Regulatory Reporting Analyst Resume Guide

Regulatory Reporting Analysts analyze and report on financial data to ensure their compliance with legal regulations. They use various software tools to collect, store, manipulate and interpret the data in order to prepare accurate reports for internal stakeholders as well as external regulatory bodies.

Your expertise in regulatory reporting is unrivalled, and you have the skills to help any company navigate complex financial regulations. But hiring managers don’t know who you are yet – so make sure your resume stands out from the crowd and helps them recognize your talents!

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

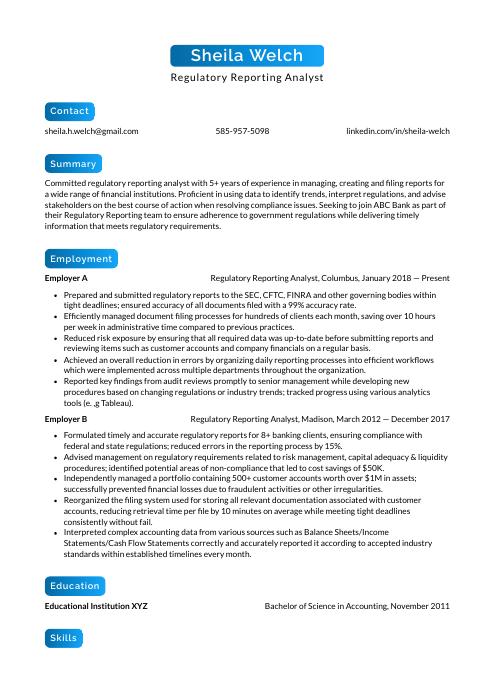

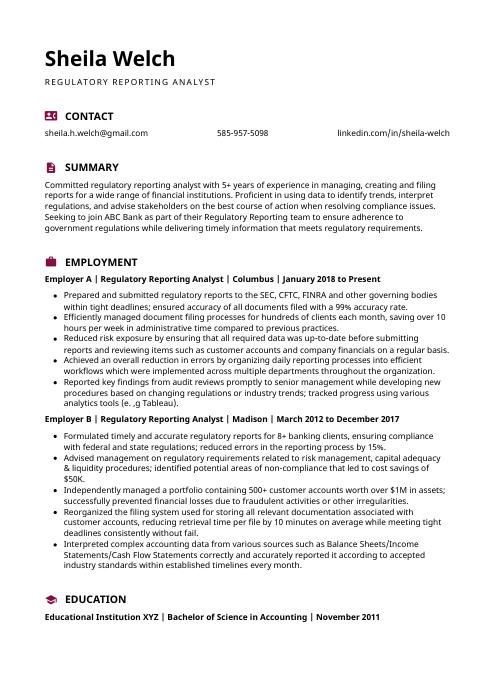

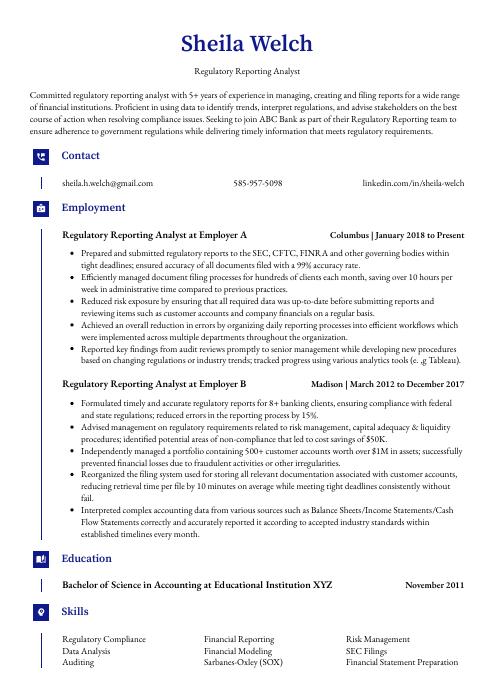

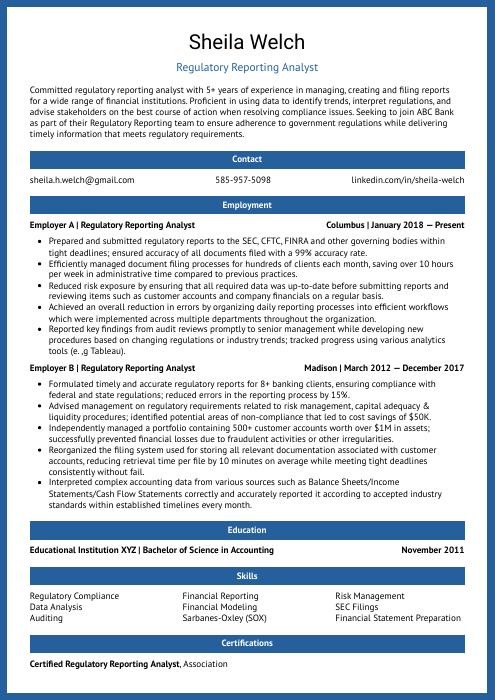

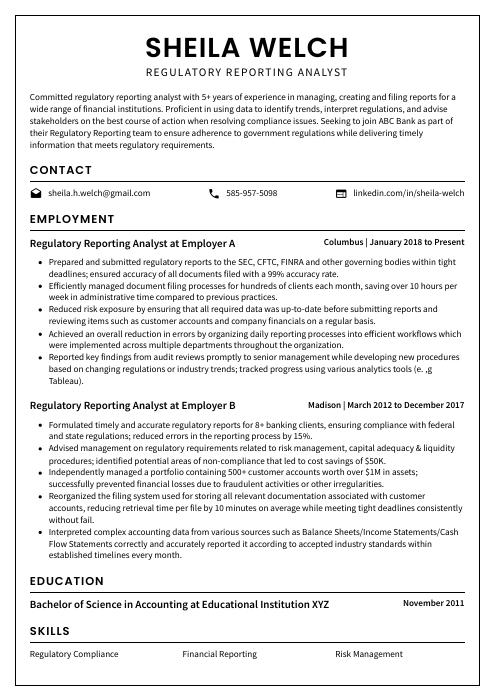

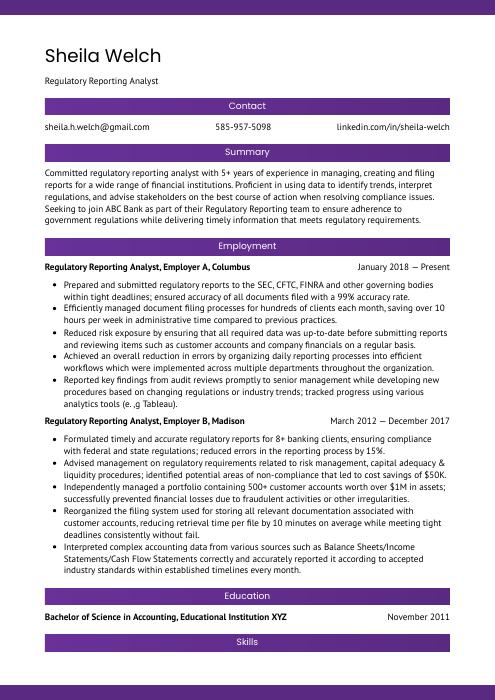

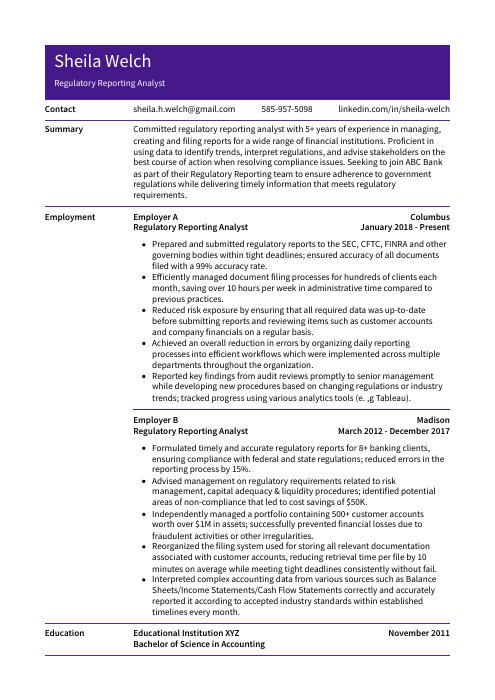

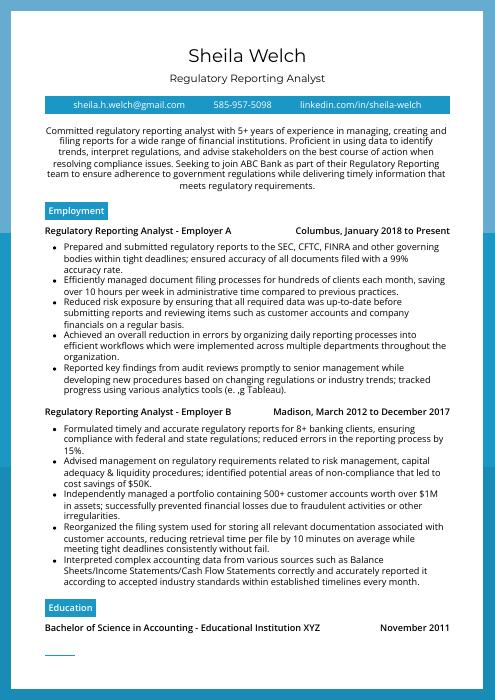

Regulatory Reporting Analyst Resume Sample

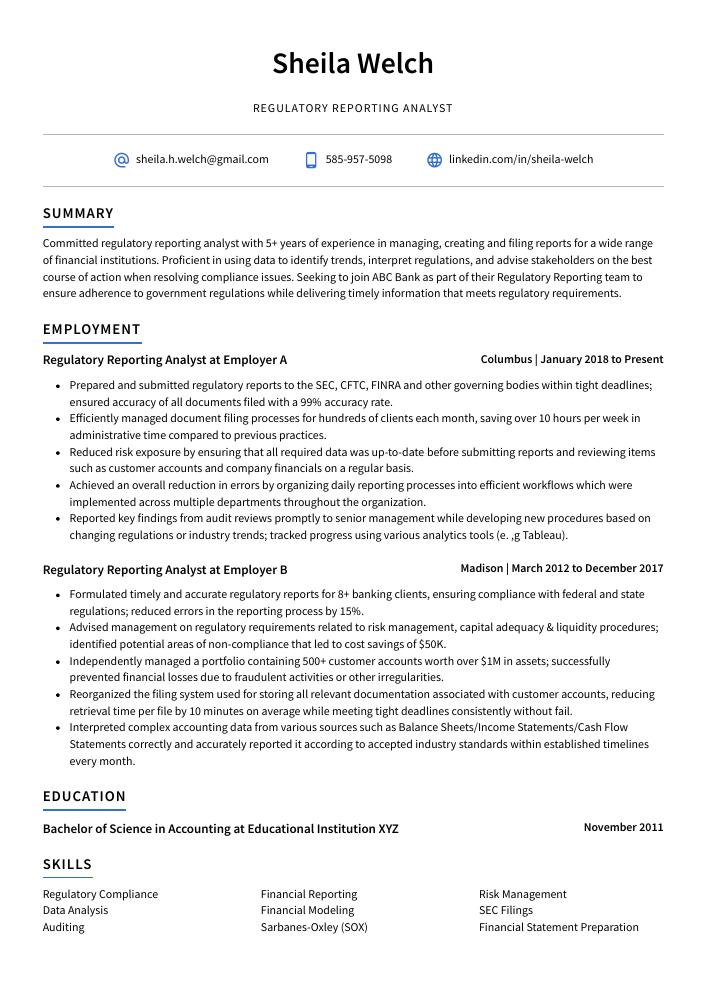

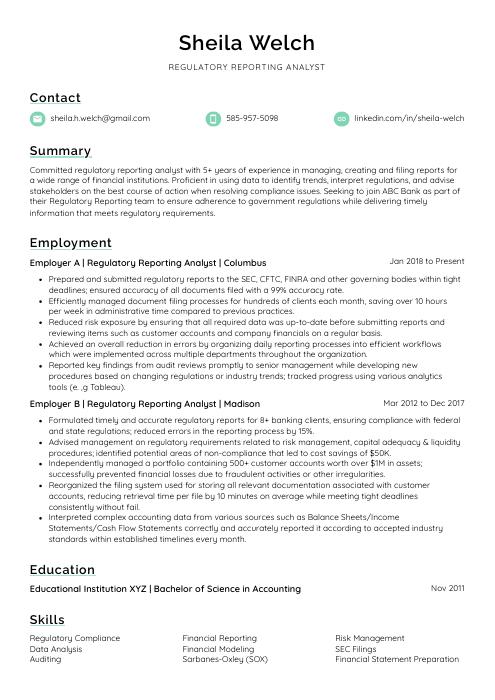

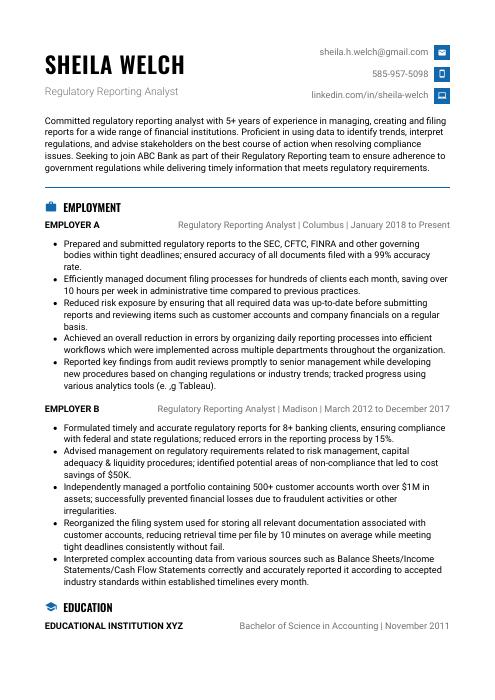

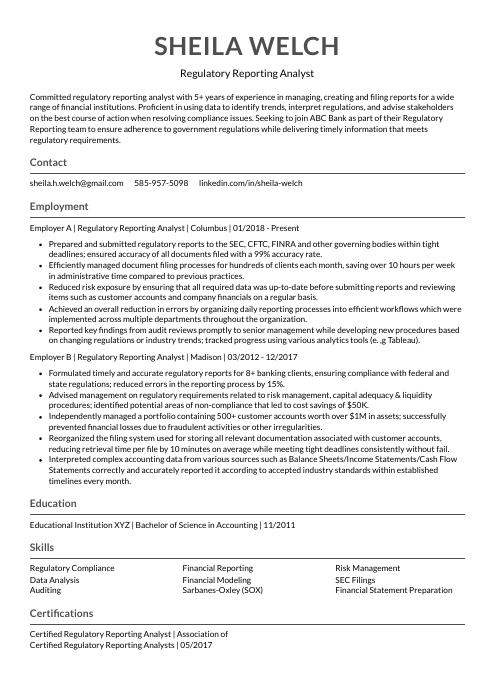

Sheila Welch

Regulatory Reporting Analyst

sheila.h.welch@gmail.com

585-957-5098

linkedin.com/in/sheila-welch

Summary

Committed regulatory reporting analyst with 5+ years of experience in managing, creating and filing reports for a wide range of financial institutions. Proficient in using data to identify trends, interpret regulations, and advise stakeholders on the best course of action when resolving compliance issues. Seeking to join ABC Bank as part of their Regulatory Reporting team to ensure adherence to government regulations while delivering timely information that meets regulatory requirements.

Experience

Regulatory Reporting Analyst, Employer A

Columbus, Jan 2018 – Present

- Prepared and submitted regulatory reports to the SEC, CFTC, FINRA and other governing bodies within tight deadlines; ensured accuracy of all documents filed with a 99% accuracy rate.

- Efficiently managed document filing processes for hundreds of clients each month, saving over 10 hours per week in administrative time compared to previous practices.

- Reduced risk exposure by ensuring that all required data was up-to-date before submitting reports and reviewing items such as customer accounts and company financials on a regular basis.

- Achieved an overall reduction in errors by organizing daily reporting processes into efficient workflows which were implemented across multiple departments throughout the organization.

- Reported key findings from audit reviews promptly to senior management while developing new procedures based on changing regulations or industry trends; tracked progress using various analytics tools (e. ,g Tableau).

Regulatory Reporting Analyst, Employer B

Madison, Mar 2012 – Dec 2017

- Formulated timely and accurate regulatory reports for 8+ banking clients, ensuring compliance with federal and state regulations; reduced errors in the reporting process by 15%.

- Advised management on regulatory requirements related to risk management, capital adequacy & liquidity procedures; identified potential areas of non-compliance that led to cost savings of $50K.

- Independently managed a portfolio containing 500+ customer accounts worth over $1M in assets; successfully prevented financial losses due to fraudulent activities or other irregularities.

- Reorganized the filing system used for storing all relevant documentation associated with customer accounts, reducing retrieval time per file by 10 minutes on average while meeting tight deadlines consistently without fail.

- Interpreted complex accounting data from various sources such as Balance Sheets/Income Statements/Cash Flow Statements correctly and accurately reported it according to accepted industry standards within established timelines every month.

Skills

- Regulatory Compliance

- Financial Reporting

- Risk Management

- Data Analysis

- Financial Modeling

- SEC Filings

- Auditing

- Sarbanes-Oxley (SOX)

- Financial Statement Preparation

Education

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Regulatory Reporting Analyst

Association of Certified Regulatory Reporting Analysts

May 2017

1. Summary / Objective

Your resume summary should provide a snapshot of your experience and skills as a regulatory reporting analyst. Highlight any relevant certifications, such as CPA or CIA, that you possess. Also mention the number of years’ experience you have in this field, the types of reports you are most familiar with (e.g., SEC filings), and how well-versed you are in financial regulations like Sarbanes-Oxley Act (SOX). Finally, emphasize any successes or achievements related to regulatory compliance that demonstrate your expertise.

Below are some resume summary examples:

Determined regulatory reporting analyst with 8+ years of experience in the banking and finance industry. Skilled at researching, interpreting, and analyzing data to ensure compliance with various regulations. At XYZ Bank, led a successful project that streamlined the monthly regulatory reporting process by 25%. Received company award for excellence in accuracy and timeliness on all submissions. A highly organized problem solver who is motivated to exceed expectations every time.

Energetic and experienced regulatory reporting analyst with ten years of expertise in the financial services industry. Adept at researching and interpreting regulations to develop compliant reports for all relevant government agencies. At XYZ, developed a process that saved over $250K in compliance costs and improved accuracy by 25%. Seeking to leverage my knowledge and experience to help ABC achieve optimal regulatory compliance performance.

Accomplished regulatory reporting analyst with over 7 years of experience in financial services. Experienced in creating, maintaining, and analyzing reports to ensure compliance with all relevant regulations. Proven ability to identify anomalies within data sets and take corrective action as needed. Skilled at developing new systems for efficient reporting processes and providing insights into the business from regulatory data analysis.

Diligent and detail-oriented regulatory reporting analyst with 5+ years of experience in financial services industry. Adept at preparing and analyzing complex reports for compliance purposes to ensure accuracy and timeliness. Experienced in leveraging analytical skills to identify discrepancies, detect errors, and resolve issues quickly. Highly skilled in utilizing IT systems such as Bloomberg terminal for data analysis tasks.

Dependable regulatory reporting analyst with 5+ years of experience managing day-to-day activities related to compliance and reporting for a wide range of financial institutions. Skilled at creating accurate reports, identifying discrepancies in data, implementing process improvements, and responding effectively to regulatory inquiries. Looking forward to applying expertise towards the success of ABC Financial Solutions.

Reliable and detail-oriented regulatory reporting analyst with extensive experience in preparing, analyzing and submitting financial reports to local and federal regulators. At XYZ successfully implemented a new system for tracking quarterly report submissions which resulted in an improved accuracy rate of 95%. Also experienced in developing internal processes that ensure compliance with applicable laws and regulations.

Talented regulatory reporting analyst with 5+ years of experience creating and executing efficient reports. Highly adept at managing large datasets, identifying discrepancies and potential risks, as well as designing new processes to streamline operations. Seeking to join ABC Company in order to drive accuracy and compliance for the organization’s financial data submissions through an effective approach.

Seasoned regulatory reporting analyst with over 5 years of experience in financial services. Skilled at analyzing data and producing accurate reports to meet tight deadlines while remaining compliant with industry regulations. Seeking a position at ABC Company where I can utilize my knowledge of regulatory requirements and technical skills to ensure timely, complete, and error-free deliverables.

2. Experience / Employment

Next comes the work history section. It should be written in reverse chronological order, with your most recent role listed first.

When describing what you did for each job, stick to bullet points and provide detail on the results achieved. For example, instead of saying “Prepared regulatory reports,” you could say something like “Compiled accurate quarterly financial reports for submission to regulators within tight deadlines; reduced errors by 10% compared to previous quarter.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Analyzed

- Monitored

- Assessed

- Reported

- Investigated

- Documented

- Researched

- Interpreted

- Compiled

- Validated

- Reconciled

- Updated

- Processed

- Audited

Other general verbs you can use are:

- Achieved

- Advised

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Analyzed regulatory reports and identified discrepancies in financial data, resulting in a 20% decrease in errors on daily submissions.

- Assessed compliance requirements of various regulatory agencies to ensure all filings were up-to-date and accurate; developed internal processes that improved efficiency by 30%.

- Actively monitored changes to internal policies related to reporting standards, responded promptly with proposed solutions when necessary, ensuring the accuracy of all filings.

- Streamlined manual filing procedures for weekly regulatory documents by automating 75% of routine tasks using advanced scripting methods; saved 10 hours per week across departmental teams for increased productivity.

- Spearheaded initiatives aimed at developing state-of-the-art tools which allowed users to generate complex risk reports within minutes instead of days; reduced report preparation time from 24 hours down to 2 hours on average.

- Validated regulatory filings for accuracy and adherence to applicable laws, regulations, and guidelines; improved filing compliance rate by 25%.

- Documented regulatory reporting processes in accordance with established standards while ensuring the confidentiality of sensitive financial data.

- Thoroughly reviewed legal documents such as contracts, leases, leases-related agreements & tender offers for accurate information prior to submission of reports.

- Expedited completion of complex regulatory reports within tight deadlines while maintaining meticulous attention to detail; reduced turnaround time by 4 hours per report on average.

- Coordinated cross-departmental efforts between finance teams and external auditors during review process to ensure smooth execution of all projects related to filing requirements.

- Presented regulatory reports to CFOs and other senior executives of 10+ financial institutions, ensuring accuracy and meeting all deadlines; reduced report preparation time by an average of 20 hours per quarter.

- Improved the auditing process for regulatory reporting by 40%, leading to higher efficiency in data gathering and analysis across multiple accounting systems.

- Demonstrated strong analytical skills when interpreting complex regulations from the Financial Conduct Authority (FCA) & Prudential Regulation Authority (PRA), helping the company remain complaint with laws at all times.

- Competently developed automated processes that streamline monthly regulatory filings, significantly reducing manual errors while increasing overall productivity by 25%.

- Compiled financial statements on a quarterly basis for 7+ clients according to FCA requirements; decreased audit-related issues resulting in smoother compliance processes each year.

- Processed monthly regulatory reports with 100% accuracy, ensuring compliance of financial information to federal and state requirements.

- Researched and identified discrepancies in the data disclosed by clients; mitigated risk exposure by resolving issues quickly within 12 hours on average.

- Meticulously analyzed historical trends in corporate filings for 10+ publicly traded companies, improving performance projections forecasts by 15%.

- Monitored trading activities across multiple markets/sectors; developed a system that flagged suspicious transactions and reduced false positives by 20%.

- Optimized reporting processes through automation initiatives, streamlining operational workflow & reducing manual labor time from 8 hours to 4 hours per week on average.

- Developed and implemented efficient regulatory reporting processes for 10+ financial products, resulting in a 40% reduction of manual work and enabling accurate filing within tight deadlines.

- Utilized advanced analytical skills to identify discrepancies in financial data from multiple sources and address them accordingly; successfully identified $800K worth of errors in the prior quarter’s reporting cycle.

- Participated actively in regular stakeholder meetings with internal teams, regulators, external auditors and other key stakeholders to ensure effective communication regarding all filings requirements and updates.

- Reconciled monthly statements against client portfolio holdings on a timely basis while meeting stringent compliance standards; reduced reconciliation time by 30%.

- Confidently handled complex queries related to legal & regulatory obligations with ease while providing technical assistance as needed when resolving customer disputes or issues raised by regulators/audit firms.

- Introduced and refined internal processes to ensure compliance with federal, state and local regulatory reporting requirements; decreased manual paperwork submissions by 90%.

- Revised existing policies and procedures for over 100 governmental forms per quarter; improved accuracy of reports submitted on time by 65% in the last year.

- Updated tax regulations across multiple markets, resulting in an 8% reduction in international taxes paid during the fiscal year 2020-2021.

- Mentored junior staff members on how to accurately prepare quarterly financial statements according to regulatory guidelines; reduced errors from 35%-10%.

- Substantially increased both efficiency and effectiveness within the team through automation of data entry tasks which saved 250 hours annually.

- Represented the organization in various regulatory reporting meetings, identifying key areas for improvement and providing recommendations that resulted in a 15% increase in compliance standards.

- Structured complex financial data into systematically organized reports to be submitted to regulators within the required deadlines; successfully completed over 700+ submissions without error or delay.

- Facilitated communication between multiple departments regarding updates on internal control processes, ensuring compliance with applicable laws & regulations and minimizing risks of non-compliance penalties by 20%.

- Audited existing procedures related to regularity reporting activities, making necessary changes where needed and streamlining operations for improved efficiency across all levels of staff involved; achieved cost savings of $10,000 per quarter as a result.

- Reliably maintained an up-to-date knowledge base on regional regulatory policies affecting company practices while liaising regularly with external stakeholders such as auditors & tax advisors to ensure full adherence at all times.

3. Skills

Two organizations that have advertised for a position with the same title may be searching for individuals whose skills are quite different. For instance, one might be looking for someone with a background in financial services and the other may need an individual who is well-versed in data analysis.

It is important to tailor your skills section of your resume to each job that you are applying for, as many employers use applicant tracking systems these days which scan resumes for certain keywords before passing them on to a human.

In addition, it’s essential that you elaborate on the most relevant skills throughout other sections of your resume – such as work experience or summary statements – so recruiters can gain better insight into how they relate directly back to the position at hand.

Below is a list of common skills & terms:

- Auditing

- Data Analysis

- Financial Modeling

- Financial Reporting

- Financial Statement Preparation

- Regulatory Compliance

- Risk Management

- SEC Filings

- Sarbanes-Oxley (SOX)

4. Education

Adding an education section to your resume will depend on how long you have been working in the field. If you just graduated and do not have much work experience, include a section detailing your educational background below your objective statement. However, if you are an experienced regulatory reporting analyst with numerous projects to showcase, omitting this section may be best.

If including an education section is necessary for the role, make sure to mention courses related to regulatory analysis that could help demonstrate your qualifications for the job.

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your expertise in a particular field. They show that you have taken the time and effort to gain knowledge of certain topics, as well as prove that you are capable of applying this knowledge in practice.

Including certifications on your resume is an effective way to showcase your qualifications and make yourself stand out from other applicants. Be sure to list any relevant certifications related to the job for which you are applying so employers can quickly assess if they match their requirements.

Certified Regulatory Reporting Analyst

Association of Certified Regulatory Reporting Analysts

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Sheila Welch, this would be Sheila-Welch-resume.pdf or Sheila-Welch-resume.docx.

7. Cover Letter

Submitting a cover letter is a great way to make your job application stand out from the rest. It is made up of 2 to 4 paragraphs and gives you an opportunity to explain why you’re perfect for the role, what makes you unique and how passionate you are about the company or industry.

Cover letters aren’t always necessary but they can be beneficial if used correctly. They give recruiters more insight into who you are as a person and professional which could potentially lead to more interview opportunities in future.

Below is an example cover letter:

Dear Jasen,

I am writing to apply for the Regulatory Reporting Analyst position at XYZ Bank. With my experience in data analysis and financial reporting, as well as my knowledge of compliance regulations, I believe I would be a valuable asset to your team.

In my current role as a Regulatory Reporting Analyst at ABC Bank, I am responsible for preparing and filing monthly reports with state and federal banking regulators. I have experience working with large data sets and complex financial information, and I have a keen eye for detail that ensures accuracy in my work. In addition, I keep up-to-date on changes in banking regulations so that our reports are always compliant.

I am confident that I can provide the same high level of service to XYZ Bank as a Regulatory Reporting Analyst. My analytical skills and attention to detail would be an asset in this role, and I am eager to put them to use for your organization. Thank you for your time and consideration; please do not hesitate to contact me if you have any questions or need any additional information about my qualifications.

Sincerely,

Sheila

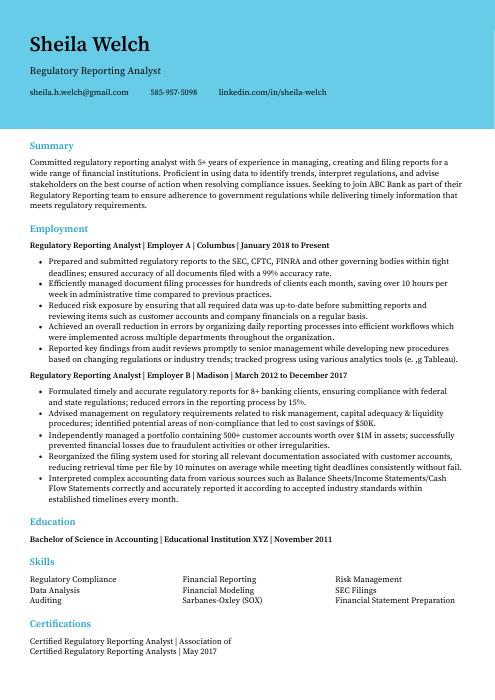

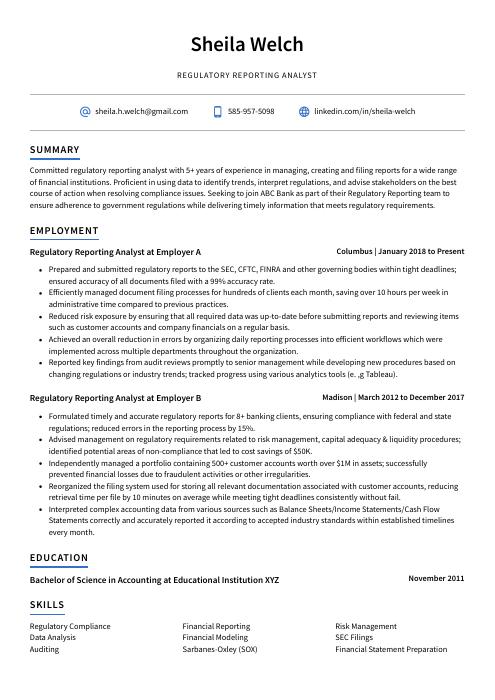

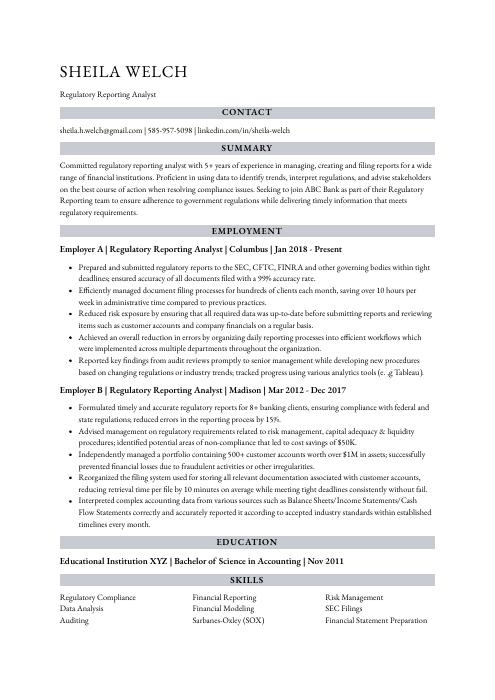

Regulatory Reporting Analyst Resume Templates

Lorikeet

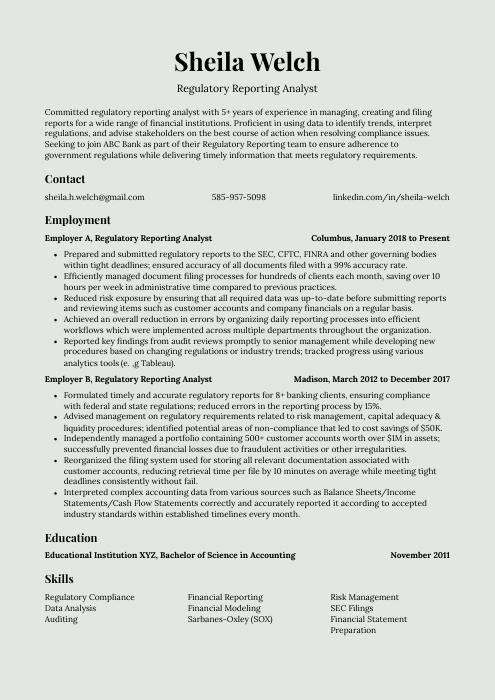

Lorikeet Echidna

Echidna Indri

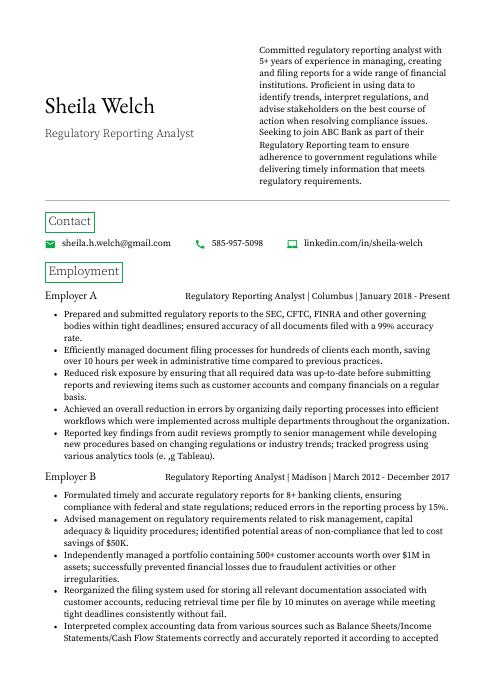

Indri Kinkajou

Kinkajou Hoopoe

Hoopoe Gharial

Gharial Ocelot

Ocelot Cormorant

Cormorant Dugong

Dugong Saola

Saola Quokka

Quokka Jerboa

Jerboa Pika

Pika Axolotl

Axolotl Numbat

Numbat Rhea

Rhea Bonobo

Bonobo Markhor

Markhor Fossa

Fossa Rezjumei

Rezjumei