Pricing Actuary Resume Guide

Pricing actuaries work with insurance companies to set rates for various types of insurance. They use their knowledge of statistics, probability, and finance to assess the risk involved in insuring a person or property and determine how much to charge for that coverage. Pricing actuaries must be able to clearly communicate their findings to company executives and boards of directors.

You’re a whiz with numbers and have a keen eye for detail, making you the perfect candidate for a pricing actuary role. However, employers won’t know this unless you demonstrate it through an impressive resume.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

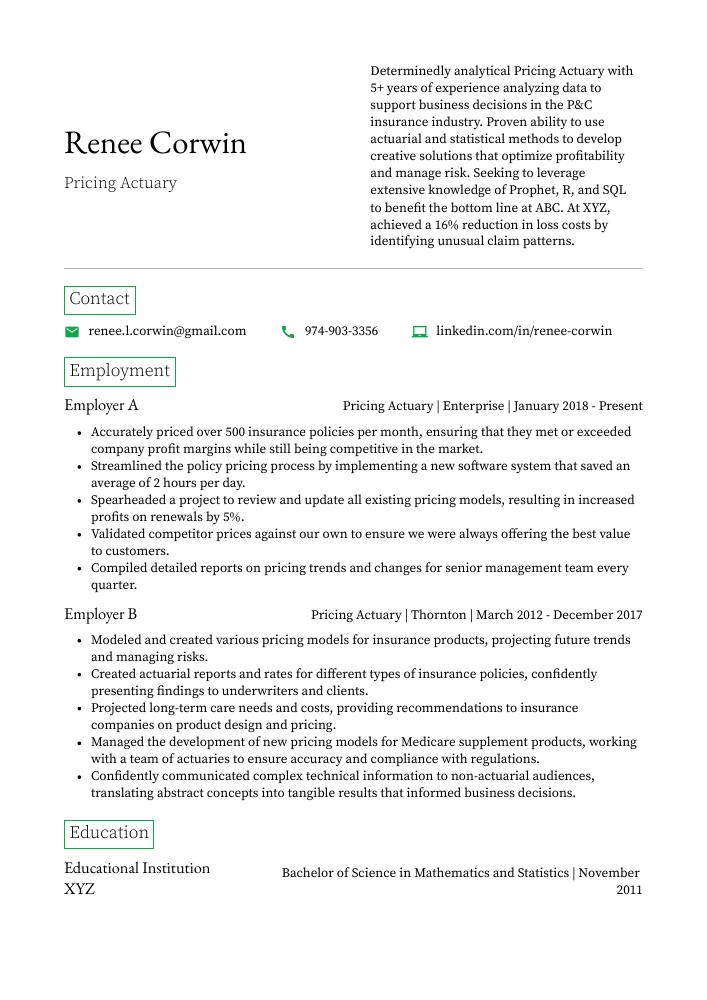

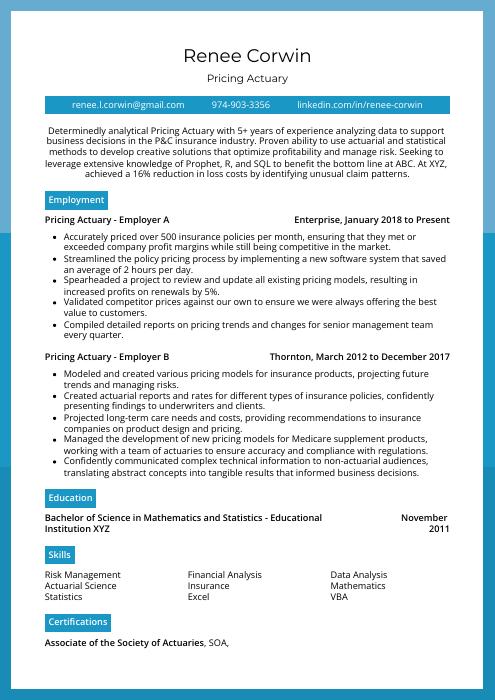

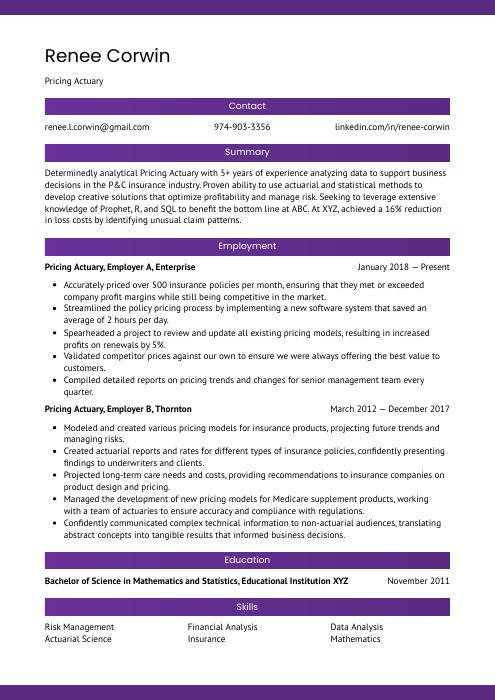

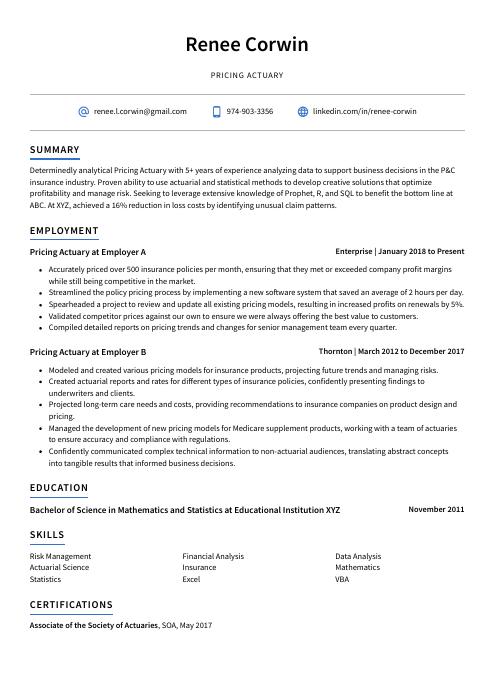

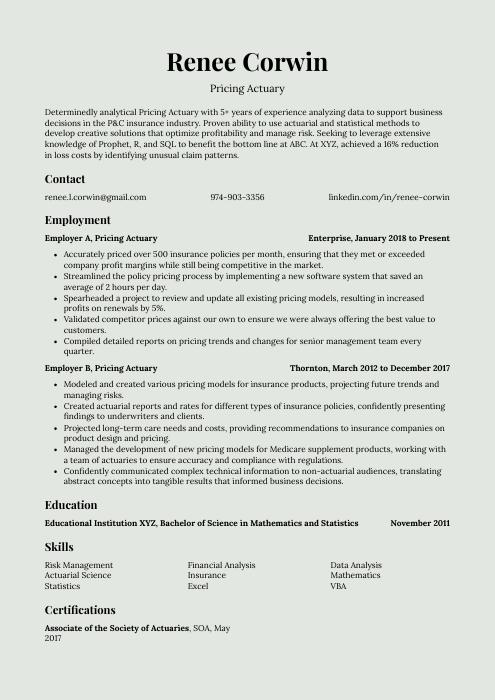

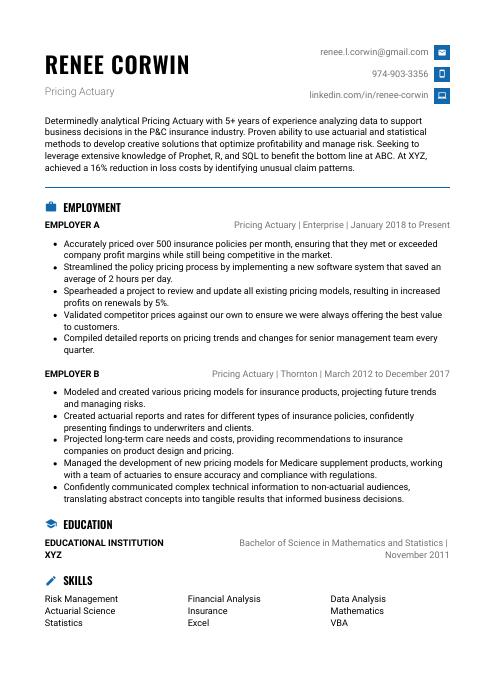

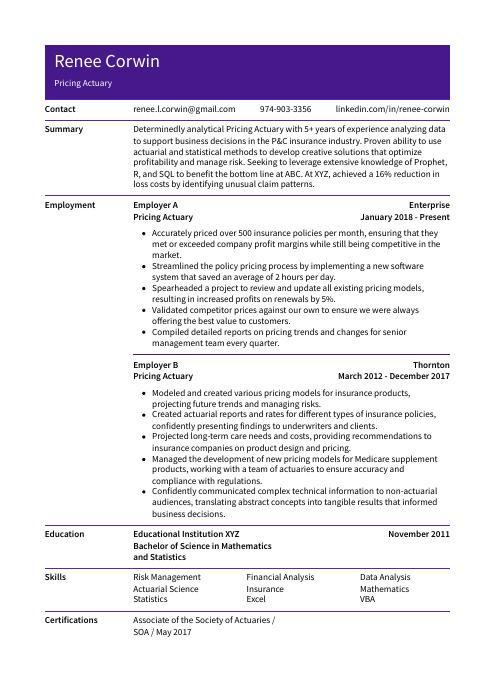

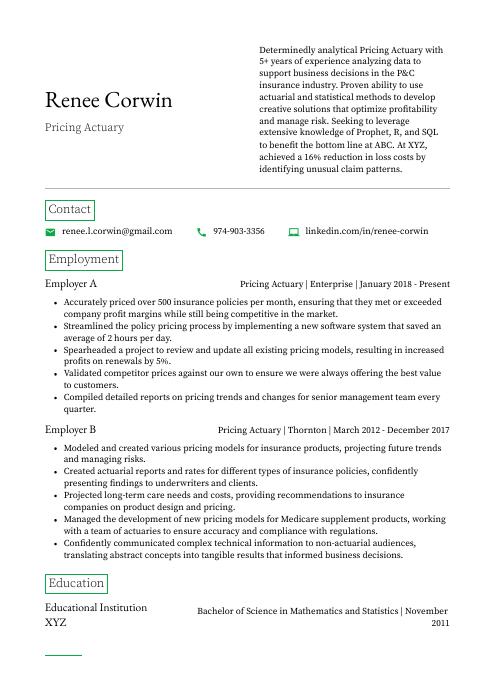

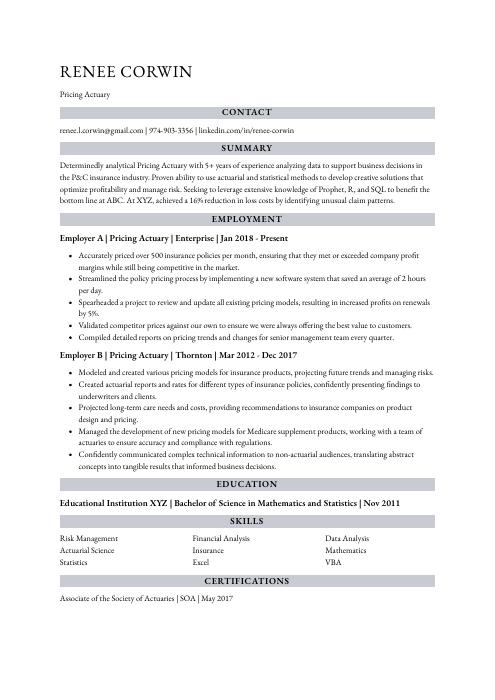

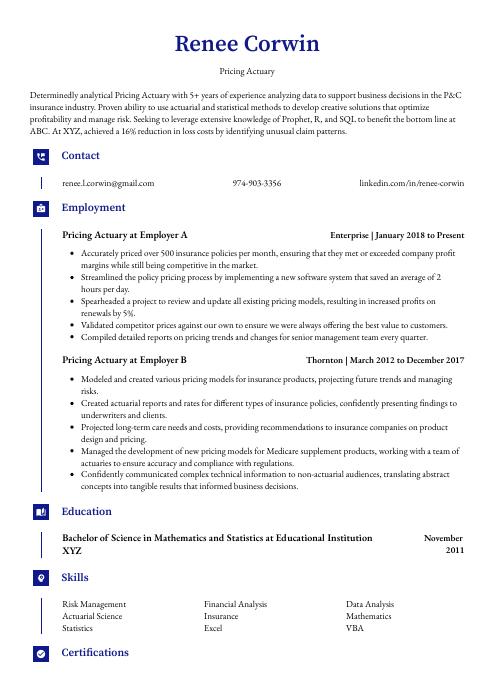

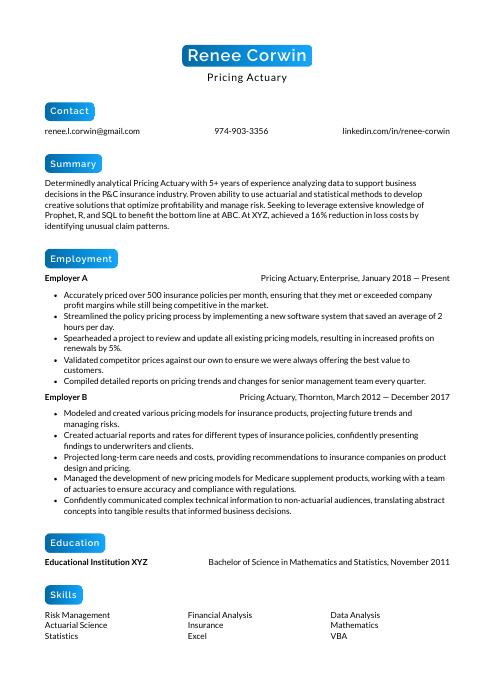

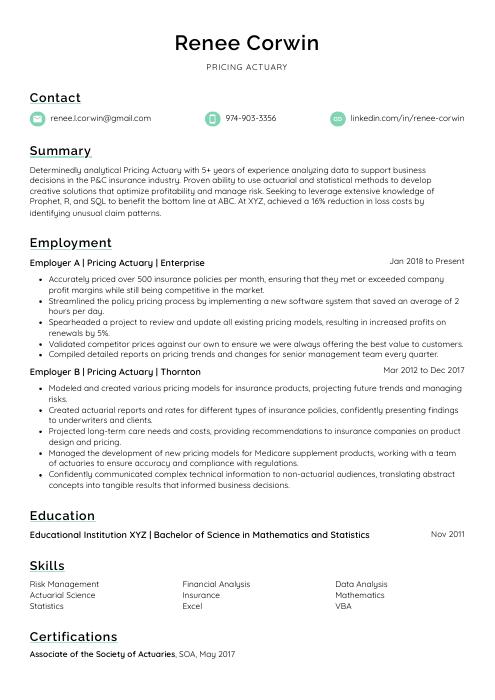

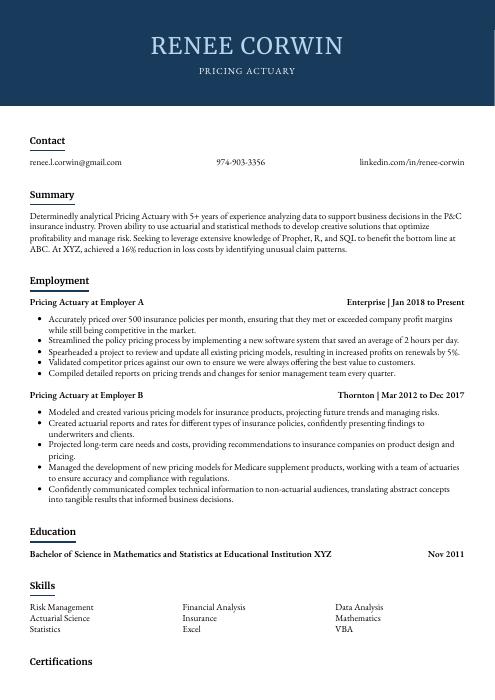

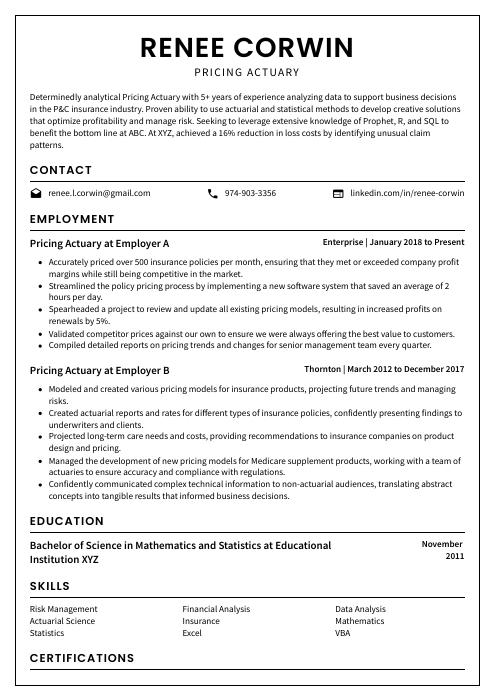

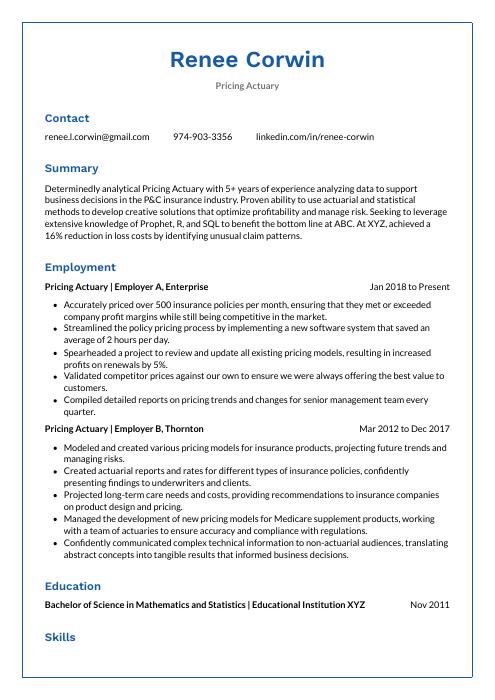

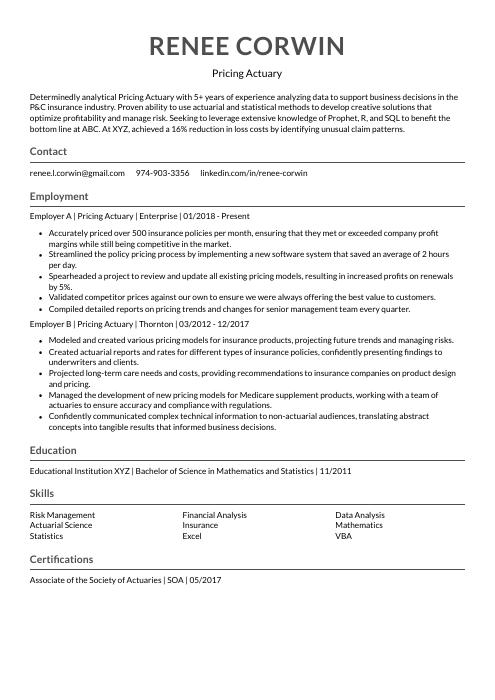

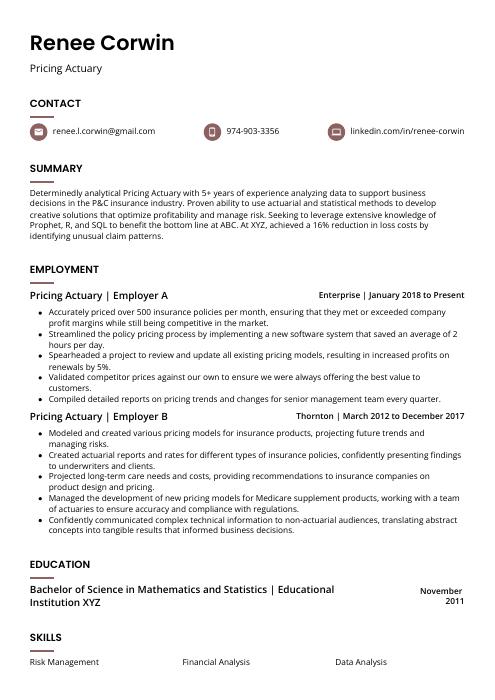

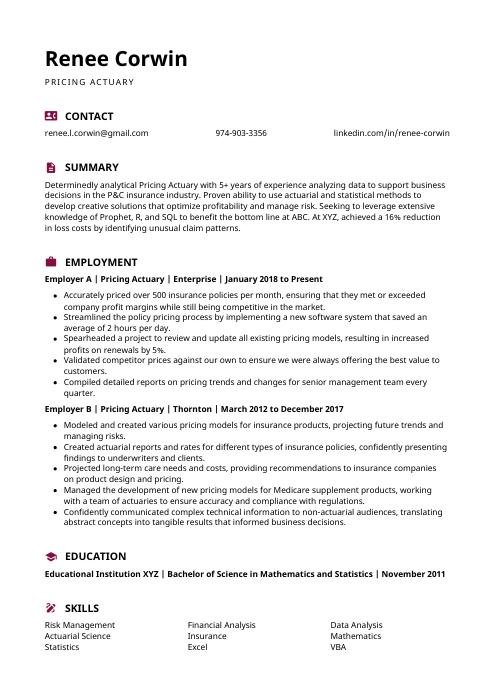

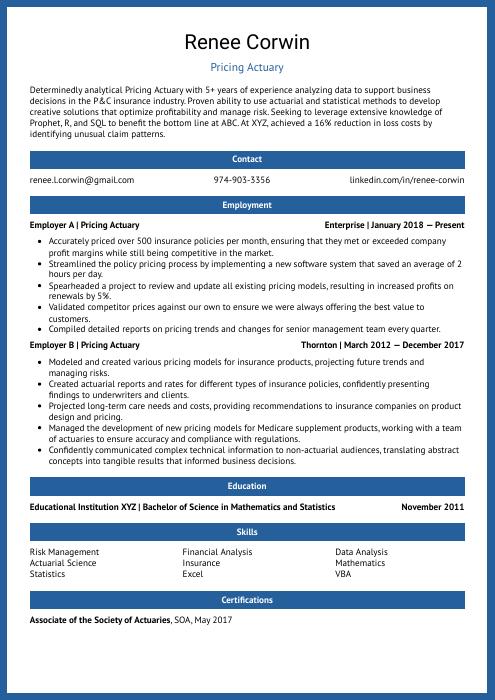

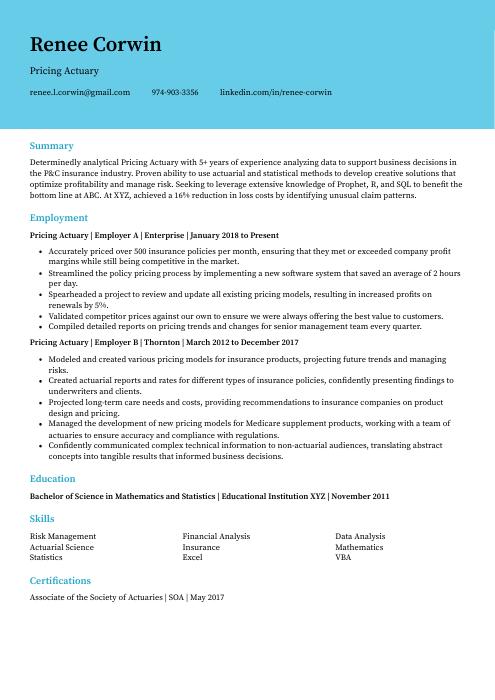

Pricing Actuary Resume Sample

Maribel Bailey

Pricing Actuary

[email protected]

264-837-0116

linkedin.com/in/maribel-bailey

Summary

Determinedly analytical Pricing Actuary with 5+ years of experience analyzing data to support business decisions in the P&C insurance industry. Proven ability to use actuarial and statistical methods to develop creative solutions that optimize profitability and manage risk. Seeking to leverage extensive knowledge of Prophet, R, and SQL to benefit the bottom line at ABC. At XYZ, achieved a 16% reduction in loss costs by identifying unusual claim patterns.

Experience

Pricing Actuary, Employer A

Spokane, Jan 2018 – Present

- Accurately priced over 500 insurance policies per month, ensuring that they met or exceeded company profit margins while still being competitive in the market.

- Streamlined the policy pricing process by implementing a new software system that saved an average of 2 hours per day.

- Spearheaded a project to review and update all existing pricing models, resulting in increased profits on renewals by 5%.

- Validated competitor prices against our own to ensure we were always offering the best value to customers.

- Compiled detailed reports on pricing trends and changes for senior management team every quarter.

Pricing Actuary, Employer B

Fort Collins, Mar 2012 – Dec 2017

- Modeled and created various pricing models for insurance products, projecting future trends and managing risks.

- Created actuarial reports and rates for different types of insurance policies, confidently presenting findings to underwriters and clients.

- Projected long-term care needs and costs, providing recommendations to insurance companies on product design and pricing.

- Managed the development of new pricing models for Medicare supplement products, working with a team of actuaries to ensure accuracy and compliance with regulations.

- Confidently communicated complex technical information to non-actuarial audiences, translating abstract concepts into tangible results that informed business decisions.

Skills

- Risk Management

- Financial Analysis

- Data Analysis

- Actuarial Science

- Insurance

- Mathematics

- Statistics

- Excel

- VBA

Education

Bachelor of Science in Mathematics and Statistics

Educational Institution XYZ

Nov 2011

Certifications

Associate of the Society of Actuaries

SOA

May 2017

1. Summary / Objective

The summary/objective at the top of your resume is like a teaser – it gives the employer an outline of who you are and why you excel as a pricing actuary. Here is where you can showcase your best qualities. For example, you could talk about the wide variety of products you have experience pricing, the complex actuarial models you have created, and how your work has helped save or make money for your company.

Below are some resume summary examples:

Talented pricing actuary with 4 years of experience in the insurance industry. Supported numerous clients in developing benefit and rates for health, life, and property-casualty products. Experienced in pricing using stochastic methods, Excel VBA, SQL, and Prophet. Seeking to join ABC Insurance as a Pricing Actuary to support the growth of new business opportunities through innovative product development.

Detail-oriented pricing actuary with 10+ years of experience in the insurance industry. At XYZ, routinely updated and reviewed policy rates for over 100 different lines of business while ensuring adherence to state filing requirements. Recognized as an expert in product development, rate making, and actuarial projections by management. Actively involved in various professional organizations (SAAS, SOA).

Proficient pricing actuary with over 4 years of experience in the insurance industry. At ABC, successfully led a team of 5 analysts in pricing 15 new products and revising 8 existing products. Demonstrated skills include proficiency in Excel/VBA, R, and SQL. Also experienced in leading projects, conducting analysis, building models, creating presentations, and communicating results to senior management.

Seasoned pricing actuary with 6+ years of experience working in the insurance industry. In previous roles, achieved an average accuracy rate of 92% when pricing insurance policies and products. Recognized for being able to price complex products quickly and accurately under time pressure. Seeking to join ABC Insurance Company where I can use my skills and knowledge to improve bottom-line performance.

Dependable pricing actuary with 5+ years of experience analyzing data and developing pricing models for insurance products. Key strengths include complex problem-solving, statistical analysis, and excellent communication skills. Seeking to join ABC Insurance as the next Pricing Actuary where I can utilize my analytical abilities to develop innovative solutions that drive business growth.

Driven pricing actuary with 5+ years of experience developing risk management solutions for some of the world’s leading insurance companies. Proven ability to price complex products, design innovative hedging strategies, and build forecasting models that accurately predict future trends. Seeking to leverage actuarial expertise to become the next pricing actuary at ABC Insurance.

Accomplished pricing actuary with 9 years of experience in insurance and reinsurance. Managed development and maintenance of multiple rating models while consistently improving processes. Skilled at building strong relationships with clients, regulators, and other stakeholders. At XYZ Re, led the price monitoring team that delivered $12M in annualized premium savings.

Committed pricing actuary with 6+ years of experience in the insurance industry. At XYZ, increased policyholder retention rates by 17% through comprehensive analysis of customer behavior and improved pricing strategies. Also led a team that developed an innovative new product which generated $6 million in first-year sales.

2. Experience / Employment

For the experience section, you will want to provide details on your employment history. This should be written in reverse chronological order, with your most recent role at the top.

When describing what you did in each role, it is best to use bullet points. This makes it easier for the reader to take in the information quickly. You also want to be sure to include specific and quantifiable examples wherever possible.

For instance, instead of saying “Calculated premiums,” you could say, “Successfully calculated premiums for a wide variety of insurance products using stochastic processes and risk models.”.

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Analyzed

- Modeled

- Validated

- Estimated

- Projected

- Presented

- Negotiated

- Implemented

- Created

- Managed

- Led

- Trained

- Coordinated

- Assisted

- Supported

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Advised clients on optimal pricing strategies for new insurance products, based on comprehensive analysis of historical claims data and other actuarial resources.

- Structured complex pricing models to determine premiums for various lines of business, including health, life and property & casualty insurance.

- Prepared detailed reports outlining results of pricing simulations and recommending changes to improve profitability; helped increase company-wide net margin by 2%.

- Assisted underwriters in evaluating risk factors for potential policyholders and developing rates that accurately reflected the level of risk involved.

- Reliably produced accurate price quotes for customers within 24 hours or less, regardless of the complexity of the request; achieved a 97% customer satisfaction rating over a 6-month period.

- Trained in stochastic and deterministic methods for pricing insurance, as well as Excel and VBA for actuarial modeling.

- Efficiently created 100+ pricing models per month to evaluate new business opportunities and support underwriting decisions; slashed model creation time by 30% through process improvements.

- Optimized existing pricing models to reduce costs and increase accuracy; achieved an average 5% reduction in premiums across all lines of business.

- Presented findings to senior management on a monthly basis, clearly articulating the impact of proposed changes on profitability and growth potential.

- Assessed market trends and competitor activity to identify areas of opportunity or risk; helped develop strategy for new products that translated into $10+ million in annual premium revenue.

- Substantially increased profitability for the company by developing and implementing a new pricing strategy.

- Achieved a 15% reduction in pricing errors through the introduction of new quality control measures.

- Represented the company at industry conferences and events, raising awareness of our products and services.

- Facilitated training sessions on pricing strategies for new staff members.

- Coordinated with other departments to ensure that pricing changes were implemented smoothly and efficiently.

- Implemented new pricing models for life insurance products, which led to a 5% increase in sales.

- Participated in monthly meetings with senior actuaries to discuss new product development and pricing strategies.

- Successfully completed all required Actuarial Exams within 2 years of starting work as an actuary.

- Reduced the time needed to complete annual pricing reports by 20%.

- Estimated the long-term impact of proposed changes to government regulations on the profitability of insurance companies selling health, life and property & casualty products.

- Diligently reviewed and revised actuarial pricing models for life insurance products, ensuring that they were in line with current market trends and met all regulatory requirements.

- Led a team of 5 actuaries in the development of new pricing models for 3 innovative life insurance products; expedited the process by 2 months and saved the company $250,000 in costs.

- Negotiated better terms with 3 external vendors providing data used in pricing models, resulting in an annual savings of $100,000 for the company.

- Demonstrated excellent analytical skills when reviewing large amounts of data to identify trends and develop recommendations for pricing changes; implemented these changes which led to a 5% increase in sales revenue last year.

- Actively participated in industry conferences and forums to stay up-to-date on latest developments in actuarial science; shared knowledge with colleagues and contributed to improving overall departmental efficiency by 10%.

- Formulated pricing models for new life insurance products, ensuring that they met all regulatory requirements and were profitable for the company.

- Mentored junior actuaries in pricing techniques and best practices, contributing to the development of their skillsets.

- Thoroughly reviewed competitor pricing models and made recommendations to senior management on how to price our products more competitively.

- Introduced a new methodology for pricing long-term care policies that reduced losses by $1 million over the first year of implementation.

- Developed a tool for analyzing policyholder behavior that helped improve retention rates by 3%.

- Supported the development and implementation of new pricing models for health, life, and property & casualty insurance products.

- Analyzed historical loss data to identify trends and recommend rate changes to keep coverage affordable and profitable for clients.

- Reorganized the company’s approach to pricing by developing a new methodology that increased accuracy by 10%.

- Improved customer satisfaction ratings by 15% after successfully negotiating better rates with providers on behalf of policyholders.

- Resourcefully identified $1 million in savings annually after conducting a review of all vendor contracts related to pricing operations.

3. Skills

The skills required for a pricing actuary job will vary from employer to employer. However, there are some skills that are essential for any pricing actuary, such as experience with modelling software and the ability to analyze data.

It is important to tailor the skills section of your resume to each job you apply for, as this ensures that you include all the relevant keywords that an applicant tracking system might be looking for.

Besides just listing skills in this section, you should also elaborate on the most important ones in other resume sections.

Below is a list of common skills & terms:

- Access

- Actuarial Science

- Data Analysis

- Excel

- Financial Analysis

- Insurance

- Mathematics

- Risk Management

- Statistics

- VBA

4. Education

Adding an education section to your resume is only necessary if you are a recent graduate or do not have much professional experience. If you have been working in the field of pricing actuary for years and have plenty of responsibilities to showcase, omitting the education section is perfectly fine.

If including an education section, mention courses and subjects you studied related to pricing actuary. For example, “Courses included Probability & Statistics, Financial Mathematics, and Economics.”

Bachelor of Science in Mathematics and Statistics

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications allow you to demonstrate to potential employers that you have the skills and knowledge required for a given role. In the pricing actuarial field, having up-to-date certifications shows that you are keeping abreast of industry changes and developments.

If you have any relevant certifications, be sure to include them in this section of your resume. Doing so will give you a competitive edge over other applicants who do not have such credentials.

Associate of the Society of Actuaries

SOA

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Maribel Bailey, this would be Maribel-Bailey-resume.pdf or Maribel-Bailey-resume.docx.

7. Cover Letter

Submitting a cover letter along with your resume can be a great way to catch a hiring manager’s attention. Cover letters are usually made up of 2-4 paragraphs and highlight information that isn’t already included in your resume.

While you don’t always need to submit a cover letter, doing so can help you stand out from other candidates who are applying for the same role. A well-written cover letter will give recruiters insights into who you are as a professional and why you would be an excellent fit for the job.

Below is an example cover letter:

Dear Susan,

I am writing to apply for the position of Pricing Actuary at [company name]. With my experience in pricing and product development, as well as my knowledge of actuarial science, I am confident that I would be a valuable asset to your team.

In my current role as a Pricing Actuary at [company name], I am responsible for developing pricing models for new products, as well as analyzing existing products to identify opportunities for improvement. In addition, I have experience working with clients to develop custom solutions that meet their specific needs. My skills in data analysis and interpretation have been essential in identifying trends and patterns that can be used to improve pricing strategies.

Actuarial science is a complex field, but one that I have always found fascinating. My ability to understand and work with complex data sets has allowed me to excel in this field. In addition, my strong communication skills have been invaluable in explaining technical concepts to non-actuaries. I am confident that these skills would enable me to make a positive contribution to your team.

I would welcome the opportunity to discuss how my experience and skills could benefit your organization further during an interview at your earliest convenience. Thank you for your time and consideration; I look forward to hearing from you soon.

Sincerely,

Maribel

Pricing Actuary Resume Templates

Rhea

Rhea Jerboa

Jerboa Axolotl

Axolotl Saola

Saola Echidna

Echidna Pika

Pika Quokka

Quokka Numbat

Numbat Gharial

Gharial Kinkajou

Kinkajou Lorikeet

Lorikeet Bonobo

Bonobo Cormorant

Cormorant Markhor

Markhor Indri

Indri Fossa

Fossa Hoopoe

Hoopoe Ocelot

Ocelot Dugong

Dugong Rezjumei

Rezjumei