Investment Advisor Resume Guide

Investment advisors work with clients to help them grow their wealth. They develop investment plans, provide advice on investing, and make recommendations on how to best use a client’s money. Investment advisors also monitor the markets and keep track of changes that could impact a client’s investments.

You have the experience and financial know-how to help people invest their money wisely. However, potential clients won’t come knocking on your door unless you have a resume that catches their eye.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

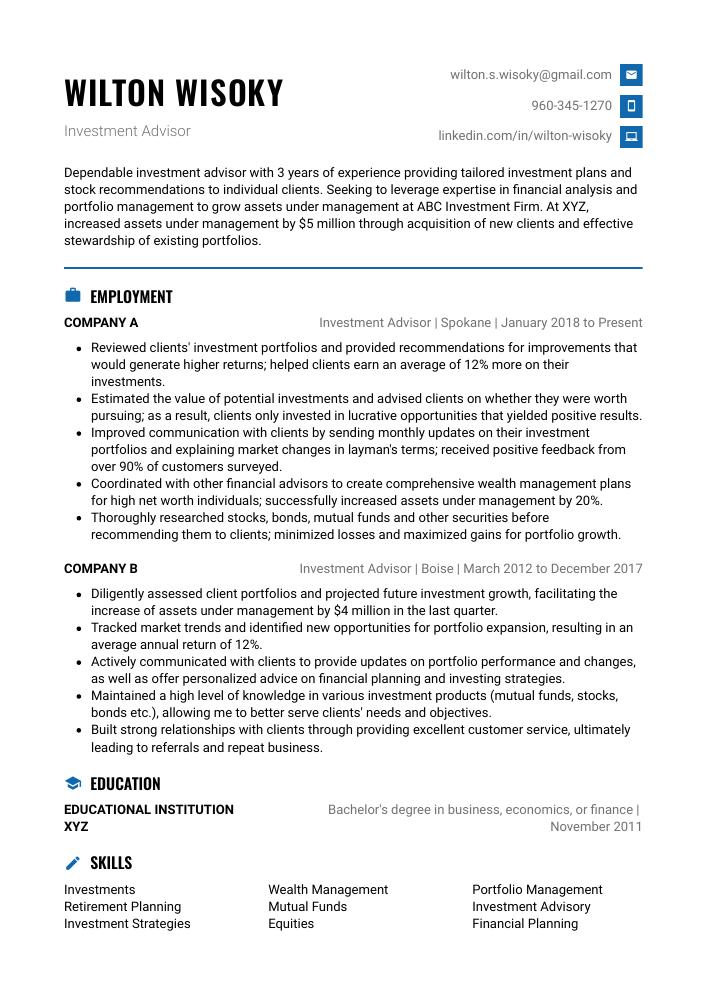

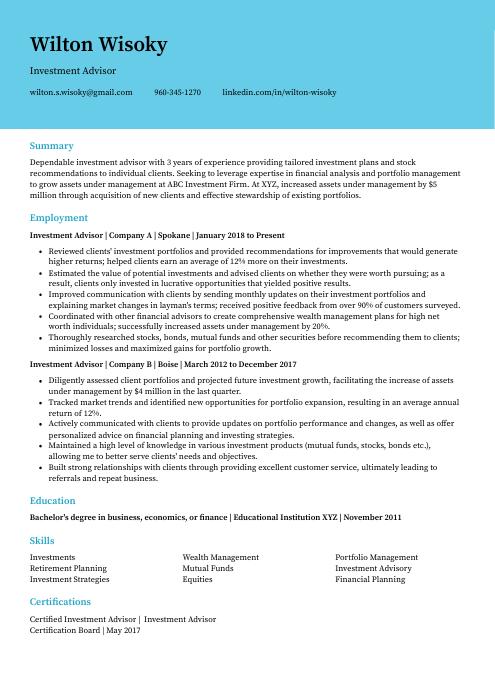

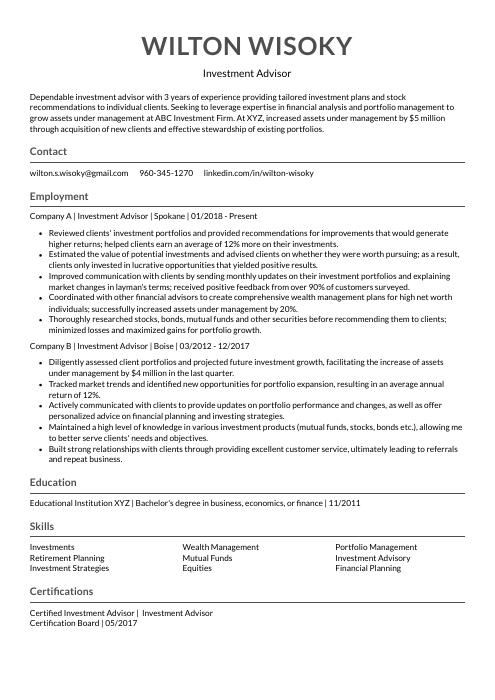

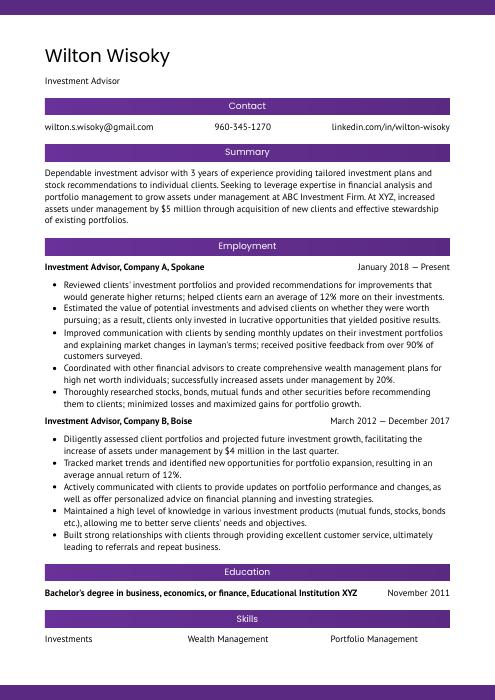

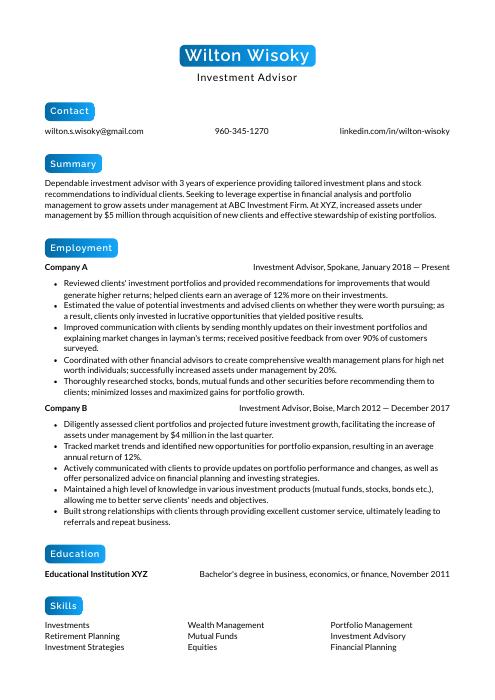

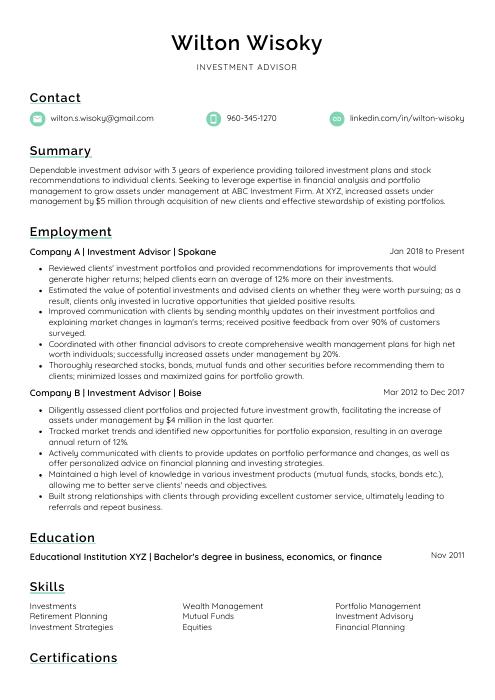

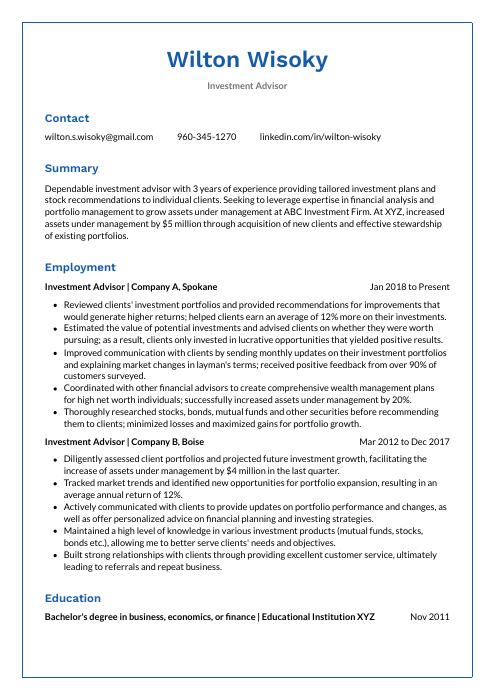

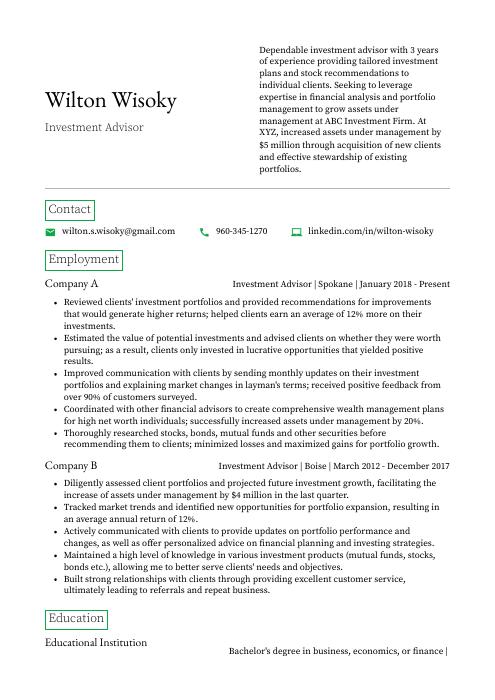

Investment Advisor Resume Sample

Wilton Wisoky

Investment Advisor

[email protected]

960-345-1270

linkedin.com/in/wilton-wisoky

Summary

Dependable investment advisor with 3 years of experience providing tailored investment plans and stock recommendations to individual clients. Seeking to leverage expertise in financial analysis and portfolio management to grow assets under management at ABC Investment Firm. At XYZ, increased assets under management by $5 million through acquisition of new clients and effective stewardship of existing portfolios.

Experience

Investment Advisor, Company ABC

Spokane, Jan 2018 – Present

- Reviewed clients’ investment portfolios and provided recommendations for improvements that would generate higher returns; helped clients earn an average of 12% more on their investments.

- Estimated the value of potential investments and advised clients on whether they were worth pursuing; as a result, clients only invested in lucrative opportunities that yielded positive results.

- Improved communication with clients by sending monthly updates on their investment portfolios and explaining market changes in layman’s terms; received positive feedback from over 90% of customers surveyed.

- Coordinated with other financial advisors to create comprehensive wealth management plans for high net worth individuals; successfully increased assets under management by 20%.

- Thoroughly researched stocks, bonds, mutual funds and other securities before recommending them to clients; minimized losses and maximized gains for portfolio growth.

Investment Advisor, Company XYZ

Boise, Mar 2012 – Dec 2017

- Diligently assessed client portfolios and projected future investment growth, facilitating the increase of assets under management by $4 million in the last quarter.

- Tracked market trends and identified new opportunities for portfolio expansion, resulting in an average annual return of 12%.

- Actively communicated with clients to provide updates on portfolio performance and changes, as well as offer personalized advice on financial planning and investing strategies.

- Maintained a high level of knowledge in various investment products (mutual funds, stocks, bonds etc.), allowing me to better serve clients’ needs and objectives.

- Built strong relationships with clients through providing excellent customer service, ultimately leading to referrals and repeat business.

Skills

- Investments

- Wealth Management

- Portfolio Management

- Retirement Planning

- Mutual Funds

- Investment Advisory

- Investment Strategies

- Equities

- Financial Planning

Education

Bachelor’s Degree in Business, Economics and Finance

Educational Institution XYZ

Nov 2011

Certifications

Certified Investment Advisor

Investment Advisor Certification Board

May 2017

1. Summary / Objective

A resume summary is like a teaser for the rest of your resume – it should provide essential information about your experience and skills as an investment advisor, and compel the reader to continue reading.

Some things you could include in your summary are: how many years of experience you have, what type of investments you specialize in (e.g. stocks, bonds, etc.), your industry certifications, and any awards or recognition you’ve received.

Below are some resume summary examples:

Determined investment advisor with more than eight years of experience providing comprehensive financial planning services to clients. Focused on helping clients reach their long-term financial goals through asset allocation, risk management, and portfolio rebalancing. In previous roles increased client assets under management by 12% and improved customer satisfaction ratings by 23%.

Accomplished investment advisor with experience in both the public and private sector. Proven ability to develop and implement investment strategies that achieve objectives while managing risk. Experienced in providing advice on a broad range of investments, including stocks, bonds, mutual funds, and Exchange Traded Funds (ETFs).

Passionate investment advisor with 6+ years of experience in the financial industry. Seeking to join ABC Wealth Management as an investment advisor to provide comprehensive wealth management services and build long-term relationships with clients. Key achievements include increasing client assets under management by 20% and generating $1.2 million in new revenue for XYZ Bank through proactive cross-selling.

Reliable investment advisor with experience in the financial industry, seeking to help individuals and families save for their future at XYZ. At ABC, increased client assets by an average of 12% per year over a 3-year period. Grew a book of business from $3 million to $13 million in 4 years through effective relationship management and new client acquisition.

Diligent and analytical investment advisor with 6+ years of experience providing professional financial services to clients. Proven ability to identify opportunities and mitigate risks through in-depth analysis while always acting in the best interest of the client. Seeking to join ABC Wealth Management as an investment advisor where I can continue to provide expert services and grow my career.

Hard-working investment advisor with 4 years of experience helping clients plan for their financial future. Seeking to leverage expertise in asset allocation and portfolio management at ABC. At XYZ, increased AUM by 25% through effective client relationship management and providing holistic financial planning services.

Enthusiastic investment advisor with 3+ years of experience in the industry. Seeking to join ABC Investments where I can use my knowledge and skills to provide clients with comprehensive financial planning services. In previous roles, increased client satisfaction ratings by 13% due to excellent customer service.

Proficient investment advisor with over a decade of experience in the financial sector. At XYZ, increased AUM by 25% and grew the client base by 42%. At ABC, successfully closed 72 investment deals worth $12M. Proven ability to provide comprehensive financial planning and analysis to high net worth individuals and families.

Driven investment advisor with 7+ years of experience providing world-class financial advice and guidance to clients. Seeking to join ABC Wealth Management where I can continue helping clients reach their long-term financial goals. In previous roles, increased client assets under management by 25% on average while consistently exceeding performance benchmarks.

2. Experience / Employment

In the experience/employment/work history section, you provide details about your past jobs. This section should be written in reverse chronological order, which means that your most recent job is listed first.

When writing this section, stick to bullet points whenever possible. Bullet points make it easier for the reader to take in the information quickly and effectively. When writing the bullet points, try to include specifics about what you did and any quantifiable results that you were able to achieve.

For example, instead of saying “Provided investment advice,” you could say “Successfully advised clients on how to grow their portfolios by an average of 12% per year over a period of five years.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Advised

- Analyzed

- Assessed

- Evaluated

- Recommended

- Researched

- Reviewed

- Studied

- Forecasted

- Projected

- Estimated

- Calculated

- Reported

- Presented

- Tracked

Other general verbs you can use are:

- Achieved

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Reliably managed a portfolio of 50+ high net-worth clients, providing them with expert financial advice and guidance.

- Introduced new investment opportunities to clients that helped them earn an average return of 10% per year.

- Calculated the risk/reward profile for each client’s portfolio and structured it in a way that minimized risk while still achieving their desired returns.

- Recommended changes to client portfolios on a quarterly basis, based on market conditions and individual needs/goals; these recommendations led to an increase in assets under management by $5 million last year.

- Maintained excellent relationships with clients, keeping them updated on their portfolios’ performance and addressing any concerns they may have had in a timely manner.

- Spearheaded the development and implementation of investment plans for clients, based on their unique financial goals and risk profiles.

- Utilized cutting-edge market analysis tools and software to identify profitable investments and forecast market trends.

- Expedited the resolution of client queries and complaints by liaising directly with service providers such as brokers, fund managers and custodians.

- Competently handled all aspects of portfolio management, including performance monitoring, asset allocation and rebalancing.

- Reported monthly to clients on the progress of their investments, highlighting any changes in strategy or recommendations for further action.

- Represented clients in investments, including stocks, bonds and mutual funds.

- Resourcefully managed client portfolios to achieve optimal results despite market volatility.

- Reorganized client portfolios to minimize risk and maximize returns.

- Formulated investment strategies for clients based on their individual goals and risk tolerance levels.

- Forecasted future trends in the markets and advised clients accordingly.

- Consistently achieved quarterly sales goals by developing and implementing effective investment strategies for clients.

- Analyzed market trends and identified opportunities for investments that generated high returns while minimizing risks.

- Reduced the amount of time needed to complete client investment portfolios by streamlining the research process.

- Achieved a 95% satisfaction rating from clients in post-investment surveys due to providing personalized service and attention to detail.

- Streamlined the new client onboarding process by creating an efficient system for gathering information and completing paperwork.

- Mentored and trained 4 new investment advisors, helping them to increase their client portfolios by an average of 20%.

- Substantially increased the value of clients’ portfolios under my management by investing in high-growth stocks and mutual funds; on average, clients saw a return of 12% per year.

- Optimized clients’ portfolio allocations to maximize returns and minimize risk; as a result, no client has lost money due to market volatility in the last 3 years.

- Participated in weekly conference calls with investment managers to discuss market trends and make buy/sell recommendations for individual stocks and ETFs.

- Studied for and passed the Certified Financial Planner (CFP) exam, becoming one of only 2 CFPs at the firm.

- Evaluated client portfolios and investment goals to develop personalized wealth management plans.

- Developed long-term financial strategies for clients based on their unique circumstances and risk tolerance levels.

- Prepared detailed reports outlining investment recommendations and expected performance outcomes.

- Compiled client data and information to identify trends and make proactive decisions about investments.

- Proficiently used various financial software programs to manage client accounts and track progress towards goals.

- Presented investment proposals to clients, providing in-depth analysis of potential risks and returns; advised clients on the best investment strategies to suit their needs and goals.

- Demonstrated expertise in a wide range of investment products, including stocks, bonds, mutual funds and ETFs; confidently provided recommendations to clients based on thorough market research.

- Revised portfolio allocations for 100+ client accounts on a quarterly basis, ensuring that asset class weights remained within desired ranges; generated an average annual return of 12% for all clients over a 3-year period.

- Actively monitored global economic trends and developments, keeping abreast of changes that could impact investments held by clients; quickly took action to minimize losses and maximize gains when necessary.

- Built strong relationships with clients through regular communication and provision of timely updates on performance; successfully retained 98% of clientele year-over-year.

- Researched and analyzed potential investments and made recommendations to clients based on findings, helping them earn an average return of 15% per year.

- Efficiently managed a portfolio of 50+ client accounts, executing trades and monitoring market trends to ensure maximum profitability.

3. Skills

Job skills will differ depending on the employer. For example, some investment firms may require their advisors to have a Series 7 license while others might not. As such, you will want to tailor your skills section to each job that you apply for.

It is crucial to do this because many employers now use applicant tracking systems (ATS). These are computer programs designed to scan resumes and filter out those that don’t contain certain keywords or characteristics.

In addition to just listing skills in this section, you should also discuss the most important ones in other areas of your resume, such as the summary or experience section.

Below is a list of common skills & terms:

- Alternative Investments

- Asset Allocation

- Asset Management

- Banking

- Bloomberg

- Bonds

- Business Development

- Business Strategy

- Capital Markets

- Commercial Banking

- Corporate Finance

- Credit

- Cryptocurrency

- Derivatives

- ETFs

- Equities

- Equity Research

- Estate Planning

- Excel

- Finance

- Financial Advisory

- Financial Analysis

- Financial Markets

- Financial Modeling

- Financial Planners

- Financial Planning

- Financial Services

- Fixed Income

- Hedge Funds

- High Net Worth Individuals

- Insurance

- Investment Advisory

- Investment Banking

- Investment Management

- Investment Strategies

- Investments

- Leveraged Buyouts

- Life Insurance

- Machine Learning

- Mergers And Acquisitions

- Mutual Funds

- NLP

- Portfolio Management

- Private Equity

- Real Estate

- Relationship Management

- Retirement

- Retirement Planning

- Risk Management

- Securities

- Series 7

- Strategic Financial Planning

- Strategy

- Tax Planning

- Teamwork

- Time Management

- Trading

- VBA

- Venture Capital

- Wealth

- Wealth Management

- Wealth Management Services

4. Education

Including an education section on your resume will depend on how far along you are in your career. If you just graduated and have no work experience, your education should be mentioned below your resume objective. However, if you have significant work experience that is relevant to the investment advisor role you are applying for, you might not want to include an education section altogether.

If including an education section, mention courses or subjects studied related to investments and finance. Examples could be “Courses included Macroeconomics, Financial Accounting, and Investments” or “Mentored by a senior investment advisor during my final semester which gave me exposure to portfolio management software.”

Bachelor’s Degree in Business, Economics and Finance

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications allow you to prove your worth to potential employers in the investment advisor industry. Your resume should list any and all licenses or certifications that are relevant to the position you are applying for.

Some examples of relevant certifications for an investment advisor include: Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), and Certified Financial Planner (CFP). If you have any of these, be sure to list them prominently on your resume.

Certified Investment Advisor

Investment Advisor Certification Board

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Wilton Wisoky, this would be Wilton-Wisoky-resume.pdf or Wilton-Wisoky-resume.docx.

7. Cover Letter

Cover letters are usually not required when applying for a job, but they can be very helpful in introducing yourself to a potential employer. They should be 2 to 4 paragraphs long and include information that is not already included in your resume.

A cover letter is a great way to stand out from the other candidates who are applying for the same role as you. It allows you to connect with the hiring manager on a more personal level and give them insights about who you are as a professional.

Below is an example cover letter:

Dear Tara,

I am writing in regards to your posting for an investment advisor. With my experience as a financial analyst and certified financial planner, I am confident I will be an asset to your organization.

My experience includes working with clients one-on-one to develop personalized investment plans based on their risk tolerance and financial goals. I have also created presentations and webinars on investing topics such as retirement planning, estate planning, and tax-advantaged investments. In addition, I have authored articles on investing strategies that have been published in industry magazines.

Your listed requirements closely match my background and skills. A few of the highlights from my resume are:

– 7 years of experience as a financial analyst and certified financial planner

– Proven ability to develop personalized investment plans for clients

– Strong understanding of various investment products and strategies

– Excellent communication skills with the ability to present complex information in a clear and concise manner

I am eager to put my knowledge and experience to work for your organization. I can be reached anytime via cell phone at [phone number] or email at [email address]. Thank you for your time, consideration, and opportunity.

Sincerely,

[Your name]

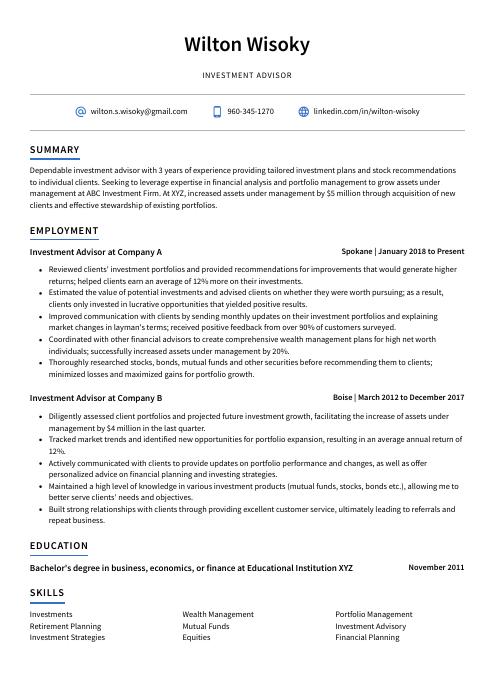

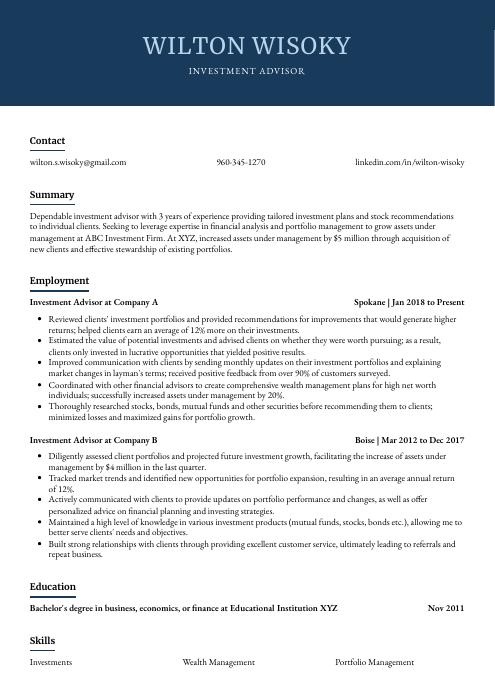

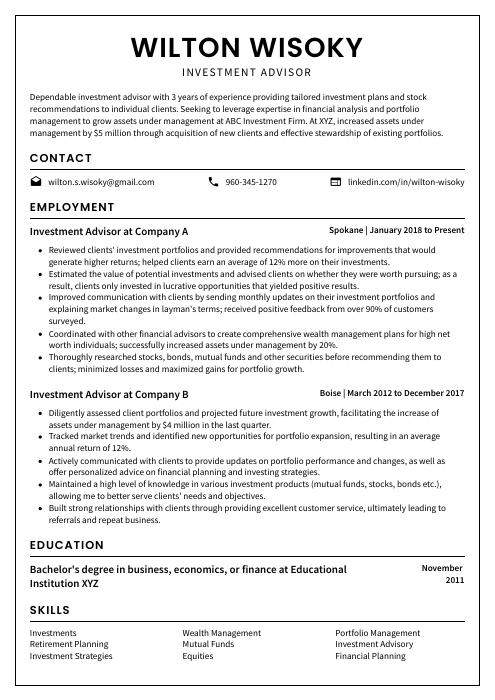

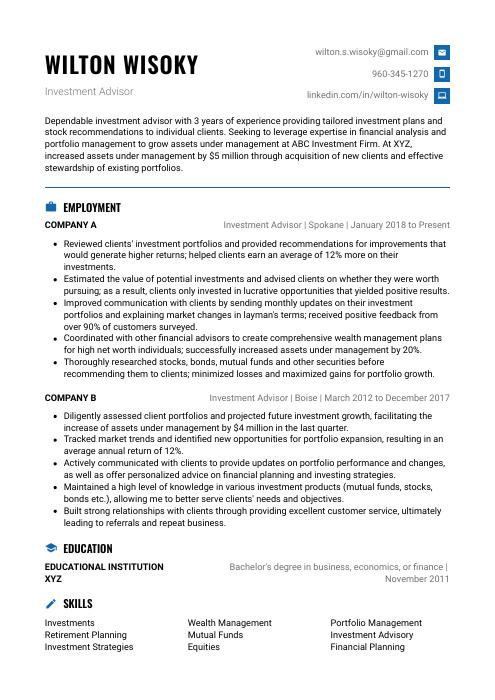

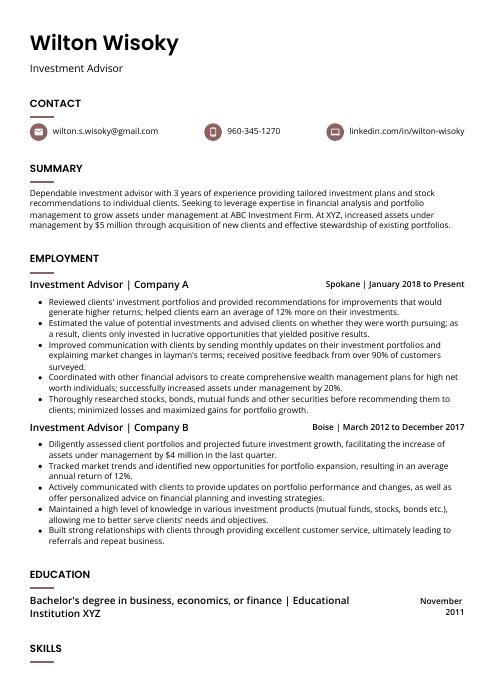

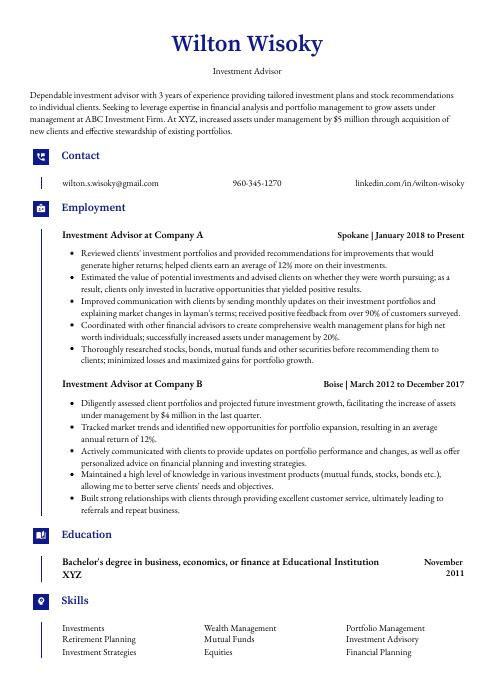

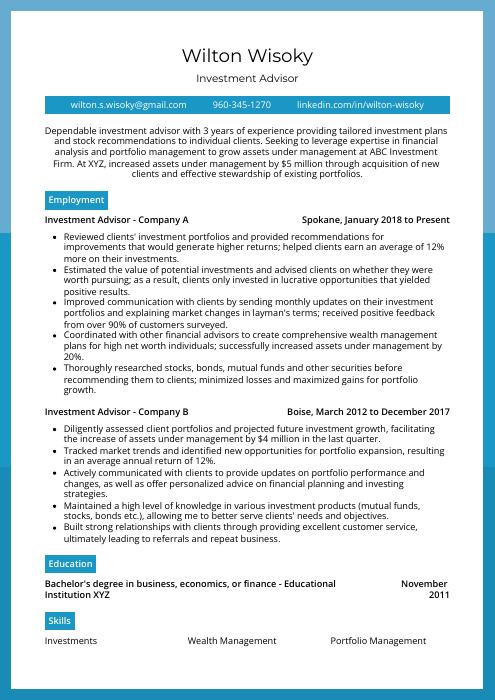

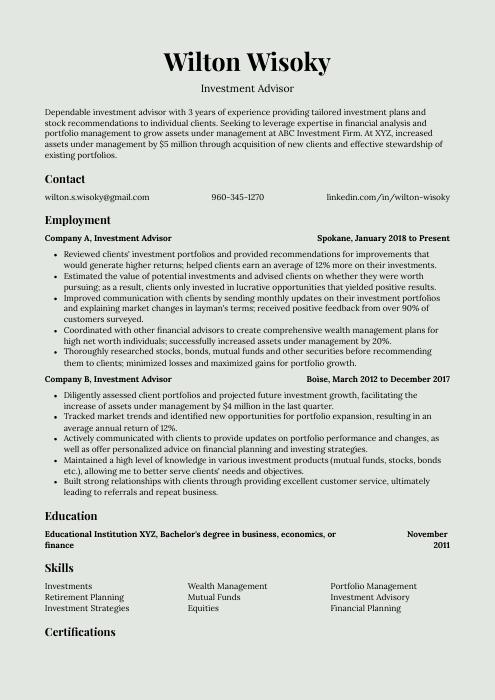

Investment Advisor Resume Templates

Axolotl

Axolotl Bonobo

Bonobo Cormorant

Cormorant Dugong

Dugong Echidna

Echidna Fossa

Fossa Gharial

Gharial Hoopoe

Hoopoe Indri

Indri Jerboa

Jerboa Kinkajou

Kinkajou Lorikeet

Lorikeet Markhor

Markhor Numbat

Numbat Ocelot

Ocelot Pika

Pika Quokka

Quokka Rhea

Rhea Saola

Saola Rezjumei

Rezjumei