Full Charge Bookkeeper Resume Guide

Full charge bookkeepers are responsible for maintaining financial records, including accounts payable and receivable, payroll, bank reconciliations and general ledger entries. They also prepare reports such as balance sheets and income statements to provide insight into an organization’s financial performance.

You have the experience and knowledge to take charge of any bookkeeping department. But hiring managers don’t know who you are yet, so create a resume that stands out from the crowd and highlights your professional achievements.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

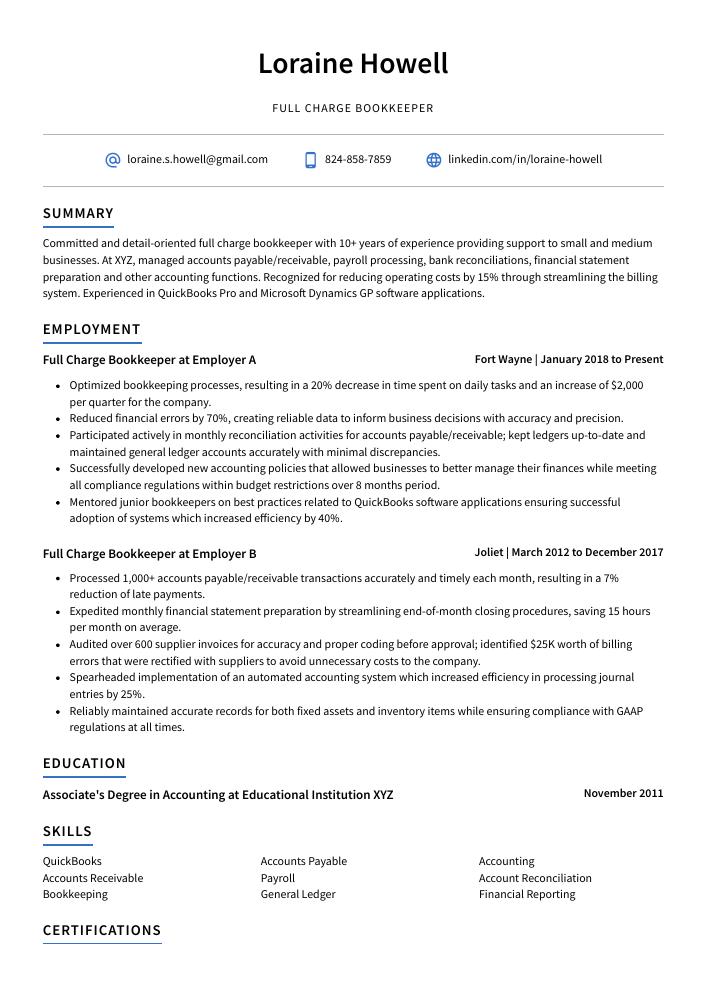

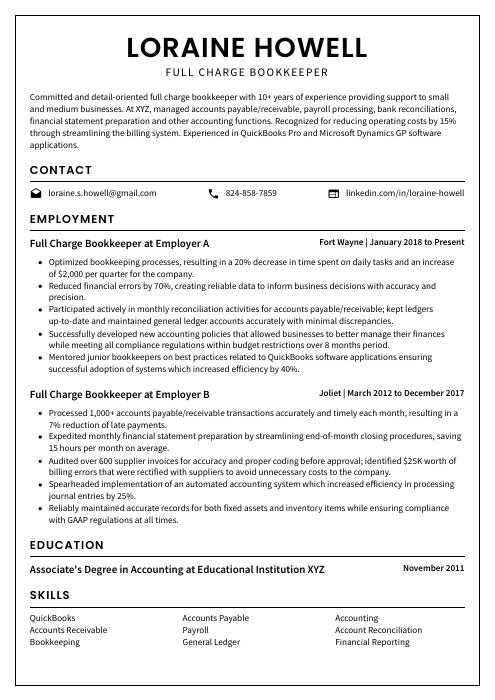

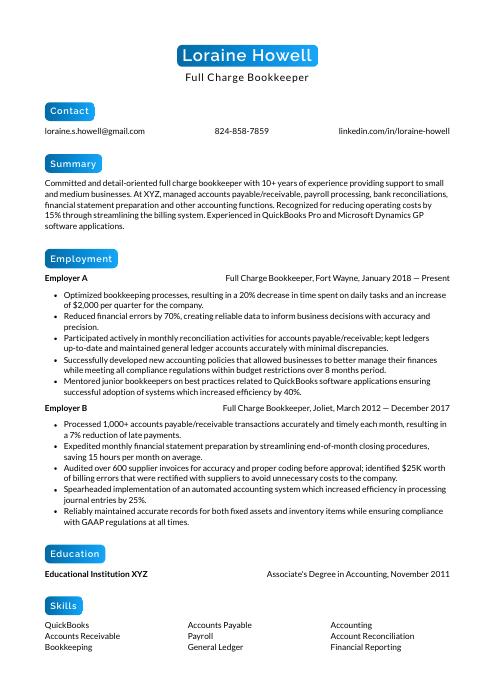

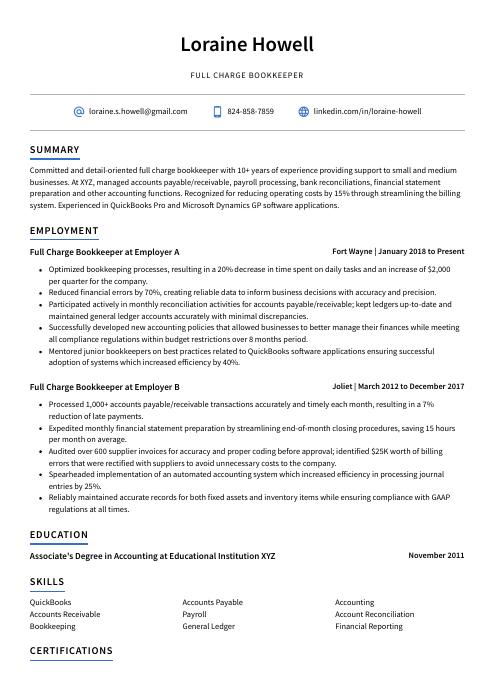

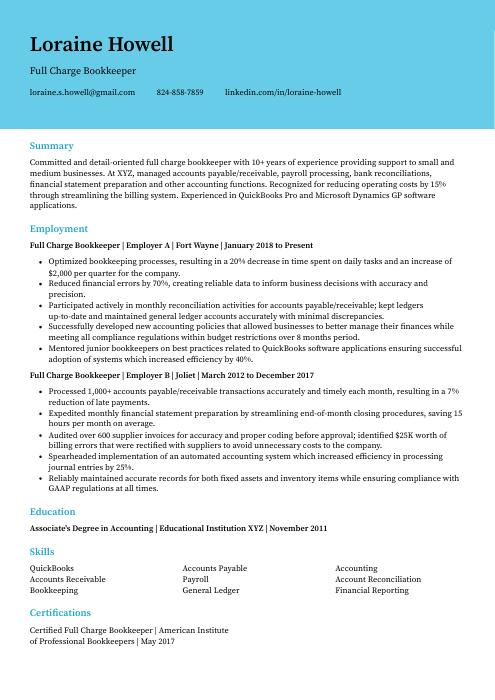

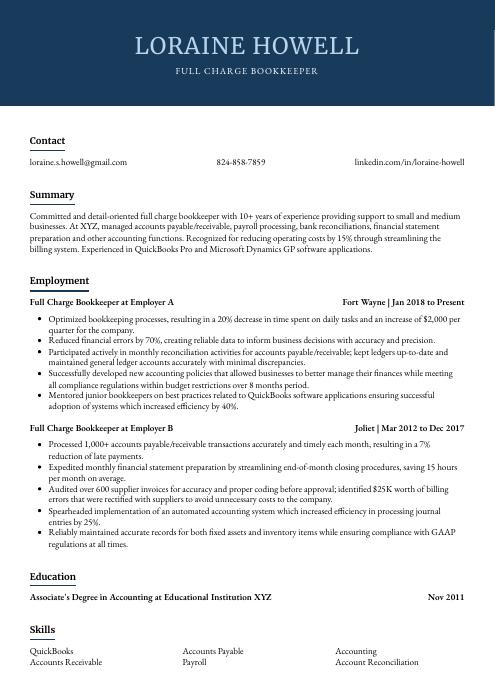

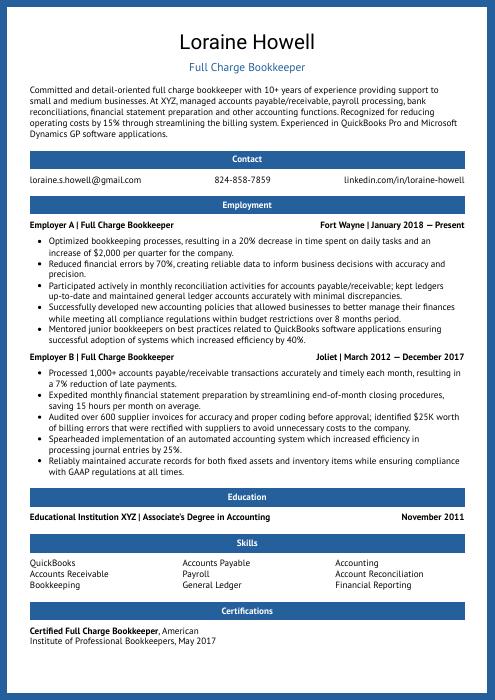

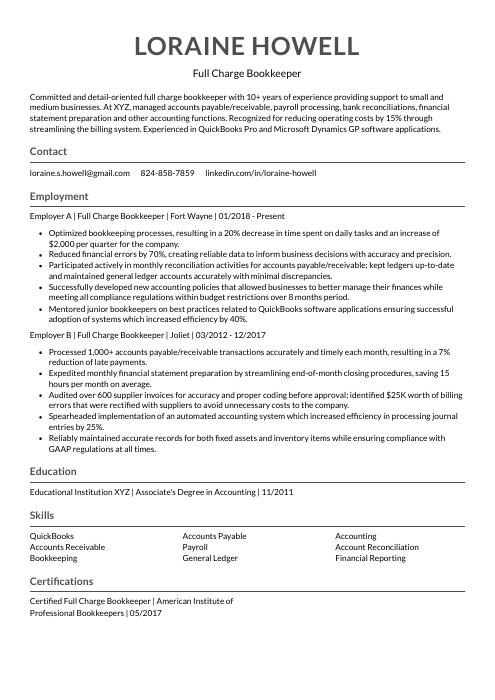

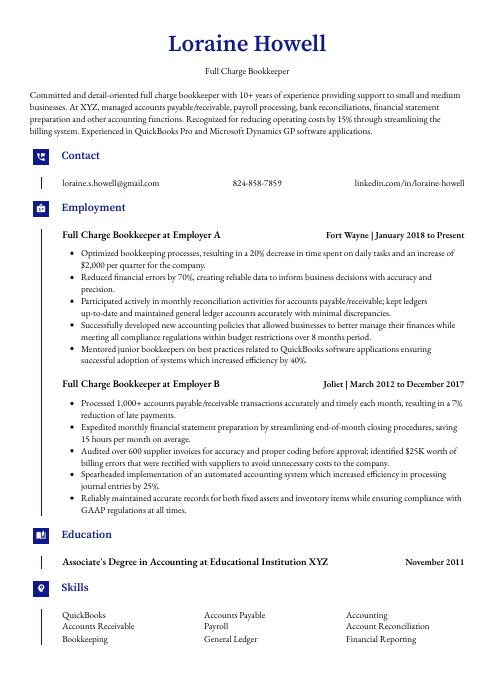

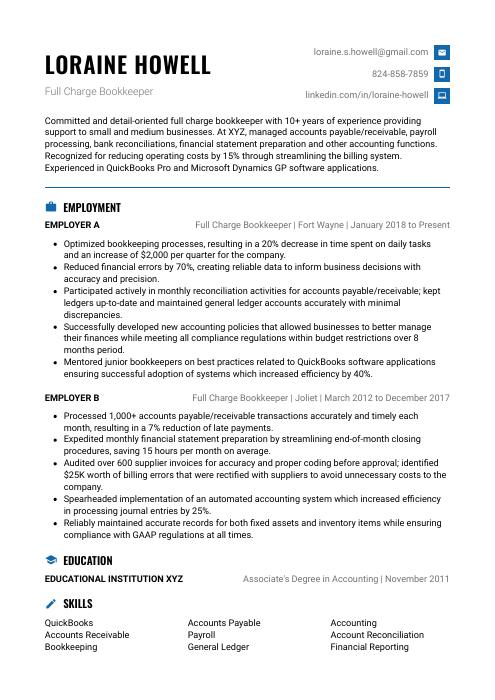

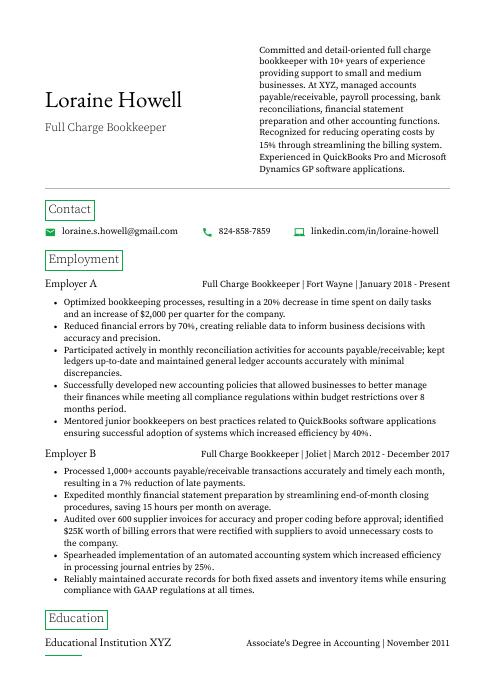

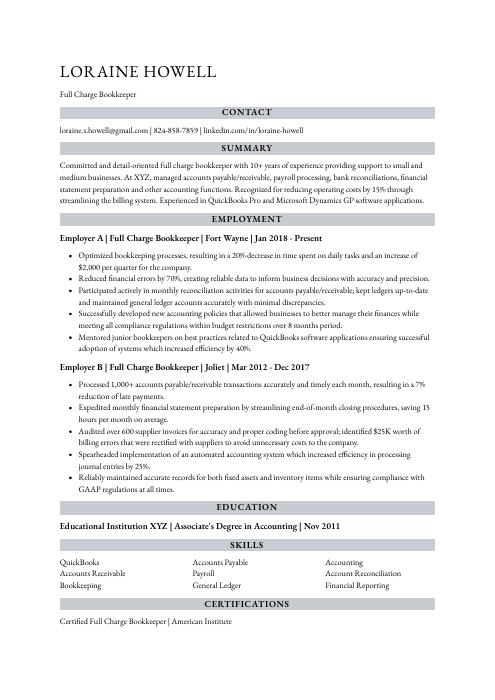

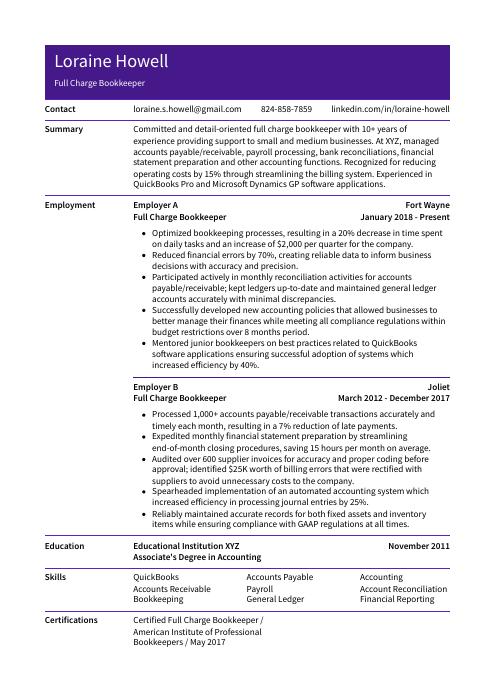

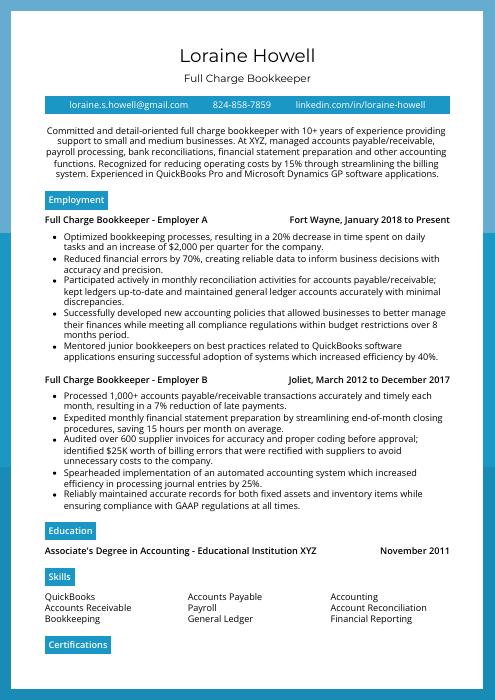

Full Charge Bookkeeper Resume Sample

Loraine Howell

Full Charge Bookkeeper

[email protected]

824-858-7859

linkedin.com/in/loraine-howell

Summary

Committed and detail-oriented full charge bookkeeper with 10+ years of experience providing support to small and medium businesses. At XYZ, managed accounts payable/receivable, payroll processing, bank reconciliations, financial statement preparation and other accounting functions. Recognized for reducing operating costs by 15% through streamlining the billing system. Experienced in QuickBooks Pro and Microsoft Dynamics GP software applications.

Experience

Full Charge Bookkeeper, Employer A

Fort Wayne, Jan 2018 – Present

- Optimized bookkeeping processes, resulting in a 20% decrease in time spent on daily tasks and an increase of $2,000 per quarter for the company.

- Reduced financial errors by 70%, creating reliable data to inform business decisions with accuracy and precision.

- Participated actively in monthly reconciliation activities for accounts payable/receivable; kept ledgers up-to-date and maintained general ledger accounts accurately with minimal discrepancies.

- Successfully developed new accounting policies that allowed businesses to better manage their finances while meeting all compliance regulations within budget restrictions over 8 months period.

- Mentored junior bookkeepers on best practices related to QuickBooks software applications ensuring successful adoption of systems which increased efficiency by 40%.

Full Charge Bookkeeper, Employer B

Joliet, Mar 2012 – Dec 2017

- Processed 1,000+ accounts payable/receivable transactions accurately and timely each month, resulting in a 7% reduction of late payments.

- Expedited monthly financial statement preparation by streamlining end-of-month closing procedures, saving 15 hours per month on average.

- Audited over 600 supplier invoices for accuracy and proper coding before approval; identified $25K worth of billing errors that were rectified with suppliers to avoid unnecessary costs to the company.

- Spearheaded implementation of an automated accounting system which increased efficiency in processing journal entries by 25%.

- Reliably maintained accurate records for both fixed assets and inventory items while ensuring compliance with GAAP regulations at all times.

Skills

- QuickBooks

- Accounts Payable

- Accounting

- Accounts Receivable

- Payroll

- Account Reconciliation

- Bookkeeping

- General Ledger

- Financial Reporting

Education

Associate’s Degree in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Full Charge Bookkeeper

American Institute of Professional Bookkeepers

May 2017

1. Summary / Objective

The summary/objective at the beginning of your full charge bookkeeper resume should be an attention-grabber – it provides a snapshot of who you are and why you would make a great addition to any team. In this section, highlight your best qualities; for example, mention the accounting software packages you have experience with, how many years of bookkeeping experience you have under your belt, and any awards or certifications that demonstrate your expertise in financial management.

Below are some resume summary examples:

Dependable full-charge bookkeeper with 5+ years of experience managing financial operations for a variety of clients. Seeking to join ABC Company and use my expertise in accounting, payroll, accounts receivable/payable, bank reconciliation and general ledger reconciliations to contribute positively to the organization’s bottom line. Achieved an average accuracy rate above 98% when preparing statements and reports in past roles.

Reliable full-charge bookkeeper with over 6 years of experience in accounting and financial management. Adept at handling multiple tasks while maintaining accuracy, confidentiality, and compliance to company policies. Seeking to join ABC Co as a full charge bookkeeper to use my expertise in data entry, accounts payable/receivable processing, payroll administration and bank reconciliation for the benefit of the organization.

Passionate full-charge bookkeeper with 10+ years of experience in the financial industry. Adept at performing full cycle accounting functions and managing daily operations for clients from various industries. At XYZ LLC, improved accuracy by 15% and reduced accounts receivable collection time by 25%. Looking to join ABC Inc as a full charge bookkeeper to use my expertise in streamlining processes and improving efficiency.

Diligent full charge bookkeeper with 8+ years of experience seeking to join ABC Organization. At XYZ, produced accurate financial records for 300 business accounts and managed the day-to-day accounting operations including payroll processing and bank reconciliations. Honed skills in QuickBooks Pro, Microsoft Excel, Outlook, PowerPoint and Word while increasing efficiency by 20%.

Energetic, full-charge bookkeeper with 10+ years of experience in providing accurate and timely financial management services. Adept at managing accounts payable, accounts receivable, bank reconciliations, payroll processing, and general ledger functions. Proven success helping small to mid-sized businesses increase efficiency by streamlining processes using QuickBooks software.

Determined full-charge bookkeeper with 5+ years of experience performing day-to-day financial operations for a diverse range of clients. Proven success in developing and managing accounting systems, monitoring expenses, tracking accounts receivable/payable, preparing taxes and audits. Seeking to leverage expertise towards becoming the next full charge bookkeeper at ABC Company.

Hard-working full-charge bookkeeper with 8+ years of experience in the accounting field. At XYZ, managed accounts receivable and accounts payable for a $2M budget. Skilled at all aspects of bookkeeping including reconciliations, bank deposits, collections and payroll processing. Developed monthly financial reports to ensure accurate record keeping and accountability of funds.

Professional full charge bookkeeper with 8+ years of experience managing all aspects of accounting, including payroll processing and accounts payable/receivable. Skilled in utilizing QuickBooks to streamline financial processes and improve accuracy. At ABC Co., successfully managed 10-person team on multiple projects while meeting key deadlines every month.

2. Experience / Employment

The employment (or experience) section is where you talk about your work history. It should be written in reverse chronological order, which means that the most recent job is listed first.

Stick to bullet points primarily in this section; doing so makes it easier for the reader to take in the information quickly and easily. When writing each point, make sure you provide detail on what you did and any results achieved from your efforts.

For example, instead of saying “Managed accounts receivable,” you could say, “Developed a system for tracking customer payments that resulted in an 8% decrease in overdue invoices.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Reconciled

- Monitored

- Processed

- Generated

- Analyzed

- Audited

- Prepared

- Calculated

- Reported

- Researched

- Documented

- Updated

- Filed

- Managed

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Researched, reconciled and corrected discrepancies in financial records to ensure accuracy of over 800 entries a month; increased accuracy rating by 27%.

- Coordinated with auditors during quarterly reviews and provided detailed reports on accounts receivable/payable status within 48 hours; reduced audit times by 10%.

- Documented all transactions including cash flow statements, journal entries, deposits & expenditures using QuickBooks software; improved data entry efficiency by 25%.

- Advised internal stakeholders on best practices for streamlining accounting processes while adhering to established guidelines and regulations; decreased overall costs associated with bookkeeping services by 15% annually.

- Confidently presented monthly financial updates to executive team members at Board meetings utilizing Powerpoint slides illustrating key findings from budget analysis report; generated new ideas for cost-saving initiatives that saved the company $12K+.

- Accurately compiled and analyzed financial records of over 200 clients, reconciling discrepancies in accounts receivables/payables to the tune of $600,000+ per month.

- Introduced new bookkeeping systems which streamlined filing processes and improved efficiency by 30%.

- Utilized QuickBooks software to record all transactions related to payroll, invoicing & payments; produced monthly balance sheets for management team review within a 2-day turnaround time frame.

- Achieved 95% accuracy rate on data entry tasks & account reconciliations while meeting tight deadlines set by upper management with no errors recorded during audit reviews.

- Developed creative strategies for minimizing tax liabilities and reducing overall expenses; saved organization an estimated $80K in taxes annually through strategic planning initiatives.

- Substantially improved the accuracy of financial statements by implementing a comprehensive system to track expenses and reconcile accounts, resulting in an 18% reduction in accounting errors.

- Managed all bookkeeping operations including A/P, A/R, payroll processing & banking activities for over 500 clients; prepared accurate monthly balance sheets and income statements with 99% accuracy rate.

- Generated detailed reports on budgeting trends and business performance metrics for senior management team; identified areas for cost savings that saved $15K yearly overhead costs.

- Updated Quickbooks software regularly to ensure data integrity and compliance with GAAP standards across multiple entities; established internal control procedures to boost security against fraudulent activity or misappropriation of funds.

- Reconciled bank account transactions daily using automated tools such as MS Excel formulas & pivot tables; maintained full documentation of cash flow movements within 1 hour turnaround time per month end cycle closing process.

- Monitored and reconciled bank accounts, accounts payable and receivable for 8 clients; reduced accounting errors by 25% through improved organization of financial records.

- Facilitated month-end closing processes including journal entries, reconciliations and budget reviews; successfully generated over $20K in cost savings within the first 6 months.

- Reorganized company’s chart of accounts to better align with new industry standards, streamlining reporting procedures and improving accuracy of financial data by 10%.

- Reported on key performance indicators such as cash flow statements, income statements & balance sheets while ensuring compliance with GAAP regulations at all times.

- Diligently managed payroll processing duties for staff members across 3 locations; decreased payment delays from 4 days to 1 day without incurring any additional costs or resources.

- Presented financial statements and reports to internal stakeholders with accuracy, increasing confidence in the business by 20%.

- Revised accounting processes that improved efficiency of team operations by 30%, reducing data entry time from 3 hours per month to 1 hour.

- Formulated accurate budgets for the company within a 10% variance rate; saved $7,500 annually through budget optimization initiatives.

- Thoroughly examined discrepancies between actual results and projected forecasts on a weekly basis; identified potential risks before they occurred which resulted in an overall savings of $12,000 over six months.

- Demonstrated excellent communication skills when liaising with external auditors during annual review sessions; helped save 4 hours every year due to efficient information exchange practices established with the auditor’s office staff members.

- Improved accounting workflow by implementing a new bookkeeping system, drastically reducing manual data entry time by 50% and increasing accuracy of financial records.

- Streamlined accounts payable processes to ensure timely payments; assessed financial discrepancies in vendor invoices resulting in savings of $12,000 per quarter.

- Assessed monthly, quarterly & annual expenses for 500+ clients; calculated payroll taxes (FICA/Medicare) accurately and processed employee paychecks on time with no errors or delays.

- Calculated total income & expenditures for the company’s multiple entities utilizing QuickBooks software, allowing management to make informed decisions regarding budgeting & forecasting that improved profitability by 25%.

- Effectively managed cash flow activities including preparing bank deposits and reconciling account statements while ensuring compliance with GAAP standards at all times.

- Structured and implemented monthly, quarterly and annual financial processes for a small business with $2 million in total revenue; reduced accounting discrepancies by 25%.

- Prepared accurate financial reports including income statements, balance sheets & cash flow analyses that were presented to the CFO on a weekly basis.

- Filed over 200 invoices per month along with other related documents in an organized digital filing system which was used to track payments made and received.

- Analyzed spending patterns of various departments within the organization while suggesting cost-effective solutions that resulted in savings of $30K annually.

- Meticulously reviewed all ledgers for accuracy before closing books each quarter; errors detected were corrected promptly without resulting any loss or delay in client payments/receipts collection process.

3. Skills

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may require proficiency in QuickBooks and Organization XYZ may need expertise with Xero. As such, you want to tailor the skills section of your resume for each job that you are applying for.

This is especially important since many companies use applicant tracking systems these days, which scan resumes for certain keywords before passing them on to a human reviewer. Therefore, it’s essential to include all relevant skills as listed in the job posting in this section of your resume so that they don’t get overlooked by an ATS program.

You can also further elaborate on any particularly pertinent qualifications or experiences related to bookkeeping through other sections like work experience or summary statement.

Below is a list of common skills & terms:

- ADP Payroll

- Account Management

- Account Reconciliation

- Accounting

- Accounts Payable

- Accounts Receivable

- Accruals

- Auditing

- Bank Reconciliation

- Bookkeeping

- Budgeting

- Cash Flow

- Data Entry

- Finance

- Financial Accounting

- Financial Analysis

- Financial Reporting

- Financial Statements

- Fixed Assets

- Full Charge Bookkeeping

- General Ledger

- Human Resources

- Internal Controls

- Invoicing

- Journal Entries

- Office Administration

- Office Management

- Payroll

- Payroll Taxes

- Peachtree

- QuickBooks

- Sales Tax

- Small Business

- Spreadsheets

- Tax

- Tax Preparation

- Teamwork

- Time Management

4. Education

Mentioning an education section on your resume will depend on how far along you are in your career. If you just graduated and have no prior experience, include an education section below your objective statement. However, if you already have years of full charge bookkeeping experience under your belt, it is okay to leave out the education section altogether.

If including an education section is necessary, try to mention courses or subjects that are relevant to the job role as a full-charge bookkeeper.

Associate’s Degree in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your knowledge and expertise in a certain field. They can be an important factor when it comes to getting hired, as they show that you have been tested by an authoritative body and are qualified for the job.

When applying for jobs, make sure to include any relevant certifications on your resume so hiring managers know what qualifications you possess. This will help them determine if you are the right fit for their organization or not.

Certified Full Charge Bookkeeper

American Institute of Professional Bookkeepers

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Loraine Howell, this would be Loraine-Howell-resume.pdf or Loraine-Howell-resume.docx.

7. Cover Letter

Cover letters are an essential part of any job application and can be a great way to make your resume stand out. They should include 2 to 4 paragraphs of information that provide more detail about who you are and why you’re the best person for the role.

Cover letters allow recruiters to get a better understanding of your skills and experience, as well as learn more about how passionate you are about the position. Even if it’s not required, writing one is highly recommended when applying for jobs.

Below is an example cover letter:

Dear Jerrell,

I am writing to express my interest in the Full Charge Bookkeeper position at your company. With more than 10 years of experience in bookkeeping and accounting, I have the skills and knowledge to perform all aspects of this role effectively.

In my current position as a full charge bookkeeper at [company name], I oversee all aspects of the accounting cycle, from Accounts Receivable and Accounts Payable to bank reconciliations and financial reporting. I have successfully implemented new systems and processes that have improved efficiency and accuracy across the department. In addition, I have developed strong relationships with vendors, customers, and other business partners.

I am confident that I can provide the same level of service and results for your company. In addition to my technical skills, I am known for my excellent customer service skills and ability to work well under pressure. I would welcome the opportunity to put my skills to work for you and contribute to the success of your organization.

Thank you for your time and consideration; please do not hesitate to contact me if you need any further information about my qualifications or experience.

Sincerely,

Loraine

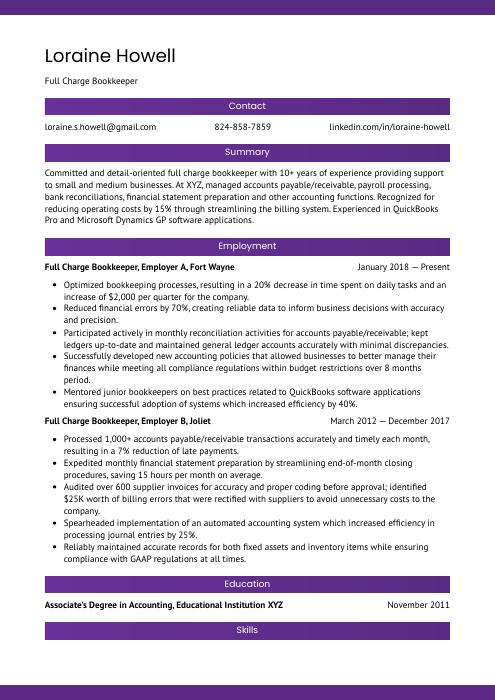

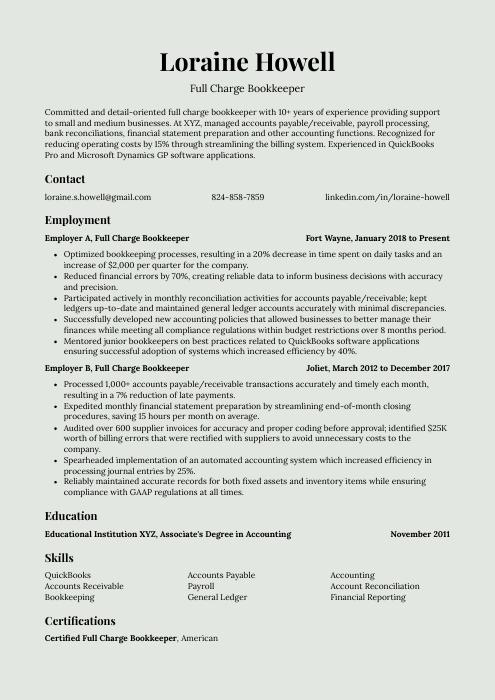

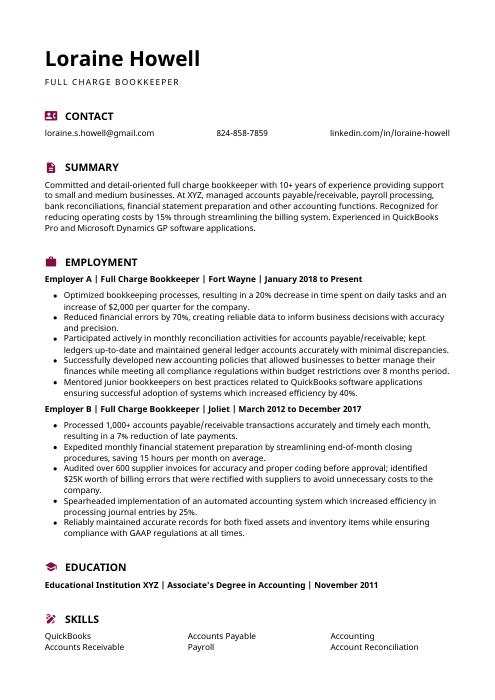

Full Charge Bookkeeper Resume Templates

Markhor

Markhor Lorikeet

Lorikeet Fossa

Fossa Cormorant

Cormorant Kinkajou

Kinkajou Axolotl

Axolotl Dugong

Dugong Bonobo

Bonobo Ocelot

Ocelot Indri

Indri Gharial

Gharial Echidna

Echidna Quokka

Quokka Numbat

Numbat Pika

Pika Rhea

Rhea Jerboa

Jerboa Saola

Saola Hoopoe

Hoopoe Rezjumei

Rezjumei