Compliance Officer Resume Guide

Compliance officers ensure that organizations are compliant with relevant regulations and laws. They review internal policies, procedures and documentation to identify any areas of noncompliance, develop risk mitigation plans for identified risks, monitor compliance activities throughout the organization, conduct investigations into potential violations or misconducts and provide guidance on regulatory requirements.

You possess all the necessary qualifications and skills to be a successful compliance officer. But employers need to see your credentials first-hand before they consider you for an interview. To make sure that happens, craft a resume that highlights your experience in the field.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

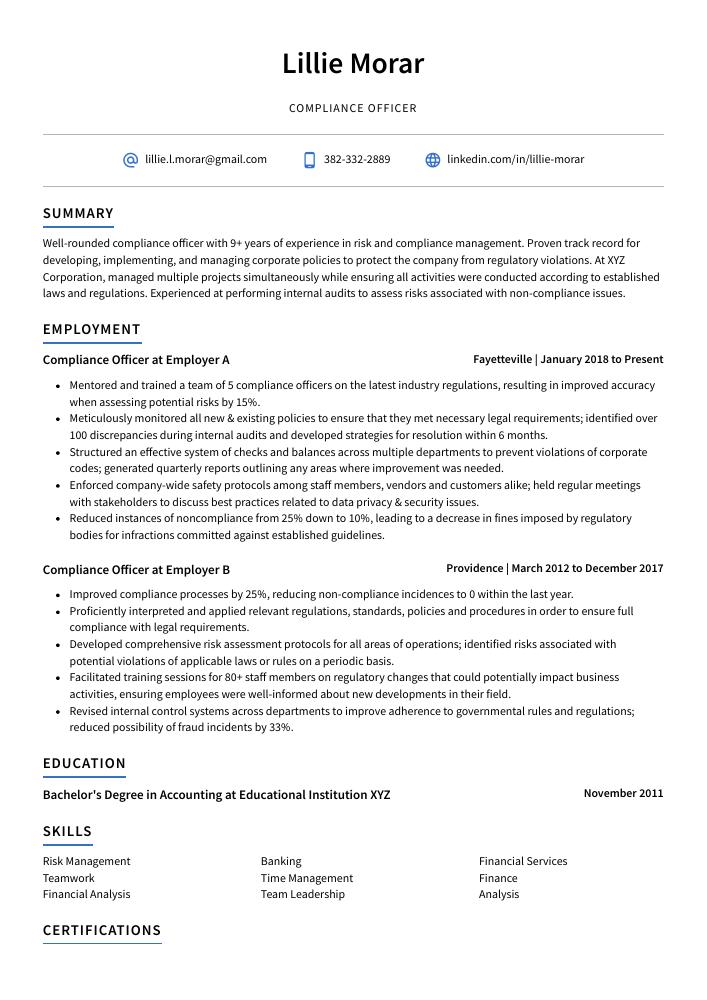

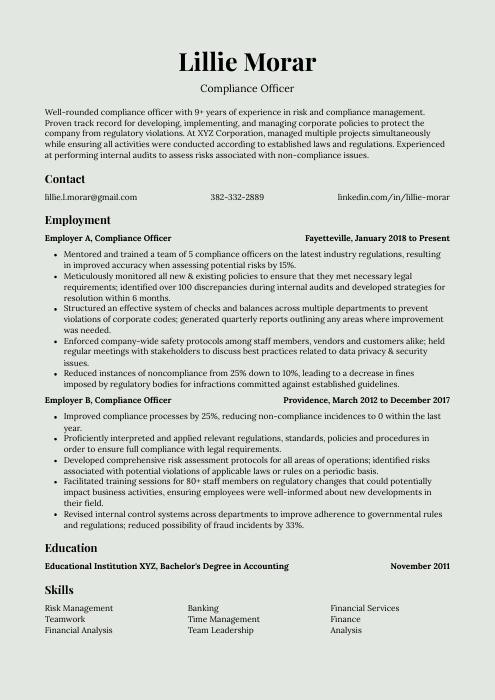

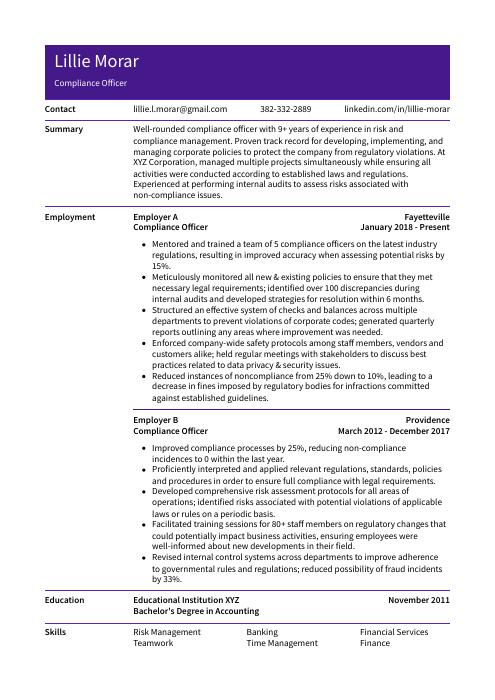

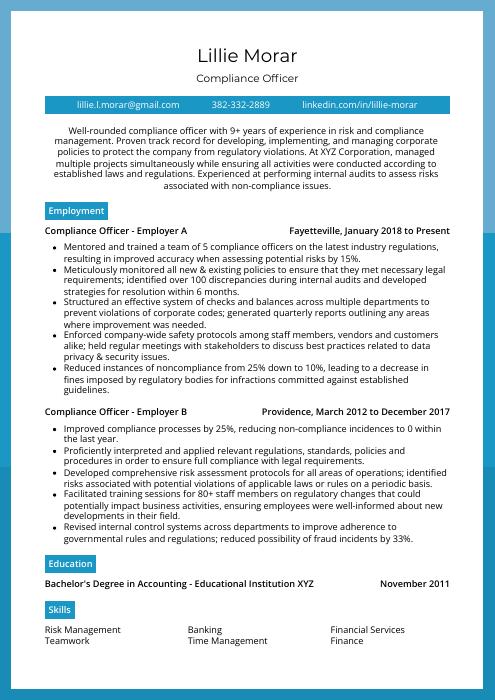

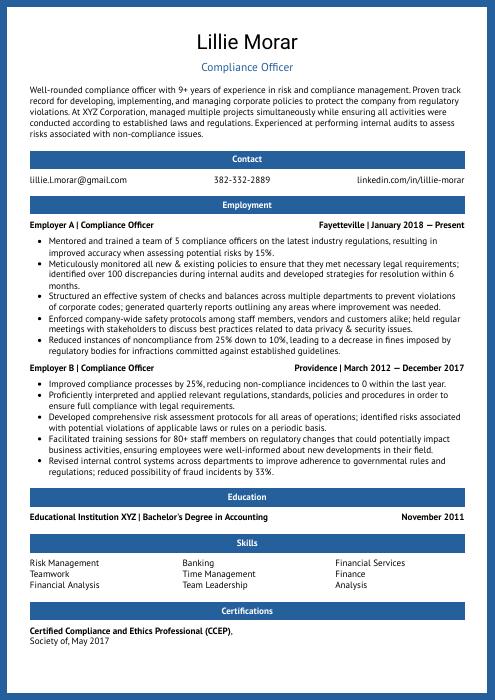

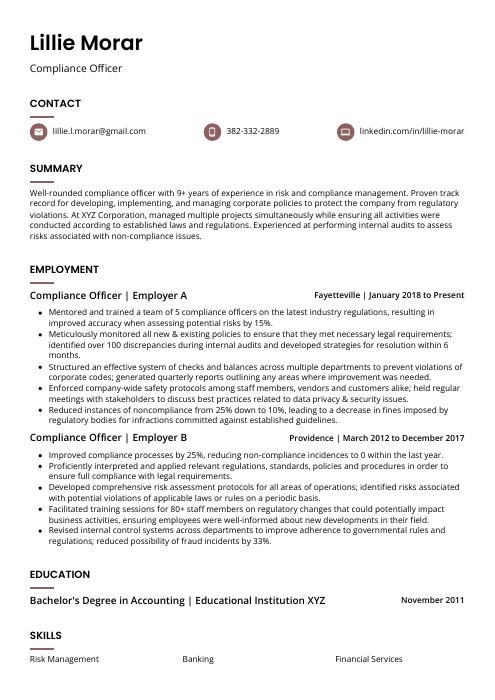

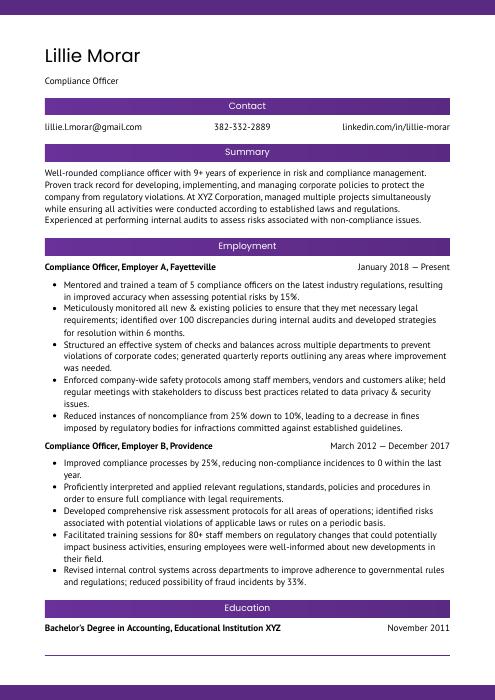

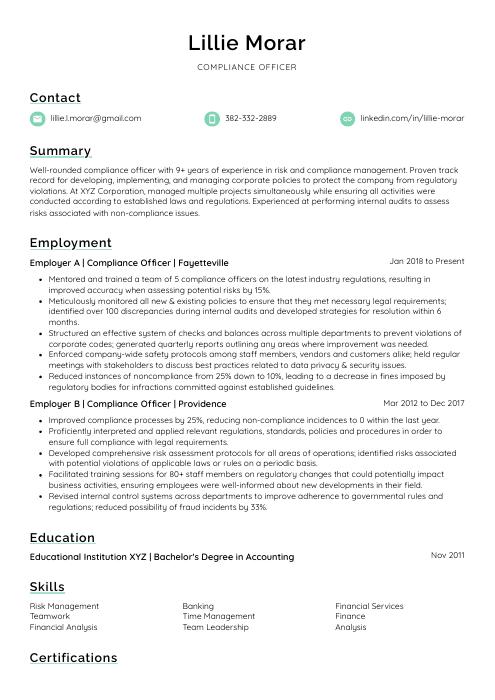

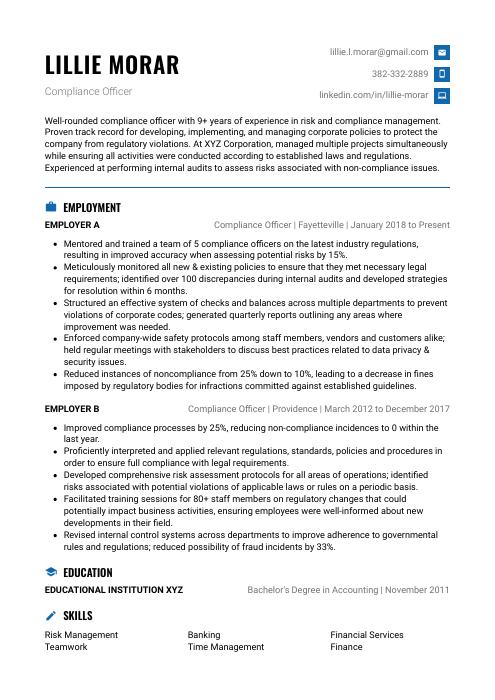

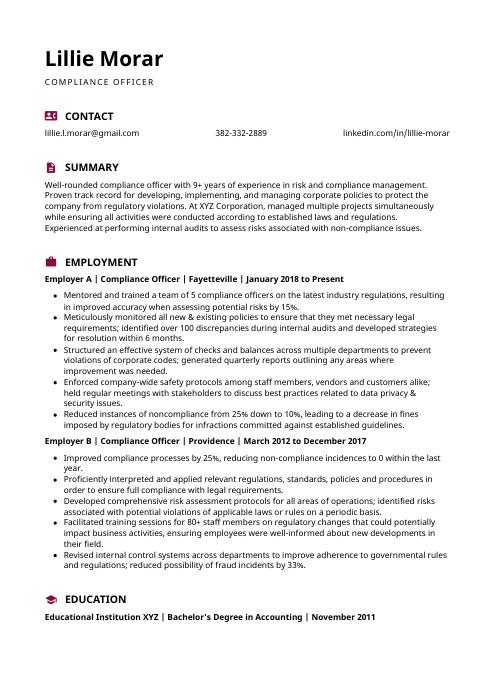

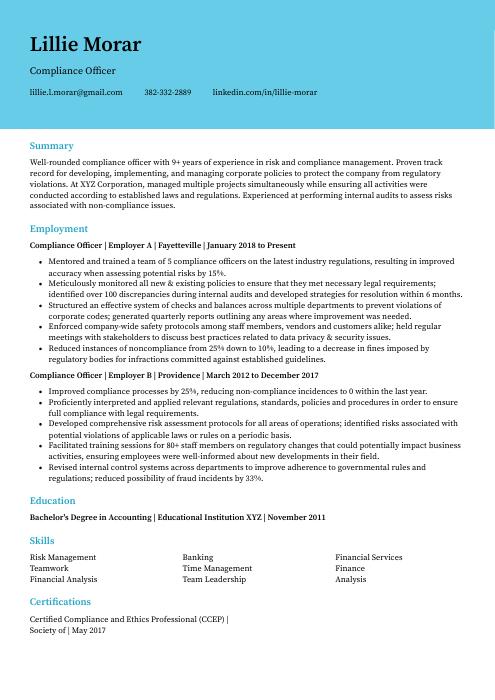

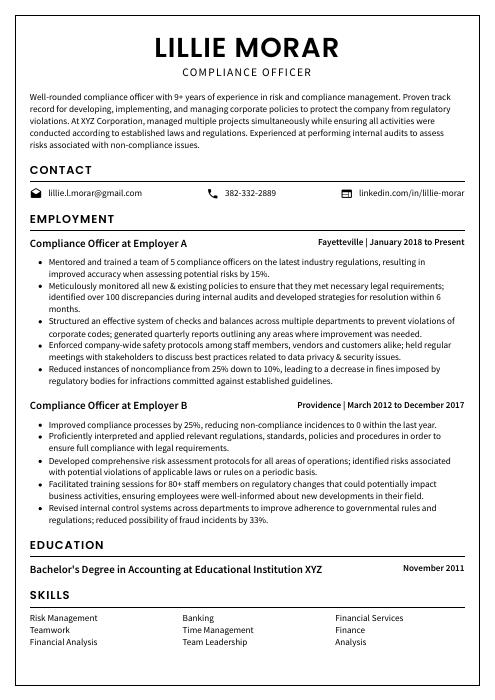

Compliance Officer Resume Sample

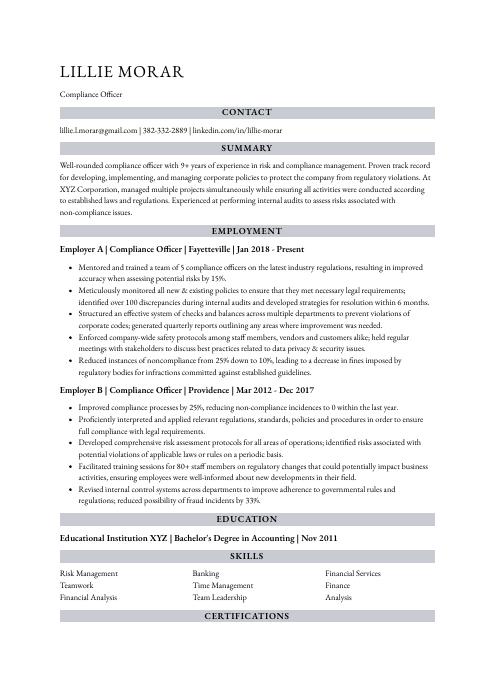

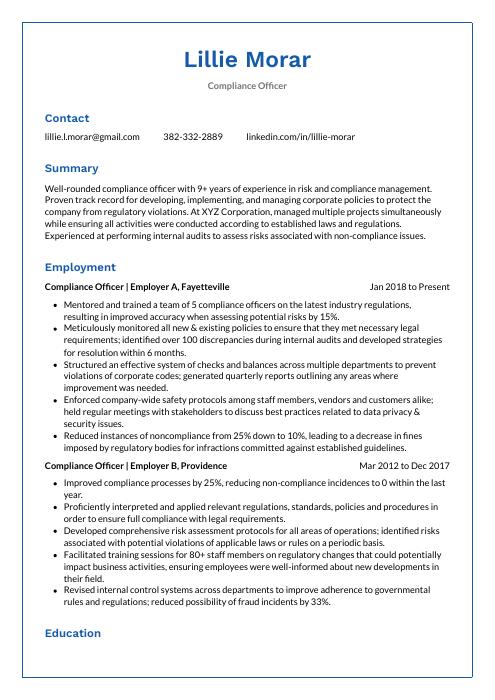

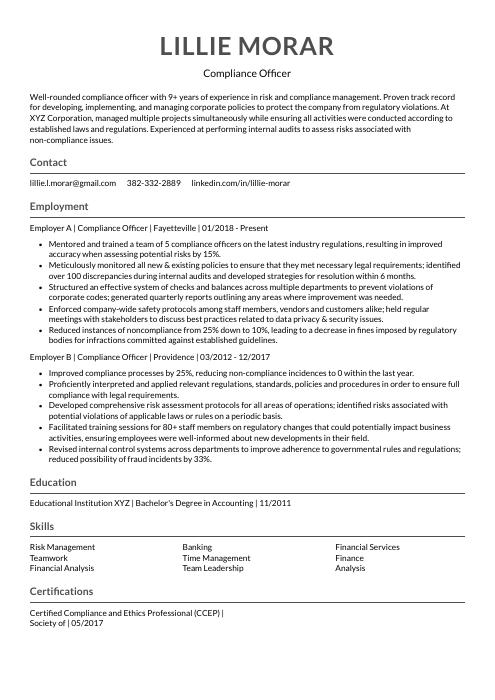

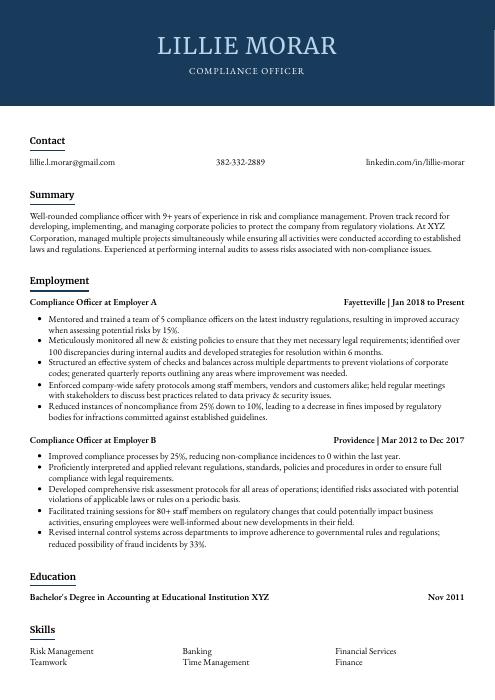

Lillie Morar

Compliance Officer

[email protected]

382-332-2889

linkedin.com/in/lillie-morar

Summary

Well-rounded compliance officer with 9+ years of experience in risk and compliance management. Proven track record for developing, implementing, and managing corporate policies to protect the company from regulatory violations. At XYZ Corporation, managed multiple projects simultaneously while ensuring all activities were conducted according to established laws and regulations. Experienced at performing internal audits to assess risks associated with non-compliance issues.

Experience

Compliance Officer, Employer A

Fayetteville, Jan 2018 – Present

- Mentored and trained a team of 5 compliance officers on the latest industry regulations, resulting in improved accuracy when assessing potential risks by 15%.

- Meticulously monitored all new & existing policies to ensure that they met necessary legal requirements; identified over 100 discrepancies during internal audits and developed strategies for resolution within 6 months.

- Structured an effective system of checks and balances across multiple departments to prevent violations of corporate codes; generated quarterly reports outlining any areas where improvement was needed.

- Enforced company-wide safety protocols among staff members, vendors and customers alike; held regular meetings with stakeholders to discuss best practices related to data privacy & security issues.

- Reduced instances of noncompliance from 25% down to 10%, leading to a decrease in fines imposed by regulatory bodies for infractions committed against established guidelines.

Compliance Officer, Employer B

Providence, Mar 2012 – Dec 2017

- Improved compliance processes by 25%, reducing non-compliance incidences to 0 within the last year.

- Proficiently interpreted and applied relevant regulations, standards, policies and procedures in order to ensure full compliance with legal requirements.

- Developed comprehensive risk assessment protocols for all areas of operations; identified risks associated with potential violations of applicable laws or rules on a periodic basis.

- Facilitated training sessions for 80+ staff members on regulatory changes that could potentially impact business activities, ensuring employees were well-informed about new developments in their field.

- Revised internal control systems across departments to improve adherence to governmental rules and regulations; reduced possibility of fraud incidents by 33%.

Skills

- Risk Management

- Banking

- Financial Services

- Teamwork

- Time Management

- Finance

- Financial Analysis

- Team Leadership

- Analysis

Education

Bachelor’s Degree in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Compliance and Ethics Professional (CCEP)

Society of

May 2017

1. Summary / Objective

A resume summary/objective for a compliance officer should highlight your ability to ensure that the organization is in line with all relevant laws and regulations. Include details such as how you have successfully implemented new policies, any awards or recognition you have received for your work, and any certifications related to regulatory compliance that you possess. This will give employers an overview of why they should consider hiring you as their next compliance officer.

Below are some resume summary examples:

Seasoned compliance officer with 8+ years of experience ensuring organizations remain compliant with relevant laws and regulations. Proven track record in developing, implementing, and maintaining compliance programs while identifying potential areas of risk or non-compliance. Seeking to join ABC Company as their next Compliance Officer where I can leverage my knowledge and expertise to help the organization stay abreast of changing industry standards.

Enthusiastic compliance officer with 8+ years of experience in financial services, banking and insurance industries. Expertise includes developing compliance policies, conducting audits and investigations, designing training programs, as well as providing guidance on regulatory requirements. Seeking to leverage these skills at ABC Company where I can implement effective strategies that promote adherence to regulations while minimizing risk exposure.

Talented compliance officer with 10+ years of experience in the finance industry. Skilled at researching, writing and implementing compliance policies to ensure regulatory adherence. Experienced in developing new processes and procedures for compliance testing and reporting, as well as providing risk assessments on potential business transactions. Adept at communicating effectively with internal stakeholders, external auditors and regulators alike.

Passionate compliance officer with 8+ years of experience ensuring a company’s regulatory compliance. Familiar with various sectors, including finance and healthcare. Skilled in creating policies and procedures that adhere to laws and regulations set by government agencies or industry organizations. Seeking an opportunity at ABC Corporation where I can leverage my expertise to ensure the highest standards are met for customer satisfaction.

Dependable compliance officer with 5+ years of experience in the financial services industry. Skilled at developing and implementing internal policies, monitoring regulatory changes, and training staff to ensure compliance with all relevant laws. At XYZ Bank, successfully implemented a risk management system that reduced audit-related issues by 70%. Passionate about helping organizations achieve success through effective legal strategies.

Committed and experienced compliance officer, with a strong background in ensuring organizations adhere to legal standards. Skilled at developing strategies for risk management, audit processes, policy implementation and enforcement of regulations. At XYZ Financial Services Inc., successfully implemented an effective system of monitoring operations that resulted in improved compliance ratings from various regulatory bodies.

Detail-oriented compliance officer with 8+ years of experience in regulatory compliance and risk management. Exceptional track record of designing, implementing, monitoring, and improving comprehensive internal controls that meet the requirements of applicable laws and regulations. Seeking to join ABC Company as a Compliance Officer to ensure ongoing compliance within its organization.

Reliable compliance officer with 5+ years of experience ensuring regulatory, ethical and legal standards are met. At XYZ Corporation, identified and resolved 11 potential non-compliance issues across six departments before they became liabilities. Looking to bring my expertise in risk management, policy enforcement, and auditing procedures to ABC Company.

2. Experience / Employment

For the experience section, you should list your employment history in reverse chronological order, with the most recent job at the top.

When writing this section, stick to bullet points primarily; doing so makes it easier for readers to take in what you have written quickly. You want to provide detail on each role and include any quantifiable results that were achieved due to your work.

For example, instead of saying “Ensured compliance,” you could say, “Developed a system for monitoring employee adherence to company policies which resulted in a 15% decrease in non-compliance incidents.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Monitored

- Enforced

- Investigated

- Audited

- Implemented

- Analyzed

- Researched

- Documented

- Evaluated

- Reported

- Advised

- Tracked

- Updated

- Ensured

Other general verbs you can use are:

- Achieved

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Effectively monitored and enforced compliance with applicable laws, regulations and industry standards; reduced safety violations by 35% over the course of 12 months.

- Demonstrated sound judgment when conducting internal audits to identify areas of non-compliance while forming recommendations for improvement; minimized financial losses due to regulatory infractions by 27%.

- Updated policies, procedures and reporting systems on a regular basis in order to reflect current legal requirements and organizational best practices within the organization’s framework.

- Assessed risk management processes regularly through data analysis techniques, identifying weaknesses in controls that could lead to potential breaches or mismanagement issues; increased accuracy of compliance reports by 40%.

- Expedited resolution timeframes for all customer complaints related to non-compliance matters within established service level agreements (SLAs); decreased customer attrition rates as a result by 20%.

- Spearheaded the development of a compliance department and created an effective risk management system that reduced violation risks by 22%.

- Compiled detailed reports on all audit findings, identified potential issues, and recommended changes to policies & procedures as needed.

- Ensured that regulatory requirements were followed accurately at all times; conducted over 150 internal audits with no non-compliance incidents reported in 2 years.

- Achieved full regulatory compliance for 6 new products within 3 months of launch; implemented necessary controls to maintain standards after initial approval was granted.

- Actively liaised with external auditors during scheduled reviews, providing relevant documentation and responding promptly to any queries raised regarding internal processes.

- Coordinated and monitored regulatory compliance activities to ensure a high level of accuracy and integrity; decreased audit findings by 34%.

- Evaluated business processes, policies and procedures for potential compliance risks and developed strategies to mitigate them.

- Consistently kept up-to-date with the latest changes in regulations through regular research on statutory laws, industry news & internal updates; identified new non-compliant areas within one month of implementation period.

- Implemented corrective action plans to address any violations or gaps in organizational policies while ensuring that they remain compliant with applicable standards such as ISO 14001 & GDPR requirements.

- Participated actively in training sessions conducted for employees regarding various aspects of legal/regulatory compliances; raised awareness about updated rules among 100+ team members per quarter resulting in improved adherence levels across all departments.

- Optimized compliance processes and procedures for a government agency, resulting in an 11% reduction of errors and costly fines.

- Advised senior leadership on changes to regulations while ensuring compliance with applicable laws; successfully implemented over 50 new policies within the organization.

- Analyzed financial statements, contracts and reports to identify discrepancies or irregularities; identified $56,000 worth of fraud that had gone unnoticed by other departments.

- Competently investigated complaints involving non-compliance matters regarding safety protocols or ethical practices; reported findings to appropriate authorities as required by law or regulation.

- Prepared comprehensive monthly reports detailing compliance issues related to licensing requirements, governmental standards and internal controls; reduced reporting timeline from 72 hours down to 48 hours per month on average.

- Reorganized the compliance department to increase efficacy, resulting in a 17% reduction of errors and violations.

- Reliably monitored regulatory changes for the organization’s industry and reported any potential conflicts or areas of non-compliance to management within 24 hours.

- Presented accurate summaries of audit results at monthly executive meetings; identified issues that required corrective action, leading to an overall improvement in regulations adherence by 25%.

- Monitored daily activities over 100 staff members across 3 different departments, ensuring that all procedures were followed correctly according to established standards; reduced instances of non-compliance by 35%.

- Streamlined document filing process through the implementation of digital record keeping system, saving 6 hours per week on paperwork management tasks while maintaining accuracy rates above 99%.

- Utilized compliance framework and best practices to successfully implement effective policies and procedures, ensuring adherence with applicable laws in a timely manner.

- Tracked changes in industry regulations, legislation updates and other legal requirements; updated internal guidelines as needed to ensure compliance with all new standards.

- Investigated potential violations of relevant rules, regulations or company policies while liaising closely with external counsels and regulatory bodies on behalf of the organization; identified issues before they escalated into major problems & reduced liabilities by 50%.

- Resourcefully implemented a process for identifying areas that need improvement regarding compliance measures & supervised the development of remediation plans accordingly; reported progress regularly to senior management team members for review & approval purposes.

- Researched state/federal statutes & precedent court decisions quickly through online databases such as Westlaw & LexisNexis to provide accurate advice on risk mitigation strategies when required within tight time frames (+30% efficiency).

- Efficiently monitored and enforced compliance with legal regulations and ethical standards, ensuring that all operations adhered to state policies; reduced violations by 15% in the past year.

- Represented the organization during regulatory agency audits, providing detailed explanations of internal processes and procedures while keeping accurate records throughout the process.

- Reported any non-compliance issues detected to management on a regular basis; conducted investigations into potential areas of risk exposure, identifying critical risks for remediation within specified deadlines.

- Documented key compliance activities such as training sessions, policy updates and audit results in order to maintain an up-to-date record system for future reference; successfully tracked over 100 changes each month without fail or delay.

- Introduced automated systems designed to improve organizational oversight capabilities while reducing manual labor associated with data entry tasks; increased efficiency by 45%.

3. Skills

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may require a compliance officer to have experience in risk management, while Organization XYZ might prioritize knowledge of anti-money laundering regulations.

It is important to tailor the skills section of your resume to each job that you are applying for because many employers use applicant tracking systems these days. These computer programs scan resumes for certain keywords before passing them on to a human.

Once listed here, you can further elaborate on your most relevant skillset by discussing it in more detail in other areas such as the summary or experience section.

Below is a list of common skills & terms:

- AML

- Analysis

- Anti Money Laundering

- Auditing

- Banking

- Change Management

- Communication

- Compliance

- Credit

- Data Analysis

- Due Diligence

- Finance

- Financial Analysis

- Financial Risk

- Financial Services

- Government

- Healthcare

- Insurance

- Internal Audit

- Investments

- Legal Research

- Legal Writing

- Loans

- Policy

- Process Improvement

- Regulatory Compliance

- Risk Assessment

- Risk Management

- Securities

- Team Leadership

- Teamwork

- Time Management

4. Education

Adding an education section to your resume will depend on how far along you are in your career. If you recently graduated and have no prior work experience, mention the education section below your resume objective. However, if you already have significant work experience to showcase, it might not be necessary to include an education section at all.

If including an education section is appropriate for the role of compliance officer that you are applying for, try mentioning courses or subjects related specifically to this field as well as any certifications or degrees earned.

Bachelor’s Degree in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are a great way to demonstrate your knowledge and proficiency in a certain field. They show potential employers that you have taken the time to invest in yourself, as well as prove that you are up-to-date on industry standards and trends.

If there is an applicable certification for the job you’re applying for, make sure it is included prominently on your resume. This will give hiring managers confidence in your abilities and help them determine if you are the right fit for their organization.

Certified Compliance and Ethics Professional (CCEP)

Society of

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Lillie Morar, this would be Lillie-Morar-resume.pdf or Lillie-Morar-resume.docx.

7. Cover Letter

Providing a cover letter when applying for a job is an essential part of the recruitment process. It’s a great way to make yourself stand out from other candidates and give hiring managers more insights about who you are as an individual.

A cover letter can include 2-4 paragraphs, which should be separate from your resume. Its purpose is to provide recruiters with additional information such as why you’re interested in the role, what makes you unique and why they should hire you. Writing one may not always be required but it will certainly increase your chances of success!

Below is an example cover letter:

Dear Randi,

I am writing to apply for the position of Compliance Officer at XYZ Corporation. As a compliance professional with more than 10 years of experience in the financial services industry, I have a deep understanding of the compliance risks and regulations that impact businesses. In my most recent role as Assistant Vice President of Regulatory Affairs at ABC Bank, I was responsible for overseeing all aspects of the bank’s compliance program, including developing and implementing policies and procedures to mitigate risk, conducting training on compliance issues, and investigating potential violations.

Through my work in regulatory affairs, I have developed strong analytical and problem-solving skills that would benefit XYZ Corporation. In particular, my experience conducting investigations has honed my ability to think critically and pay attention to detail. My investigative work has also taught me how to effectively communicate with stakeholders from various departments within an organization in order to gather information and resolve complex problems.

In addition to my experience in regulatory affairs, I have a solid understanding of banking operations due to my prior experience working as a teller and loan officer. This knowledge would be valuable in helping XYZ Corporation meet its compliance obligations under the Bank Secrecy Act (BSA) and other banking regulations.

I am confident that I can be an asset to your team and contribute positively to XYZ Corporation’s compliance program. Enclosed is my resume which provides additional details about my qualifications; I look forward to speaking with you soon so we can discuss this opportunity further. Thank you for your time & consideration.

Sincerely,

Lillie

Compliance Officer Resume Templates

Saola

Saola Pika

Pika Rhea

Rhea Ocelot

Ocelot Fossa

Fossa Jerboa

Jerboa Lorikeet

Lorikeet Echidna

Echidna Hoopoe

Hoopoe Dugong

Dugong Cormorant

Cormorant Axolotl

Axolotl Kinkajou

Kinkajou Gharial

Gharial Quokka

Quokka Numbat

Numbat Markhor

Markhor Indri

Indri Bonobo

Bonobo Rezjumei

Rezjumei