Revenue Cycle Analyst Resume Guide

Revenue cycle analysts are responsible for managing and analyzing the financial performance of a company’s revenue cycle. They analyze data to identify issues that could be causing inefficiencies, develop strategies to improve processes, track key performance indicators, and ensure compliance with industry regulations.

You have the analytical and problem-solving skills necessary for success in a revenue cycle analyst role. To make yourself known to hiring managers, you must write an eye-catching resume that captures their attention.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

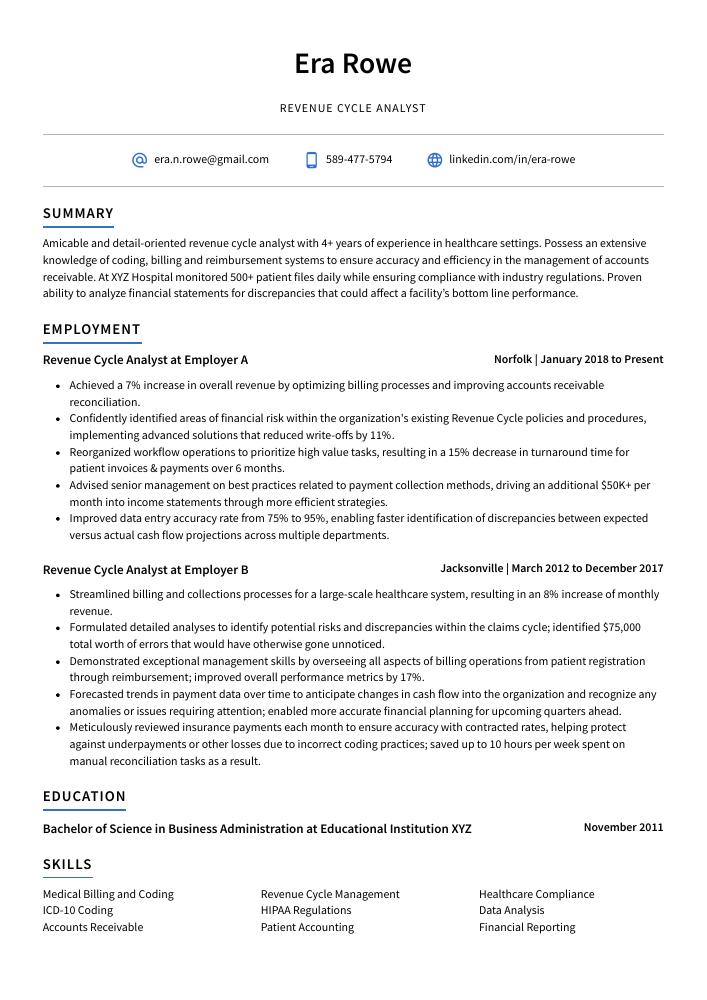

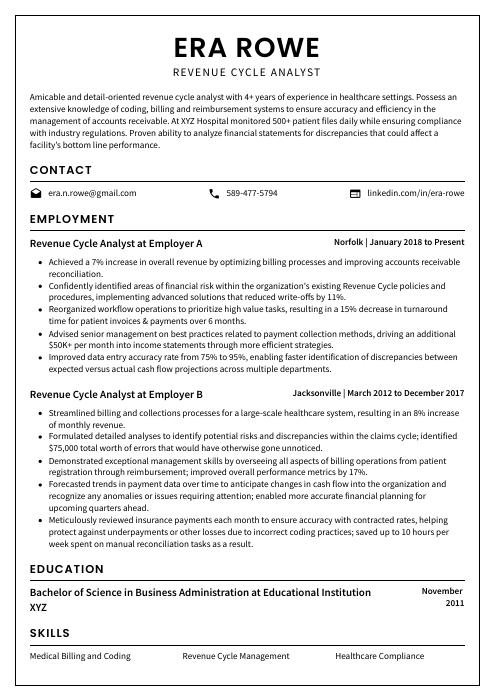

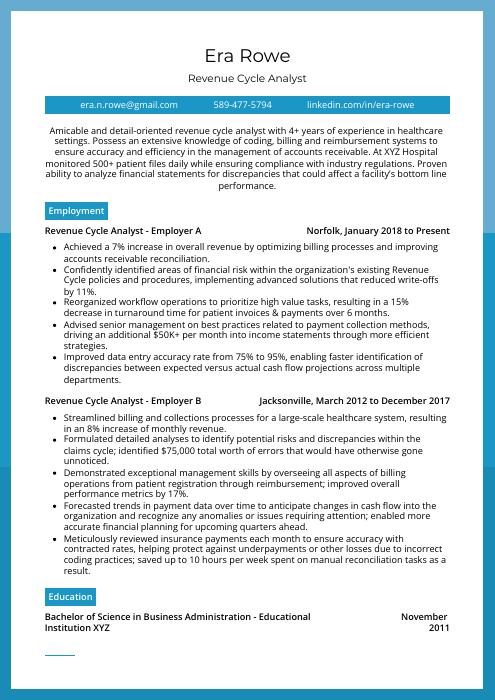

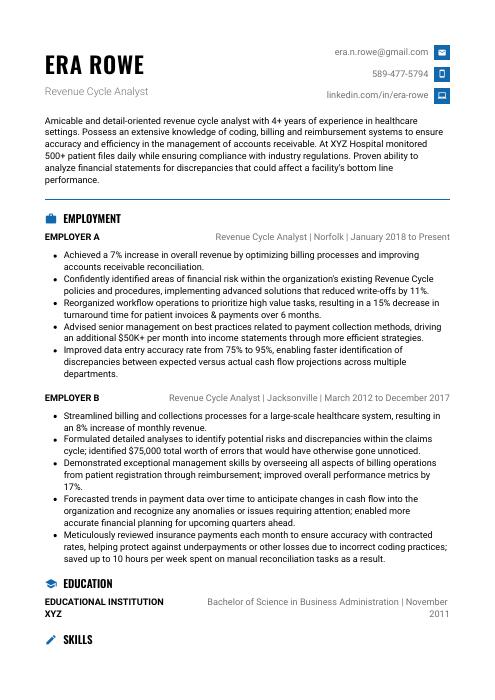

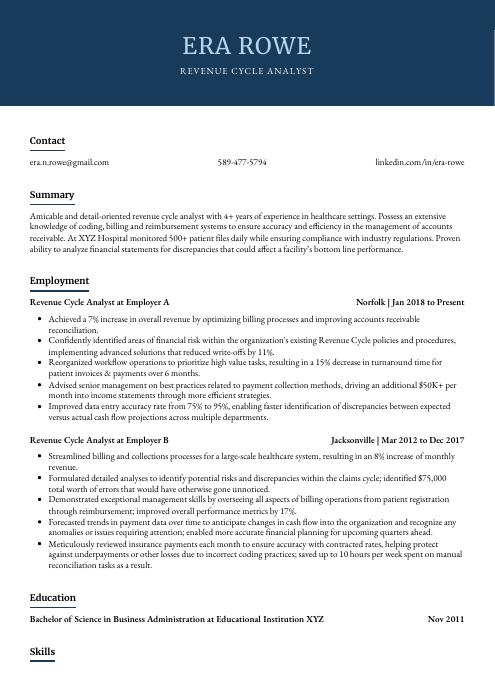

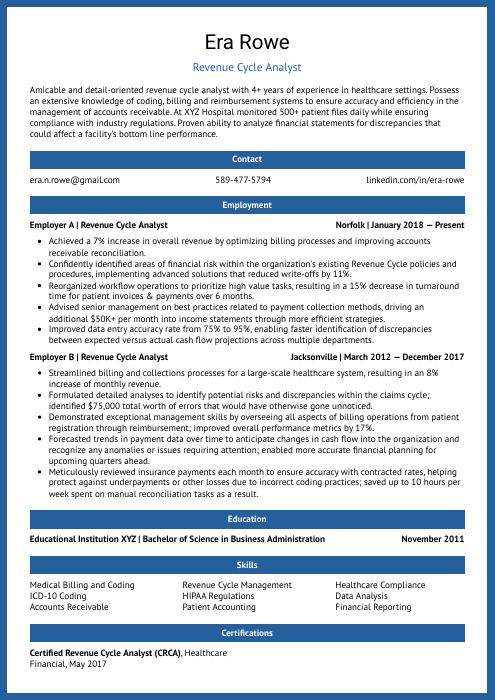

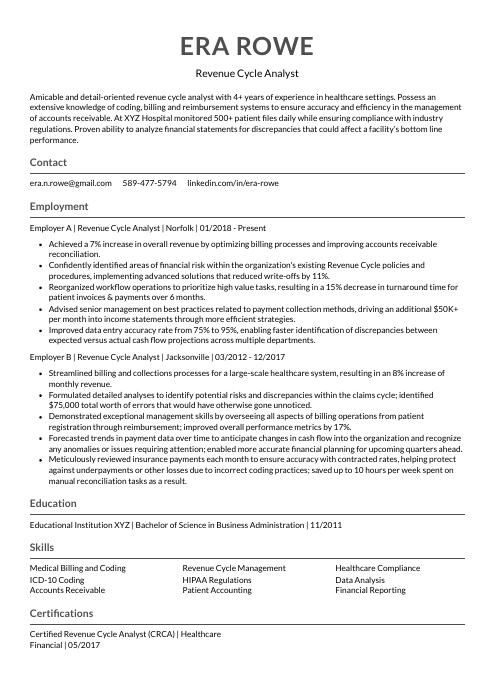

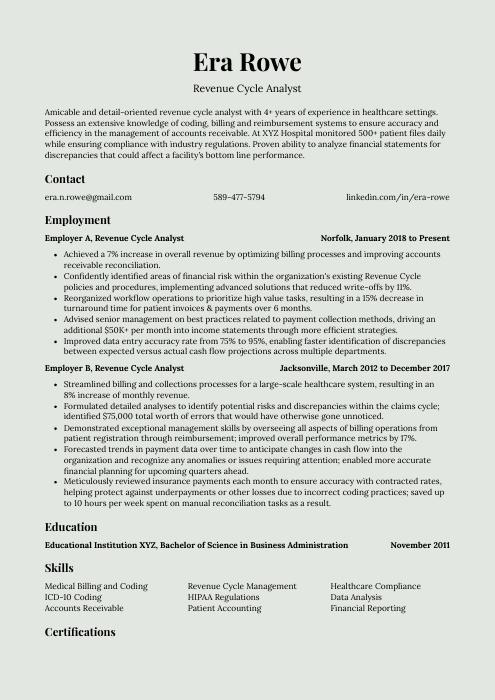

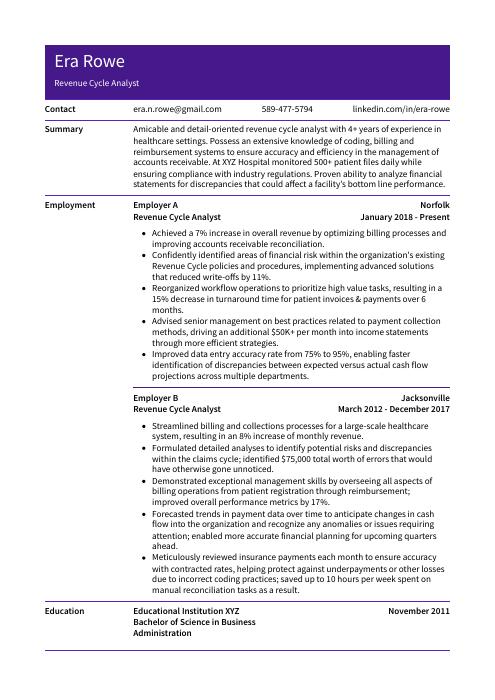

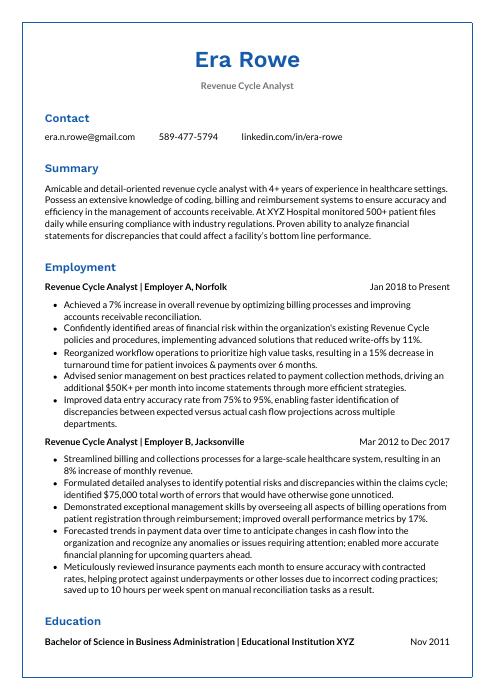

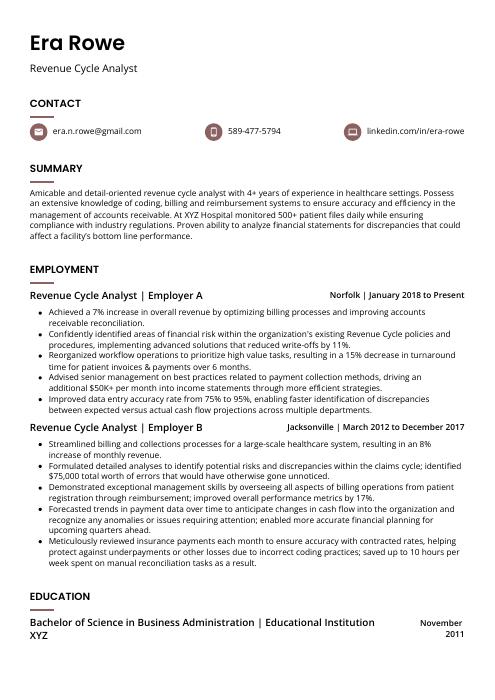

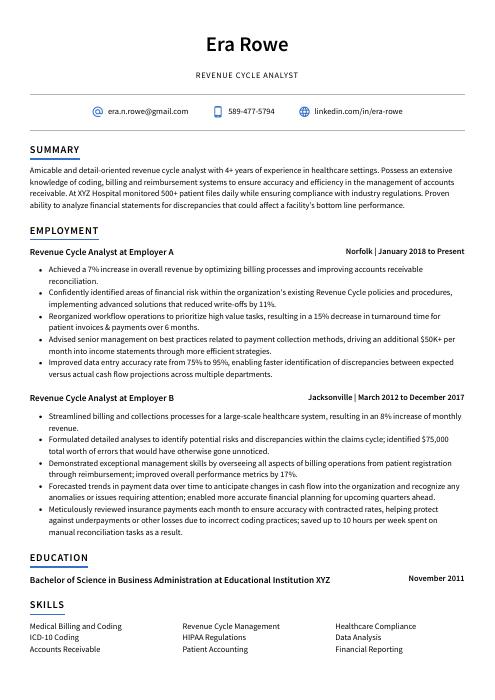

Revenue Cycle Analyst Resume Sample

Era Rowe

Revenue Cycle Analyst

[email protected]

589-477-5794

linkedin.com/in/era-rowe

Summary

Amicable and detail-oriented revenue cycle analyst with 4+ years of experience in healthcare settings. Possess an extensive knowledge of coding, billing and reimbursement systems to ensure accuracy and efficiency in the management of accounts receivable. At XYZ Hospital monitored 500+ patient files daily while ensuring compliance with industry regulations. Proven ability to analyze financial statements for discrepancies that could affect a facility’s bottom line performance.

Experience

Revenue Cycle Analyst, Employer A

Norfolk, Jan 2018 – Present

- Achieved a 7% increase in overall revenue by optimizing billing processes and improving accounts receivable reconciliation.

- Confidently identified areas of financial risk within the organization’s existing Revenue Cycle policies and procedures, implementing advanced solutions that reduced write-offs by 11%.

- Reorganized workflow operations to prioritize high value tasks, resulting in a 15% decrease in turnaround time for patient invoices & payments over 6 months.

- Advised senior management on best practices related to payment collection methods, driving an additional $50K+ per month into income statements through more efficient strategies.

- Improved data entry accuracy rate from 75% to 95%, enabling faster identification of discrepancies between expected versus actual cash flow projections across multiple departments.

Revenue Cycle Analyst, Employer B

Jacksonville, Mar 2012 – Dec 2017

- Streamlined billing and collections processes for a large-scale healthcare system, resulting in an 8% increase of monthly revenue.

- Formulated detailed analyses to identify potential risks and discrepancies within the claims cycle; identified $75,000 total worth of errors that would have otherwise gone unnoticed.

- Demonstrated exceptional management skills by overseeing all aspects of billing operations from patient registration through reimbursement; improved overall performance metrics by 17%.

- Forecasted trends in payment data over time to anticipate changes in cash flow into the organization and recognize any anomalies or issues requiring attention; enabled more accurate financial planning for upcoming quarters ahead.

- Meticulously reviewed insurance payments each month to ensure accuracy with contracted rates, helping protect against underpayments or other losses due to incorrect coding practices; saved up to 10 hours per week spent on manual reconciliation tasks as a result.

Skills

- Medical Billing and Coding

- Revenue Cycle Management

- Healthcare Compliance

- ICD-10 Coding

- HIPAA Regulations

- Data Analysis

- Accounts Receivable

- Patient Accounting

- Financial Reporting

Education

Bachelor of Science in Business Administration

Educational Institution XYZ

Nov 2011

Certifications

Certified Revenue Cycle Analyst (CRCA)

Healthcare Financial

May 2017

1. Summary / Objective

Your resume summary should be a snapshot of your professional experience and qualifications as a revenue cycle analyst. Include details such as the number of years you have been in this role, any certifications or awards you may have received, and how many successful projects you have completed. You can also mention specific software programs that are relevant to the job description – for example, if you are experienced with Epic Systems then make sure to include it here!

Below are some resume summary examples:

Seasoned revenue cycle analyst with 8+ years of comprehensive experience in medical billing and collections. Proven success at ABC Company, where I helped reduce unpaid claims by 19% and improved collection rates from 56 to 75%. Demonstrated ability to manage complex cases effectively while maintaining excellent customer service standards. Looking for an opportunity to join XYZ Healthcare as a revenue cycle analyst where I can utilize my skillset and knowledge.

Committed revenue cycle analyst with 5+ years of experience in financial operations. Expertise in creating and monitoring billing processes, ensuring accuracy of payment information, and analyzing revenue data to identify areas for improvement. At ABC Medical Center improved cash collection by 6% while reducing denials by 3%. Looking to join XYZ Health Services as a Revenue Cycle Analyst where I can maximize efficiency through my knowledge and expertise.

Energetic revenue cycle analyst with 5+ years of experience in the healthcare industry. Proven track record for increasing revenue and improving patient satisfaction. At XYZ, successfully implemented new billing system that improved payment accuracy by 80%. Experienced working with various financial systems, including EPIC, Cerner, McKesson and Meditech. Skilled at analyzing data to identify patterns and discrepancies in order to optimize process flow.

Skilled Revenue Cycle Analyst with 5+ years of experience in healthcare financial management. Proven track record of increasing revenue by 30% and reducing A/R days from 70 to 48 through process enhancements, system optimization, and billing accuracy improvement initiatives. Experienced in coding medical records according to ICD-10 standards, managing contracts & payer relationships, monitoring patient accounts for follow up activities etc.

Reliable and detail-oriented revenue cycle analyst with 5+ years of experience analyzing and optimizing financial processes to ensure accurate payments from insurance companies. Seeking a position at ABC Company utilizing my knowledge of healthcare billing systems, data analysis skills, and strong work ethic to maximize profits for the organization. At XYZ Inc., identified $1M in errors that were leading to delayed reimbursements.

Diligent revenue cycle analyst with 5+ years of experience in the healthcare field. Proven track record of utilizing data analysis to optimize revenue and improve cash flow for clients. At XYZ, developed an automated solution that reduced manual labor hours by 60% while increasing accuracy by 95%. Seeking to leverage my accounting knowledge and problem-solving skills to help ABC maximize their financial performance.

Hard-working revenue cycle analyst with 4+ years of experience in the healthcare sector. Skilled at managing and analyzing data to maximize patient satisfaction, reduce costs and improve efficiency. Established a successful process for optimizing billing cycles that increased revenue by 19%. Seeking an opportunity to join ABC Healthcare as a Revenue Cycle Analyst and use my expertise to optimize their processes.

Detail-oriented revenue cycle analyst with 6+ years of experience in healthcare administration. Highly skilled at financial analysis, forecasting, and budgeting. Proven track record of improving patient satisfaction by 42% while increasing cash collections by 23%. Committed to optimizing revenue cycles through data-driven solutions as the next Revenue Cycle Analyst for ABC Hospital.

2. Experience / Employment

In the experience section, you should list your past employment in reverse chronological order. Stick to bullet points when describing what you did and the results achieved.

For example, instead of saying “Analyzed revenue cycle data,” you could say, “Performed detailed analysis on patient billing information to identify discrepancies that resulted in a 5% increase in overall collections.”.

You also want to provide detail about any projects or initiatives that were successful during your time with each employer. This allows potential employers to get an understanding of how well-rounded and experienced you are as a Revenue Cycle Analyst.

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Analyzed

- Monitored

- Reconciled

- Streamlined

- Optimized

- Forecasted

- Resolved

- Investigated

- Implemented

- Processed

- Managed

- Reported

- Documented

- Tracked

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Structured

- Utilized

Below are some example bullet points:

- Efficiently managed the entire revenue cycle process for a high-volume medical practice with 9 locations, resulting in an increase of $4 million in total billing and collections over 6 months.

- Developed departmental policies and procedures to ensure compliance with state regulations; cut down denials due to administrative errors by 20%.

- Facilitated weekly meetings between office staff and billers/collectors to review accuracy of submitted claims, reduce outstanding AR accounts by 25%, and address any other payment issues that arose.

- Analyzed trends related to patient utilization across all departments using healthcare analytics software; identified areas where operational improvements could be made which resulted in increased net revenues by 10%.

- Streamlined existing processes through automation which improved charge entry turnaround time from 8 days on average to 2 days or less within 3 months’ time period.

- Revised and maintained accuracy of patient billing records to ensure compliance with insurance regulations, resulting in a reduction of unpaid accounts by 25%.

- Assessed and analyzed revenue cycle performance metrics on a monthly basis and identified underlying issues causing payment delays or denials; proposed solutions that increased reimbursement rate by 15%.

- Tracked claims submissions through the entire lifecycle from creation to denial/payment resolution, preventing over $5K worth of fraudulent claim payments.

- Investigated complex cases related to medical coding errors and implemented corrective measures for 30+ patients’ accounts, reducing accounting discrepancies by 8%.

- Consistently monitored all payor contracts for changes in policy requirements that could impact timely reimbursements; initiated process updates immediately upon identification which decreased collection time frame by 10 days on average per account.

- Successfully analyzed, monitored and reported on patient revenue cycle data for a multi-million dollar healthcare organization; identified discrepancies that resulted in an 8% increase in net profits.

- Spearheaded the implementation of new software systems to streamline medical billing processes, reducing manual paperwork by 32%.

- Documented all financial interactions between patients and providers within the hospital’s EMR system; organized over 3,000 records to improve accuracy of insurance claims submissions.

- Processed incoming payments from third-party payers and converted them into appropriate insurance codes using proprietary software; achieved 95% accuracy rate with zero errors or omissions.

- Coordinated regular meetings with department staff regarding changes in reimbursement policies and regulations, ensuring compliance at all times with federal & state laws governing healthcare finance operations.

- Competently analyzed and managed revenue cycle activities across 18 departments, resulting in improved cash flow of $1.5M over a period of two years.

- Presented comprehensive financial reports to senior management on monthly basis, demonstrating an increase of 7% in overall patient visits for the year.

- Represented the organization at finance-related conferences and seminars as well as educational webinars; identified cost savings opportunities that resulted in reduction of expenses by 12%.

- Implemented new software systems related to accounts receivable processes, improving billing efficiency by 20 hours per week while ensuring accuracy & completeness with all transactions/data entry tasks conducted by staff members within departmental guidelines & regulations set forth by governing bodies such as HIPAA or CMS (Centers for Medicare & Medicaid Services).

- Compiled daily/weekly performance metrics relevant to profit margins, accounts receivable aging analysis and other key factors influencing total revenue generated from services provided; reported findings regularly which helped inform strategic decisions made regarding pricing policies for different service lines offered at facility’s clinics/hospitals etc.

- Prepared monthly financial reports and analyzed complex data to identify discrepancies in revenue cycle, resulting in a 22% reduction of outstanding accounts receivable.

- Expedited billing processes by introducing automated payment methods and implementing new procedures for credit card collections that increased overall cash flow by $20,000 per month.

- Proficiently utilized various software programs such as MS Excel, Epic Systems & QuickBooks to manage all aspects of the revenue cycle including coding insurance claims and tracking payments from third-party payers.

- Utilized knowledge of ICD-10 codes while verifying medical records with insurance companies prior to submitting claims; achieved an average accuracy rate of 97%.

- Introduced innovative strategies for streamlining collection efforts which led to a 10% decrease in denied/underpaid claims over the course of one year.

- Structured and implemented processes to streamline the revenue cycle management (RCM) system, resulting in a 33% reduction of billing errors and an 8% increase in overall collections.

- Mentored a team of 5 junior employees on RCM best practices; improved their data entry accuracy by 20%.

- Reconciled complex financial accounts related to healthcare claims processing using insurance payer-specific guidelines; resolved over $200,000 worth of discrepancies within 2 months.

- Participated actively in weekly meetings with senior executives to discuss various strategies for improving cash flow and reducing denials; identified potential areas for cost savings that resulted in annual savings up to $250,000 per year.

- Actively monitored Medical Necessity Denial rates across all departments & worked closely with the coding staffs to ensure accurate medical codes were used when submitting claims – reduced denial rate by 25%.

- Reduced denials and write-offs by 30% through the utilization of data analytics and proactive billing practices.

- Reported on payments, denials, appeals & reimbursements to management for over 200 patient accounts every month; identified trends in claims submissions & rejections that resulted in improved coding accuracy rate of 95%.

- Resolved more than 300 customer disputes within payment cycles as well as managed corresponding documentation such as medical records and insurance forms for up to 20 clients daily with a 100% accuracy rate.

- Optimized monthly revenue cycle processes by reorganizing existing workflow protocols which led to an increase of $5K+ in weekly collections from payers and patients alike.

- Substantially reduced A/R days from 50 days down to 35 while ensuring accurate account balances were maintained throughout all billing cycles resulting in 98% collection success rate across all services provided.

3. Skills

Even though two organizations are hiring for the same role, the skillset they want an ideal candidate to possess could differ significantly. For instance, one may be on the lookout for an individual with experience in Epic Systems, while the other may prefer someone who is familiar with Cerner.

It’s important to tailor your skills section of your resume according to each job you are applying for; this way, it will be easier for employers and their applicant tracking systems (ATS) to identify that you have the necessary qualifications for a particular role.

In addition, make sure that you highlight certain key skills in more detail throughout other sections – such as the summary or work history – so potential employers can get a better understanding of what makes you an ideal candidate.

Below is a list of common skills & terms:

- Accounts Receivable

- Data Analysis

- Financial Reporting

- HIPAA Regulations

- Healthcare Compliance

- ICD-10 Coding

- Medical Billing and Coding

- Patient Accounting

- Revenue Cycle Management

4. Education

Mentioning an education section on your resume will depend on how far along you are in your career. If you just graduated and have no prior experience, include an education section below your resume objective. However, if you have been working as a revenue cycle analyst for years with plenty of accomplishments to showcase, omitting the education section is perfectly acceptable.

If including an education section is necessary, try to mention courses and subjects related to the revenue cycle analyst role that demonstrate knowledge relevant to the job.

Bachelor of Science in Business Administration

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications demonstrate to employers that you have been tested and evaluated in a given field by an accredited organization. Having certifications on your resume shows potential employers that you are more knowledgeable and experienced than other applicants.

If the job posting requires specific skills, including any relevant certifications can be beneficial for making yourself stand out from the competition. Make sure to list all of your professional development courses as well so hiring managers can see how up-to-date your industry knowledge is.

Certified Revenue Cycle Analyst (CRCA)

Healthcare Financial

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Era Rowe, this would be Era-Rowe-resume.pdf or Era-Rowe-resume.docx.

7. Cover Letter

Attaching a cover letter to your job application is a great way to show recruiters and hiring managers that you’re serious about the position. It should be made up of 2-4 paragraphs, providing more information than what’s already included in your resume.

Cover letters allow you to explain why this particular role interests you and how it relates to your professional goals. They are also an opportunity for you to showcase some of the skills or experiences that make you uniquely qualified for the job at hand.

Below is an example cover letter:

Dear Cooper,

I am writing today to apply for the Revenue Cycle Analyst position at XYZ Company. With my experience in healthcare administration and financial analysis, I am confident that I would be a valuable asset to your team.

In my current role as a Revenue Cycle Analyst at ABC Hospital, I am responsible for overseeing the hospital’s billing and collections process. This includes working with insurance companies to ensure timely reimbursement, analyzing data to identify areas of improvement, and training staff on best practices. As a result of my efforts, our department has increased efficiency by 15% over the past year.

I have also gained experience with project management during my time at ABC Hospital. I recently led a successful initiative to streamline the hospital’s coding process, which resulted in more accurate coding and improved reimbursement rates. My ability to manage projects from start to finish would be an asset to your organization as you continue implementing new revenue cycle initiatives.

In addition to my experience in revenue cycle management, I hold a Bachelor’s degree in Healthcare Administration and a Master’s degree in Business Administration (MBA). My educational background has given me the knowledge and skills necessary to excel in this role.

I look forward to putting my experience and skillset to work for XYZ Company as your next Revenue Cycle Analyst. Thank you for your consideration; I look forward hearing from you soon regarding this opportunity.

Sincerely,

Era

Revenue Cycle Analyst Resume Templates

Jerboa

Jerboa Numbat

Numbat Gharial

Gharial Cormorant

Cormorant Rhea

Rhea Echidna

Echidna Bonobo

Bonobo Hoopoe

Hoopoe Ocelot

Ocelot Indri

Indri Saola

Saola Pika

Pika Markhor

Markhor Dugong

Dugong Lorikeet

Lorikeet Quokka

Quokka Kinkajou

Kinkajou Fossa

Fossa Axolotl

Axolotl Rezjumei

Rezjumei