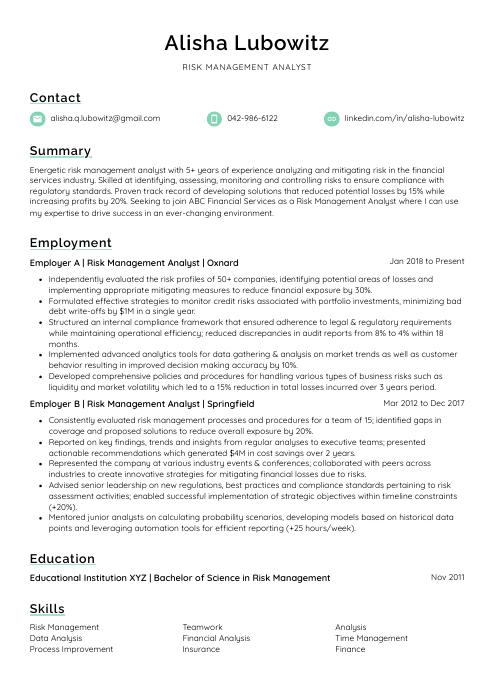

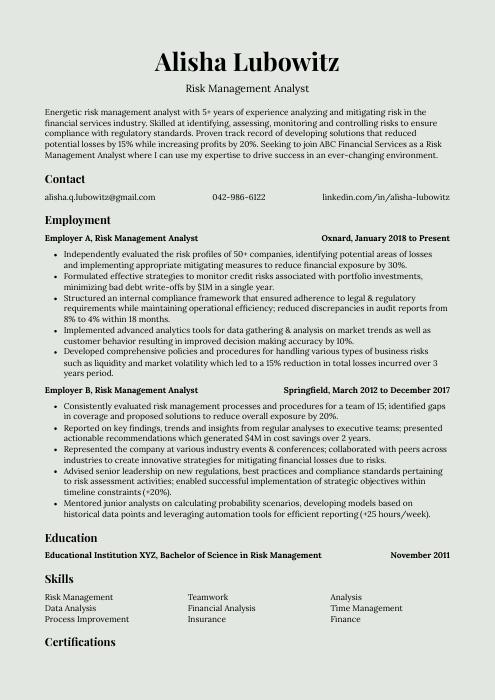

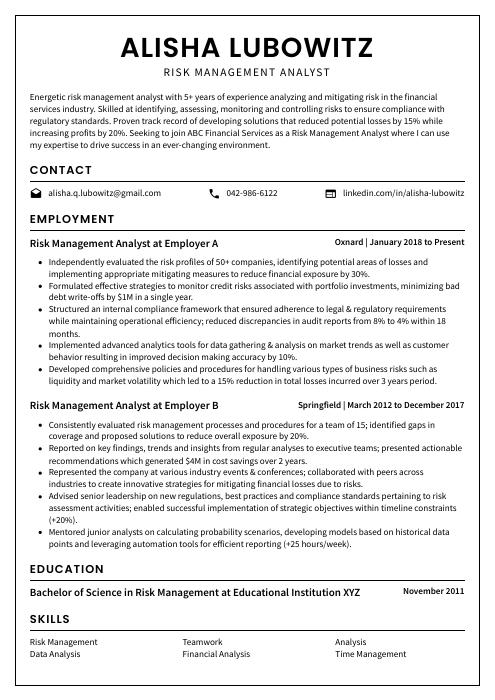

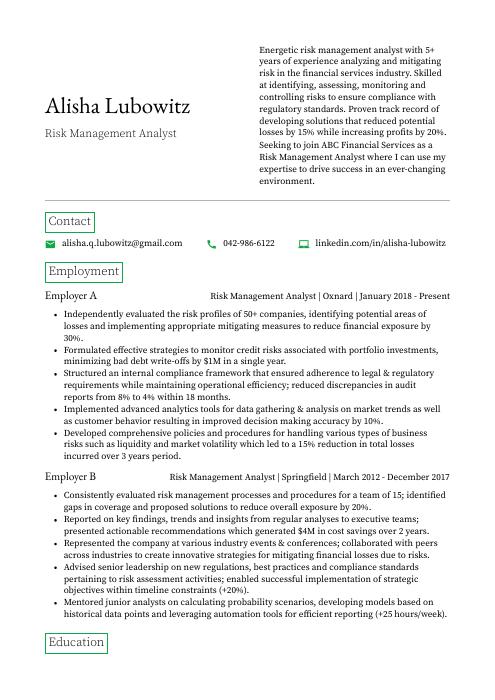

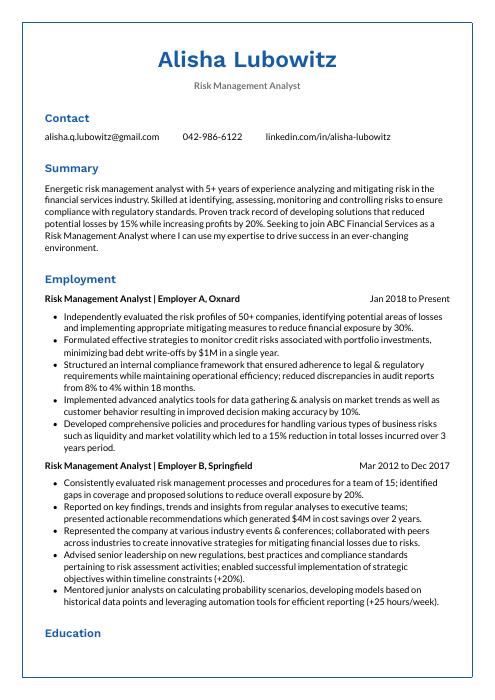

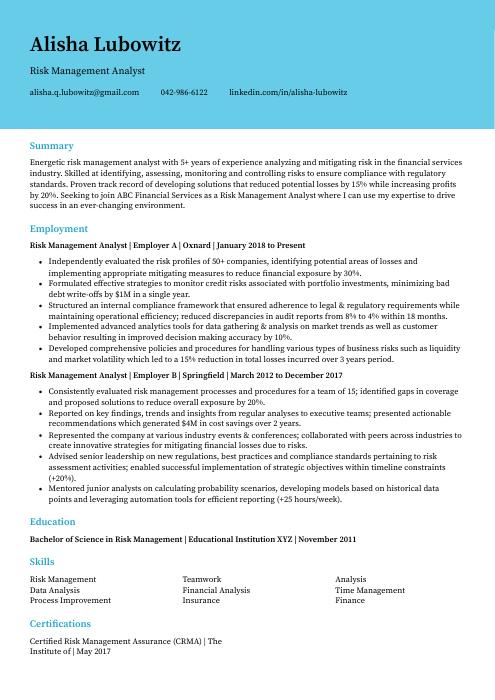

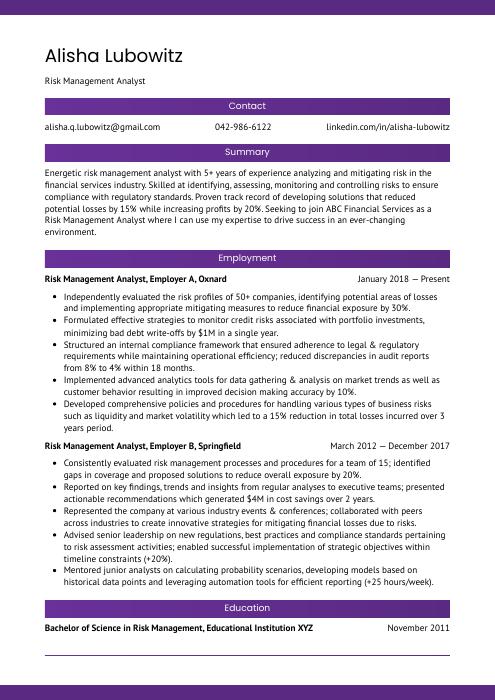

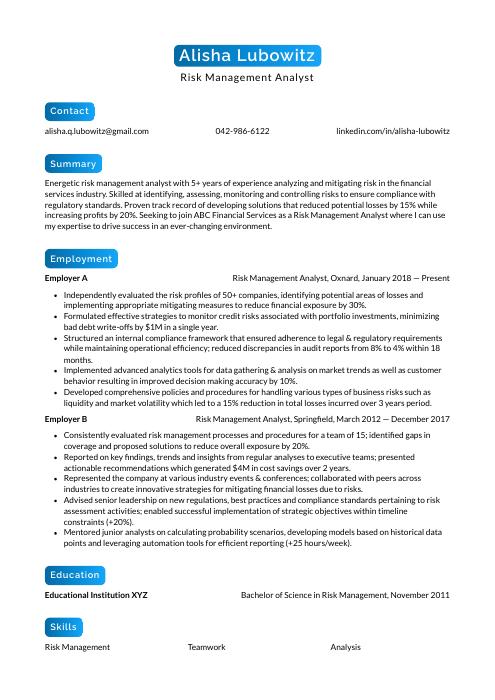

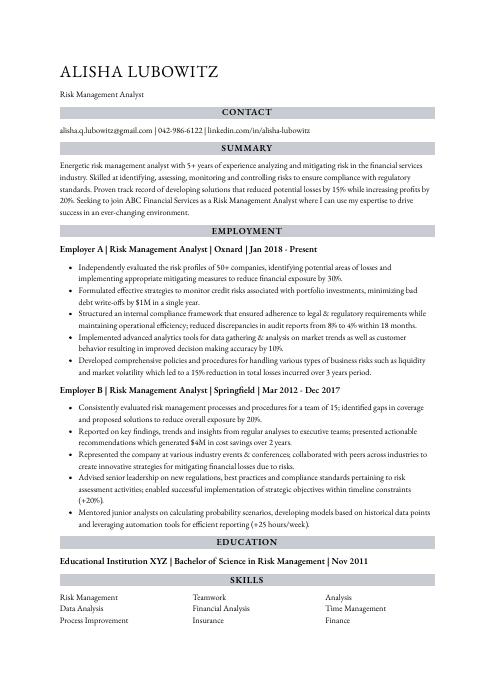

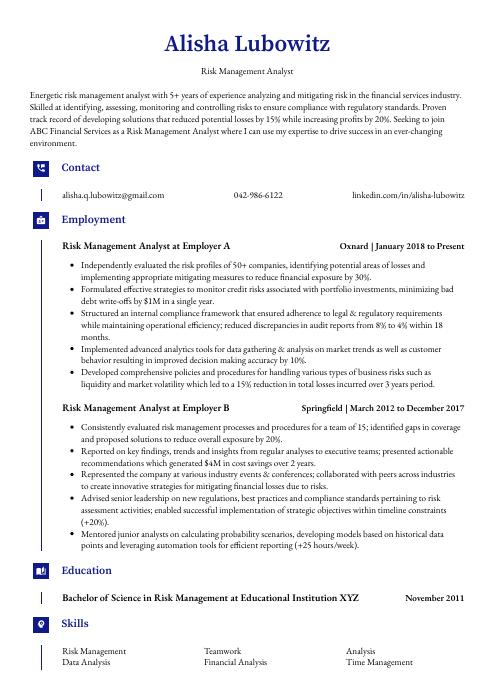

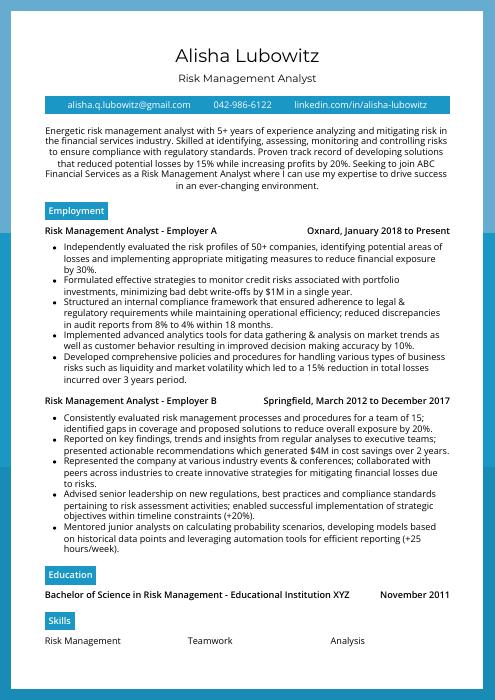

Risk Management Analyst Resume Sample

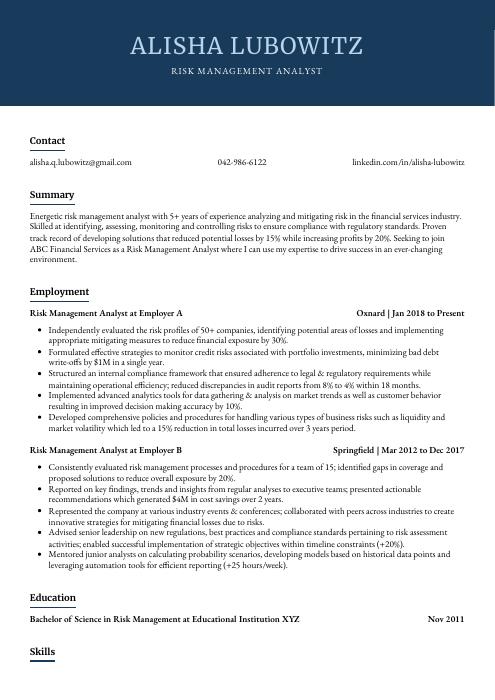

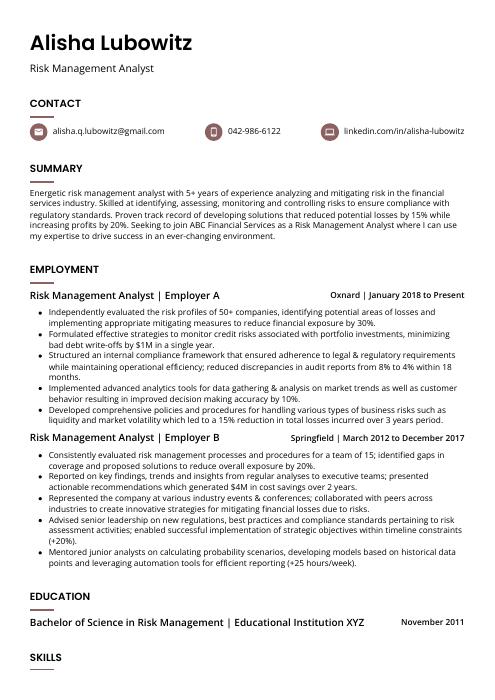

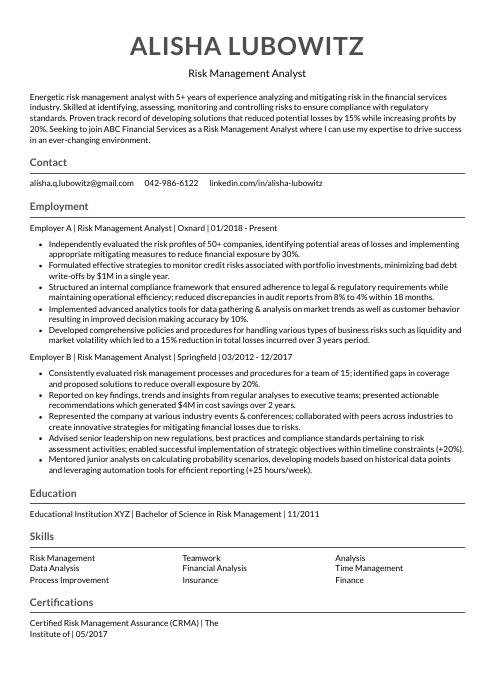

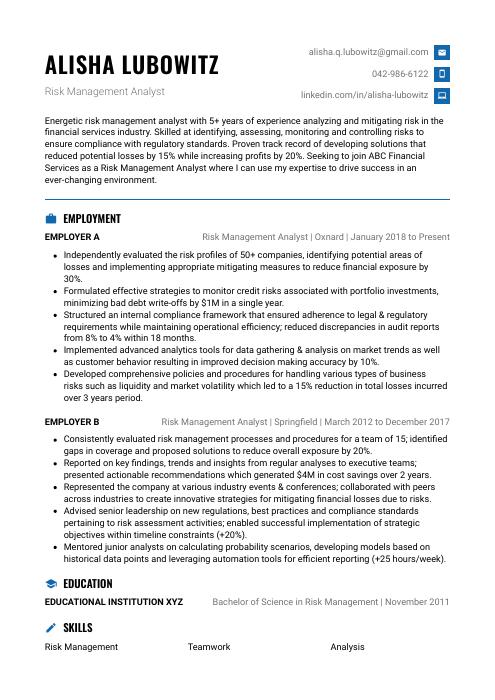

Alisha Lubowitz

Risk Management Analyst

[email protected]

042-986-6122

linkedin.com/in/alisha-lubowitz

Summary

Energetic risk management analyst with 5+ years of experience analyzing and mitigating risk in the financial services industry. Skilled at identifying, assessing, monitoring and controlling risks to ensure compliance with regulatory standards. Proven track record of developing solutions that reduced potential losses by 15% while increasing profits by 20%. Seeking to join ABC Financial Services as a Risk Management Analyst where I can use my expertise to drive success in an ever-changing environment.

Experience

Risk Management Analyst, Employer A

Oxnard, Jan 2018 – Present

- Independently evaluated the risk profiles of 50+ companies, identifying potential areas of losses and implementing appropriate mitigating measures to reduce financial exposure by 30%.

- Formulated effective strategies to monitor credit risks associated with portfolio investments, minimizing bad debt write-offs by $1M in a single year.

- Structured an internal compliance framework that ensured adherence to legal & regulatory requirements while maintaining operational efficiency; reduced discrepancies in audit reports from 8% to 4% within 18 months.

- Implemented advanced analytics tools for data gathering & analysis on market trends as well as customer behavior resulting in improved decision making accuracy by 10%.

- Developed comprehensive policies and procedures for handling various types of business risks such as liquidity and market volatility which led to a 15% reduction in total losses incurred over 3 years period.

Risk Management Analyst, Employer B

Springfield, Mar 2012 – Dec 2017

- Consistently evaluated risk management processes and procedures for a team of 15; identified gaps in coverage and proposed solutions to reduce overall exposure by 20%.

- Reported on key findings, trends and insights from regular analyses to executive teams; presented actionable recommendations which generated $4M in cost savings over 2 years.

- Represented the company at various industry events & conferences; collaborated with peers across industries to create innovative strategies for mitigating financial losses due to risks.

- Advised senior leadership on new regulations, best practices and compliance standards pertaining to risk assessment activities; enabled successful implementation of strategic objectives within timeline constraints (+20%).

- Mentored junior analysts on calculating probability scenarios, developing models based on historical data points and leveraging automation tools for efficient reporting (+25 hours/week).

Skills

- Risk Management

- Teamwork

- Analysis

- Data Analysis

- Financial Analysis

- Time Management

- Process Improvement

- Insurance

- Finance

Education

Bachelor of Science in Risk Management

Educational Institution XYZ

Nov 2011

Certifications

Certified Risk Management Assurance (CRMA)

The Institute of

May 2017

1. Summary / Objective

Your resume summary/objective should be a concise and compelling introduction to your professional experience as a risk management analyst. In this section, you can highlight the key skills that make you an ideal candidate for the job – such as your ability to identify potential risks in complex financial situations, develop strategies for mitigating those risks, and create detailed reports on risk levels. You could also mention any certifications or awards related to risk management that demonstrate your expertise.

Below are some resume summary examples:

Driven and analytical risk management analyst with 5+ years of experience in the financial services industry. Expertise in developing, monitoring and controlling internal processes to ensure compliance with applicable laws, regulations and company policies. Adept at identifying risks associated with various investments and proactively providing solutions to mitigate them. Experienced in conducting audits on a regular basis for clients across multiple sectors.

Proficient risk management analyst with 8+ years of experience providing financial advice to clients on strategies for reducing risk and optimizing investments. At XYZ, managed a portfolio of 25 high-net-worth individuals while developing comprehensive plans to manage their financial risks. Recognized twice as “Employee of the Month” by senior leadership team for consistent performance excellence in assessing risk levels and creating tailored solutions.

Reliable risk management analyst with 5+ years of experience in assessing and mitigating risk for financial institutions. At XYZ, successfully identified potential risks and implemented comprehensive strategies to reduce them by 50%. Skilled at analyzing data, identifying trends, and preparing reports that facilitate informed decision-making. Committed to helping organizations stay compliant with regulations while maximizing long-term profitability.

Amicable risk management analyst with 7+ years of experience in the financial services industry. Established track record of mitigating risk and developing compliance solutions for Fortune 500 companies, including ABC Bank and XYZ Investment Group. Adept at using Excel to analyze data trends and identify potential risks. Proven ability to develop strategic plans that reduce exposure while remaining compliant with regulations.

Accomplished risk management analyst with 8+ years of experience in financial services, audit and compliance. Seeking to join ABC Corp as a risk management specialist where my expertise in developing strategies for identifying potential risks and implementing preventative measures will be an asset. Achieved 95% accuracy rate on all audits conducted at XYZ Inc., saving the company $1 million annually.

Dependable risk management analyst with 5+ years of experience assessing and mitigating organizational risk. Proficient in data analysis, financial modeling, market research, and project management. Seeking to join ABC Company as a Risk Management Analyst where I can utilize my expertise to help the organization identify potential risks and create effective strategies for minimizing those risks.

Passionate risk management analyst with 5+ years of experience assessing, analyzing and mitigating risks for a variety of financial products. Acknowledged by the ABC Bank Board for uncovering fraudulent activities in one project which saved $4M in losses. Looking to join XYZ Financial Services as Risk Management Analyst to apply skill set and provide exceptional risk analysis services.

Well-rounded risk management analyst with 5+ years of experience in the banking and insurance industry. Seeking to use sharp analytical skills, risk assessment expertise, and problem-solving aptitude to join ABC Financial as a Risk Management Analyst. At XYZ Bank, identified process improvement opportunities that saved $2 million annually while reducing operational risks by 32%.

2. Experience / Employment

In the experience/employment/work history section, you should provide details on your past roles. This section should be written in reverse chronological order, with the most recent role listed first.

When writing this section, stick to bullet points; doing so allows the reader to quickly digest what you have done and accomplished. When crafting these bullets, take some time to think about the specifics of each job and any quantifiable results that were achieved as a result of your work.

For example, instead of saying “Assessed risk,” you could say “Analyzed financial data from 10+ clients per month using quantitative models such as Monte Carlo simulations; identified potential risks for each client which resulted in an 8% reduction in overall losses.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Assessed

- Analyzed

- Evaluated

- Identified

- Mitigated

- Monitored

- Reported

- Resolved

- Reviewed

- Developed

- Implemented

- Investigated

- Managed

- Documented

- Communicated

Other general verbs you can use are:

- Achieved

- Advised

- Compiled

- Coordinated

- Demonstrated

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Resolved $200,000 in potential losses through extensive identification and analysis of financial risks associated with current/future projects.

- Diligently monitored compliance to applicable laws and regulations impacting risk management operations; increased overall corporate legal safety by 15%.

- Managed a team of 3 analysts responsible for developing strategies to mitigate business risks based on industry trends, customer feedback and market conditions.

- Developed an automated system for identifying underperforming assets resulting in the reduction of portfolio-related losses by 20% within 6 months.

- Expedited problem solving process time from 8 hours down to 4 hours per incident via implementation of new workflow automation tools & techniques.

- Resourcefully prepared detailed risk assessments to identify potential threats and vulnerabilities, implementing strategies that minimized financial losses by 15% in one year.

- Communicated regularly with stakeholders regarding risk management initiatives and policies; successfully explained complex concepts to a team of 20+ personnel on the basics of proper governance procedures.

- Identified risks posed by technology systems and processes, designing preventative measures accordingly while creating streamlined emergency response plans for high-risk situations.

- Streamlined reporting systems which monitored all activities related to security breaches, ensuring compliance with industry standards at all times through regular auditing sessions; reduced paperwork time from 6 hours per week to 2 hours per week on average during this process.

- Developed innovative solutions for reducing existing exposure levels across multiple departments within the organization, resulting in improved overall efficiency & cost savings amounting up to $50K annually.

- Coordinated the development of risk management strategies and plans to reduce potential losses, achieving a 20% decrease in operational risks over the course of one year.

- Assessed current operations for potential vulnerabilities; identified weaknesses within existing processes, which were then remedied with improved controls practices.

- Monitored daily activities for compliance with internal policies & external regulations; managed all corrective measures needed when violations occurred and decreased associated penalties by $2k/year on average.

- Reorganized risk management protocols based upon new industry standards or changes in market conditions; streamlined procedures that increased efficiency while reducing costs by $1k/monthly basis per quarter on average.

- Competently communicated suggestions to senior executives regarding ways to minimize financial exposures due to unforeseen events or changing trends in the marketplace, leading to an increase in profits of up 7%.

- Presented risk management strategies to senior stakeholders, resulting in a cost savings of $750,000 over the course of the year.

- Optimized risk assessment processes by streamlining workflow and implementing new technologies; reduced time spent on manual data entry tasks by 45%.

- Achieved an 85% accuracy rate when identifying potential losses caused by financial risks across multiple markets and industries.

- Substantially improved operational efficiencies through proactive measures such as regular meetings with key personnel to review progress against objectives; increased revenue growth by 12% within 6 months.

- Analyzed trends in customer behavior, credit quality & market liquidity using advanced analytics tools to gain insights into current & future financial risks for business decision-making purposes.

- Efficiently identified and mitigated potential risks in banking operations, resulting in a 20% reduction of operational losses over the past year.

- Documented risk management procedures for compliance with current regulations; monitored changes to ensure regulatory requirements were met on all levels.

- Reviewed financial statements and identified areas of non-compliance with internal policies & external laws; proactively raised concerns to senior stakeholders and provided corrective solutions accordingly.

- Utilized advanced analytics tools such as Excel and SAS to identify trends that could lead to greater exposure of firm assets or liabilities, informing timely preventative measures before any threat materializes into actual loss/damage incidents.

- Researched market developments related to new products, services or technologies being adopted by competitors in order to assess their impact on business risk profile; established mitigation strategies where necessary.

- Improved risk management policies by 40%, resulting in a reduction of $2.5M in losses due to financial and operational risks over the past 5 years.

- Reduced compliance violation incidents from 1,200+ to 600 through effective risk assessment and monitoring procedures; minimized regulatory penalties by 95%.

- Participated actively as an integral member of the Risk Management Task Force responsible for crafting strategies that reduce organizational risks across multiple departments.

- Demonstrated strong problem-solving abilities when responding quickly to unexpected events or security threats, leading teams onsite during crisis situations with high levels of professionalism and expertise.

- Successfully implemented automated processes for daily risk analysis tasks which increased productivity & accuracy by 50% while decreasing manual workloads significantly.

- Confidently assessed and identified risks for over 100 projects, developing detailed plans to mitigate potential losses of $1.2M in the last year.

- Revised existing risk management policies and procedures to ensure compliance with new government regulations; reduced audit-related fines by 40%.

- Facilitated monthly meetings with key stakeholders across various departments to review project progress and discuss strategies for managing high-risk initiatives; improved communication processes between teams by 25%.

- Compiled comprehensive reports on financial market trends, industry developments and associated risks that could adversely affect company operations; enabled senior management team to make informed decisions regarding investments & budget allocations resulting in an overall increase of profits by 12%.

- Spearheaded development process of a custom technological platform designed specifically for capturing data related to risk analysis activities such as identification, evaluation & control; decreased manual labor hours required per task from 10 hours down to 2 hours on average.

3. Skills

Even though two organizations are hiring for the same role, the skillset they want an ideal candidate to possess could differ significantly. For instance, one may be on the lookout for an individual who is well-versed in enterprise risk management and another may be looking for someone with experience of financial modeling.

Therefore, it’s important to tailor the skills section of your resume to each job you are applying for. This will ensure that the keywords used by applicant tracking systems (ATS) match up with those specified in the job posting – otherwise, your resume won’t make it past this stage.

In addition to just listing relevant skills here, you should also discuss them further in other sections such as summary or work experience.

Below is a list of common skills & terms:

- Access

- Accounting

- Analysis

- Analytical Skills

- Banking

- Business Analysis

- Commercial Insurance

- Communication

- Data Analysis

- Data Entry

- Finance

- Financial Analysis

- Government

- Healthcare

- Insurance

- Policy

- Process Improvement

- Program Management

- Project Planning

- Property and Casualty Insurance

- Risk Assessment

- Risk Management

- Social Networking

- Team Leadership

- Teamwork

- Time Management

- Workers Compensation

4. Education

Adding an education section to your resume is only necessary if you are a recent graduate or have not yet acquired any work experience. If you do include an education section, make sure to mention courses and subjects that relate directly to the risk management analyst role you are applying for.

If, however, you already have several years of professional experience in the field under your belt, it might be better to omit this section altogether and focus on showcasing those accomplishments instead.

Bachelor of Science in Risk Management

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications demonstrate to a potential employer that you have the necessary skills and knowledge required for the job. Having certifications in your field of expertise can help make you stand out from other applicants, as it shows that you are proficient and knowledgeable in your chosen area.

Include any relevant certifications on your resume so hiring managers know exactly what qualifications and credentials you possess. This will give them confidence that they are making an informed decision when considering who to hire for the position.

Certified Risk Management Assurance (CRMA)

The Institute of

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Alisha Lubowitz, this would be Alisha-Lubowitz-resume.pdf or Alisha-Lubowitz-resume.docx.

7. Cover Letter

Providing a cover letter is an excellent way to demonstrate your enthusiasm and interest in a job role. It is usually made up of 2 to 4 paragraphs that provide additional details about yourself, such as why you’re the best candidate for the position and what unique qualities or skills you can bring to it.

Although cover letters are not always required when applying for jobs, they can be extremely useful in helping you stand out from other applicants. They also give employers more insight into who you are outside of just reading your resume alone.

Below is an example cover letter:

Dear Maci,

I am writing to apply for the Risk Management Analyst position at XYZ Corporation. As a risk management professional with more than 10 years of experience in the financial services industry, I am confident that I can make a significant contribution to your organization.

In my current role as Assistant Vice President of Risk Management at ABC Bank, I oversee all aspects of risk management for the retail banking division. This includes developing and implementing policies and procedures to mitigate risks associated with consumer lending products, such as credit cards and mortgages. I have also led several successful projects to improve our risk management processes, including a complete overhaul of our fraud detection system.

My background has given me a deep understanding of both the theory and practice of risk management. In addition, my experience leading teams and managing large-scale projects will be invaluable in this role. I am confident that I can hit the ground running and make an immediate impact at XYZ Corporation.

Thank you for your time and consideration; I look forward to speaking with you about this opportunity soon.

Sincerely,

Alisha

Risk Management Analyst Resume Templates

Ocelot

Ocelot Axolotl

Axolotl Pika

Pika Hoopoe

Hoopoe Lorikeet

Lorikeet Saola

Saola Cormorant

Cormorant Quokka

Quokka Markhor

Markhor Dugong

Dugong Jerboa

Jerboa Bonobo

Bonobo Fossa

Fossa Indri

Indri Echidna

Echidna Kinkajou

Kinkajou Numbat

Numbat Gharial

Gharial Rhea

Rhea Rezjumei

Rezjumei