Bank Customer Service Representative Resume Guide

Bank customer service representatives are responsible for providing excellent customer service to bank customers. They handle a variety of tasks, such as assisting customers with account inquiries, processing transactions, and resolving complaints. They must be able to maintain a high level of professionalism at all times and work well under pressure.

You’re a patient and efficient customer service representative, always putting the needs of bank customers first. However, your resume is collecting dust on the shelves of human resources departments. If you want to get hired as a bank customer service representative, you need to write a resume that will make bankers take notice.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

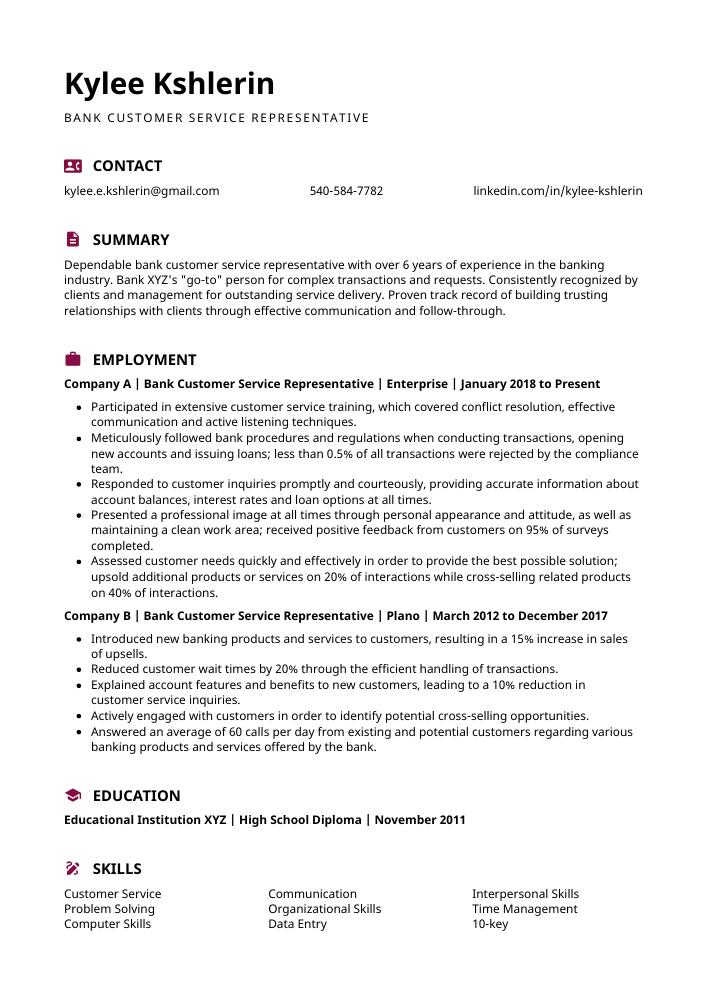

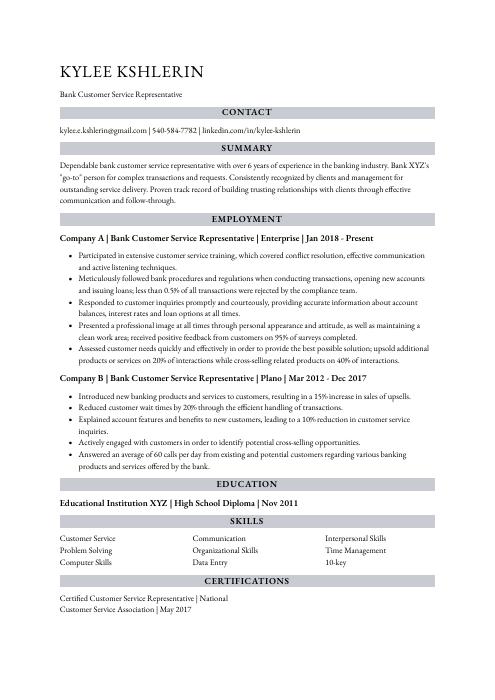

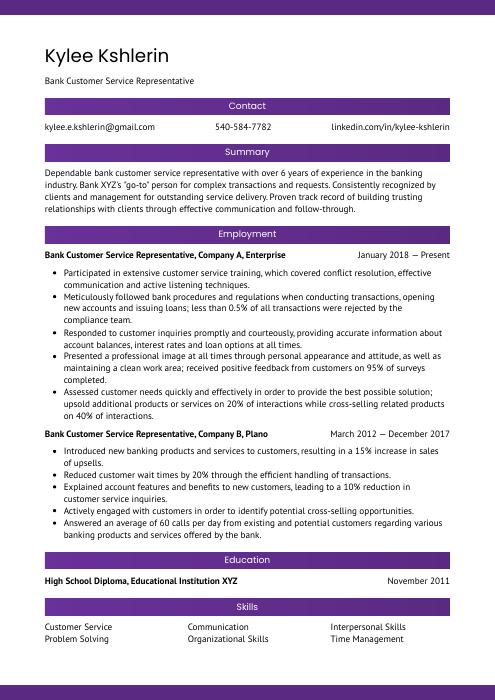

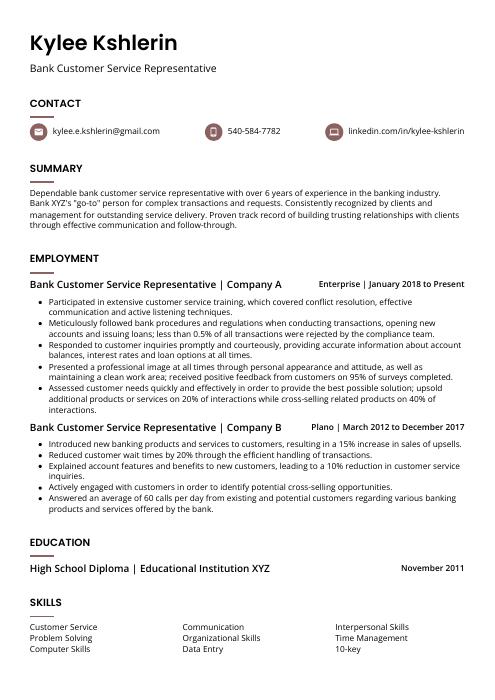

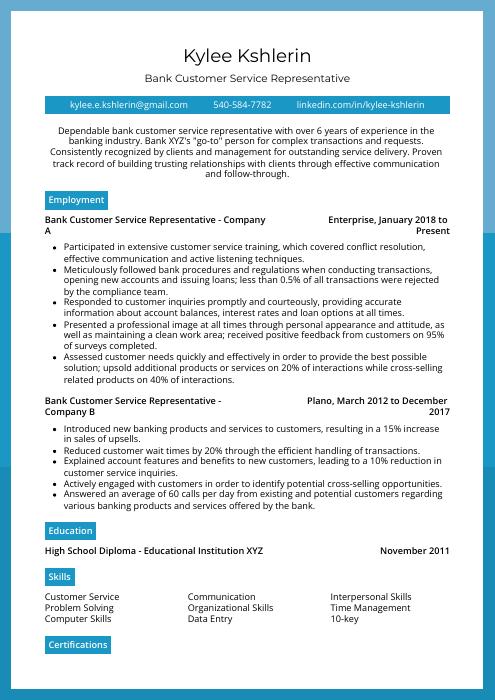

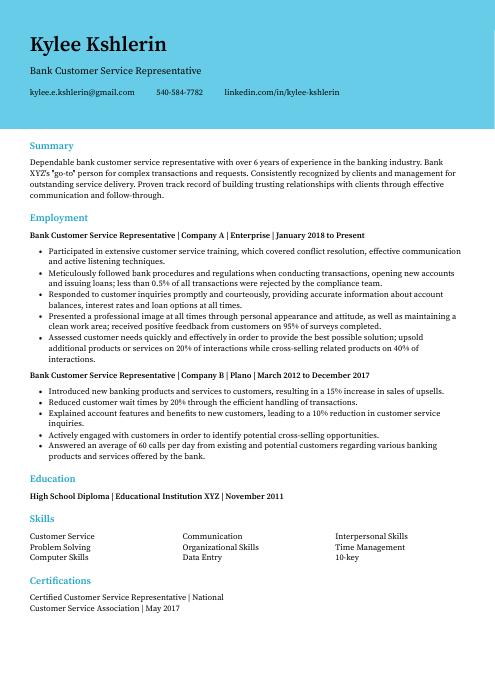

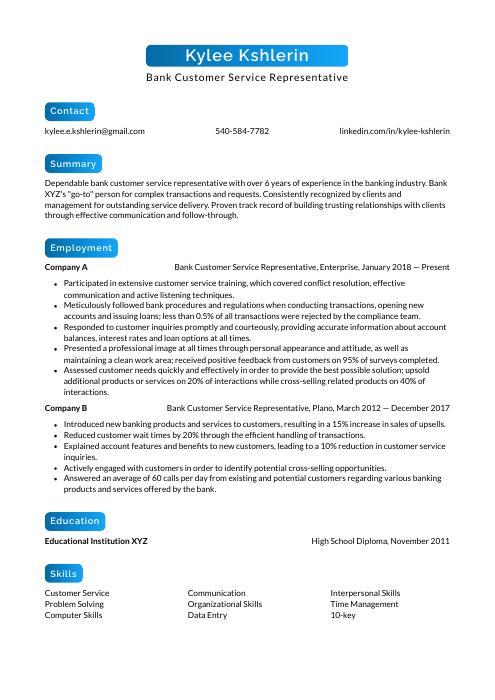

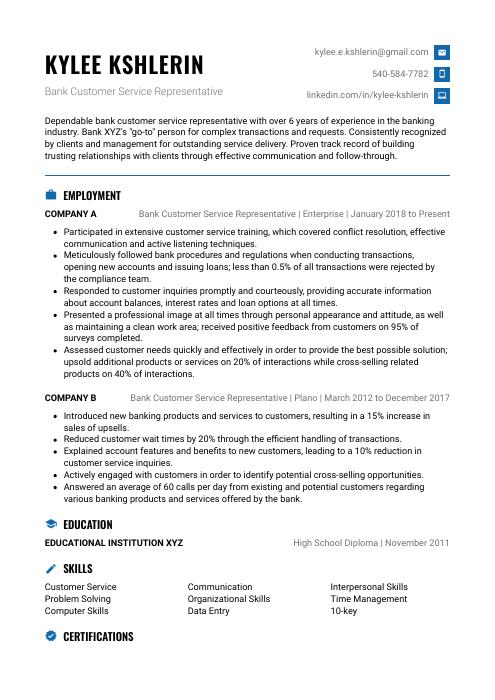

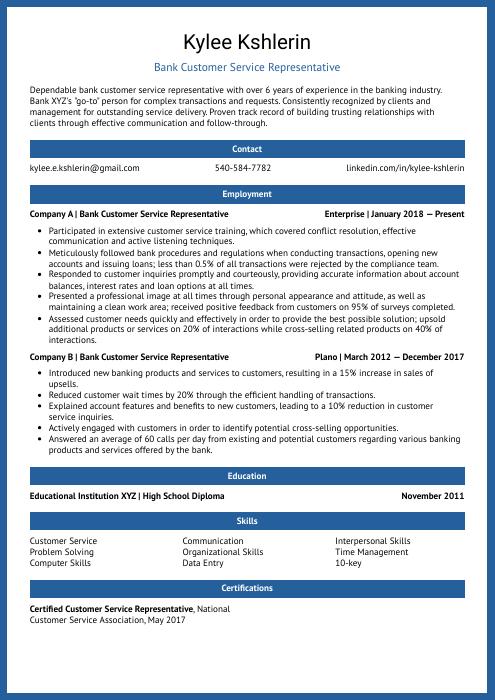

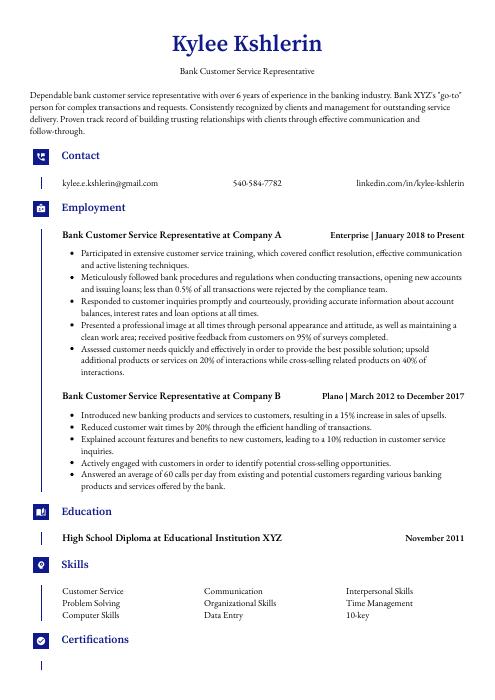

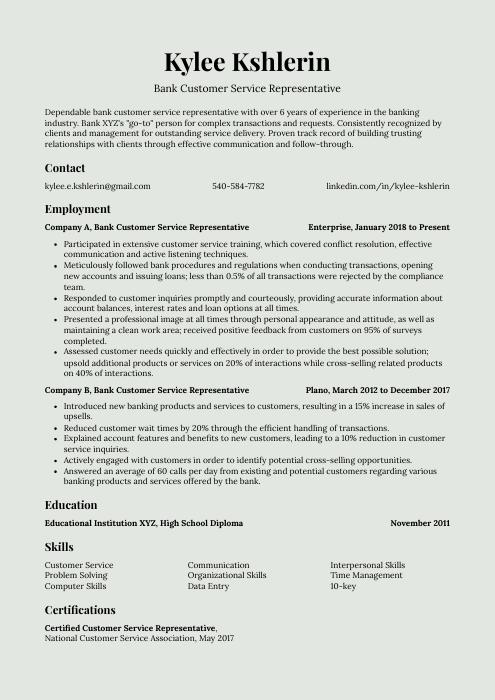

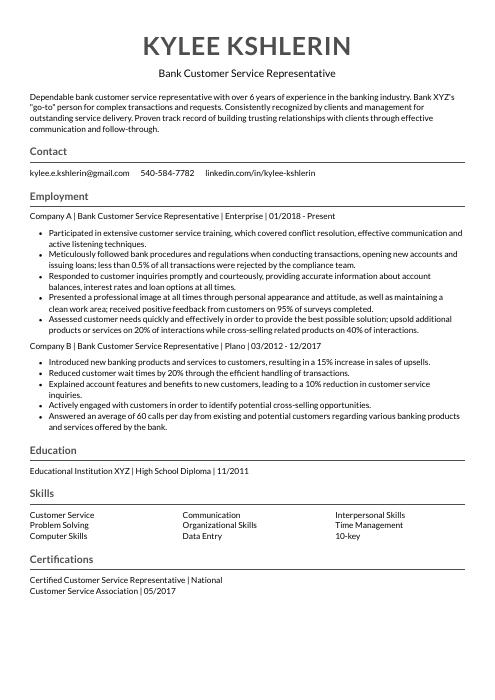

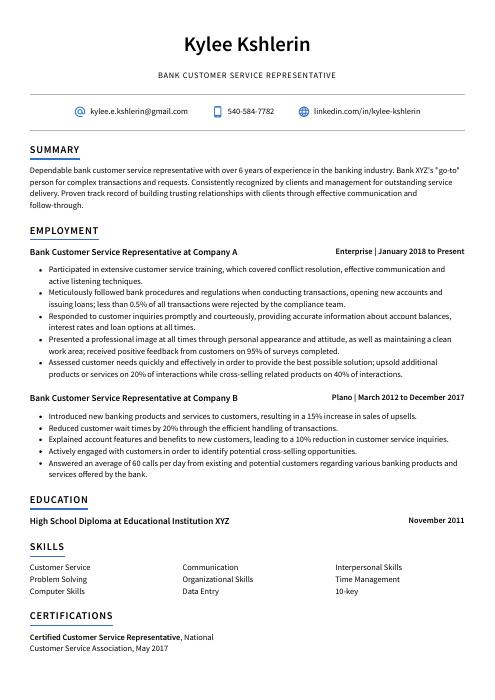

Bank Customer Service Representative Resume Sample

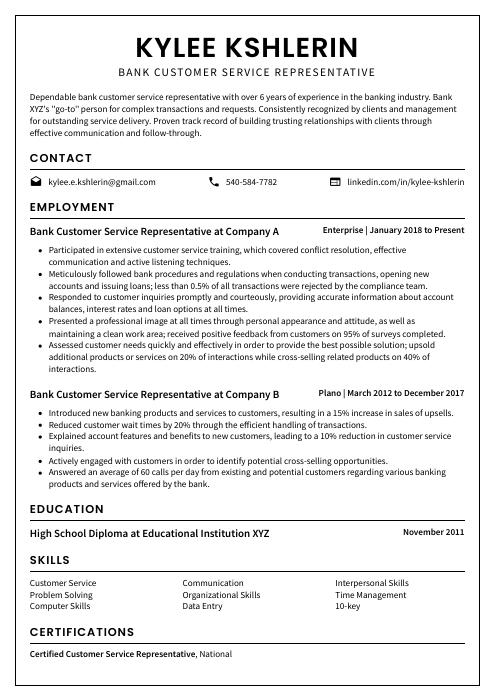

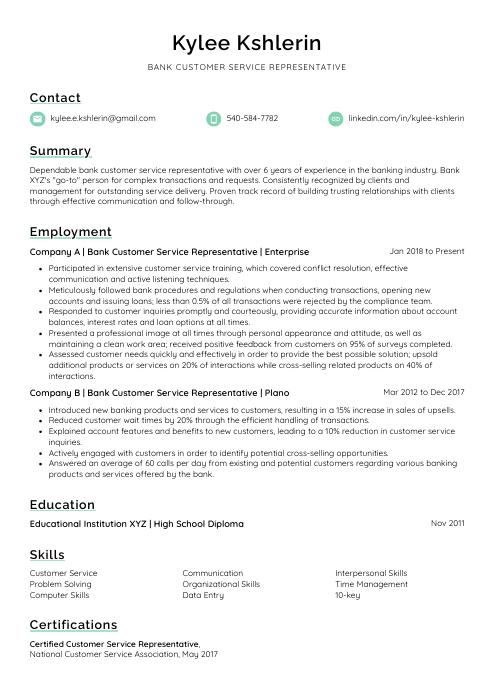

Kylee Kshlerin

Bank Customer Service Representative

[email protected]

540-584-7782

linkedin.com/in/kylee-kshlerin

Summary

Dependable bank customer service representative with over 6 years of experience in the banking industry. Bank XYZ’s “go-to” person for complex transactions and requests. Consistently recognized by clients and management for outstanding service delivery. Proven track record of building trusting relationships with clients through effective communication and follow-through.

Experience

Bank Customer Service Representative, Company ABC

Enterprise, Jan 2018 – Present

- Participated in extensive customer service training, which covered conflict resolution, effective communication and active listening techniques.

- Meticulously followed bank procedures and regulations when conducting transactions, opening new accounts and issuing loans; less than 0.5% of all transactions were rejected by the compliance team.

- Responded to customer inquiries promptly and courteously, providing accurate information about account balances, interest rates and loan options at all times.

- Presented a professional image at all times through personal appearance and attitude, as well as maintaining a clean work area; received positive feedback from customers on 95% of surveys completed.

- Assessed customer needs quickly and effectively in order to provide the best possible solution; upsold additional products or services on 20% of interactions while cross-selling related products on 40% of interactions.

Bank Customer Service Representative, Company XYZ

Plano, Mar 2012 – Dec 2017

- Introduced new banking products and services to customers, resulting in a 15% increase in sales of upsells.

- Reduced customer wait times by 20% through the efficient handling of transactions.

- Explained account features and benefits to new customers, leading to a 10% reduction in customer service inquiries.

- Actively engaged with customers in order to identify potential cross-selling opportunities.

- Answered an average of 60 calls per day from existing and potential customers regarding various banking products and services offered by the bank.

Skills

- Customer Service

- Communication

- Interpersonal Skills

- Problem Solving

- Organizational Skills

- Time Management

- Computer Skills

- Data Entry

- 10-key

Education

High School Diploma

Educational Institution XYZ

Nov 2011

Certifications

Certified Customer Service Representative

National Customer Service Association

May 2017

1. Summary / Objective

The summary or objective at the top of your resume is like a teaser – it gives the employer an outline of who you are and why you excel as a bank customer service representative.

Here, you can talk about your extensive experience in the banking industry, how you’re able to handle difficult customer inquiries with ease, and how you helped increase customer satisfaction ratings at your previous job.

Below are some resume summary examples:

Proficient bank customer service representative with more than three years of experience in the banking industry. Seeking to leverage communications and problem-solving skills to grow with ABC Bank as a teller or loan officer. At XYZ Bank, increased customer satisfaction ratings by 12% via efficient and accurate assistance with transactions, product information, and account maintenance.

Committed and driven Bank Customer Service Representative with 4+ years of experience providing 5-star service to customers. Proven ability to establish rapport, build relationships, and resolve issues in a fast-paced environment. Known for having a go-getter attitude and being a team player. Seeking an opportunity to leverage my customer service skills to contribute to the success of your organization.

Diligent and personable Bank Customer Service Representative with more than 3 years of experience in a high-volume call center environment. Committed to delivering amazing customer experiences and driving business results. In previous roles, increased customer satisfaction scores by an average of 4% each quarter. Seeking to leverage strong communication skills and drive for excellence to take the next step in my career as a Bank Customer Service Representative at ABC Bank.

Reliable bank customer service representative with over 4 years of experience providing quality service to customers. Proven ability to handle customer inquiries and complaints in a professional and courteous manner. Seeking to leverage excellent customer service skills to grow brand loyalty and satisfaction at ABC Bank.

Determined bank customer service representative with more than seven years of experience providing excellent customer service in a fast-paced environment. Committed to resolving customer inquiries efficiently and effectively. Seeking to leverage my abilities to provide outstanding customer service at ABC Bank.

Skilled and experienced Bank Customer Service Representative. 5+ years of experience in providing excellent customer service in a fast-paced, demanding environment. Outstanding people skills with a proven ability to diffusing difficult customer situations. Consistently recognized by management for meeting and exceeding performance goals. Seeking to use my skills and experience to provide outstanding customer service at ABC Bank.

Energetic bank customer service representative with 6+ years of experience in the banking industry. Seeking to leverage proven customer service and problem-solving skills to grow brand loyalty at ABC Bank. In previous roles, increased customer satisfaction by 34% via individualized attention and efficient issue resolution.

Talented customer service professional with 7+ years in the banking sector. Committed to providing excellent customer support and maintaining a high level of satisfaction among clients. Experienced in managing multiple tasks simultaneously while paying strict attention to detail. Track record of consistently meeting or exceeding performance goals set by management. Bilingual English/Spanish speaker.

Well-rounded customer service representative with 3+ years of experience in the banking industry. Excellent ability to handle customer inquiries and complaints in a professional manner. Proven track record of providing quality customer service that resulted in increased customer satisfaction by 20%. Seeking to leverage strong communication skills and problem-solving abilities to provide excellent customer service at ABC Bank.

2. Experience / Employment

In the experience section, you will detail your employment history. This should be written in reverse chronological order, which means that your most recent job will be listed first.

When writing about what you did in each role, stick to bullet points. This allows the reader to take in the information more easily. You want to provide specific details of what you did and any quantifiable results that were achieved.

For example, instead of saying “Helped customers with their banking needs,” you could say, “Assisted 50+ customers per day with a variety of banking needs such as deposits, withdrawals, and loan applications.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Answered

- Assisted

- Responded

- Helped

- Guided

- Informed

- Explained

- Resolved

- Investigated

- Coordinated

- Processed

- Entered

- Verified

- Transferred

- Escalated

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Prepared

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Effectively communicated with customers to resolve complaints and inquiries in a timely manner, maintaining a 97% satisfaction rating.

- Facilitated the transfer of $12 million between customer accounts while ensuring all security measures were met.

- Represented the bank at community outreach events, leading informational seminars on budgeting and responsible spending habits for over 500 individuals.

- Mentored new customer service representatives during their first month on the job, reducing onboarding time by 30%.

- Reorganized the customer service department to increase efficiency, resulting in a decrease in average call wait times from 12 minutes to 4 minutes.

- Investigated and resolved customer complaints regarding fraudulent activity, errors on their accounts and discrepancies with transactions; averaged 10 cases per day.

- Revised account information and updated customer profiles in the bank’s system following completed investigations; prevented future occurrences of erroneous charges or withdrawals.

- Informed customers about new products, services and promotions that the bank was offering; upsold additional features to over 30% of clients approached.

- Compiled weekly reports detailing all complaints received, resolutions provided and sales made; shared findings with upper management to help shape company-wide policies going forward.

- Diligently monitored customer accounts for any unusual or suspicious activity; took appropriate action to freeze assets and report fraud when necessary, averting loss on behalf of the bank 100% of the time.

- Expedited the resolution of over 1,500 customer complaints and inquiries per month, reducing the average call wait time by 18%.

- Coordinated the open and close of new customer accounts, processed an average of 300 account applications per week and ensured compliance with bank regulations.

- Developed a deep understanding of bank products and services through continual self-education and successfully upsold customers on higher tiered products 80% of the time.

- Verified customer identification documents against physical characteristics according to AML/KYC guidelines; identified 3 potential cases of fraud before they resulted in losses for the bank.

- Proficiently operated 10+ different computer systems and software programs used by the bank to perform daily tasks such as processing transactions, updating account records and generating reports.

- Resolved customer complaints and inquiries in a timely and professional manner, resulting in a 96% satisfaction rating.

- Formulated creative solutions to customer service issues, saving the bank an average of $450 per month in operational costs.

- Structured new customer onboarding processes that reduced training time by 20%.

- Successfully completed all required compliance training modules within the first week of starting employment.

- Utilized excellent written and verbal communication skills to provide clear and concise explanations of banking products and services to customers on a daily basis.

- Confidently handled customer inquiries and resolved complaints in a professional manner, defusing angry or upset customers on over 50% of calls.

- Demonstrated strong upselling skills by convincing 20% of customers to open new accounts or sign up for additional services.

- Improved first call resolution rates by 10%, resulting in fewer escalated calls and happier customers.

- Achieved consistently high scores on monthly quality assurance audits, with an average score of 4.5 out of 5 (or 90%).

- Helped train 3 new customer service representatives, serving as a resource for them when needed and helping them to adjust to the company’s systems and procedures.

- Optimized customer satisfaction by providing efficient and accurate service, processing an average of 200 transactions per day.

- Spearheaded the development of a new customer loyalty program that increased customer retention rates by 5%.

- Reliably opened and closed the bank branch on time, ensuring that all security procedures were followed correctly.

- Prepared reports on customer feedback and made recommendations to management on ways to improve service levels.

- Transferred money between accounts, processed loan applications and issued debit/credit cards according to bank guidelines.

- Streamlined customer service procedures, resulting in a 12% increase in efficiency.

- Assisted customers with account inquiries, deposits/withdrawals, loan applications and other banking services.

- Processed an average of 30 customer transactions per hour during busy periods.

- Independently resolved customer complaints and escalated complex issues to management as necessary.

- Demonstrated outstanding people skills by diffusing tense situations and providing exceptional service that resulted in high levels of customer satisfaction (measured at 97%).

- Advised over 100 customers per day on their banking inquiries, providing exceptional service that resulted in a satisfaction rating of 95%.

- Guided customers through account openings, closures, transfers and other transactions while maintaining a high level of accuracy (99.5%).

- Entered customer data and updates into the bank’s computer system quickly and efficiently, reducing the average transaction time by 2 minutes.

- Resourcefully resolved customer complaints and concerns to their satisfaction 100% of the time; utilized excellent problem-solving skills to diffuse tense situations with irate customers.

3. Skills

Skills that are commonly required for bank customer service representatives include:

- Excellent communication, both written and verbal

- Strong customer service orientation

- Ability to deal with difficult customers in a professional manner

- Familiarity with banking products and services

If you have these skills, be sure to list them prominently in the skills section of your resume. You can further elaborate on some of them in other resume sections such as the summary or experience section.

Other common skills & terms include:

- 10-key

- Communication

- Computer Skills

- Customer Service

- Data Entry

- Interpersonal Skills

- Organizational Skills

- Problem Solving

- Time Management

- Typing

4. Education

Mentioning your education on your resume is not always necessary, but it may help you stand out from other candidates if you have recently graduated or do not have much work experience. If you decide to include an education section, mention courses and subjects that are relevant to the bank customer service representative job you are applying for. For example, “Courses included Introduction to Banking, Customer Service Fundamentals and Conflict Resolution.”

High School Diploma

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications are always impressive to see on a resume as they demonstrate that you have put in extra effort to improve your skillset.

If you are applying for a role that requires certifications, such as financial advisor or banking customer service representative, then definitely include them in this section. If the job doesn’t require any specific certifications but you have some nonetheless, feel free to list them here as well so potential employers can see your dedication to professional development.

Certified Customer Service Representative

National Customer Service Association

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Kylee Kshlerin, this would be Kylee-Kshlerin-resume.pdf or Kylee-Kshlerin-resume.docx.

7. Cover Letter

Writing a cover letter is a great way to introduce yourself and explain why you’re the best candidate for the job. They are usually made up of 2 to 4 paragraphs and provide more detail than your resume alone.

Most employers won’t require a cover letter, but it’s always worth writing one anyway. Not only does it give you an opportunity to sell yourself, but it also shows that you’re willing to go the extra mile.

Below is an example cover letter:

Dear Colten,

I am writing to apply for the position of Bank Customer Service Representative at your bank. With more than five years of customer service experience, I am confident in my ability to provide excellent service and support to your customers.

In my current role as a Customer Service Representative at [company name], I provide exceptional customer service by handling customer inquiries and complaints in a professional and efficient manner. I have also developed strong relationships with customers, which has resulted in increased customer satisfaction and loyalty. In addition, I have successfully upsold products and services to customers on numerous occasions.

I am knowledgeable about banking products and services, as well as compliance regulations related to the banking industry. In addition, I have excellent computer skills and can quickly learn new software applications if necessary. My positive attitude, strong work ethic, and ability to work independently or as part of a team make me an ideal candidate for this position.

I would be grateful for the opportunity to discuss how I could contribute to your team’s success as a Bank Customer Service Representative at [bank name]. Thank you for your time and consideration; please do not hesitate to contact me should you require any additional information about my qualifications or background.

Sincerely,

[Your name]

Bank Customer Service Representative Resume Templates

Hoopoe

Hoopoe Pika

Pika Bonobo

Bonobo Numbat

Numbat Jerboa

Jerboa Fossa

Fossa Rhea

Rhea Dugong

Dugong Kinkajou

Kinkajou Echidna

Echidna Ocelot

Ocelot Cormorant

Cormorant Lorikeet

Lorikeet Quokka

Quokka Markhor

Markhor Gharial

Gharial Saola

Saola Indri

Indri Axolotl

Axolotl Rezjumei

Rezjumei