Financial Engineer Resume Guide

Financial engineers use mathematical and quantitative models to analyze financial markets, design complex derivative instruments, assess risk management strategies, and develop automated trading systems. They are skilled in both finance and engineering disciplines as they apply their knowledge of mathematics, computing programming languages such as VBA or MATLAB, and economic theories to solve financial problems.

You have a knack for numbers, and you know how to turn them into financial success. But potential employers don’t know about your abilities yet – make sure they do by crafting an impressive resume that demonstrates why you’re the best person for the job.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

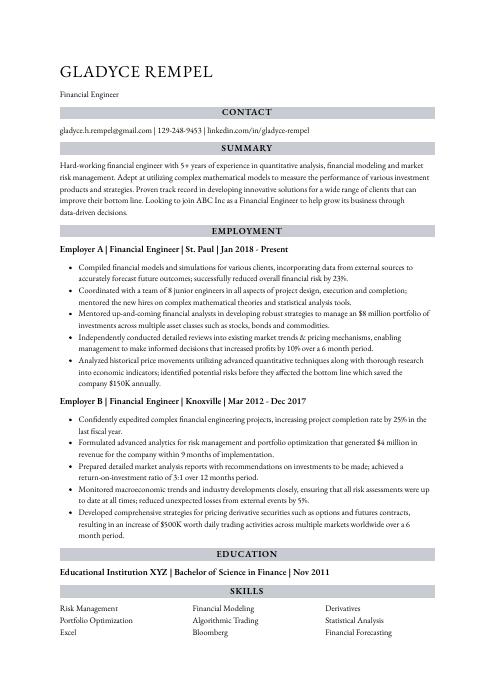

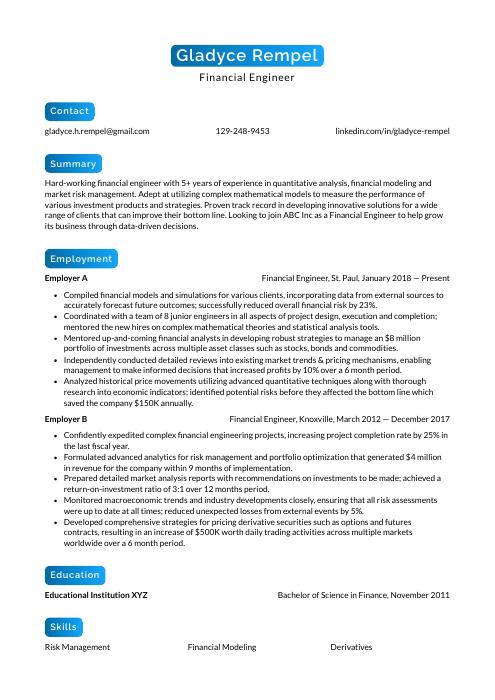

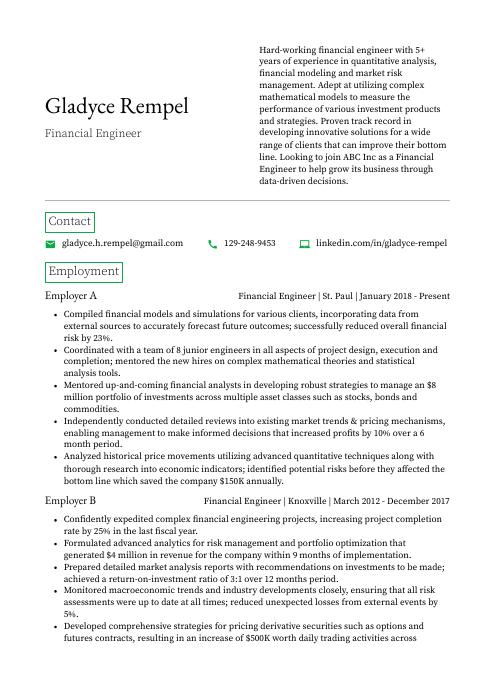

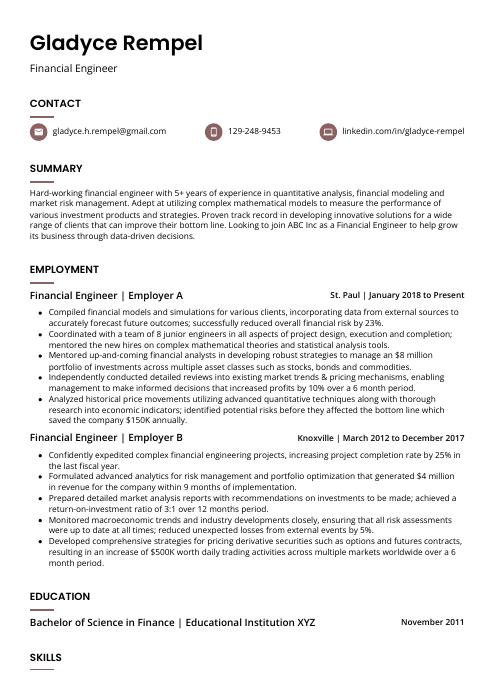

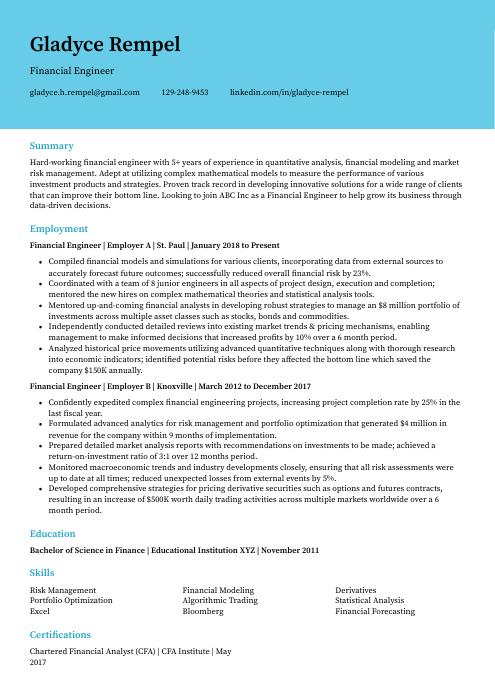

Financial Engineer Resume Sample

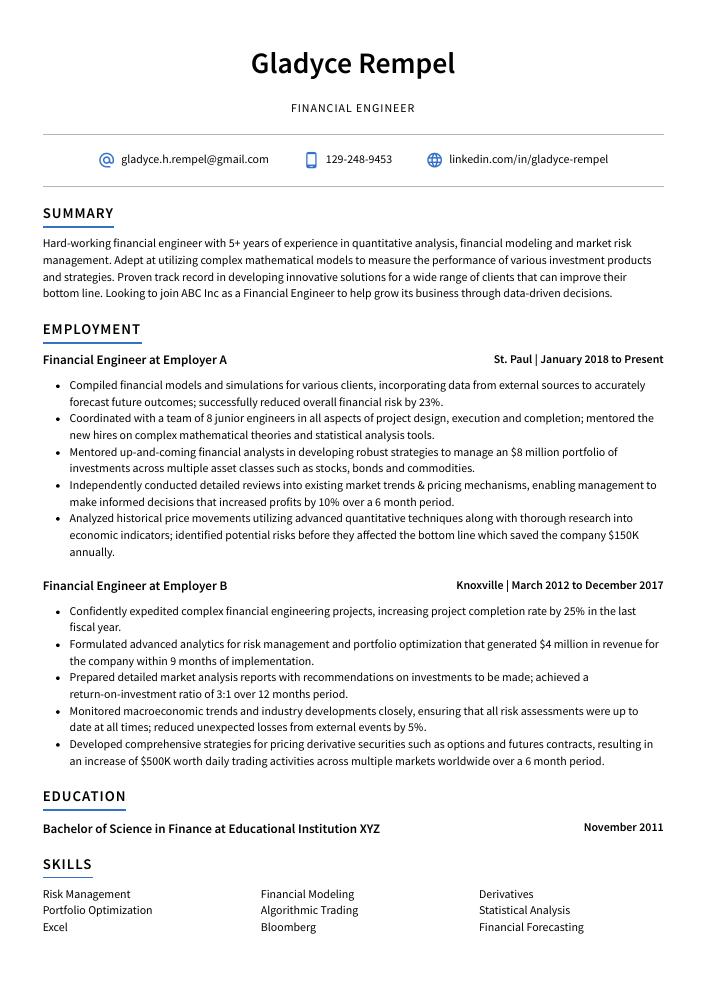

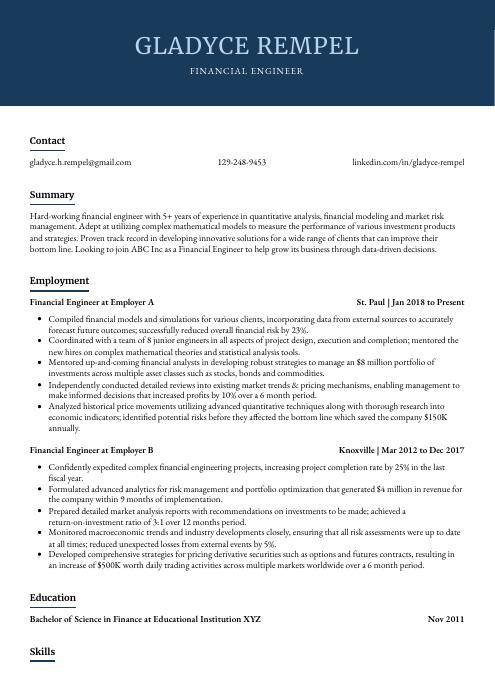

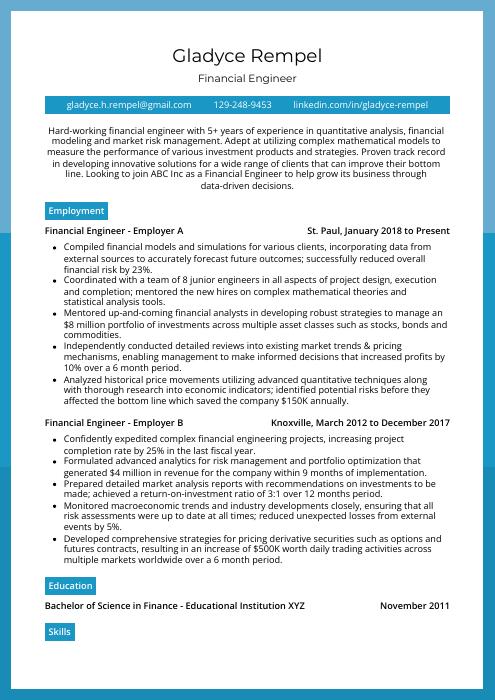

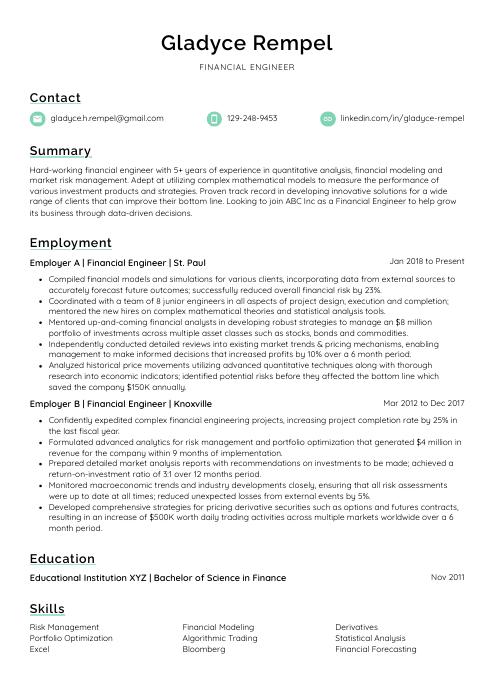

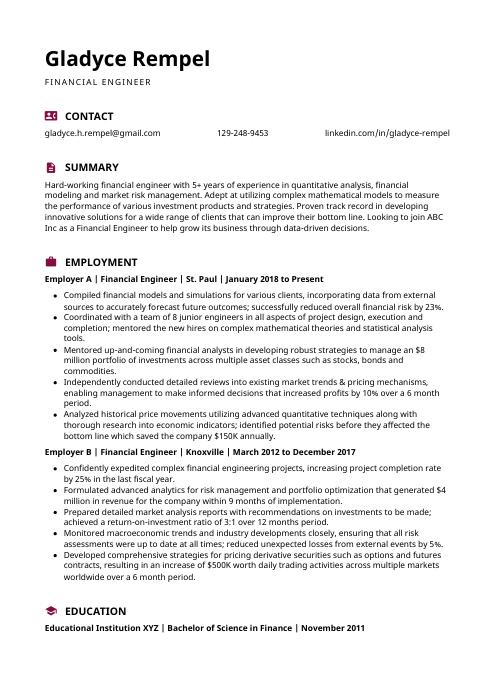

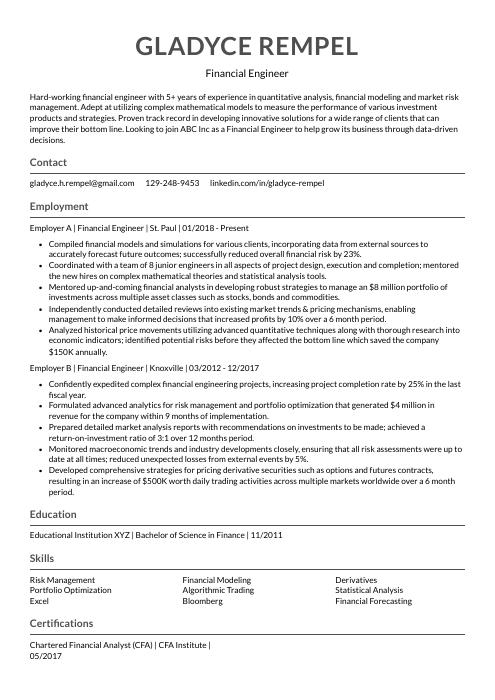

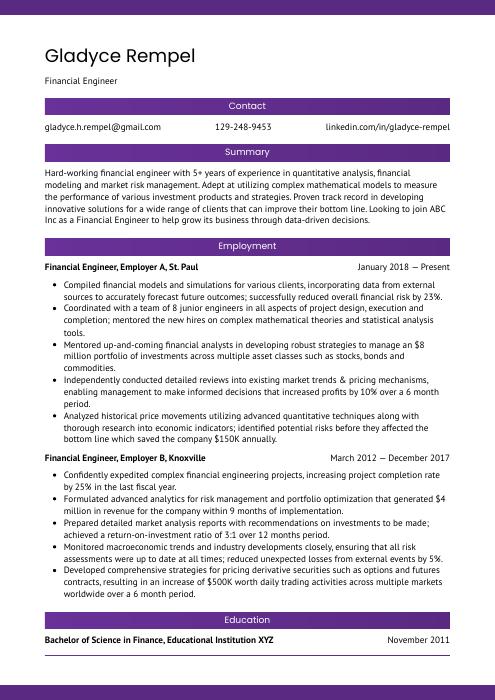

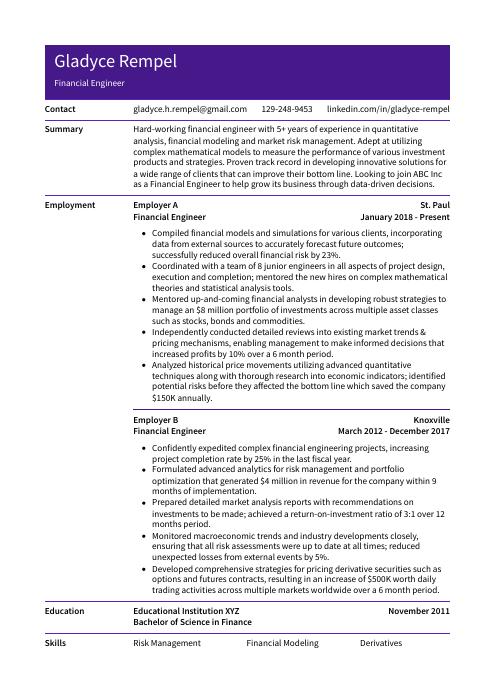

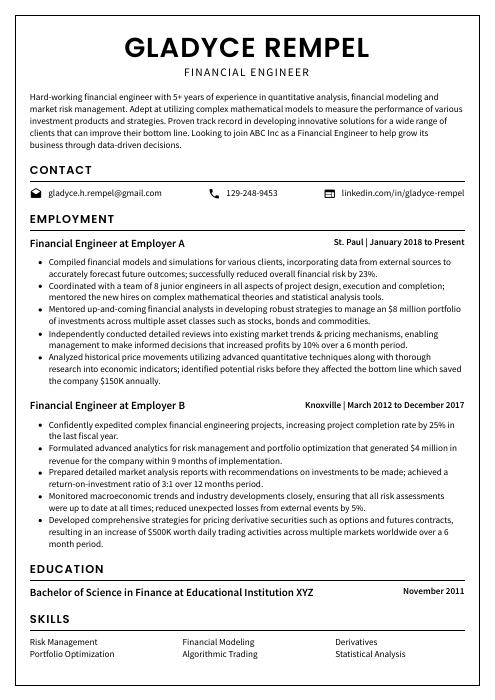

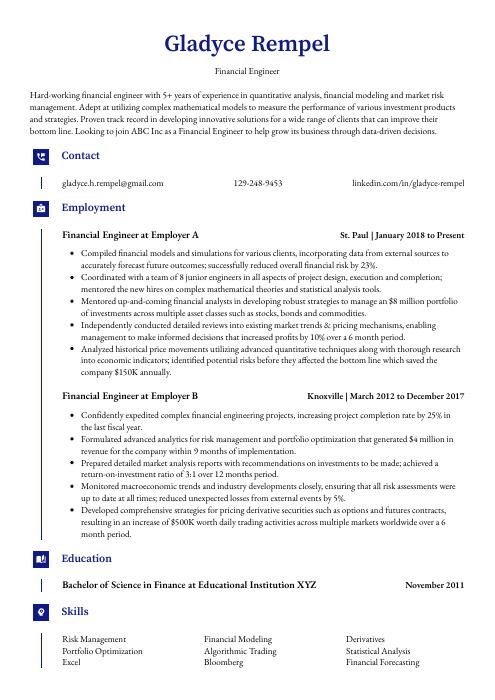

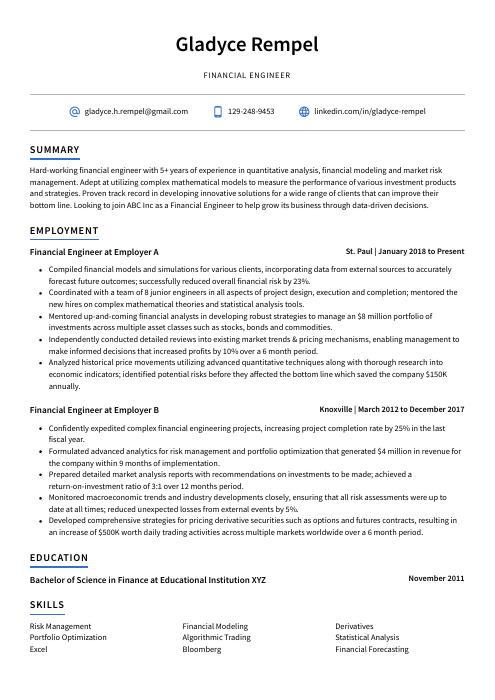

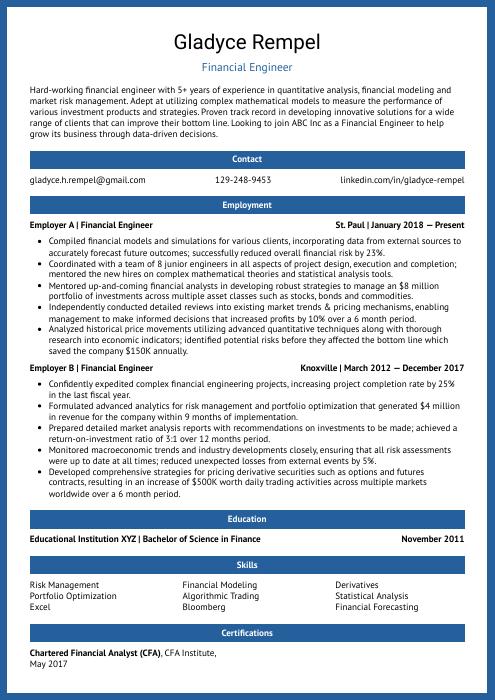

Gladyce Rempel

Financial Engineer

[email protected]

129-248-9453

linkedin.com/in/gladyce-rempel

Summary

Hard-working financial engineer with 5+ years of experience in quantitative analysis, financial modeling and market risk management. Adept at utilizing complex mathematical models to measure the performance of various investment products and strategies. Proven track record in developing innovative solutions for a wide range of clients that can improve their bottom line. Looking to join ABC Inc as a Financial Engineer to help grow its business through data-driven decisions.

Experience

Financial Engineer, Employer A

St. Paul, Jan 2018 – Present

- Compiled financial models and simulations for various clients, incorporating data from external sources to accurately forecast future outcomes; successfully reduced overall financial risk by 23%.

- Coordinated with a team of 8 junior engineers in all aspects of project design, execution and completion; mentored the new hires on complex mathematical theories and statistical analysis tools.

- Mentored up-and-coming financial analysts in developing robust strategies to manage an $8 million portfolio of investments across multiple asset classes such as stocks, bonds and commodities.

- Independently conducted detailed reviews into existing market trends & pricing mechanisms, enabling management to make informed decisions that increased profits by 10% over a 6 month period.

- Analyzed historical price movements utilizing advanced quantitative techniques along with thorough research into economic indicators; identified potential risks before they affected the bottom line which saved the company $150K annually.

Financial Engineer, Employer B

Knoxville, Mar 2012 – Dec 2017

- Confidently expedited complex financial engineering projects, increasing project completion rate by 25% in the last fiscal year.

- Formulated advanced analytics for risk management and portfolio optimization that generated $4 million in revenue for the company within 9 months of implementation.

- Prepared detailed market analysis reports with recommendations on investments to be made; achieved a return-on-investment ratio of 3:1 over 12 months period.

- Monitored macroeconomic trends and industry developments closely, ensuring that all risk assessments were up to date at all times; reduced unexpected losses from external events by 5%.

- Developed comprehensive strategies for pricing derivative securities such as options and futures contracts, resulting in an increase of $500K worth daily trading activities across multiple markets worldwide over a 6 month period.

Skills

- Risk Management

- Financial Modeling

- Derivatives

- Portfolio Optimization

- Algorithmic Trading

- Statistical Analysis

- Excel

- Bloomberg

- Financial Forecasting

Education

Bachelor of Science in Finance

Educational Institution XYZ

Nov 2011

Certifications

Chartered Financial Analyst (CFA)

CFA Institute

May 2017

1. Summary / Objective

Your resume summary or objective should give the hiring manager a snapshot of your financial engineering skills and experience. In this section, you can highlight any certifications or qualifications that make you stand out from other applicants, such as an MBA in finance or CFA certification. You could also mention how many years of experience you have working with quantitative analysis tools and developing complex algorithms for trading strategies.

Below are some resume summary examples:

Talented financial engineer with strong knowledge of financial modeling, forecasting, and analysis. At XYZ Bank, successfully developed a quantitative model for pricing derivatives that was adopted across the entire department. Experienced in developing automated trading systems using Python and other programming languages to maximize profits from market fluctuations. Recognized as an expert in portfolio management techniques and risk/return optimization strategies.

Committed and analytical financial engineer with 7+ years of experience in quantitative finance, portfolio management, and risk modeling. Skilled at assessing market trends to identify investment opportunities. Successful track record of utilizing advanced statistical models to forecast asset prices and mitigate risks associated with investments. Looking to join ABC Company as a Financial Engineer where I can leverage my expertise to achieve organizational goals.

Driven financial engineer with 7+ years of experience developing financial models and quantitative risk management tools. Proven track record in leveraging mathematical and computing skills to analyze data, identify trends, predict outcomes, and optimize processes for clients within the banking industry. Seeking an opportunity at ABC Bank to apply my knowledge in financial engineering towards creating innovative solutions that maximize returns on investments.

Well-rounded financial engineer with 8+ years of experience in risk-management and financial analysis. Demonstrated success in developing sophisticated quantitative models for derivative pricing, capital structure optimization, portfolio management, and foreign exchange hedging strategies. Skilled communicator who is comfortable presenting complex ideas to a wide range of audiences including executives and board members.

Reliable and results-driven financial engineer with 5+ years of experience developing and implementing quantitative models for risk management and portfolio optimization. Expert in creating, testing, validating, and documenting complex mathematical algorithms to assess credit risks in various markets. Demonstrated success at XYZ Bank through the development of a machine learning model that improved accuracy by 20%.

Professional financial engineer with 5+ years of experience crafting financial models and forecasting analytics for a variety of clients. Demonstrated success in creating risk management strategies, optimizing portfolio performance, and developing innovative investment solutions. Looking to join ABC’s team as the next financial engineer to help drive growth through data-driven insights.

Amicable financial engineer with 5+ years of experience in the banking and finance sector. Specialized knowledge in financial modelling, risk management, investments, and portfolio analysis. At XYZ Bank designed models for credit rating systems that increased asset yield by 25%. Currently looking to leverage my expertise to create a more efficient system at ABC Financial Services.

Enthusiastic and highly motivated financial engineer with 5+ years of experience in quantitative and portfolio analysis, data science, and financial modeling. Expertise in developing sophisticated models to assess the risk-reward tradeoffs of investment strategies. Passionate about applying cutting-edge technology solutions to optimize portfolio performance at ABC Corporation.

2. Experience / Employment

In the experience section, you’ll want to provide details about your employment history. It should be written in reverse chronological order, which means your most recent job is listed first.

Stick to bullet points for the best results; this makes it easier for the reader to take in what you have written quickly. When writing out each point, make sure that you include specifics on what tasks were completed and any quantifiable results achieved from them.

For example, instead of saying “Developed financial models,” say something like “Designed complex financial models using Monte Carlo simulations to accurately forecast risk exposure with a 95% accuracy rate.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Analyzed

- Calculated

- Forecasted

- Optimized

- Monitored

- Modeled

- Assessed

- Evaluated

- Reconciled

- Reported

- Researched

- Developed

- Implemented

- Managed

Other general verbs you can use are:

- Achieved

- Advised

- Compiled

- Coordinated

- Demonstrated

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Resourcefully reorganized and optimized investment portfolios to maximize returns, resulting in a 30% increase in total assets under management.

- Demonstrated expertise in financial engineering concepts such as derivatives, options and asset-liability matching; developed innovative strategies resulting in an 18% decrease of risk exposure during market downturns.

- Evaluated financial instruments for accuracy and liquidity while adhering to global regulations; issued over $7 million worth of debt securities within two months with no errors or missteps recorded throughout the process.

- Reconciled discrepancies between actual portfolio performance versus expected results on weekly basis; identified potential problems before they became serious issues, leading to a 75% reduction of operational losses over 6 months period.

- Utilized specialized software programs like MATLAB & RStudio for data analysis & forecasting purposes when making key decisions related to investments allocation & pricing adjustments.

- Revised financial models and identified ways to optimize financial engineering processes which resulted in a 10% decrease of operational costs.

- Diligently monitored the financial performance of assigned portfolios, making necessary adjustments as needed to ensure compliance with regulations and risk management policies; reduced portfolio volatility by 14%.

- Spearheaded development of innovative finance products that successfully drove up asset growth by $4 million within 6 months.

- Facilitated meetings between stakeholders from different departments to resolve complex financial issues; improved communication among teams, resulting in an expedited decision-making process (by 5 hours on average).

- Advised senior management on strategies for mitigating risks related to derivatives trading activities while ensuring respective returns met predefined benchmark targets set out by business objectives; increased profits generated from investments by 8%.

- Achieved a 16% increase in profits by developing risk management models and trading strategies for a large financial institution.

- Represented the company at global conferences, presenting research on new technologies that could improve portfolio performance by 8%.

- Actively monitored market data to identify trends and opportunities while ensuring compliance with relevant regulations; prevented losses of over $500K within the past year through timely action.

- Optimized instrument pricing processes using sophisticated analytical techniques such as Monte Carlo Simulations, resulting in improved accuracy of quotes by more than 20%.

- Improved operational efficiency of business processes related to asset valuation and accounting systems, reducing processing time from 6 hours per day to 3 hours per day on average.

- Implemented complex quantitative models to forecast financial markets and generated $2M in additional revenue annually.

- Utilized financial engineering concepts including stochastic calculus, derivatives pricing and econometrics to analyze risk management strategies for the organization’s portfolio investments.

- Managed a team of 10+ analysts throughout the entire process of developing an automated trading system that increased profits by 8%.

- Consistently monitored market risks associated with derivative products such as futures, options, swaps and other structured securities across multiple asset classes worldwide; improved understanding of complex relationships between economic variables by 25%.

- Assessed stock option prices using Black-Scholes model which enabled more accurate price predictions resulting in 40% fewer losses from unexpected fluctuations in the market conditions compared to previous years.

- Successfully led a team of 5 financial engineers in developing and implementing innovative algorithmic trading strategies that resulted in an 18% return on investments over the past 2 years.

- Introduced new pricing models for derivative products and options, reducing cost by $3 million per quarter through better hedging techniques.

- Calculated risk-reward ratios across multiple asset classes to optimize portfolio performance; achieved a 30% success rate above industry average in forecasting market trends accurately.

- Researched diverse economic indices globally and applied statistical methods to analyze data insights, resulting in improved accuracy of predictions by 10%.

- Structured multi-million dollar derivatives transactions using advanced financial engineering tools such as MATLAB & R programming language; completed projects within tight deadlines without compromising quality standards.

- Streamlined financial processes, saving $250K in operational costs and increasing efficiency by 35%.

- Modeled complex financial scenarios for clients using advanced mathematical models to optimize their portfolio performance; generated over 10% returns on average per quarter.

- Competently interpreted market trends utilizing quantitative analysis methods to identify new profitable opportunities within the industry.

- Participated in cross-functional projects with other departments to develop innovative solutions that would reduce trading risk while also improving overall ROI of investments by 12%.

- Developed detailed investment strategies tailored specifically to meet client goals while managing a portfolio worth more than $1Million dollars across multiple asset classes such as stocks, bonds and commodities.

- Reported financial analysis results to C-suite executives, accurately forecasting revenue growth of over $2.5 million in the next financial quarter.

- Presented innovative strategies to reduce operational costs by 10%, leading to a significant increase in profitability for the company year on year.

- Reduced errors and discrepancies between financial statements by 40% through detailed quality assurance checks and proactive problem solving skills in collaboration with other departments within the organization.

- Forecasted potential risks associated with investments, helping senior management make informed decisions that minimized losses while maximizing returns over 20%.

- Reliably monitored market trends & regulatory changes across multiple countries daily; identified gaps and opportunities which resulted in an additional 15% gain from international investments last month alone.

3. Skills

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may be looking for someone with experience in financial modeling, while Organization XYZ may want a candidate who is proficient in risk management.

Therefore, you should tailor the skills section of your resume to each job that you are applying for. This will ensure that it passes through applicant tracking systems – computer programs used by employers to scan resumes and filter out those deemed not to be a good fit based on certain criteria (such as specific keywords).

You can further elaborate on your skillset by discussing it in more detail elsewhere; this could include both the summary or experience sections of your resume.

Below is a list of common skills & terms:

- Algorithmic Trading

- Bloomberg

- Derivatives

- Excel

- Financial Forecasting

- Financial Modeling

- Financial Statement Analysis

- Portfolio Optimization

- Risk Management

- Statistical Analysis

4. Education

Including an education section on your resume will depend on how far along you are in your career. If you just graduated and have no work experience, mention your education below the resume objective. However, if you already have a few years of relevant financial engineering experience to showcase, it may be unnecessary to include an education section altogether.

If including an education section is necessary for this role, try mentioning courses and subjects related to finance or economics that can demonstrate your knowledge of the field.

Bachelor of Science in Finance

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications demonstrate to potential employers that you have the knowledge and skills necessary for a given job. Having certifications can give you an edge over other applicants who may not have them, as it shows that you are committed to your profession and willing to invest in yourself.

Including any relevant certifications on your resume will help demonstrate why you would be the best candidate for the position. It also gives hiring managers insight into what type of professional development courses or seminars you’ve taken part in, which could prove beneficial when considering your candidacy.

Chartered Financial Analyst (CFA)

CFA Institute

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Gladyce Rempel, this would be Gladyce-Rempel-resume.pdf or Gladyce-Rempel-resume.docx.

7. Cover Letter

Including a cover letter when applying for a job is one of the best ways to make sure your application stands out. It gives you the opportunity to provide more information about yourself, highlight why you’re an excellent fit and explain what makes you different from other applicants.

A cover letter should be made up of 2 to 4 paragraphs and typically follows your resume when being sent in as part of a job application package. By taking the time to craft a great cover letter, employers will gain better insights into who you are as an individual and how well-suited you are for their role.

Below is an example cover letter:

Dear Dariana,

I am writing today to apply for the financial engineer position at XYZ Corporation. As a highly skilled and innovative financial engineer with experience developing complex financial models and conducting analysis to support business decision-making, I am confident I will be an asset to your organization.

In my current role as a financial analyst at ABC Company, I have gained extensive experience in all aspects of financial engineering, including model development, statistical analysis, forecasting, and optimization. I have also played a key role in several large projects that required me to liaise with cross-functional teams and external stakeholders. My excellent communication skills and ability to manage multiple tasks simultaneously have allowed me to successfully contribute to these projects.

I am knowledgeable in a variety of programming languages (such as R, Python, and MATLAB) and software applications (such as Excel), which has enabled me to develop sophisticated models that are both efficient and accurate. In addition, my strong analytical skills allow me to quickly identify trends and patterns in data sets that can be used to improve decision-making processes.

I believe my skills and experience make me the perfect candidate for this position. I look forward to discussing how I can contribute to your organization’s success in further detail during an interview at your earliest convenience. Thank you for your time; I look forward hearing from you soon!

Sincerely,

Gladyce

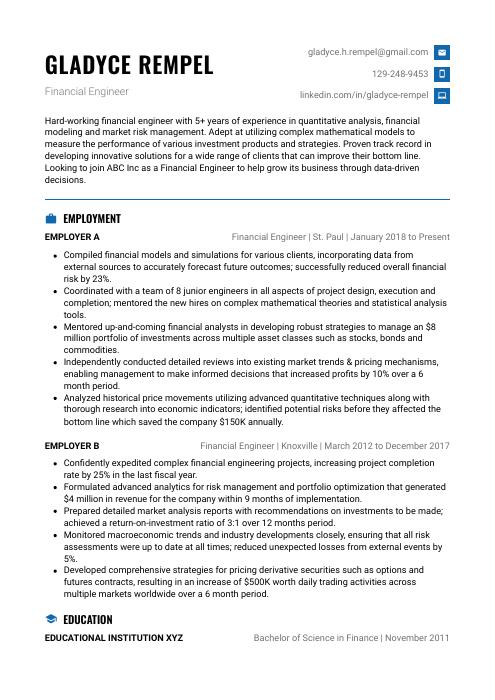

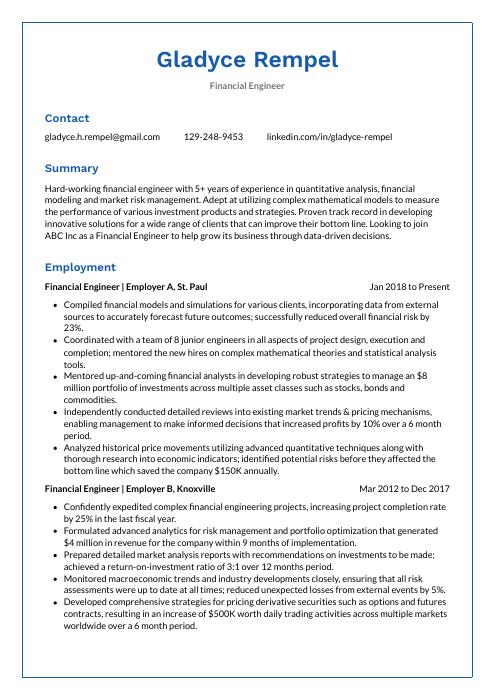

Financial Engineer Resume Templates

Bonobo

Bonobo Rhea

Rhea Lorikeet

Lorikeet Hoopoe

Hoopoe Indri

Indri Jerboa

Jerboa Pika

Pika Cormorant

Cormorant Gharial

Gharial Axolotl

Axolotl Ocelot

Ocelot Numbat

Numbat Kinkajou

Kinkajou Quokka

Quokka Fossa

Fossa Dugong

Dugong Echidna

Echidna Saola

Saola Markhor

Markhor Rezjumei

Rezjumei