Bank Branch Manager Resume Guide

Bank branch managers are responsible for the overall operations of a bank branch. This includes supervising staff, managing budgets, and ensuring compliance with bank regulations. They also develop business plans and strategies to grow the branch’s customer base and profitability.

You have the experience and expertise to manage any bank branch, but employers don’t know who you are. To get their attention, you need to write a resume that highlights your management skills and accomplishments.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

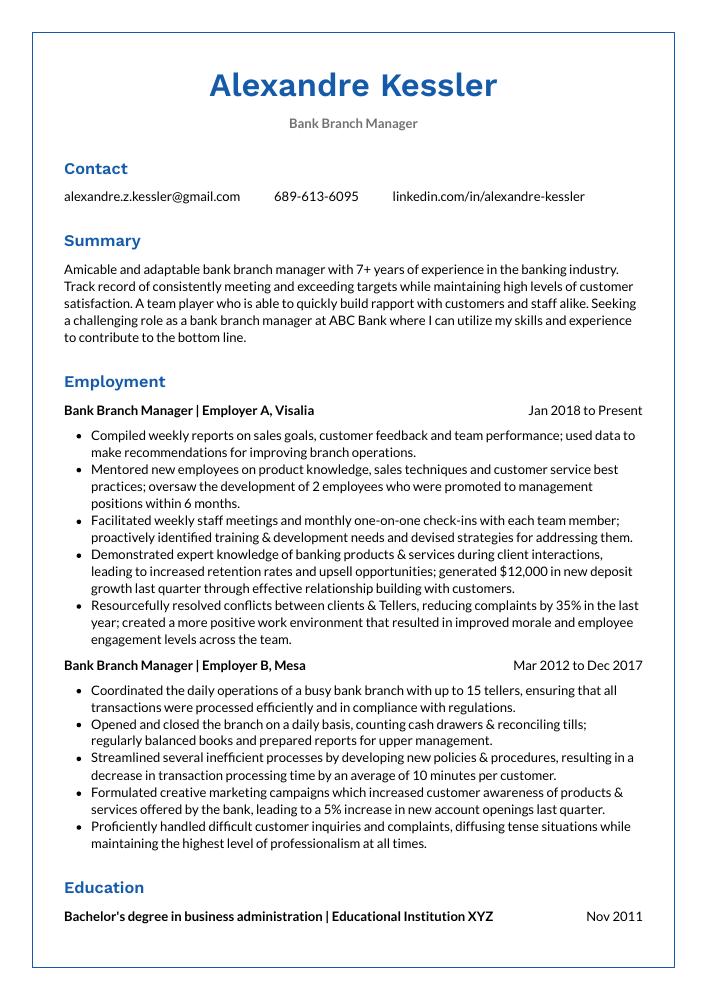

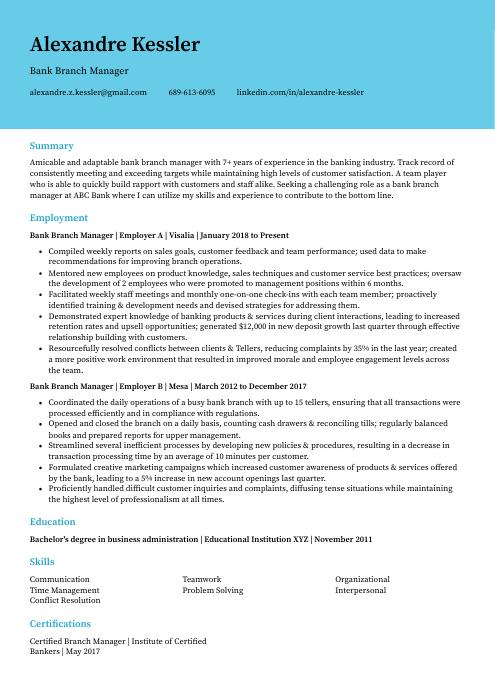

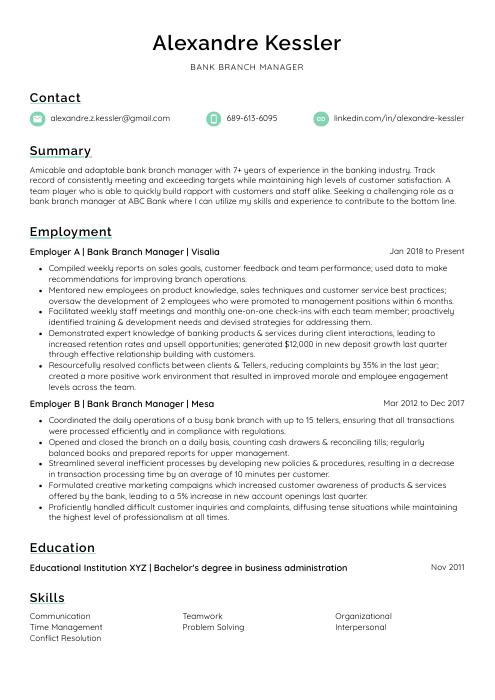

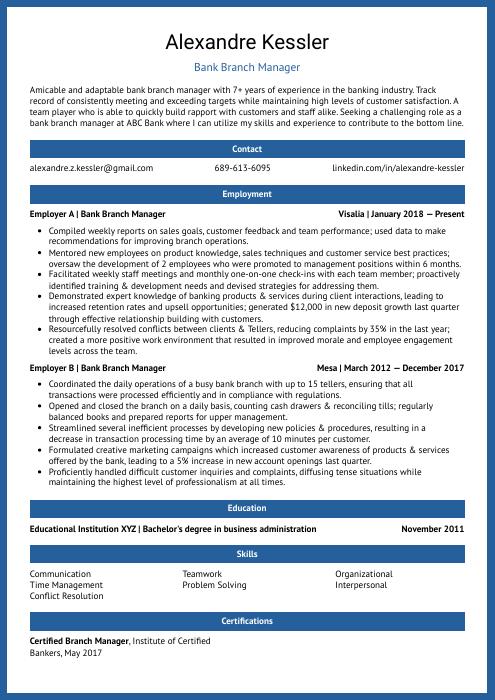

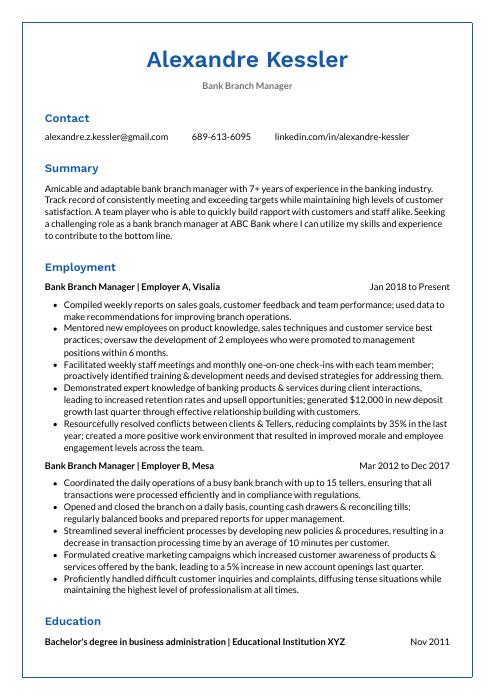

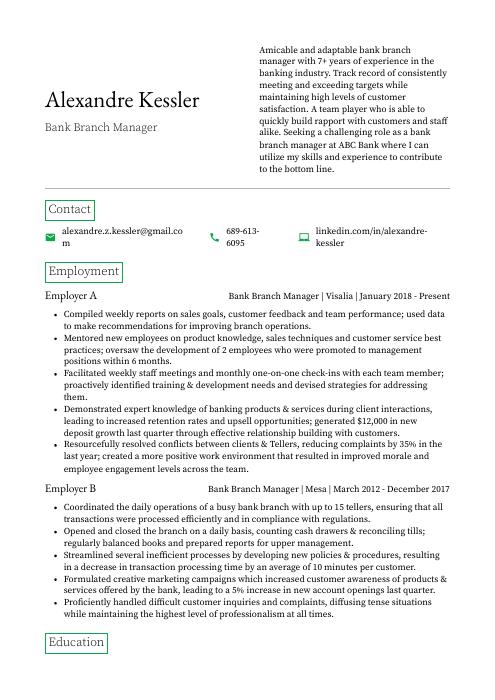

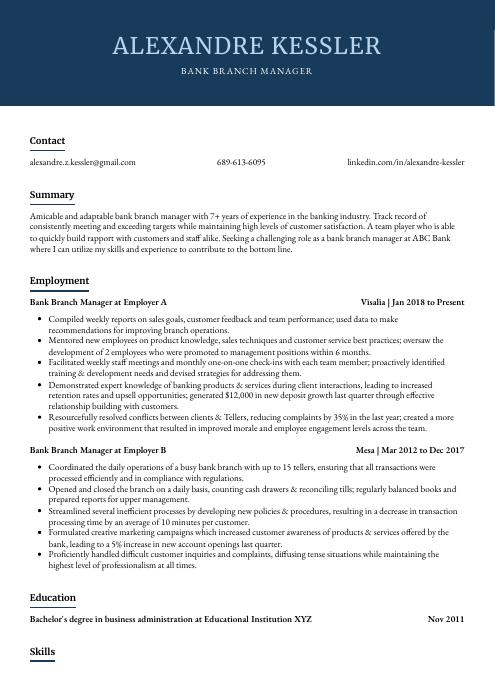

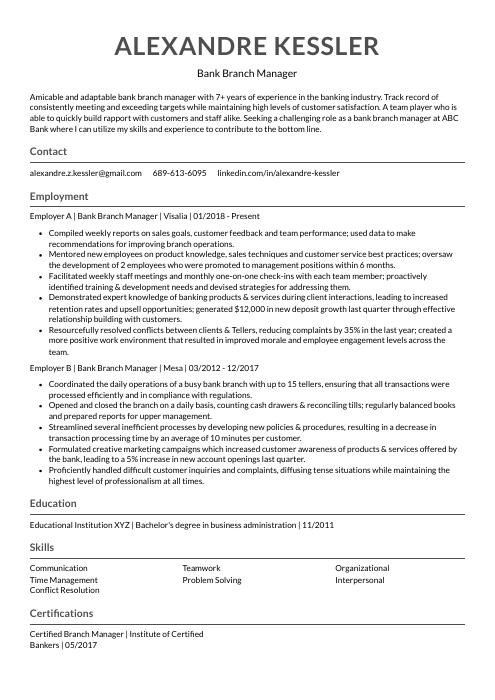

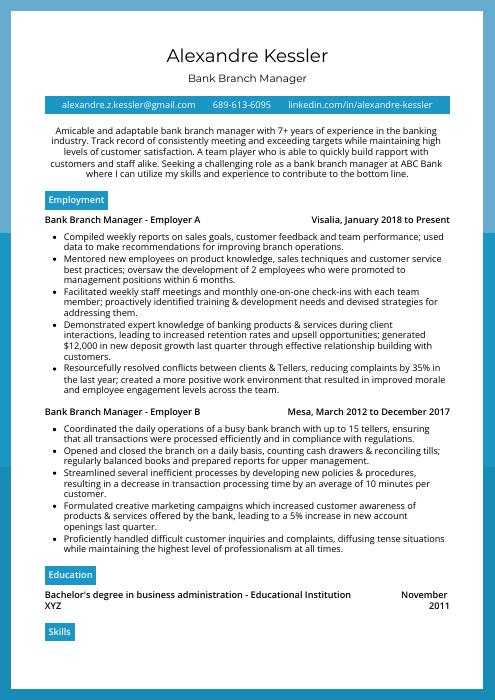

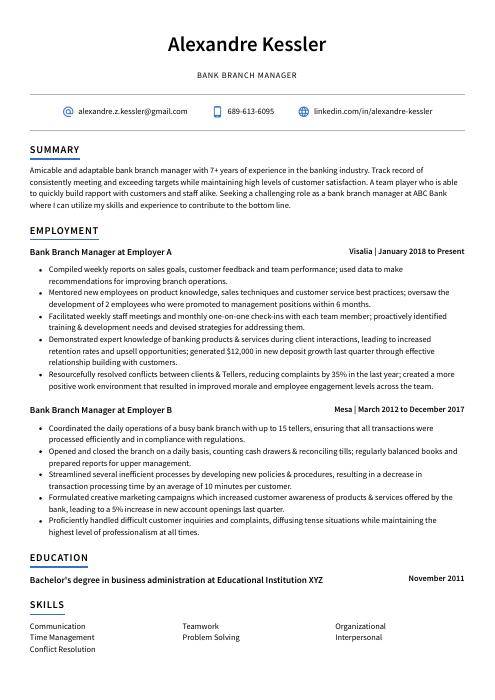

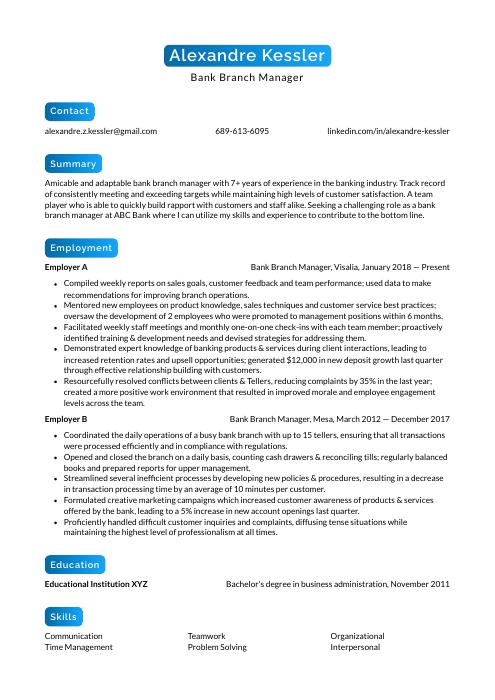

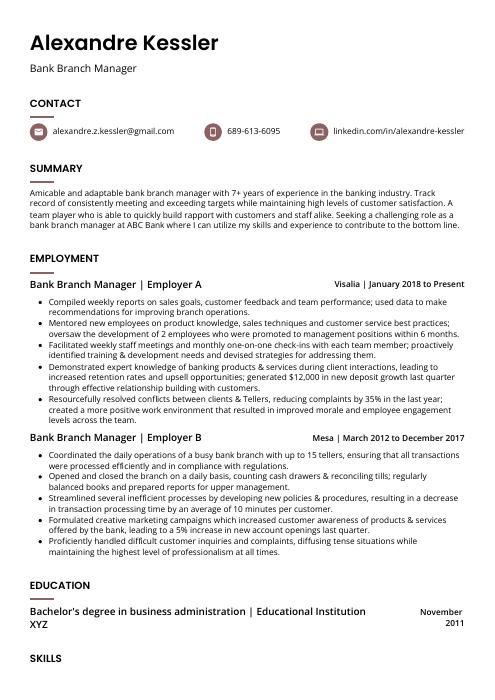

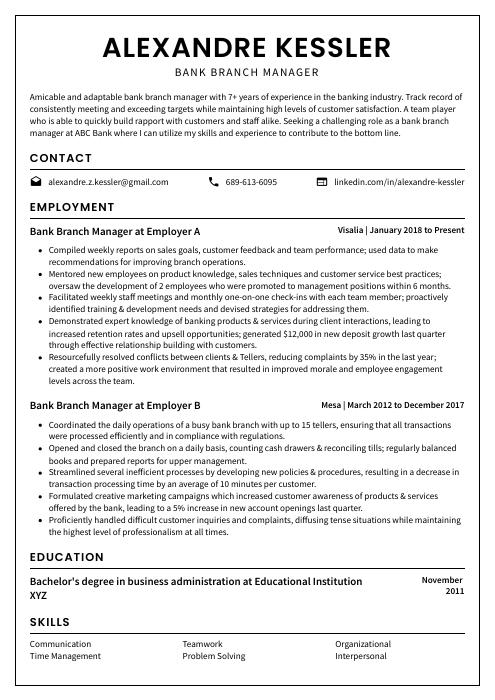

Bank Branch Manager Resume Sample

Brice Dibbert

Bank Branch Manager

[email protected]

749-070-2459

linkedin.com/in/brice-dibbert

Summary

Amicable and adaptable bank branch manager with 7+ years of experience in the banking industry. Track record of consistently meeting and exceeding targets while maintaining high levels of customer satisfaction. A team player who is able to quickly build rapport with customers and staff alike. Seeking a challenging role as a bank branch manager at ABC Bank where I can utilize my skills and experience to contribute to the bottom line.

Experience

Bank Branch Manager, Employer A

Roseville, Jan 2018 – Present

- Compiled weekly reports on sales goals, customer feedback and team performance; used data to make recommendations for improving branch operations.

- Mentored new employees on product knowledge, sales techniques and customer service best practices; oversaw the development of 2 employees who were promoted to management positions within 6 months.

- Facilitated weekly staff meetings and monthly one-on-one check-ins with each team member; proactively identified training & development needs and devised strategies for addressing them.

- Demonstrated expert knowledge of banking products & services during client interactions, leading to increased retention rates and upsell opportunities; generated $1,200,000 in new deposit growth last quarter through effective relationship-building with customers.

- Resourcefully resolved conflicts between clients & tellers, reducing complaints by 35% in the last year; created a more positive work environment that resulted in improved morale and employee engagement levels across the team.

Bank Branch Manager, Employer B

New York City, Mar 2012 – Dec 2017

- Coordinated the daily operations of a busy bank branch with up to 15 tellers, ensuring that all transactions were processed efficiently and in compliance with regulations.

- Opened and closed the branch on a daily basis, counting cash drawers & reconciling tills; regularly balanced books and prepared reports for upper management.

- Streamlined several inefficient processes by developing new policies & procedures, resulting in a decrease in transaction processing time by an average of 3 minutes per customer.

- Formulated creative marketing campaigns which increased customer awareness of products & services offered by the bank, leading to a 5% increase in new account openings last quarter.

- Proficiently handled difficult customer inquiries and complaints, diffusing tense situations while maintaining the highest level of professionalism at all times.

Skills

- Communication

- Teamwork

- Organizational

- Time Management

- Problem Solving

- Interpersonal

- Conflict Resolution

Education

Bachelor’s Degree in Business Administration

Educational Institution XYZ

Nov 2011

Certifications

Certified Branch Manager

Institute of Certified Bankers

May 2017

1. Summary / Objective

A resume summary/objective is like a movie trailer – it provides the hiring manager with essential bits of information and, if written correctly, should compel them to read on. The summary is where you can sell yourself; for example, you could mention your extensive experience in the banking industry, your successful track record in managing branch operations, and your proven ability to increase sales and profitability.

Below are some resume summary examples:

Passionate bank branch manager with 9+ years of experience in the financial industry. Expertise in developing and implementing innovative strategies to increase customer satisfaction and grow market share. Proven success increasing loan volume by 25% while decreasing delinquencies by 30%. Track record of reducing expenses by 10% without compromising quality or service levels.

Professional bank branch manager with 5+ years of experience in the financial industry. At XYZ Bank, managed a team of 15 tellers, loan officers, and customer service representatives. Achieved company’s highest ever Net Promoter Score of 89% through outstanding customer service. Led the development and implementation of new processes that increased efficiency by 27%.

Driven bank branch manager with more than 10 years of experience in the financial industry. Managed up to 12 direct reports and a $4 million operating budget. Cut expenses by 15% while increasing revenue 20%. Recognized as “Employee of the Month” four times. Seeking to leverage strong leadership skills and experience to take on a new challenge at ABC Bank.

Accomplished bank branch manager with proven ability to increase sales and profitability while ensuring compliance with all banking regulations. Demonstrated people management skills, including the ability to motivate staff and resolve conflict. At XYZ Bank, managed a team of 15 tellers and loan officers while also increasing new account openings by 20%.

Hard-working bank branch manager with 7+ years of experience in the banking industry. I have a proven track record of success in meeting and exceeding goals set by upper management. In my current role as Assistant Manager at XYZ Bank, I oversee a team of 10 tellers and 2 customer service representatives. I am also responsible for ensuring that all compliance regulations are met.

Proficient bank branch manager with 7 years of experience in the banking industry. At XYZ Bank, managed a team of 12 and increased loan volume by 15% through proactive customer service initiatives. Led the development and implementation of new bank products, services, and processes resulting in an increase in customer satisfaction ratings by 5%.

Diligent bank branch manager with over 10 years of experience in the banking industry. At XYZ Bank, increased new account growth by 23% and deposits by 18%. Grew loan portfolio by $3M through developing strong relationships with local businesses. Proven ability to effectively manage a team and provide excellent customer service.

Detail-oriented bank branch manager with 5+ years of experience overseeing all aspects of daily bank operations. Motivated to increase customer satisfaction and loyalty by providing the highest level of service possible. In previous role, increased new account openings by 16% through innovative marketing initiatives.

2. Experience / Employment

In the experience section, you detail your work history. This should be written in reverse chronological order so that your most recent job is at the top.

When detailing what you did in each role, use bullet points. This will make it easier for the reader to understand what you are trying to say. When writing out the bullet points, take some time to think about the specifics of what you did and any quantifiable results that were achieved.

For example, instead of saying “Helped customers with their banking needs,” you could say, “Assisted an average of 50+ customers per day with a wide range of banking needs such as opening new accounts, applying for loans, and transferring money.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Managed

- Led

- Organized

- Supervised

- Trained

- Hired

- Scheduled

- Opened

- Closed

- Deposited

- Withdrew

- Counted

- Balanced

- Reported

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Developed and executed monthly sales goals and objectives for a team of 8 personal bankers, leading the branch to consistently meet and exceed targets by an average of 15%.

- Spearheaded the creation of a new customer referral program that generated over 100 new leads per month and resulted in a 5% increase in overall branch business.

- Achieved “Outstanding” performance ratings in all 4 quarterly audits conducted by corporate headquarters, highlighting exceptional management of risk exposure and compliance with banking regulations.

- Utilized keen analytical skills to identify process improvements that increased teller line efficiency by 30% during busy periods and led to shorter customer wait times.

- Meticulously reviewed loan applications & documents for accuracy and completeness prior to submitting them for approval; helped reduce processing time by an average of 2 days per file while maintaining a 99% quality control rating.

- Organized and managed the operations of a busy bank branch with 15+ staff members, ensuring that all daily tasks were completed efficiently and within strict deadlines.

- Competently handled customer inquiries and complaints, resolving issues in a timely and professional manner while always adhering to confidentiality regulations.

- Reduced operational costs by 10% through effective resource planning and allocation of human resources.

- Represented the bank in a positive light at all times through polite interactions with customers, maintaining a clean and presentable work area, and dressing professionally according to company standards.

- Maintained up-to-date knowledge of banking products and services, as well as industry news and developments, in order to provide accurate information to clients when needed.

- Optimized staff utilization and scheduling to reduce Tellers’ idle time by 15%, while still providing excellent customer service during busy periods.

- Reported monthly to the Regional Manager on branch sales goals, KPIs and staff performance metrics; provided recommendations for process improvements based on data analysis.

- Consistently achieved or exceeded targets for new account openings, cross-selling products and services, and referral program sign-ups; generated an additional $110,000 in revenue last quarter.

- Supervised a team of 10+ Tellers, Personal Bankers and Customer Service Representatives; provided coaching & feedback to help them improve their performance and meet individual development goals.

- Scheduled regular one-on-one meetings with direct reports to discuss their progress, identify areas of improvement and provide guidance on how they can contribute more effectively to the team’s success.

- Counted and balanced the cash drawer every day, resolved discrepancies and reported issues to the corporate office as needed.

- Improved customer satisfaction ratings by implementing a new complaints resolution process; successfully lowered number of customer complaints by 42%.

- Revised teller training program and scheduled more rigorous testing for all incoming employees; resulted in a 20% decrease in errors made during transactions.

- Structured employee shift patterns to ensure adequate coverage at all times and created a cross-training program to fill gaps in staffing; decreased instances of overtime by 30%.

- Efficiently managed operations of the branch, including opening/closing procedures, vault management, security protocols and compliance with regulations.

- Diligently managed a team of 10 tellers, ensuring that all daily transactions were completed accurately and in a timely manner.

- Deposited an average of $0.5 million in cash and checks per day into the bank’s vaults, while maintaining strict security protocols at all times.

- Assessed loan applications from potential borrowers and advised them on the best course of action based on their financial situation; helped grow the branch’s loan portfolio by 20% over 6 months.

- Advised clients on various investment opportunities available to them and presented different options in a clear and concise manner; increased branch’s investment revenue by $50,000 last quarter.

- Presented quarterly reports detailing branch performance metrics such as deposits, withdrawals, loans processed, etc. to senior management; provided recommendations for improving efficiency and maximizing profits where possible.

- Closed an average of 3 accounts per day, ensuring that all paperwork was completed accurately and in compliance with bank regulations.

- Accurately processed customer transactions, including deposits, withdrawals, transfers, and loan payments, totaling over $20 million per month.

- Participated in the development and implementation of a new account opening procedure that reduced processing time by 15%.

- Reorganized the teller line to improve customer flow and decrease wait times by 20%.

- Prepared weekly reports on branch sales goals and progress towards targets; shared recommendations with senior management on ways to increase productivity and profitability.

- Expedited the opening and closing of the bank branch on a daily basis, ensuring that all employees were following proper protocol and procedures.

- Withdrew cash from the vault as needed to replenish teller stations and meet customer demand; balanced drawer at the end of each shift.

- Led a team of 10+ tellers, providing guidance and coaching on how to handle difficult customer interactions, process transactions accurately & efficiently, resolve complaints effectively etc.

- Reliably opened and closed the bank branch in accordance with all security protocols, reducing incidents of theft or robbery by 20%.

- Balanced the books for the bank branch on a monthly basis, ensuring that there was no discrepancy between assets and liabilities; prepared financial reports for upper management as needed.

- Introduced a new customer service initiative that boosted satisfaction ratings by 5%.

- Trained and supervised a team of 10 tellers, ensuring that all transactions were carried out accurately and in accordance with bank policy.

- Hired and trained 2 new customer service representatives, who went on to successfully resolve over 100 customer complaints between them.

- Successfully managed the branch’s budget, reducing overall expenses by 3% while still maintaining high levels of customer satisfaction.

3. Skills

Job skills will vary from employer to employer – this can be ascertained through the job posting. One bank may be looking for a branch manager with experience in overseeing operations, while another may prefer someone with experience in sales and marketing.

It is essential to keep this in mind because of the applicant tracking systems used by many companies. Their role is to analyze resumes for certain characteristics (such as specific keywords), filtering out those that they deem not to be a high-quality match for that particular job opening.

Besides just listing skills here, you should also elaborate on your most relevant ones in other resume sections, such as the summary or work history section.

Below is a list of common skills & terms:

- Communication

- Conflict Resolution

- Interpersonal

- Organizational

- Problem Solving

- Teamwork

- Time Management

4. Education

Including an education section on your resume is not always necessary. If you have plenty of relevant work experience, you may not need to include an education section at all. However, if you are just starting out in your career or do not have a lot of experience, you should mention your education below your resume objective.

If including an education section, highlight any courses and subjects related to the bank branch manager job you are applying for. For example “Courses included Financial Analysis & Reporting, Banking Regulations, and Principles of Banking.”

Bachelor’s Degree in Business Administration

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications prove that you have the specialized knowledge required to do the job. They also show that you are willing to invest in your professional development.

If you have any industry-specific certifications or licenses, include them in this section of your resume. This will demonstrate to potential employers that you are qualified for the position and have kept up with recent changes in the field.

Certified Branch Manager

Institute of Certified Bankers

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Brice Dibbert, this would be Brice-Dibbert-resume.pdf or Brice-Dibbert-resume.docx.

7. Cover Letter

Including a cover letter as part of your job application is a great way to expand on the information in your resume and give potential employers a better sense of who you are as a professional.

A cover letter typically contains 2 to 4 paragraphs, each serving a different purpose. For example, the first paragraph might be used to introduce yourself and explain why you’re interested in the role, whilst the second paragraph could highlight some of your key skills and experience that make you an ideal candidate.

Below is an example cover letter:

Dear Jadon,

I am writing in response to your job posting for a bank branch manager. With more than 10 years of experience in the banking industry, I am confident I will be an asset to [bank name].

In my current role as assistant bank branch manager at [bank name], I oversee all daily operations of the branch and manage a team of tellers, loan officers, and customer service representatives. I have successfully increased efficiency by streamlining processes and implementing new technology solutions. In addition, I have developed strong relationships with customers and partners that have resulted in increased business for the branch.

I am knowledgeable about all aspects of banking operations and regulations, and I am skilled in developing strategies to increase profitability and reduce risk. My experience has taught me how to effectively manage a team, resolve conflict, and provide excellent customer service. In addition, I have a proven track record of achieving sales goals through effective marketing initiatives.

I would welcome the opportunity to bring my skills and experience to [bank name] as your next bank branch manager. Thank you for your time; please do not hesitate to contact me if you have any questions or need additional information about my qualifications.

Sincerely,

Brice

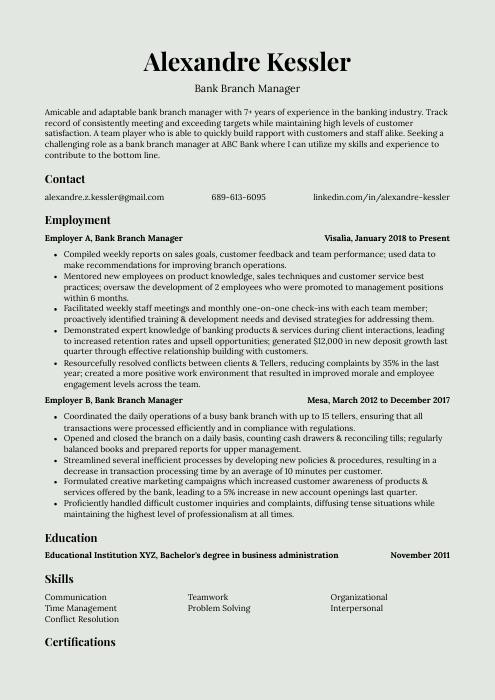

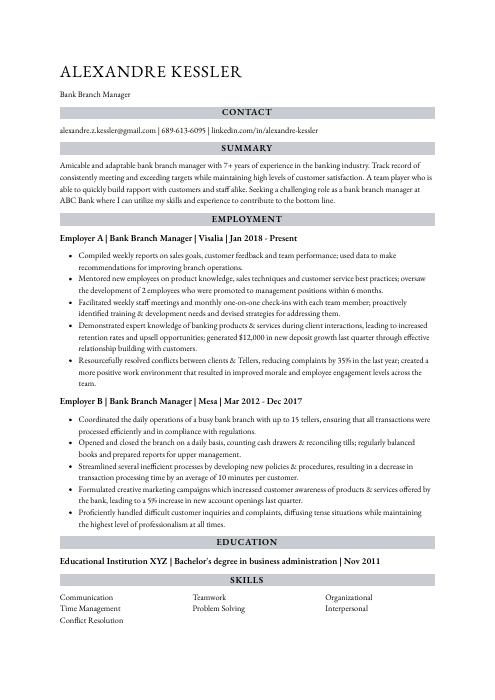

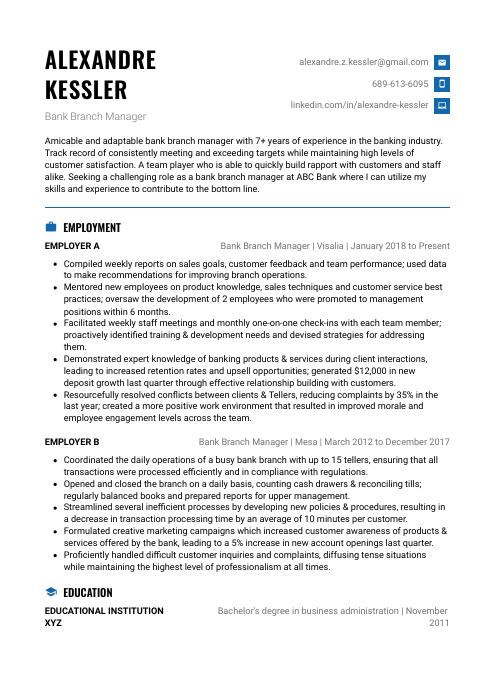

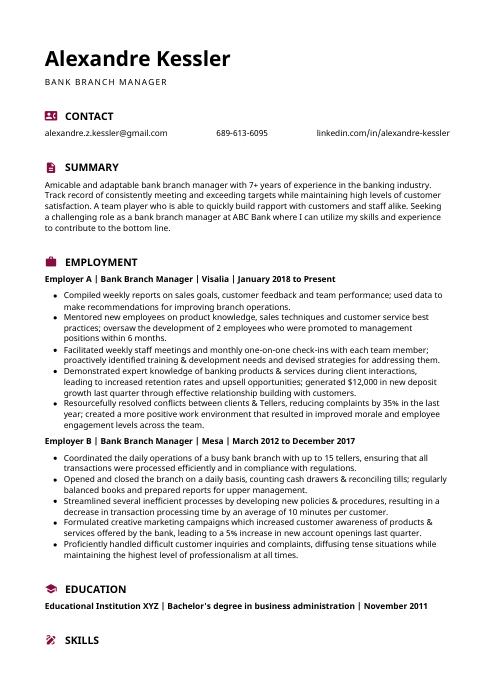

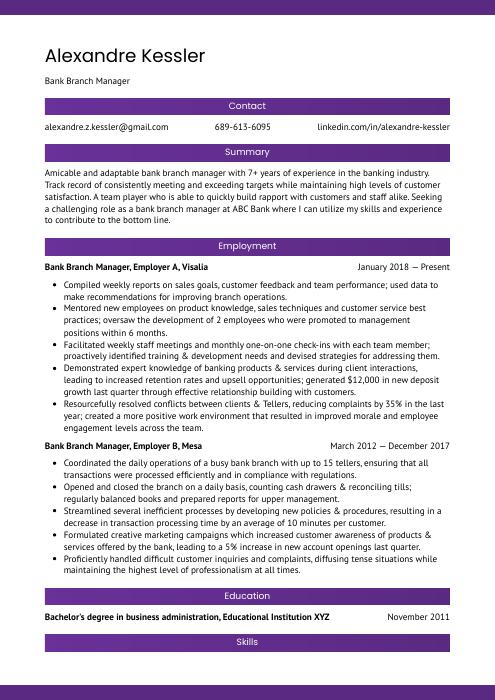

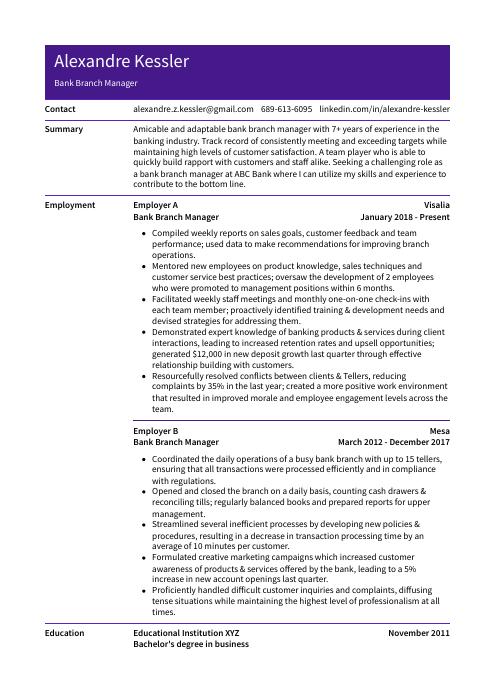

Bank Branch Manager Resume Templates

Dugong

Dugong Lorikeet

Lorikeet Ocelot

Ocelot Markhor

Markhor Quokka

Quokka Bonobo

Bonobo Indri

Indri Gharial

Gharial Rhea

Rhea Axolotl

Axolotl Kinkajou

Kinkajou Fossa

Fossa Saola

Saola Numbat

Numbat Echidna

Echidna Hoopoe

Hoopoe Cormorant

Cormorant Jerboa

Jerboa Pika

Pika Rezjumei

Rezjumei