Branch Manager Resume Guide

Branch Managers are responsible for overseeing the operations of a specific branch, ensuring that all employees are performing their duties correctly and efficiently. They also manage personnel issues such as hiring and training new staff members, resolving customer complaints, and maintaining financial records. Additionally, Branch Managers must ensure compliance with company policies while developing strategies to increase sales performance at their assigned location.

Your expertise in managing a team and overseeing operations would be an invaluable asset to any organization. But they don’t know who you are, so you need to write a resume that stands out from the crowd and shows them why they should hire you as their branch manager.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

Branch Manager Resume Sample

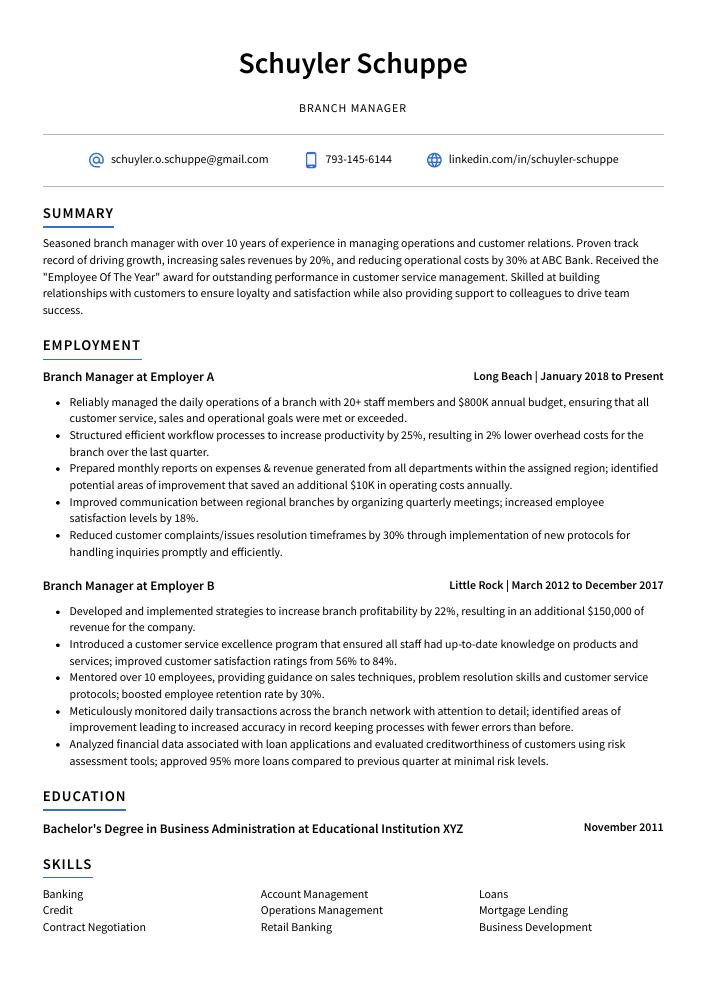

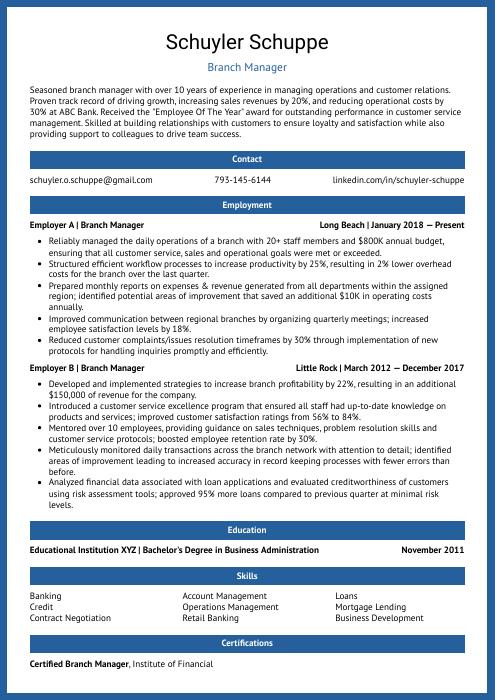

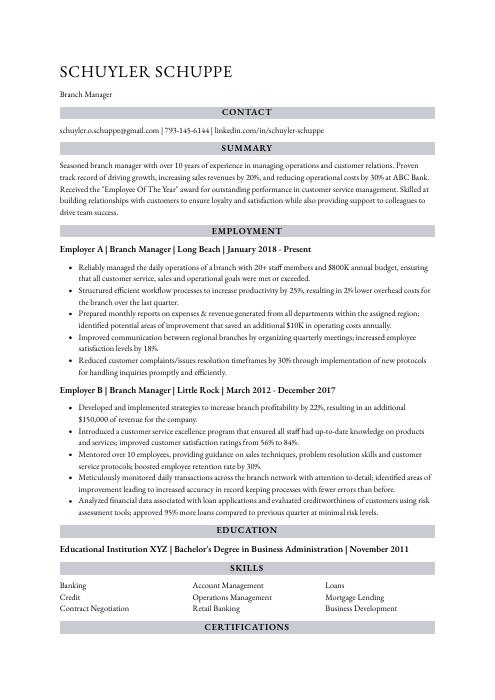

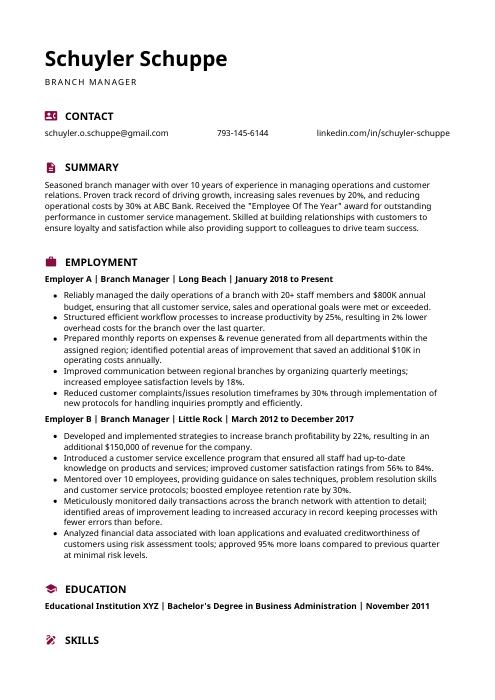

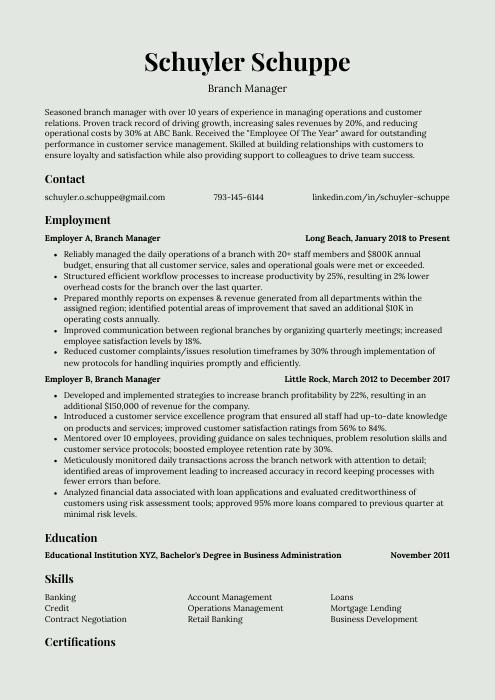

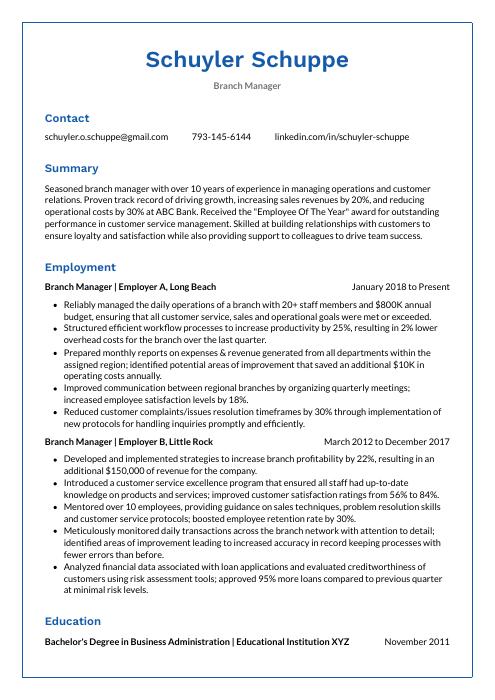

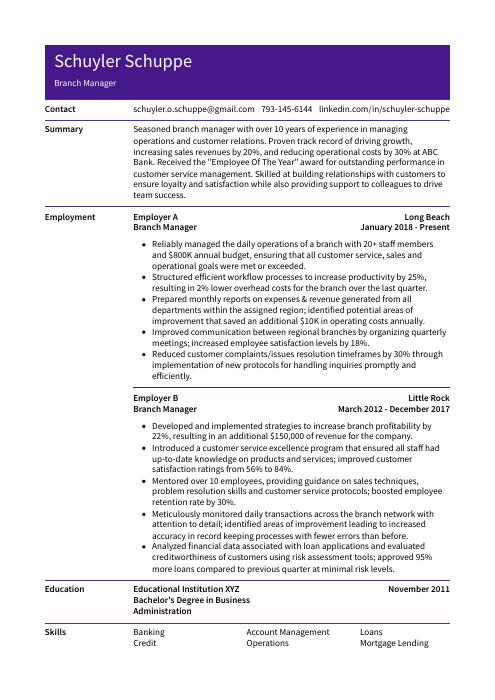

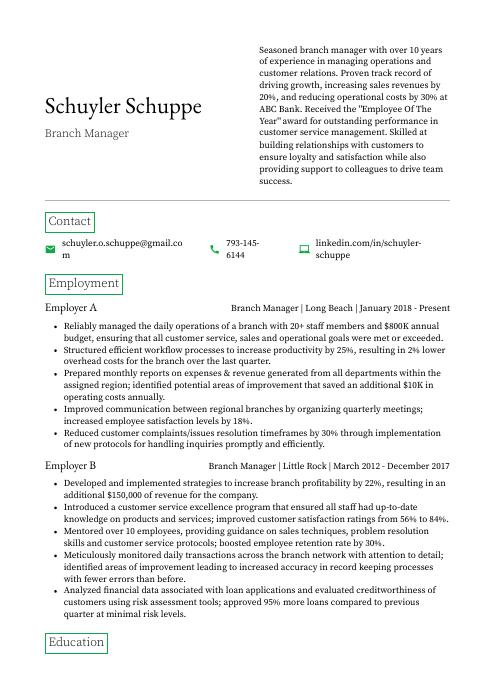

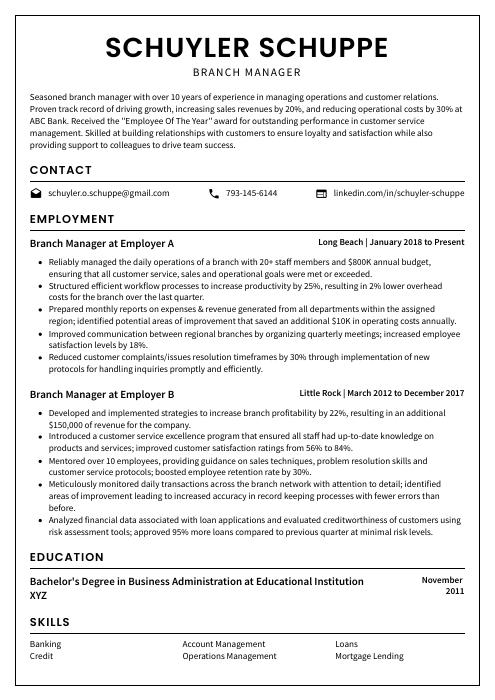

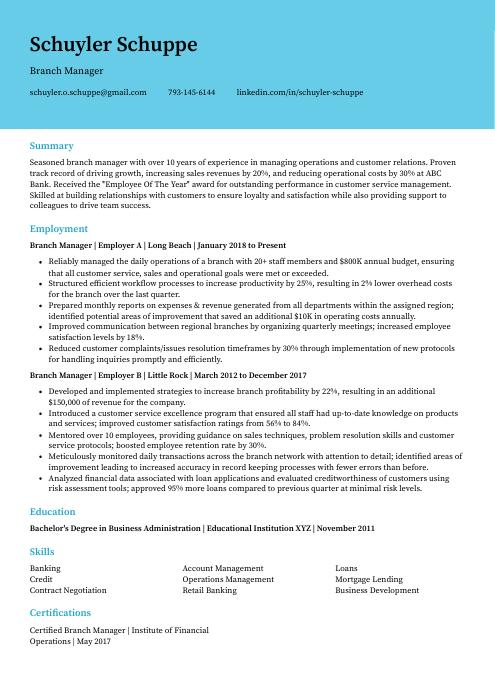

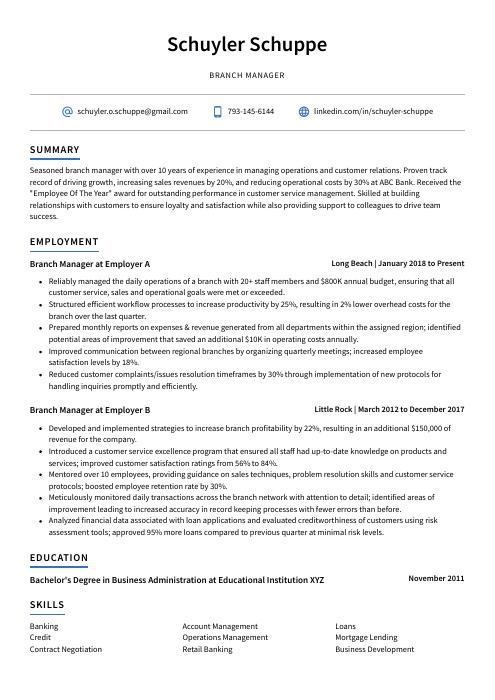

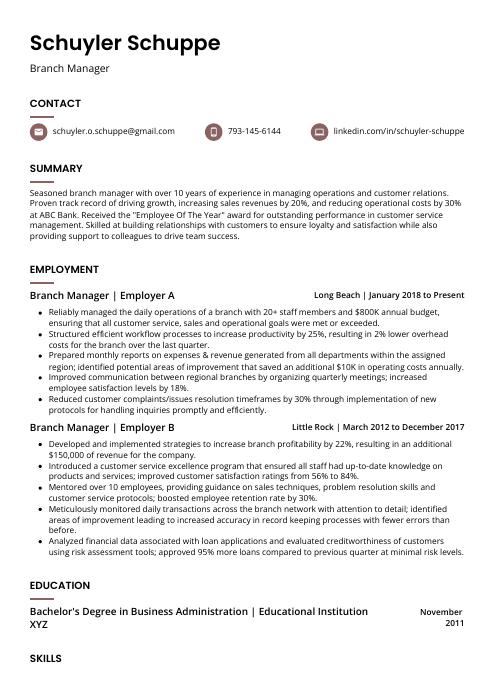

Schuyler Schuppe

Branch Manager

[email protected]

793-145-6144

linkedin.com/in/schuyler-schuppe

Summary

Seasoned branch manager with over 10 years of experience in managing operations and customer relations. Proven track record of driving growth, increasing sales revenues by 20%, and reducing operational costs by 30% at ABC Bank. Received the “Employee Of The Year” award for outstanding performance in customer service management. Skilled at building relationships with customers to ensure loyalty and satisfaction while also providing support to colleagues to drive team success.

Experience

Branch Manager, Employer A

Long Beach, Jan 2018 – Present

- Reliably managed the daily operations of a branch with 20+ staff members and $800K annual budget, ensuring that all customer service, sales and operational goals were met or exceeded.

- Structured efficient workflow processes to increase productivity by 25%, resulting in 2% lower overhead costs for the branch over the last quarter.

- Prepared monthly reports on expenses & revenue generated from all departments within the assigned region; identified potential areas of improvement that saved an additional $10K in operating costs annually.

- Improved communication between regional branches by organizing quarterly meetings; increased employee satisfaction levels by 18%.

- Reduced customer complaints/issues resolution timeframes by 30% through implementation of new protocols for handling inquiries promptly and efficiently.

Branch Manager, Employer B

Little Rock, Mar 2012 – Dec 2017

- Developed and implemented strategies to increase branch profitability by 22%, resulting in an additional $150,000 of revenue for the company.

- Introduced a customer service excellence program that ensured all staff had up-to-date knowledge on products and services; improved customer satisfaction ratings from 56% to 84%.

- Mentored over 10 employees, providing guidance on sales techniques, problem resolution skills and customer service protocols; boosted employee retention rate by 30%.

- Meticulously monitored daily transactions across the branch network with attention to detail; identified areas of improvement leading to increased accuracy in record keeping processes with fewer errors than before.

- Analyzed financial data associated with loan applications and evaluated creditworthiness of customers using risk assessment tools; approved 95% more loans compared to previous quarter at minimal risk levels.

Skills

- Banking

- Account Management

- Loans

- Credit

- Operations Management

- Mortgage Lending

- Contract Negotiation

- Retail Banking

- Business Development

Education

Bachelor’s Degree in Business Administration

Educational Institution XYZ

Nov 2011

Certifications

Certified Branch Manager

Institute of Financial Operations

May 2017

1. Summary / Objective

Your resume summary or objective should be a concise overview of your experience and qualifications as a branch manager. Include the number of years you have been in management, any awards or recognition you’ve received for outstanding performance, and how many branches you have successfully managed. Additionally, mention any relevant certifications that demonstrate your knowledge in banking operations and customer service.

Below are some resume summary examples:

Energetic and ambitious branch manager with 8+ years of experience in leading successful teams, developing growth strategies, and increasing customer satisfaction across multiple locations. At ABC Bank, streamlined processes resulting in a 20% improvement on time-to-market for new products while achieving the highest customer retention rate among all branches. Looking to bring my leadership skills to XYZ Corporation’s team as their next Branch Manager.

Determined branch manager with 5+ years of experience in financial services, overseeing operations and personnel. Successfully increased sales by 25% while reducing costs by 18%. Proven ability to lead teams towards success through setting clear objectives, providing ongoing support and mentorship, and being an advocate for customers. Looking to bring knowledge of product lines and customer service strategies to ABC Bank as its next Branch Manager.

Reliable and dedicated branch manager with 8+ years of experience in managing the operations of a retail bank. Proven track record of successfully developing, implementing, and overseeing strategies to increase customer loyalty and boost profitability by 40%. Experienced at leading teams up to 15 members while driving productivity through effective motivation tactics. Looking to leverage my skillset to become an asset for XYZ Bank.

Driven branch manager with 8+ years of experience leading teams to exceed goals and streamline operations. At XYZ Bank, managed a team of 10 employees and achieved sales targets ahead of schedule for three consecutive quarters. Successfully implemented new customer service initiatives that increased customer satisfaction by 24%. Committed to developing an engaged workplace culture where employees can reach their full potential.

Accomplished branch manager with 10+ years of experience driving profitable retail operations in a high-volume environment. Skilled at recruiting and developing talent, optimizing processes, coaching team members to success, and exceeding customer expectations. Seeking to bring expertise and leadership skills to ABC Bank as the next Branch Manager. Most recently increased deposits by 15% while reducing operational costs by 12%.

Well-rounded branch manager with 5+ years of experience leading teams and managing customer relationships. At XYZ, successfully managed a team of 20 salespeople and achieved an increase in revenue by 25%. Proven track record in developing growth strategies to ensure customer satisfaction while reducing operational costs. Results-driven leader who is passionate about creating successful business plans for long-term success.

Skilled branch manager with 8+ years of experience leading teams to exceed sales goals and service objectives. Proven track record in developing staff, managing budgets, driving customer satisfaction initiatives, and improving operational efficiency. Demonstrated success in increasing revenue by 11% annually while reducing costs by 9%. Seeking to join ABC Bank as the next Branch Manager and lead their team to new heights.

Detail-oriented branch manager with over 8 years of experience managing banking operations and leading teams. Proven track record in improving customer satisfaction, introducing new products to the market, and increasing profitability by 15%. Looking for an opportunity to join ABC Bank as its next Branch Manager and bring an energetic approach to driving long-term success.

2. Experience / Employment

In the experience section, you’ll provide details on your past roles. This should be written in reverse chronological order, meaning the most recent role is listed first.

Stick to bullet points when describing what you did; this makes it easier for the reader to digest quickly and understand what you have done. When writing these bullets, make sure that they are detailed and include quantifiable results whenever possible. For example, instead of saying “Managed a team,” say something like “Led a team of 10 employees across multiple departments while meeting all quarterly targets.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Managed

- Supervised

- Monitored

- Coordinated

- Analyzed

- Developed

- Trained

- Scheduled

- Delegated

- Motivated

- Resolved

- Implemented

- Optimized

- Streamlined

- Forecasted

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Demonstrated

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Structured

- Utilized

Below are some example bullet points:

- Implemented cost-saving initiatives that reduced branch expenses by 15% over a 12 month period.

- Formulated and executed weekly staff schedules for 10+ employees, ensuring all shifts were filled with adequately trained personnel.

- Confidently managed high-pressure customer complaints in an efficient manner to maintain customer satisfaction levels above 90%.

- Achieved record sales figures within the last quarter through successful execution of effective marketing strategies and upselling techniques; increased overall revenue by $5,000+.

- Scheduled and conducted regular performance reviews with team members on their progress towards individual goals while providing timely feedback & guidance as needed.

- Resolved customer inquiries and escalated cases to corporate level with 98% satisfaction rate, while supervising a team of 10 employees in the branch.

- Demonstrated outstanding leadership by coaching staff members on sales techniques, product knowledge & customer service best practices resulting in a 17% increase in total profits over 6 months.

- Advised customers on products and services offered within the branch; successfully upsold 250+ additional items each month for an extra $4,500 revenue per quarter.

- Resourcefully managed inventory levels across all departments ensuring sufficient stock supply at all times; reduced wastage costs from 8% to 2%.

- Utilized data-driven performance metrics and KPI analysis to assess employee productivity and identify areas of improvement leading to increased efficiency savings of 20 hours/week overall.

- Coordinated and supervised the daily operations for a branch office with 20+ staff members; increased efficiency by 25% through effective workflow management.

- Optimized sales performance by monitoring customer trends and providing strategic guidance to team members; achieved $1 million in quarterly revenue targets three quarters in succession.

- Forecasted resource needs accurately 10 weeks ahead of time, resulting in successful implementation of cost saving measures amounting to $10,000 annually.

- Supervised all banking activities including loan processing, cash handling and customer service delivery while ensuring adherence to strict regulatory guidelines at all times; successfully reduced errors rate from 5% to 1%.

- Consistently motivated employees with regular feedback sessions on their performance that led to improved morale amongst the team and higher levels of productivity across the board (+25%).

- Represented the branch in regional managerial meetings, resolving customer complaints and queries with a 98% satisfaction rate.

- Expedited operations by optimizing the workflow process for both front-end staff and back-office personnel; reduced turnaround time of tasks by 20%.

- Spearheaded projects to improve customer service standards within the branch; increased customer loyalty levels from 35% to 65% over 6 months.

- Substantially improved bank asset management systems through introducing new accounting practices that were adopted across all branches nationwide, resulting in an increase of $7 million in profits annually.

- Presented monthly reports on sales performances, financials and operational developments at executive board meetings; received commendations from senior executives for superior performance results achieved during tenure as Branch Manager.

- Diligently monitored branch operations, supervising 25+ staff members and ensuring that all procedures were carried out in accordance with company regulations.

- Reorganized the branch’s workflow systems to reduce customer service wait time by 40% and maximize efficiency of daily processes.

- Streamlined financial planning protocols for a budget of $800,000; achieved cost savings of 10% without compromising quality standards or services offered.

- Managed the development and implementation of new marketing strategies to increase sales volume by 20%; exceeded monthly sales targets on average by 5%.

- Regularly evaluated employee performance metrics and provided constructive feedback which resulted in improved team productivity levels by 25%.

- Compiled sales reports, analyzed customer trends and assessed staff performance on a weekly basis; identified areas of improvement in the branch which resulted in an increase of $5,000 in net profit.

- Delegated tasks among team members to ensure smooth daily operations; developed training programs for new employees designed to enhance their knowledge and skillset.

- Assessed current processes within the branch, identifying opportunities for streamlining procedures/activities that led to a 20% reduction in operational costs over 6 months.

- Participated actively in community outreach initiatives aimed at promoting products & services offered by the branch; successfully increased brand awareness amongst potential customers by 15%.

- Successfully managed upsells with customers leading to additional purchases worth $15,000 over 3 quarters while maintaining high levels of customer satisfaction ratings (95%).

- Motivated a team of 20+ employees to exceed branch targets, resulting in an increase of total sales by 11% compared to the previous year.

- Revised and implemented new strategies that ensured efficient operations, enabling the branch to serve over 350 customers on a daily basis with minimal wait times.

- Competently managed all financial activities within the branch such as budgeting and controlling expenses; reduced costs by 10%.

- Facilitated customer service training courses for junior staff members and developed innovative methods to improve customer satisfaction levels; increased client feedback ratings from 4/5 stars to 5/5 stars overall in just 3 months.

- Trained four new recruits on product knowledge and sales techniques which resulted in improved performance among staff who achieved their individual monthly goals ahead of schedule by 6 days on average each month.

3. Skills

Two organizations that have advertised for a position with the same title may be searching for individuals whose skills are quite different. For instance, one might prioritize customer service experience while the other puts more emphasis on financial literacy.

Therefore, it is important to tailor your skills section of your resume for each job that you are applying for. This will not only help employers find what they’re looking for but also increase the chances of passing through their applicant tracking systems (ATS). These computer programs scan resumes for specific keywords before forwarding them onto a human recruiter.

The most relevant skills should be listed here and then further discussed in detail in other sections such as summary or work experience.

Below is a list of common skills & terms:

- Account Management

- Banking

- Business Development

- Coaching

- Cold Calling

- Commercial Banking

- Commercial Lending

- Consumer Lending

- Contract Management

- Contract Negotiation

- Credit

- Credit Analysis

- Customer Satisfaction

- Direct Sales

- FHA

- Finance

- Financial Analysis

- Financial Services

- Forecasting

- Human Resources

- Investment Properties

- Investments

- Key Account Management

- Loan Origination

- Loans

- Logistics

- Mortgage Banking

- Mortgage Lending

- Operations Management

- Portfolio Management

- Pricing

- Process Improvement

- Purchasing

- Real Estate

- Recruiting

- Refinance

- Relationship Management

- Residential Mortgages

- Retail Banking

- Risk Management

- Sales Operations

- Sales Process

- Small Business Lending

- Team Leadership

- Teamwork

- Time Management

4. Education

Including an education section on your resume is a must if you are applying for a branch manager role. Mentioning the courses, subjects, and qualifications related to management will demonstrate that you have the necessary skills needed for this position.

If you graduated quite recently and don’t have much experience yet, include an education section below your resume objective. However, if you already have extensive work experience in management roles at different companies with plenty of responsibilities to showcase, then omitting the education section is also acceptable.

Bachelor’s Degree in Business Administration

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your knowledge and expertise in a particular field. Employers will be impressed by any certifications that you have obtained, as it shows them that you have taken the initiative to further develop yourself professionally.

Including relevant certificates on your resume can help give employers an idea of what qualifications and skillsets you possess, which may make all the difference when it comes to getting hired for certain positions.

Certified Branch Manager

Institute of Financial Operations

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Schuyler Schuppe, this would be Schuyler-Schuppe-resume.pdf or Schuyler-Schuppe-resume.docx.

7. Cover Letter

Attaching a cover letter to your job application is a great way to give yourself an edge over other candidates. It provides recruiters with more information about you, allows you to explain why you’re the perfect fit for the role and gives them insights into who you are as a professional.

Cover letters should be concise yet informative. They usually consist of 2-4 paragraphs that extend on what’s already mentioned in your resume and provide details such as any relevant experience or skillset that may not have been included before.

Below is an example cover letter:

Dear Isac,

I am writing to apply for the branch manager position at [bank name]. With more than 10 years of experience in the banking industry, I have the skills and knowledge necessary to successfully lead a team and manage all aspects of a branch.

In my current role as assistant branch manager at [bank name], I oversee daily operations, manage a staff of 15 employees, and provide excellent customer service. I have also been successful in increasing loan growth and deposits while reducing expenses. In addition, I have implemented new policies and procedures that have improved efficiency and compliance with regulations.

I am confident that I can bring these same success to your organization as branch manager. In addition to my operational experience, I have a proven track record of developing relationships with customers and building loyalty among employees. As branch manager, I will be an asset to your team and contribute to the continued success of [bank name].

Thank you for your consideration, and I look forward to speaking with you soon about this opportunity.

Sincerely,

Schuyler

Branch Manager Resume Templates

Ocelot

Ocelot Gharial

Gharial Jerboa

Jerboa Numbat

Numbat Hoopoe

Hoopoe Saola

Saola Markhor

Markhor Pika

Pika Quokka

Quokka Cormorant

Cormorant Dugong

Dugong Axolotl

Axolotl Fossa

Fossa Rhea

Rhea Echidna

Echidna Indri

Indri Bonobo

Bonobo Kinkajou

Kinkajou Lorikeet

Lorikeet Rezjumei

Rezjumei