Fraud Analyst Resume Guide

Fraud analysts investigate and analyze suspicious financial activity to identify potential cases of fraud. They review claims, account histories, electronic data and other documents for accuracy and completeness in order to detect fraudulent activity. Additionally, they develop strategies to prevent future occurrences of fraud by analyzing trends in the data.

You have a knack for quickly spotting fraudulent activity, and could be an asset to any financial institution. However, hiring managers don’t know about your abilities yet. To make them aware of these skills, you must create a resume that stands out from the crowd.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

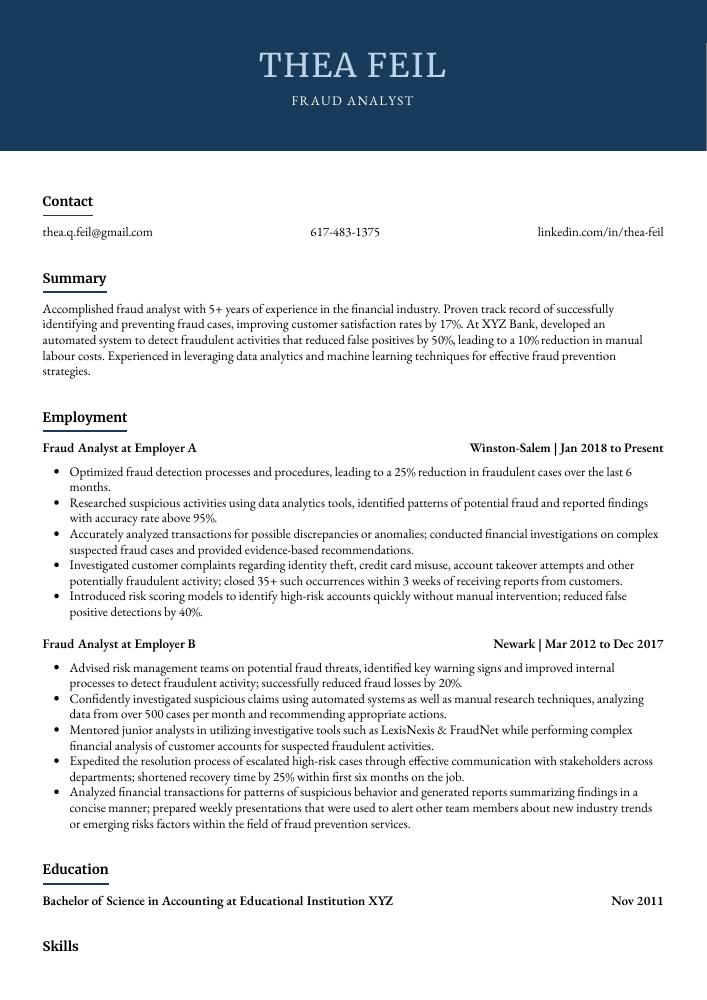

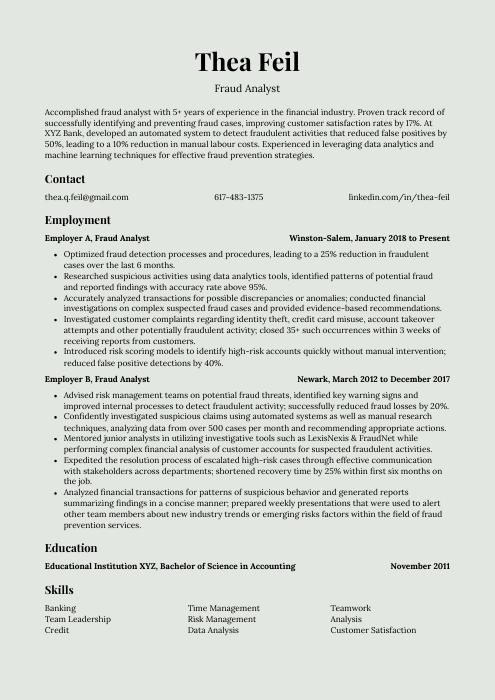

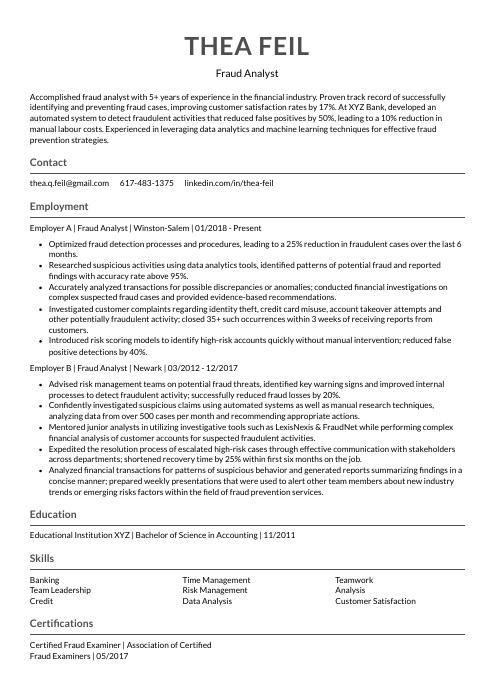

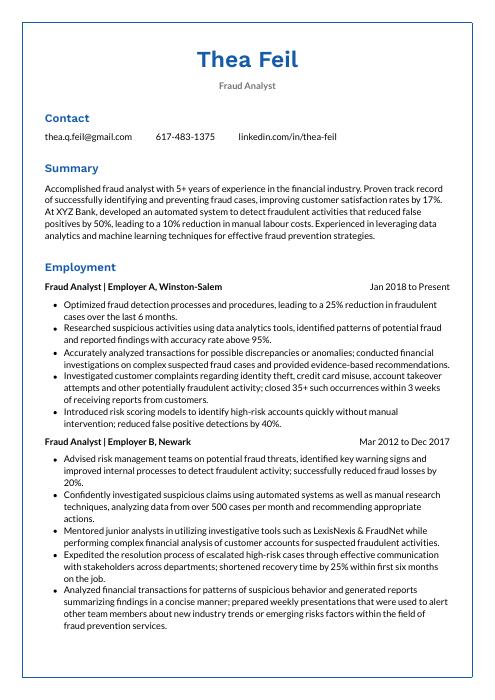

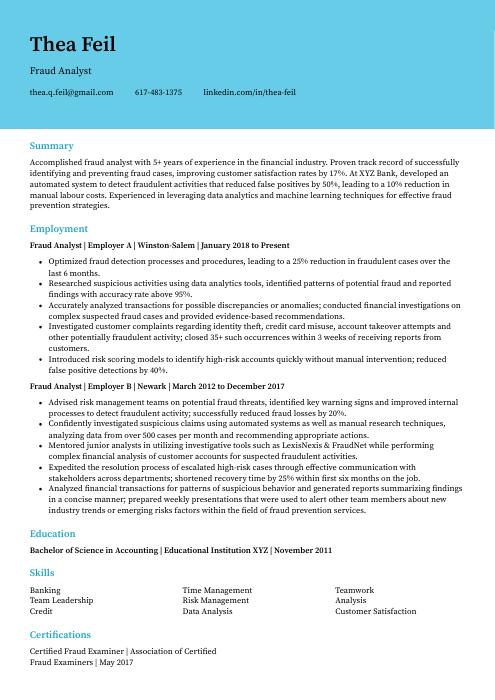

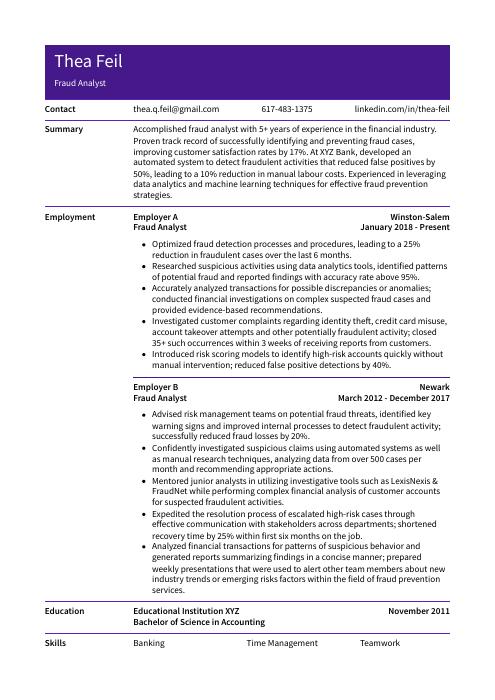

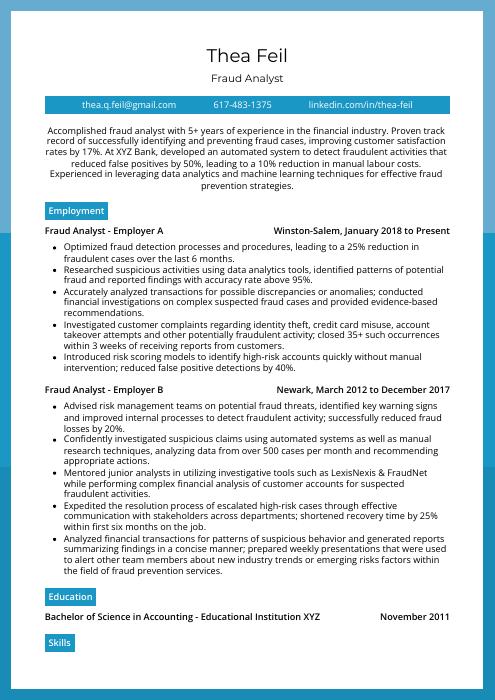

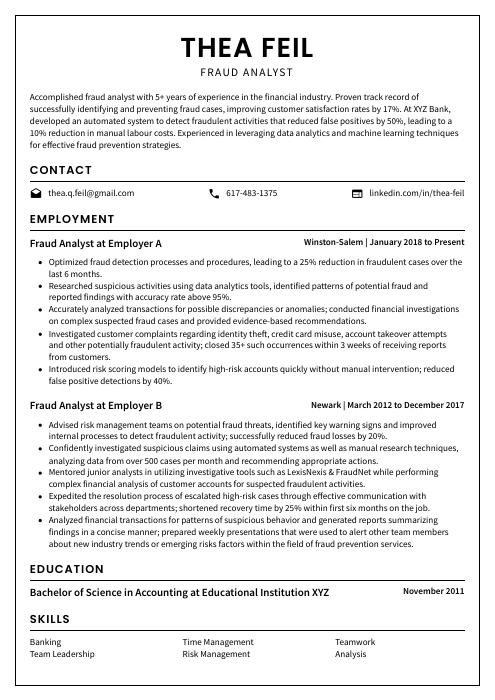

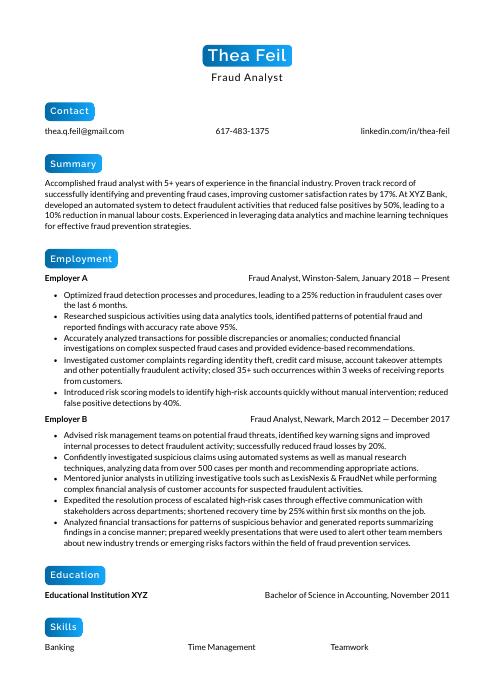

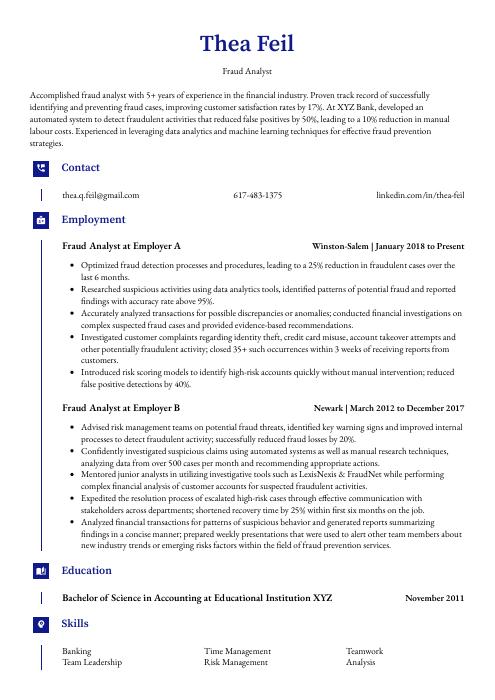

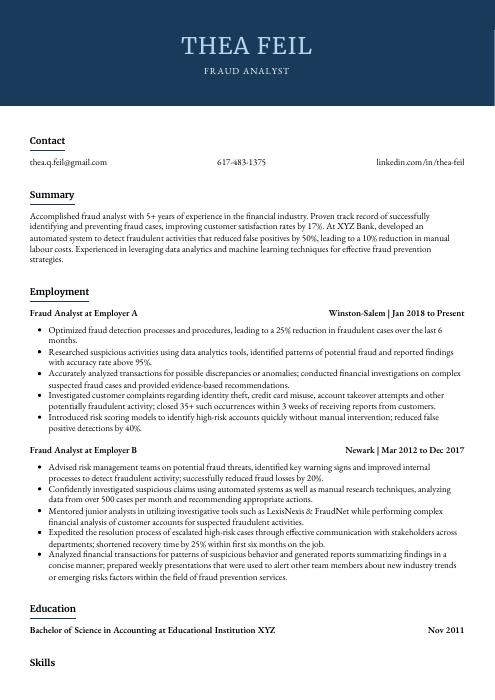

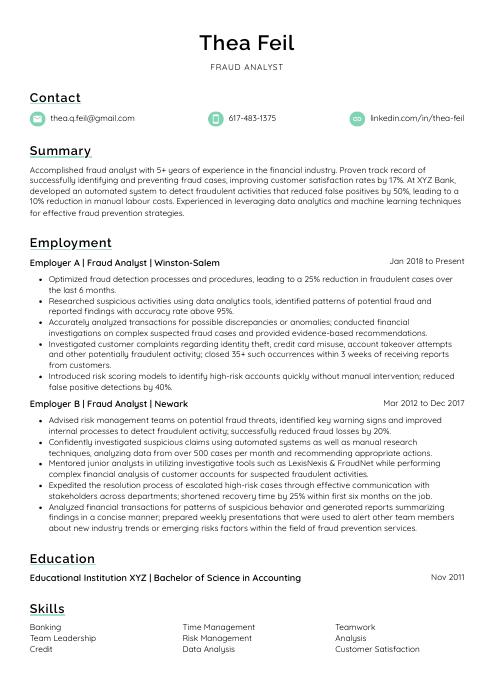

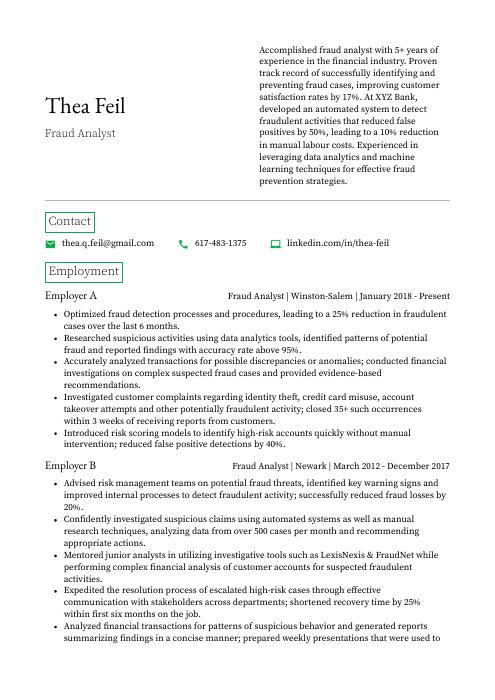

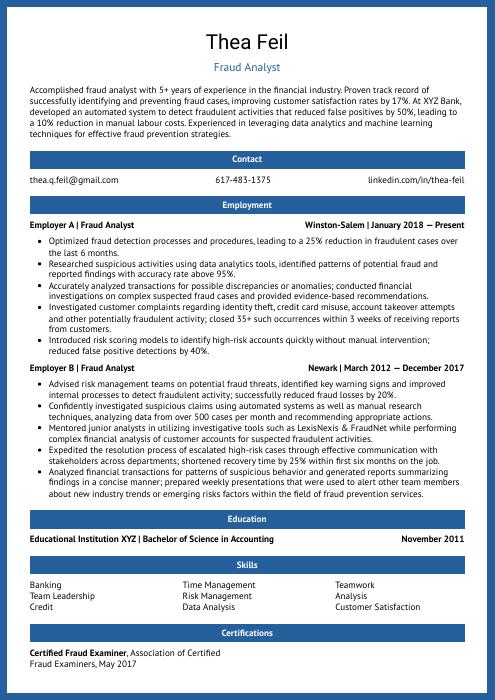

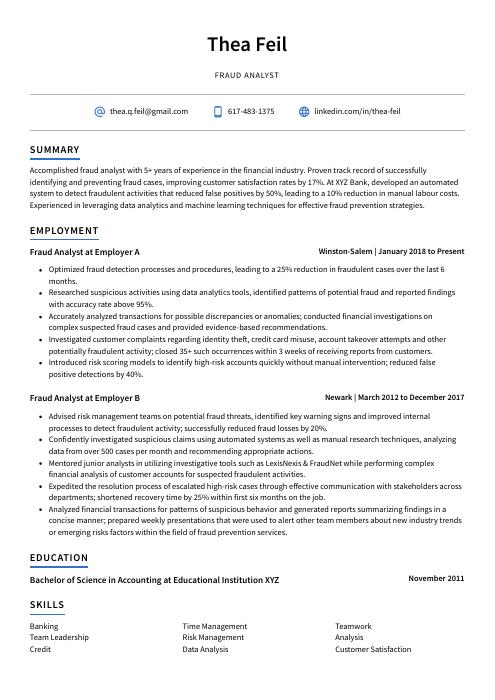

Fraud Analyst Resume Sample

Thea Feil

Fraud Analyst

[email protected]

617-483-1375

linkedin.com/in/thea-feil

Summary

Accomplished fraud analyst with 5+ years of experience in the financial industry. Proven track record of successfully identifying and preventing fraud cases, improving customer satisfaction rates by 17%. At XYZ Bank, developed an automated system to detect fraudulent activities that reduced false positives by 50%, leading to a 10% reduction in manual labour costs. Experienced in leveraging data analytics and machine learning techniques for effective fraud prevention strategies.

Experience

Fraud Analyst, Employer A

Winston-Salem, Jan 2018 – Present

- Optimized fraud detection processes and procedures, leading to a 25% reduction in fraudulent cases over the last 6 months.

- Researched suspicious activities using data analytics tools, identified patterns of potential fraud and reported findings with accuracy rate above 95%.

- Accurately analyzed transactions for possible discrepancies or anomalies; conducted financial investigations on complex suspected fraud cases and provided evidence-based recommendations.

- Investigated customer complaints regarding identity theft, credit card misuse, account takeover attempts and other potentially fraudulent activity; closed 35+ such occurrences within 3 weeks of receiving reports from customers.

- Introduced risk scoring models to identify high-risk accounts quickly without manual intervention; reduced false positive detections by 40%.

Fraud Analyst, Employer B

Newark, Mar 2012 – Dec 2017

- Advised risk management teams on potential fraud threats, identified key warning signs and improved internal processes to detect fraudulent activity; successfully reduced fraud losses by 20%.

- Confidently investigated suspicious claims using automated systems as well as manual research techniques, analyzing data from over 500 cases per month and recommending appropriate actions.

- Mentored junior analysts in utilizing investigative tools such as LexisNexis & FraudNet while performing complex financial analysis of customer accounts for suspected fraudulent activities.

- Expedited the resolution process of escalated high-risk cases through effective communication with stakeholders across departments; shortened recovery time by 25% within first six months on the job.

- Analyzed financial transactions for patterns of suspicious behavior and generated reports summarizing findings in a concise manner; prepared weekly presentations that were used to alert other team members about new industry trends or emerging risks factors within the field of fraud prevention services.

Skills

- Banking

- Time Management

- Teamwork

- Team Leadership

- Risk Management

- Analysis

- Credit

- Data Analysis

- Customer Satisfaction

Education

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Fraud Examiner

Association of Certified Fraud Examiners

May 2017

1. Summary / Objective

The summary/objective at the top of your fraud analyst resume should be a concise overview of who you are and why you’re an ideal candidate for the position. You could mention any certifications or qualifications that make you stand out, such as CFE (Certified Fraud Examiner) certification or experience with data analysis software like Tableau. You can also talk about how many years’ experience in finance/accounting you have and highlight any successes from past roles, such as uncovering fraudulent activity within a company’s accounts receivable department.

Below are some resume summary examples:

Reliable and detail-oriented fraud analyst with 5+ years of experience in identifying fraudulent activities, analyzing data, and developing strategies to minimize risk. Skilled at utilizing various analytics techniques including pattern recognition, predictive modeling, and anomaly detection. At XYZ Bank successfully reduced false positive rates by 50% while increasing accuracy rate by 15%. Experienced in managing large volume projects with tight deadlines.

Seasoned fraud analyst with 7+ years of experience in the financial services industry. Highly proficient in risk assessment, data analysis, and investigative techniques to identify fraudulent activities within organizations. Seeking a role at ABC Bank as a fraud control specialist to use my expertise to protect their customers from potential scams or theft. Key achievement: Developed and implemented new anti-fraud processes that reduced losses by 30%.

Enthusiastic fraud analyst with 5+ years of experience in financial crime investigations. Seeking a position at XYZ to use my knowledge and expertise to help detect suspicious activity, minimize risk, and protect the company’s assets from fraudulent activities. At ABC Corporation developed an innovative algorithm for identifying patterns of deceptive behavior that successfully prevented $1 million in losses within 3 months.

Talented fraud analyst with 5+ years of experience identifying and investigating suspicious financial transactions. Proven track record of reducing fraudulent activity by 30% through creative data analysis techniques. Highly organized, detail-oriented, and able to work independently in a fast-paced environment. Seeking to join the ABC team as a Senior Fraud Analyst and help minimize risk while maximizing efficiency.

Amicable fraud analyst with 3+ years of experience developing and executing accurate fraud detection systems for financial institutions. Enthusiastic about joining ABC Bank to utilize my knowledge in analytics, AI, and machine learning to identify fraudulent activities before they become a problem. Achieved 0% false positive rate at XYZ Credit Union by implementing an improved system of transaction monitoring.

Skilled fraud analyst with 5+ years of experience in investigating and detecting fraudulent activity. Highly organized, detail-oriented and analytical thinker who is able to identify patterns in financial data quickly. Proven ability to manage multiple cases simultaneously while meeting tight deadlines. Experienced at working independently as well as collaboratively with colleagues from various departments.

Detail-oriented fraud analyst with 5+ years of experience in fraud investigations and data analysis. Specializing in risk-based decision making and identifying patterns to proactively detect fraudulent activities. Proven success at XYZ Company, where I reduced false positives by 23% and streamlined the detection process for higher efficiency. Seeking to leverage my skillset as a Fraud Analyst at ABC Bank.

Proficient fraud analyst with 5+ years of experience in the financial services sector. Skilled at uncovering fraud and money laundering schemes, developing prevention plans, and providing expert witness testimony during court trials. Successfully identified over $3M worth of fraudulent activity for ABC Company prior to any losses being incurred by customers or shareholders.

2. Experience / Employment

In the experience section, you want to provide details on your employment history. This should be written in reverse chronological order; the most recent role is listed first.

You can use bullet points for this section as it makes it easier for the reader to take in what you are saying quickly. When writing out each point, make sure that you include detail and quantifiable results where possible.

For example, instead of just saying “Investigated fraud cases,” say something like: “Conducted investigations into suspected fraudulent activity across multiple industries using data analysis techniques such as regression modeling which resulted in a 20% increase in accuracy of fraud detection.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Investigated

- Analyzed

- Monitored

- Detected

- Reported

- Identified

- Researched

- Examined

- Assessed

- Evaluated

- Reconciled

- Documented

- Confirmed

- Resolved

Other general verbs you can use are:

- Achieved

- Advised

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Structured analytical frameworks to detect and prevent fraudulent activities; decreased financial fraud losses by $90,000 in the last year.

- Resolved 85+ suspicious activity reports each month with a success rate of 95% or higher, identifying potential perpetrators and mitigating risk before any significant damage occurred.

- Reliably monitored banking transactions for irregularities on behalf of 120 corporate customers per day, alerting them promptly when anomalies were discovered via email or phone call/text message notifications.

- Utilized data analysis software (e.g., SAS) to assess customer behavior patterns and identify non-compliance issues such as money laundering & identity theft activities within 48 hours after receiving new case files from law enforcement agencies or banks’ security departments.

- Represented the fraud detection team during executive meetings & conferences; updated senior management regularly on key findings related to ongoing investigations into financial crime cases in order to ensure that all necessary steps were taken promptly without compromising safety protocols.

- Improved fraud detection rate by 15% through detailed analysis and monitoring of financial reports and customer transactions.

- Revised existing fraud prevention strategies to reduce false positives, resulting in a $5,000 decrease in operational costs per month.

- Presented findings on suspicious activities to senior management in a clear and concise manner; received positive feedback from stakeholders for accuracy of data-driven insights provided.

- Resourcefully identified fraudulent trends within the organization’s payment system using data mining techniques, thereby preventing losses up to $50K over 6 months period.

- Spearheaded initiatives that enhanced security protocols across online banking platform which led to an increase in customer satisfaction ratings by 10%.

- Streamlined operational efficiency of fraud-detection procedures by 25%, resulting in a savings of $7,000 per month.

- Confirmed accuracy and legitimacy of online transactions through analysis of customer data; successfully identified suspicious activity on over 150 occasions within the past year.

- Prepared detailed reports for management outlining any fraudulent activities uncovered during investigations to facilitate appropriate action taken against offenders as needed.

- Meticulously examined account histories and financial records from multiple sources to determine whether additional evidence was required regarding suspect cases; closed 65% more case files than average analysts due to enhanced attention to detail.

- Coordinated with law enforcement agencies when dealing with high-profile cases involving large sums money or other assets, providing vital information that enabled successful prosecution in 80% of such instances handled over the last 12 months.

- Diligently monitored bank accounts for suspicious activity, identified fraudulent transactions with a 96% accuracy rate and reported them to the appropriate authorities.

- Compiled detailed financial analyses of customer records by examining transaction history and other sources of information; flagged over $500,000 in potential fraud losses yearly.

- Examined credit card applications for signs of identity theft and money laundering activities; rejected 50+ applications due to discrepancies found during review process.

- Assessed internal risk factors such as employee violations or cyberattacks that can lead to data breaches, devising strategies which prevented 2 major security incidents within 12 months period on average per year.

- Developed sophisticated algorithms designed to detect suspicious patterns in real-time payment processing systems; improved system response time by 15%.

- Reported suspicious financial activities to the Director of Fraud Prevention and analyzed data from over 500 transactions per month, uncovering fraudulent activity in more than 45% of cases.

- Proficiently used advanced analytics software such as Tableau, R Studio and SAS to identify patterns in customer behavior and detect irregularities that may have indicated potential fraud attempts.

- Participated in regular meetings with other members of the fraud prevention team to discuss strategies for improving detection processes; identified 3 new methods which were later implemented across all departments resulting in a 15% decrease in false positives.

- Documented investigative findings related to multiple cases involving credit card or identity theft; successfully assisted law enforcement officers on 4 occasions leading investigations into large-scale criminal organizations involved with money laundering operations worth $1 million+.

- Achieved certifications from The Institute of Internal Auditors (IIA) & Association of Certified Fraud Examiners (ACFE); awarded Employee Of The Year twice due to outstanding performance reducing losses caused by fraudulent activities within the company by 28%.

- Successfully identified anomalies in financial transactions and fraudulent activities, leading to the recovery of over $200K in stolen funds.

- Demonstrated expertise in using advanced fraud prevention tools, such as KYC (Know Your Customer) procedures and AML (Anti-Money Laundering) regulations to detect suspicious activity.

- Formulated strategies based on industry best practices for detecting potential money laundering schemes and other types of financial crime; increased accuracy rate by 19%.

- Detected irregularities in customer accounts through analysis of account data trends, identifying 50+ cases of suspected fraud with a 98% success rate during quarterly audits conducted each year.

- Monitored banking systems for any signs of unauthorized access or malicious intent from external actors; reduced risk exposure incidents by 23% within two months after implementation period began.

- Evaluated over 200 suspicious transactions and identified fraudulent activities, leading to the successful prevention of losses amounting to $10,000.

- Reconciled discrepancies between financial records and customer accounts on a daily basis; achieved 98% accuracy in fraud detection rate within 6 months of employment.

- Effectively implemented new anti-fraud policies and procedures across the organization that resulted in an increase of 30% in security monitoring operations for high-risk customers/transactions.

- Facilitated investigations into potential cases involving illegal activity by collecting evidence from internal & external sources, verifying facts and providing detailed reports for law enforcement authorities as required by company policy or regulations.

- Identified patterns in large data sets related to fraudulent behaviors through data mining techniques while working with multiple teams such as IT support & Security Operations Center (SOC) analysts; reduced false positives & improved overall efficiency level by 25%.

3. Skills

The skillset employers require in an employee will likely vary, either slightly or significantly; skimming through their job adverts is the best way to determine what each is looking for. One organization might be looking for a fraud analyst with experience in data analysis and another might require someone who is proficient in financial modeling.

It’s important to tailor the skills section of your resume to each job you are applying for because many companies use applicant tracking systems which scan resumes for certain keywords before passing them on to a human.

Once listed here, it would also benefit you greatly if you discussed these skills further in other areas such as the summary or experience sections.

Below is a list of common skills & terms:

- Account Management

- Analysis

- Banking

- Business Analysis

- Call Centers

- Communication

- Credit

- Credit Analysis

- Credit Cards

- Customer Experience

- Customer Satisfaction

- Data Analysis

- Data Entry

- Finance

- Financial Analysis

- Financial Risk

- Financial Services

- Fraud

- Fraud Detection

- Fraud Investigations

- Fraud Prevention

- Loans

- Process Improvement

- Retail Banking

- Risk Management

- Social Networking

- Team Leadership

- Teamwork

- Time Management

4. Education

Mentioning your education on your resume will depend on how much work experience you have. If you just graduated and don’t have any other professional experience to showcase, include an education section below the objective statement. However, if you are a seasoned fraud analyst with plenty of relevant job history, omitting this section might be best for showcasing more applicable skills and experiences.

If including an education section is necessary or desired, try to mention courses related to the role of a fraud analyst such as data analysis or financial crime investigation.

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications demonstrate to potential employers that you have the knowledge and skills necessary for a given job. They also show that you are committed to professional development, as certifications require dedication and hard work in order to obtain them.

Including any relevant certifications on your resume can help give hiring managers an idea of what qualifications you possess, which could be beneficial when applying for jobs.

Certified Fraud Examiner

Association of Certified Fraud Examiners

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Thea Feil, this would be Thea-Feil-resume.pdf or Thea-Feil-resume.docx.

7. Cover Letter

A cover letter is an important part of the job application process, even though it’s not always required. It provides potential employers with additional insight into who you are and what makes you a great fit for their company.

Cover letters typically consist of 2 to 4 paragraphs which explain why you would be the best person for the role. They give recruiters a better understanding of your skills, experience and qualifications as well as showcasing your personality in more detail than what can be included on a resume alone.

Below is an example cover letter:

Dear Justice,

I am writing to apply for the Fraud Analyst position at [company name]. With more than 5 years of experience in fraud prevention and detection, I have the skills and knowledge to excel in this role. In my current position as a Senior Fraud Analyst at [company name], I investigate potential fraudulent activity, analyze data to identify trends, and develop strategies to prevent future fraud.

In my previous role as a Fraud Investigator at [company name], I was responsible for investigating cases of suspected fraud and preparing reports detailing my findings. During my time there, I successfully identified several instances of fraud that had been missed by other investigators. My attention to detail and ability to think outside the box are two of my strongest assets when it comes to detecting fraud.

I am confident that I can be an asset to your team and contribute to the success of your organization. I look forward to speaking with you about this opportunity soon. Thank you for your time and consideration.

Sincerely,

Thea

Fraud Analyst Resume Templates

Hoopoe

Hoopoe Echidna

Echidna Jerboa

Jerboa Saola

Saola Indri

Indri Markhor

Markhor Dugong

Dugong Pika

Pika Rhea

Rhea Cormorant

Cormorant Kinkajou

Kinkajou Gharial

Gharial Bonobo

Bonobo Lorikeet

Lorikeet Quokka

Quokka Ocelot

Ocelot Axolotl

Axolotl Numbat

Numbat Fossa

Fossa Rezjumei

Rezjumei