Accounts Receivable Specialist Resume Guide

Accounts receivable specialists handle the financial side of a company’s accounts. They are responsible for keeping track of all incoming payments, issuing invoices to customers, and resolving any billing issues that may arise. They also work with other departments within their organization to ensure timely collection on outstanding payments.

You have the ability to manage accounts and ensure that payments are received in a timely manner. But potential employers don’t know about your skills yet, so you must create an eye-catching resume to make them take notice.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

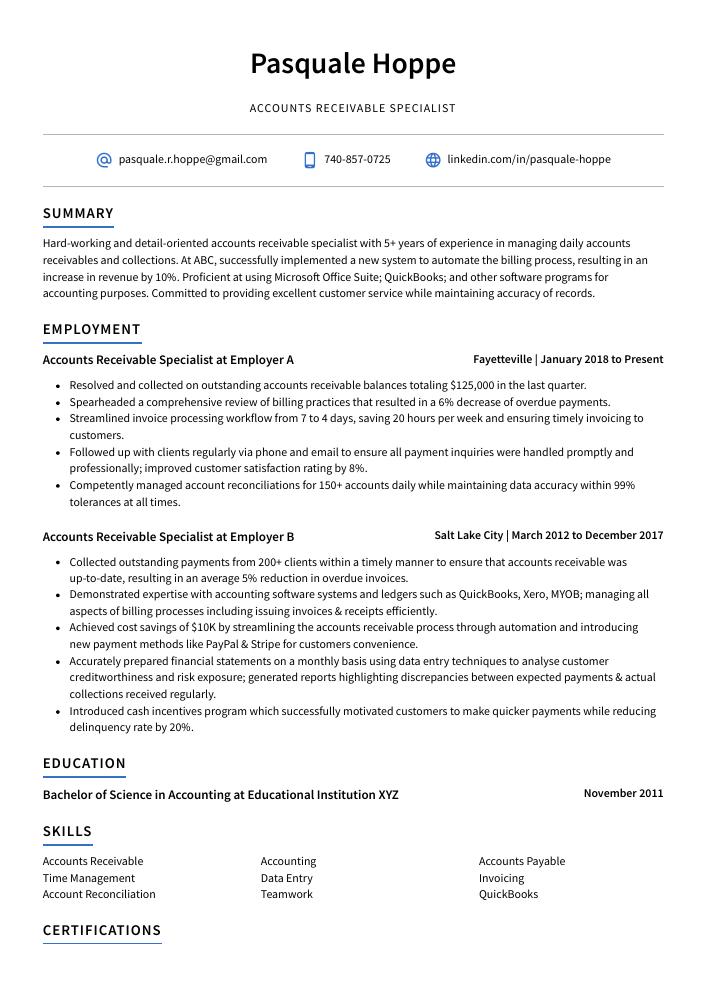

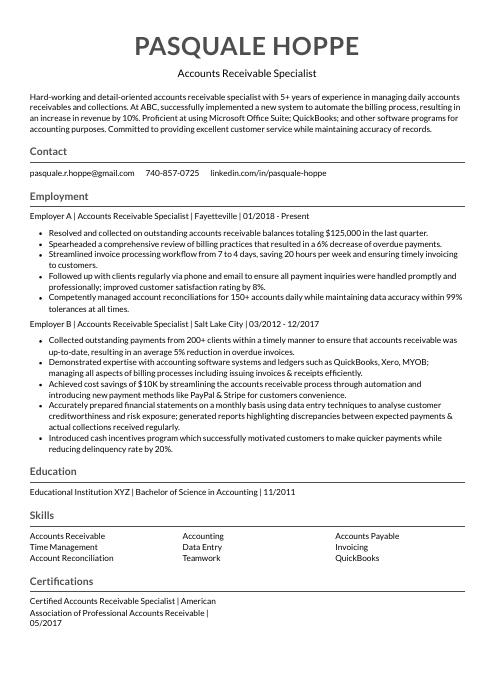

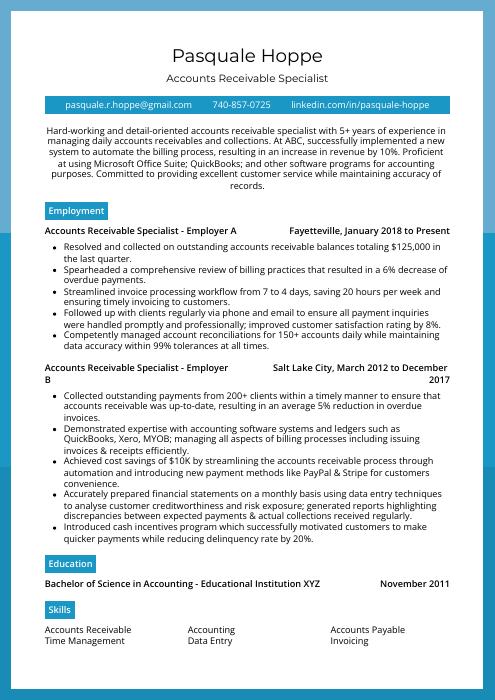

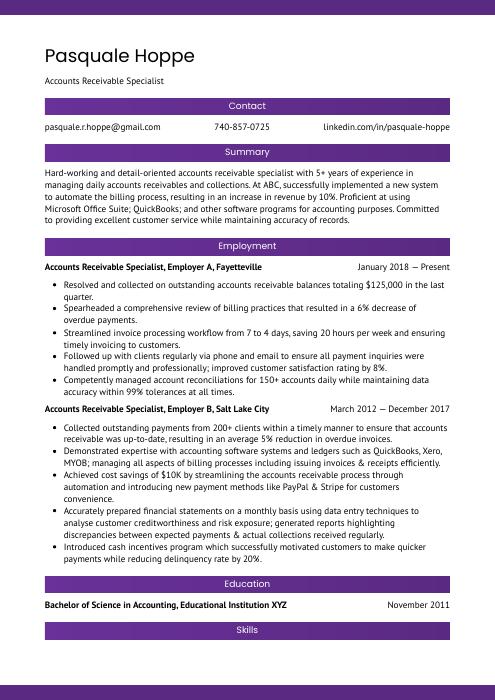

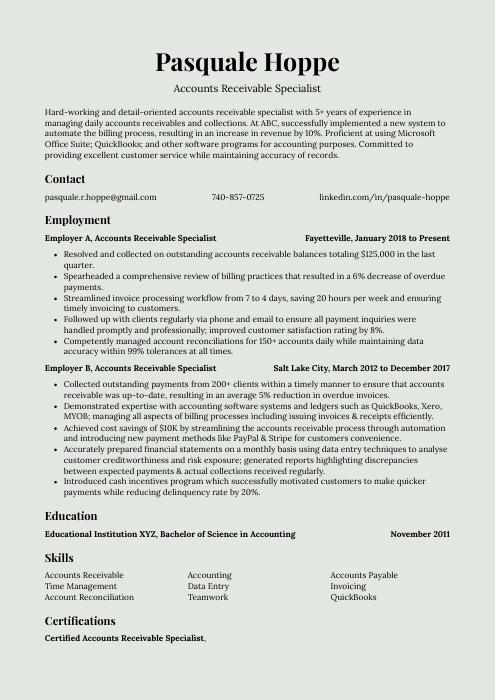

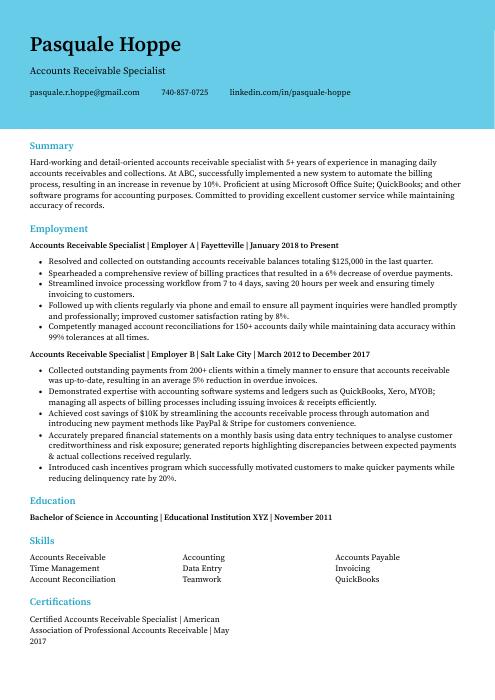

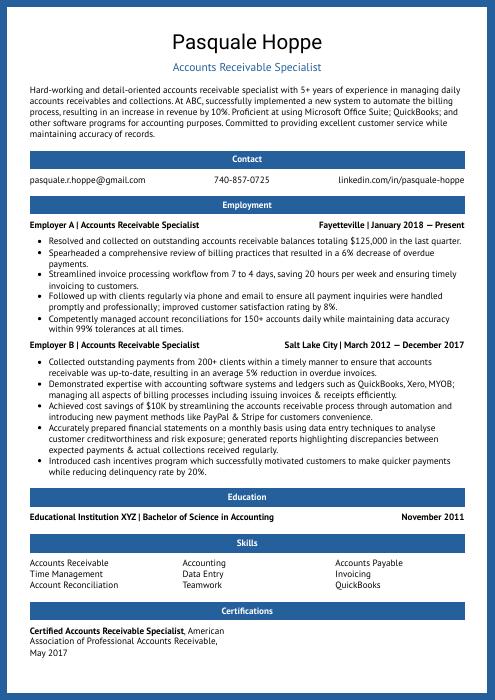

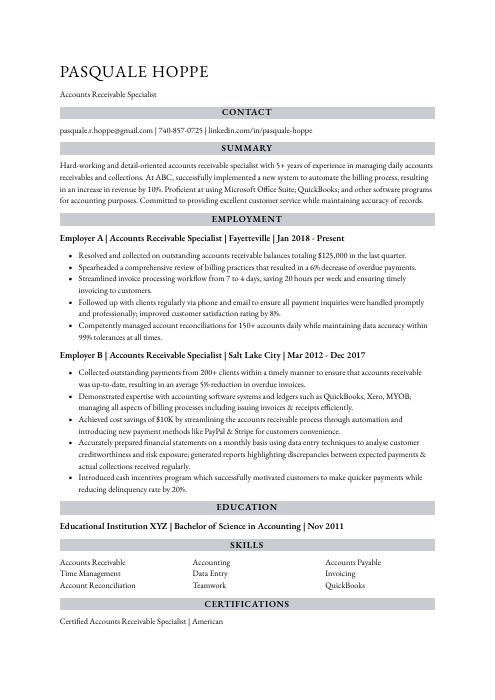

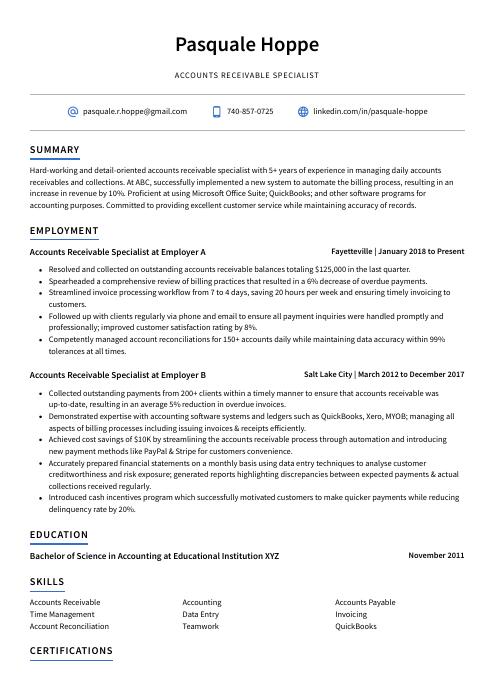

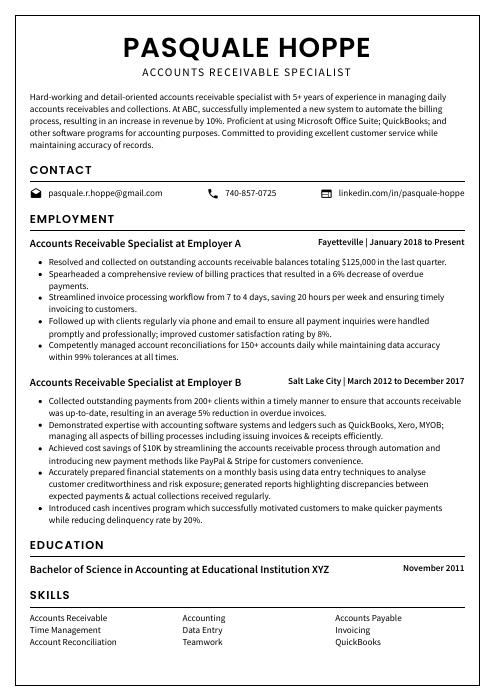

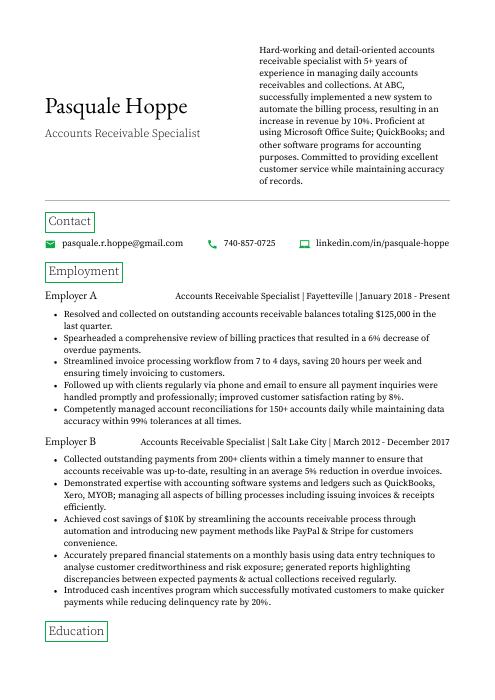

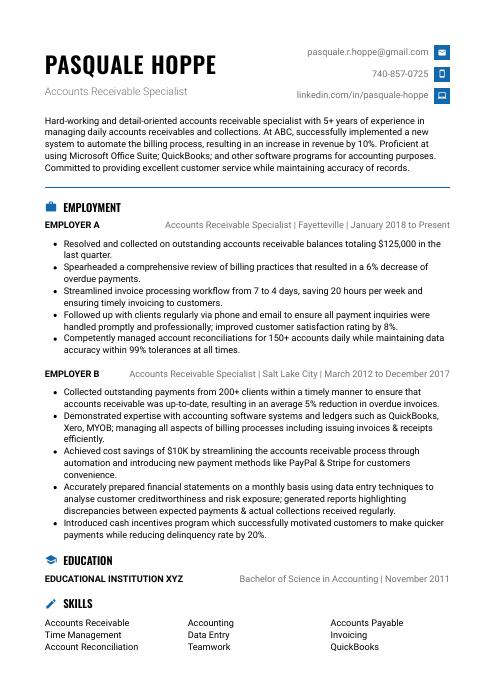

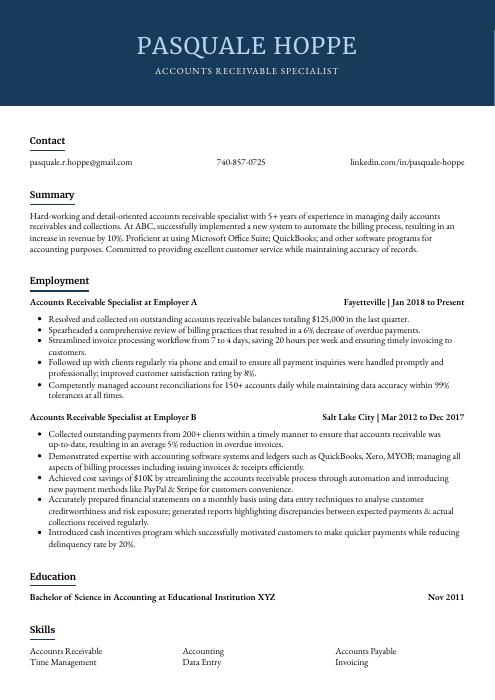

Accounts Receivable Specialist Resume Sample

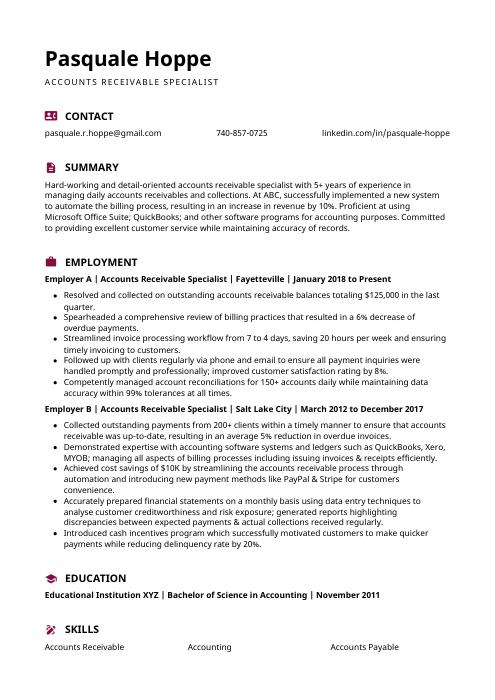

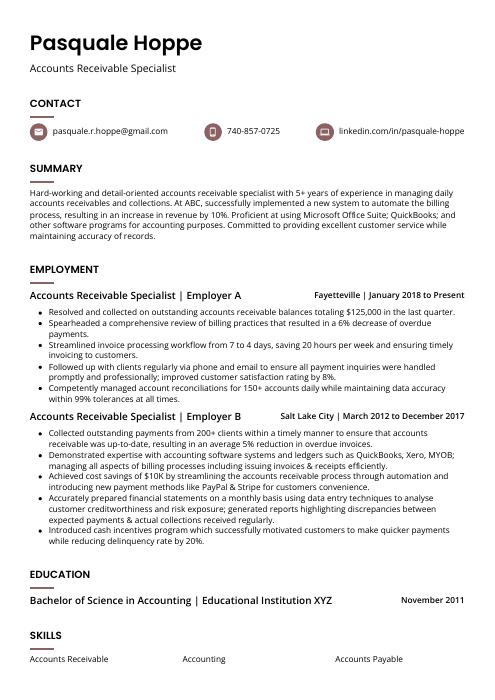

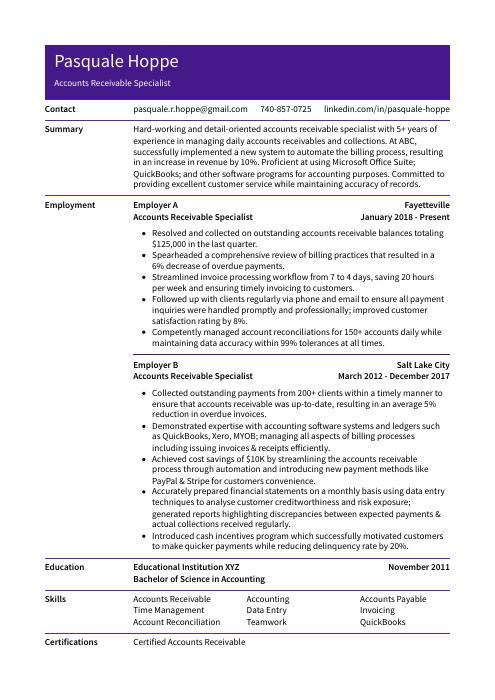

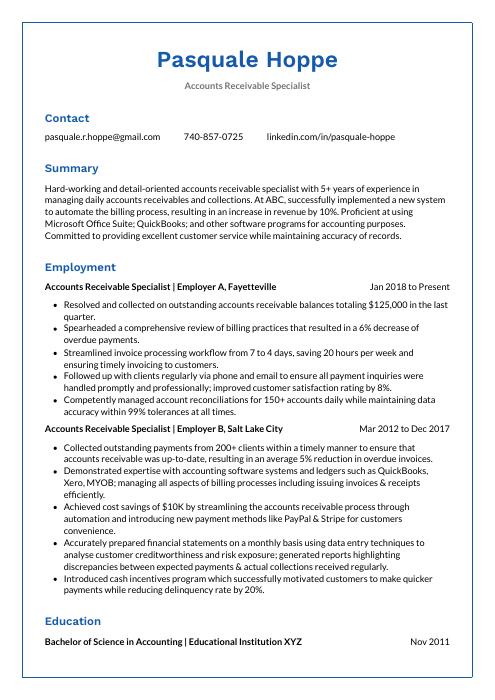

Pasquale Hoppe

Accounts Receivable Specialist

pasquale.r.hoppe@gmail.com

740-857-0725

linkedin.com/in/pasquale-hoppe

Summary

Hard-working and detail-oriented accounts receivable specialist with 5+ years of experience in managing daily accounts receivables and collections. At ABC, successfully implemented a new system to automate the billing process, resulting in an increase in revenue by 10%. Proficient at using Microsoft Office Suite; QuickBooks; and other software programs for accounting purposes. Committed to providing excellent customer service while maintaining accuracy of records.

Experience

Accounts Receivable Specialist, Employer A

Fayetteville, Jan 2018 – Present

- Resolved and collected on outstanding accounts receivable balances totaling $125,000 in the last quarter.

- Spearheaded a comprehensive review of billing practices that resulted in a 6% decrease of overdue payments.

- Streamlined invoice processing workflow from 7 to 4 days, saving 20 hours per week and ensuring timely invoicing to customers.

- Followed up with clients regularly via phone and email to ensure all payment inquiries were handled promptly and professionally; improved customer satisfaction rating by 8%.

- Competently managed account reconciliations for 150+ accounts daily while maintaining data accuracy within 99% tolerances at all times.

Accounts Receivable Specialist, Employer B

Salt Lake City, Mar 2012 – Dec 2017

- Collected outstanding payments from 200+ clients within a timely manner to ensure that accounts receivable was up-to-date, resulting in an average 5% reduction in overdue invoices.

- Demonstrated expertise with accounting software systems and ledgers such as QuickBooks, Xero, MYOB; managing all aspects of billing processes including issuing invoices & receipts efficiently.

- Achieved cost savings of $10K by streamlining the accounts receivable process through automation and introducing new payment methods like PayPal & Stripe for customers convenience.

- Accurately prepared financial statements on a monthly basis using data entry techniques to analyse customer creditworthiness and risk exposure; generated reports highlighting discrepancies between expected payments & actual collections received regularly.

- Introduced cash incentives program which successfully motivated customers to make quicker payments while reducing delinquency rate by 20%.

Skills

- Accounts Receivable

- Accounting

- Accounts Payable

- Time Management

- Data Entry

- Invoicing

- Account Reconciliation

- Teamwork

- QuickBooks

Education

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Accounts Receivable Specialist

American Association of Professional Accounts Receivable

May 2017

1. Summary / Objective

A resume summary/objective for an accounts receivable specialist should highlight your ability to manage and reconcile large volumes of financial data. You can also mention the accounting software you are proficient in, any relevant certifications or qualifications you have obtained, and how your attention to detail has helped improve accuracy in past roles.

Below are some resume summary examples:

Passionate accounts receivable specialist with 5+ years of experience helping companies achieve their financial goals. Efficiently managed accounts for over 100 clients at ABC, resulting in a 60% reduction in overdue payments and improved customer satisfaction by 30%. Experienced in creating reports to monitor progress and ensure accuracy; leveraging excellent problem-solving skills to resolve invoice discrepancies quickly.

Professional accounts receivable specialist with 7+ years of experience managing accounts for high-volume corporate clients. Proven track record of increasing collection rates through efficient and effective customer interactions, resulting in a 10% reduction in past due balances at XYZ Company. Advanced knowledge of accounting software (Quickbooks, Sage 50) and various ERP systems to ensure accurate reconciliations.

Skilled accounts receivable specialist with 7+ years of experience in financial services. Proven track record of accurately maintaining account records and collecting payments on time. At XYZ, managed accounts for over 100 customers while consistently meeting monthly goals and reducing overdue accounts by 25%. Recognized as a top performer among peers for the ability to build strong customer relationships.

Amicable accounts receivable specialist with 5+ years of experience ensuring timely payments and maintaining accurate records. Aiming to leverage professional network and problem-solving skills to help ABC Corporation improve their accounts receivable operations. At XYZ Company, reduced overdue invoices by 35% through creative solutions such as automated reminders and customer incentives.

Well-rounded accounts receivable specialist with 4+ years of experience managing accounts for clients across a range of industries. Proven track record in minimizing overdue payments and maintaining accurate records to ensure timely reconciliation. Seeking to apply my financial acumen, attention to detail, and communication skills at ABC Company as an Accounts Receivable Specialist.

Committed accounts receivable specialist with 5+ years of experience. At XYZ, managed a portfolio of 10 accounts and successfully reduced overdue payments by 50%. Received “Employee Of The Month” awards for consistently achieving top performance in the collection process. Excellent analytical skills, able to quickly spot discrepancies and errors on customer invoices or statements.

Driven accounts receivable specialist with 7+ years of experience managing large customer portfolios and collections. Skilled in accurately tracking payments, ensuring compliance, and negotiating payment plans while maintaining positive relationships with clients. Seeking to apply my skills at ABC Company where I can contribute to the success of the accounts receivable department.

Dependable accounts receivable specialist with 7+ years of experience in credit and collections, including working with clients to ensure payments are received on time. Achieved 92% collection rate while minimizing delinquencies at XYZ Inc., reducing bad debt by 24%. Looking to bring this expertise to ABC Corp. and help the organization maintain strong financial health.

2. Experience / Employment

In the experience section, you should provide details on your employment history. It’s best to list this information in reverse chronological order; that is, the most recent job goes first.

When detailing what you did for each role, use bullet points rather than full sentences. This makes it easier for the reader to quickly digest what you have written and understand your accomplishments. You also want to be specific about what tasks were completed and how successful they were—for example: “Processed an average of 500 customer invoices per month with a 99% accuracy rate.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Reconciled

- Monitored

- Processed

- Resolved

- Analyzed

- Collected

- Generated

- Reported

- Followed

- Updated

- Investigated

- Adjusted

- Documented

- Audited

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Independently monitored and reconciled accounts receivable transactions to ensure accuracy of financial records, resulting in a 7% decrease in overdue invoices.

- Updated over 500 customer accounts on a daily basis, ensuring timely payments and resolving any outstanding disputes or billing issues quickly and efficiently.

- Processed an average of 200 payment requests per day for clients across multiple industries; achieved 100% compliance with all internal policies and procedures relating to A/R management activities throughout the year.

- Expedited collection efforts by sending out weekly reminder emails to customers who were delayed on their payments, resulting in an 11% increase in collections within two months.

- Coordinated with sales reps regarding client inquiries related to invoicing discrepancies while providing exceptional customer service at all times; decreased call volume by 15%.

- Consistently and accurately processed $1.5M in accounts receivable payments each month, reducing overdue invoices by 25%.

- Optimized billing and collection processes for 300+ customer accounts, which resulted in a 10% increase in annual revenue.

- Mentored junior staff members on best practices for preparing financial reports and resolving client disputes; created training materials to facilitate the onboarding process of new employees.

- Reorganized filing systems and document retention policies leading to improved compliance with regulations while ensuring all necessary documents were readily available when required; reduced storage costs by 30%.

- Prepared monthly reconciliation statements reflecting both unpaid balances due as well as any credits owed back to customers, resulting in more accurate records overall with minimal discrepancies identified during audits.

- Adjusted accounts receivable records of over 800 customers and reconciled discrepancies between accounts to ensure accuracy; reduced account errors by 17%.

- Monitored customer payments regularly, ensuring that all invoices were paid on time in accordance with company policies; increased collections efficiency by 24% within the first quarter.

- Proficiently utilized accounting software (QuickBooks) to process transactions accurately and promptly; improved accounting cycles from 10 days to 7 days on average.

- Utilized data analytics tools for generating detailed financial reports related to unpaid dues, credit limits & payment trends for senior management review; enabled monthly reviews of overdue accounts instead of quarterly ones previously practiced.

- Investigated any irregularities or inconsistencies regarding billing disputes, refunds or credits in a timely manner resulting in effective resolution within 48 hours without fail.

- Facilitated timely collection of $500,000+ in overdue accounts receivables by developing and implementing effective strategies to contact customers.

- Reconciled customer accounts by verifying invoices, credits and payments against records; identified discrepancies and took appropriate action to resolve them quickly.

- Documented daily collections activities such as deposits received, credit memos issued or payment arrangements made for future payments; generated detailed financial reports on a weekly basis with accuracy rate of 99%.

- Effectively communicated with customers via phone calls & emails regarding status updates & account changes while adhering strictly to company’s policies & procedures at all times.

- Participated actively in annual audits conducted by external auditors, providing comprehensive data related to accounts receivable transactions efficiently within the required timeframe resulting in successful completion of audit process ahead of schedule each year (by 2 days).

- Structured and administered comprehensive accounts receivable systems and processes, reducing the company’s A/R cycle time by 30%.

- Reduced bad debt losses on a yearly basis through effective management of customer credit limits and payment collections; increased cash flow by $8,000 in 3 months.

- Developed new strategies to streamline billing procedures and optimize invoice accuracy; reduced billing errors by 25% compared to the previous year.

- Meticulously tracked customer payments for over 200 clients using accounting software & spreadsheets; quickly identified discrepancies or late payments with follow-up actions taken accordingly.

- Generated timely financial reports summarizing key AR metrics such as total outstanding balance owed from customers, unpaid invoices per month & average collection period which aided senior management in making informed decisions about business operations going forward.

- Improved accounts receivable process by 20%, resulting in a 10% increase in total collection rate.

- Successfully collected on overdue accounts, with an average of $12,000 per month over the last 18 months.

- Assessed and analyzed customer account data to identify payment discrepancies or delinquencies and recommended appropriate corrective action when needed.

- Advised customers about payment plans that fit their budget and ensured timely payments for all invoices due; reduced past-due balances from 45 days to 15 days within one year of employment at company A.

- Reported any suspicious activity related to customer’s accounts via monthly audit reports; identified fraud cases worth more than $8,000 which were successfully recovered by accounting department before they caused losses to the business’ bottom line revenue numbers.

- Represented an accounts receivable team of 10 staff, processing over 1,500 invoices and collections totaling $2.5 million per month with accuracy and efficiency.

- Audited all accounts for discrepancies in payments or deductions; identified errors that resulted in the recovery of an additional $25K in revenue within one quarter.

- Revised existing processes to speed up payment collection time by 20%, drastically reducing late payments from customers while increasing customer satisfaction ratings by 22%.

- Presented detailed financial reports on Accounts Receivable status to upper management; improved visibility into outstanding debtors and reduced delinquency rate by 32% year-on-year since 2016/2017 fiscal year end (FYE).

- Efficiently tracked client records using bespoke software packages such as Oracle Finacle & Microsoft Dynamics GP, ensuring data integrity at all times throughout the entire billing process cycle.

- Resourcefully managed accounts receivable for over 300 customers, updating customer information and reducing overdue payments by 15%.

- Compiled detailed financial reports on a weekly basis to monitor all A/R activity, including invoicing & collection of payment from clients; generated $250K in new revenue last year.

- Analyzed trends and patterns related to account delinquency and developed tailored solutions to ensure prompt collection of due payments within 30-60 days across multiple industries.

- Formulated strategies that improved the accuracy of billing process while minimizing late fees or write-offs; reduced outstanding balances by 40% in one quarter alone.

3. Skills

Even though two organizations are hiring for the same role, the skillset they want an ideal candidate to possess could differ significantly. For instance, one may be on the lookout for an individual with a solid understanding of accounting principles, while the other may be looking for an accounts receivable specialist who is proficient in Microsoft Excel.

It is essential to tailor your skills section according to each job you are applying for because many employers use applicant tracking systems these days. These computer programs scan resumes for certain keywords before passing them on to a human; if yours does not contain any relevant ones, then it will likely get filtered out quickly.

Besides just listing skills here, you should also discuss them further in other areas such as the summary or experience sections.

Below is a list of common skills & terms:

- Account Management

- Account Reconciliation

- Accounting

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Bookkeeping

- Communication

- Customer Satisfaction

- Data Entry

- Finance

- Financial Analysis

- Financial Reporting

- Forecasting

- General Ledger

- Healthcare

- Invoicing

- Medical Billing

- Microsoft Outlook

- Payroll

- Process Improvement

- QuickBooks

- Team Leadership

- Teamwork

- Time Management

4. Education

Adding an education section to your resume will depend on how much experience you have in the field of accounts receivable. If you are still new to the industry and don’t have a lot of work experience, it’s important to include an education section that lists any courses or certifications related to accounts receivable.

If you do decide to add an education section, try mentioning relevant courses and subjects such as accounting principles, financial analysis, bookkeeping methods, etc. These can help demonstrate your knowledge base for potential employers.

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your knowledge and expertise in a specific field. They are also an effective way for employers to quickly identify if you have the right qualifications for the job they’re looking to fill.

Including certifications on your resume is beneficial as it shows potential employers that you have taken extra steps to stay up-to-date with industry standards and best practices, which can be highly attractive when applying for jobs.

Certified Accounts Receivable Specialist

American Association of Professional Accounts Receivable

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Pasquale Hoppe, this would be Pasquale-Hoppe-resume.pdf or Pasquale-Hoppe-resume.docx.

7. Cover Letter

A cover letter is a great way to introduce yourself and showcase your professional skills. It should be made up of 2 to 4 paragraphs, separate from your resume, that provide more detail about who you are and why you’re the best candidate for the role.

Cover letters aren’t usually mandatory when applying for most jobs but writing one is highly recommended if you want to make sure recruiters take notice of your application. They give hiring managers an insight into what makes you unique as a professional and can help them decide whether or not they would like to invite you in for an interview.

Below is an example cover letter:

Dear Adela,

I am writing in regards to your opening for an Accounts Receivable Specialist. With my background in accounting and customer service, I feel confident I would be a valuable asset to your organization.

In my current role as an Accounts Receivable Clerk at [company name], I am responsible for processing invoices, issuing refunds, and maintaining records of customer payments. Through my work experience, I have developed strong attention to detail and excellent time management skills which allow me to efficiently handle a high volume of work. My interpersonal skills are also top-notch, which has resulted in me being able to effectively communicate with customers and resolve any issues they may have regarding their account.

The combination of my accounting knowledge and customer service experience makes me the ideal candidate for this position. I would welcome the opportunity to put my skills to use in benefiting your company and look forward to speaking with you soon about this role. Thank you for your time!

Sincerely,

Pasquale

Accounts Receivable Specialist Resume Templates

Indri

Indri Rhea

Rhea Jerboa

Jerboa Hoopoe

Hoopoe Fossa

Fossa Pika

Pika Markhor

Markhor Saola

Saola Lorikeet

Lorikeet Kinkajou

Kinkajou Gharial

Gharial Dugong

Dugong Ocelot

Ocelot Numbat

Numbat Axolotl

Axolotl Cormorant

Cormorant Quokka

Quokka Echidna

Echidna Bonobo

Bonobo Rezjumei

Rezjumei