Accounts Payable Coordinator Resume Guide

Accounts payable coordinators are responsible for managing the accounts payables of a company. They ensure that all invoices and payments to vendors, suppliers, and other creditors are accurate and processed in an efficient manner. They also monitor cash flow by tracking expenses, verifying receipt of goods or services purchased on credit, reconciling discrepancies between invoices and purchase orders as well as preparing reports related to these activities.

Your financial expertise and accounting skills are invaluable to any business. But employers won’t know who you are unless they see a resume that stands out from the crowd. Put together an impressive document so hiring managers can recognize your abilities right away.

This guide will walk you through the entire process of creating a top-notch resume. We first show you a complete example and then break down what each resume section should look like.

Table of Contents

The guide is divided into sections for your convenience. You can read it from beginning to end or use the table of contents below to jump to a specific part.

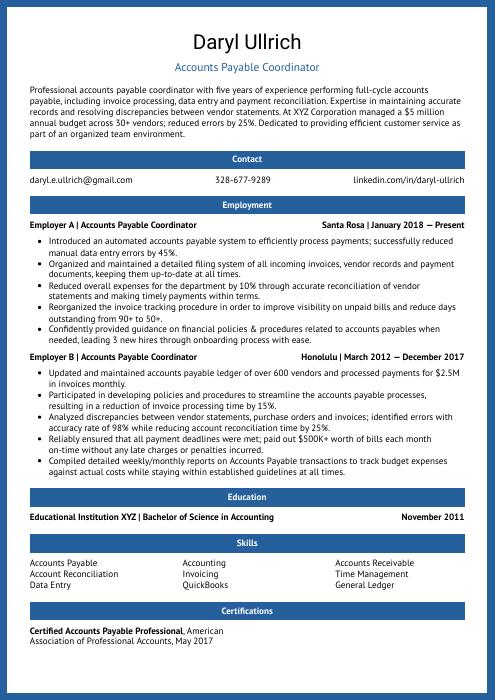

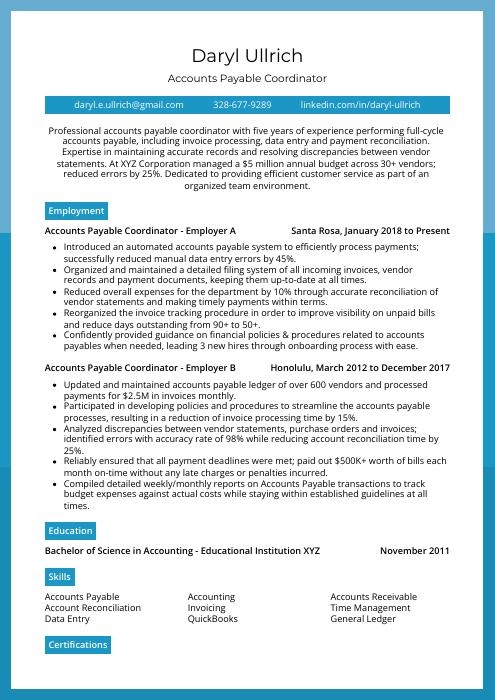

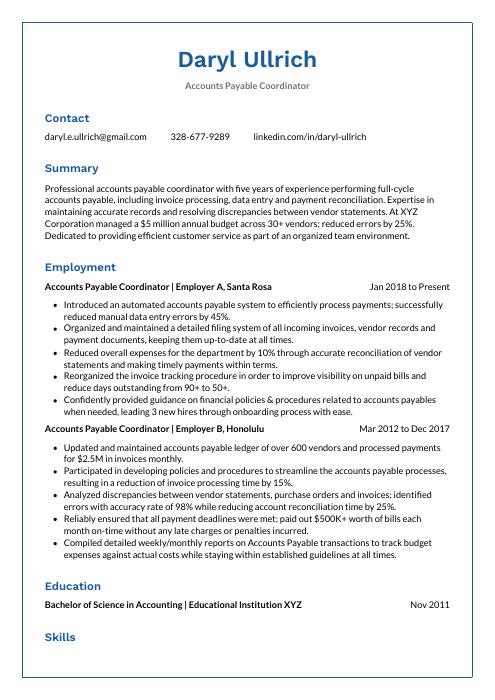

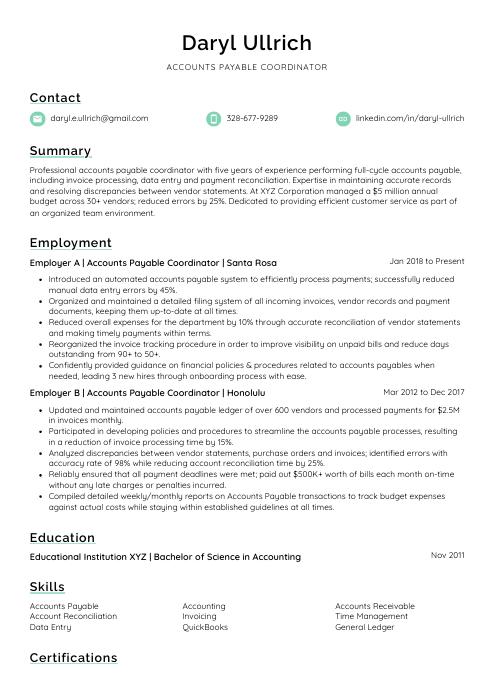

Accounts Payable Coordinator Resume Sample

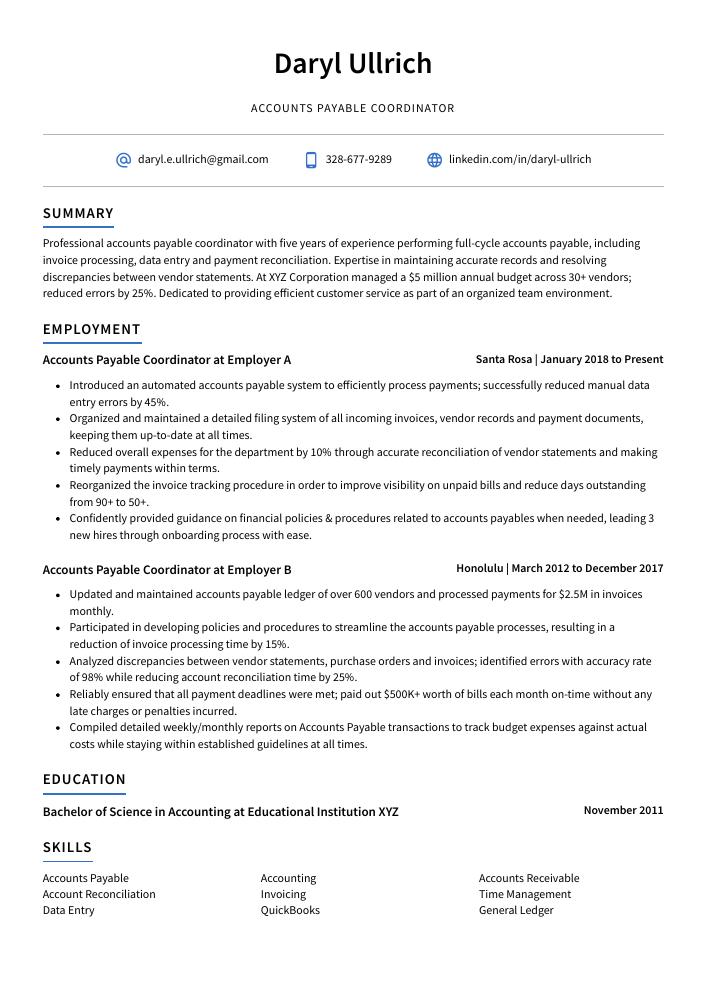

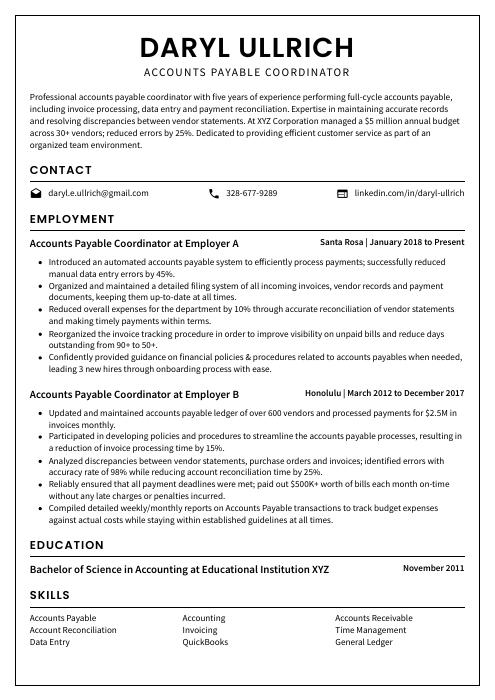

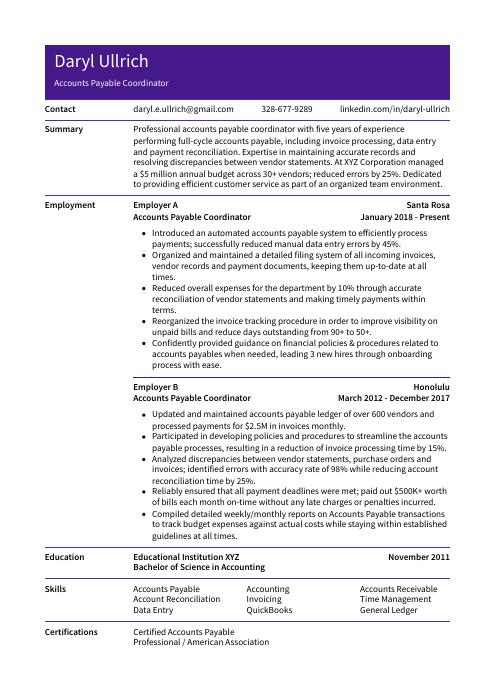

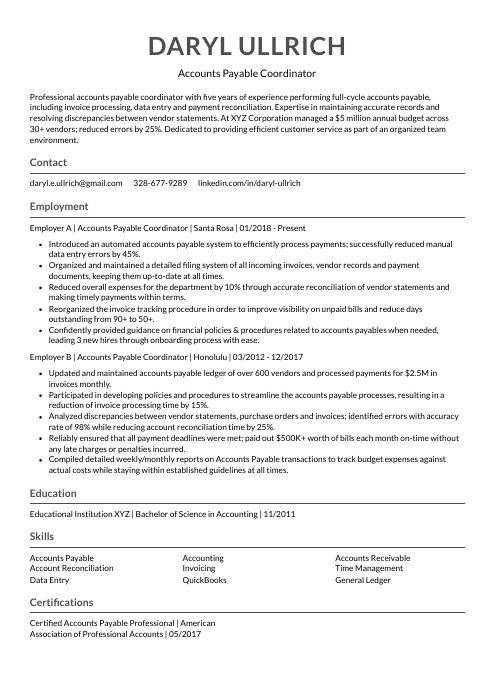

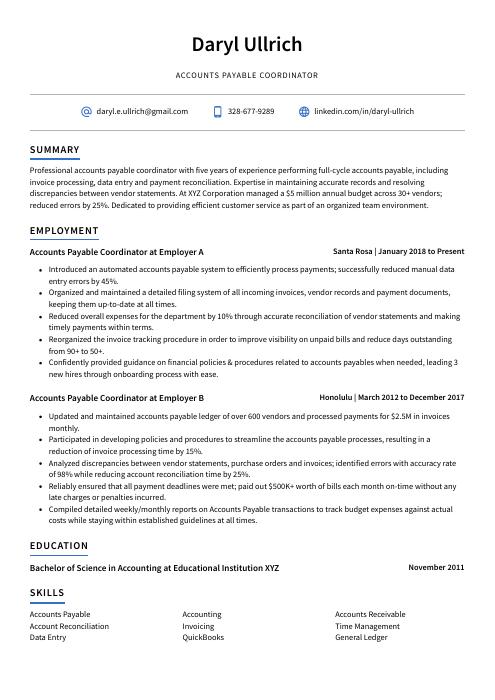

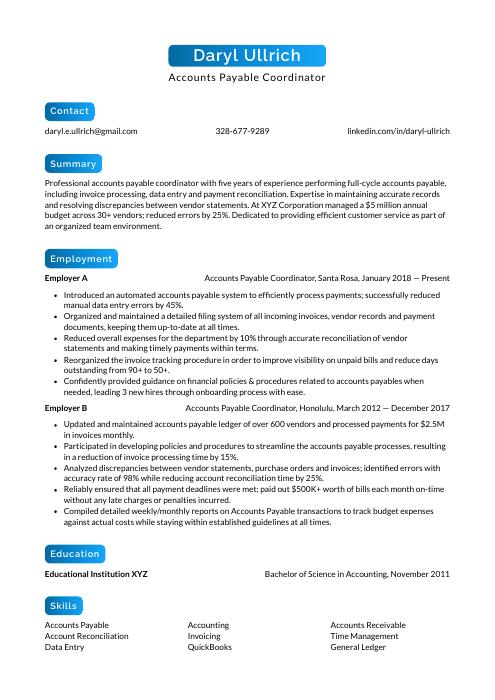

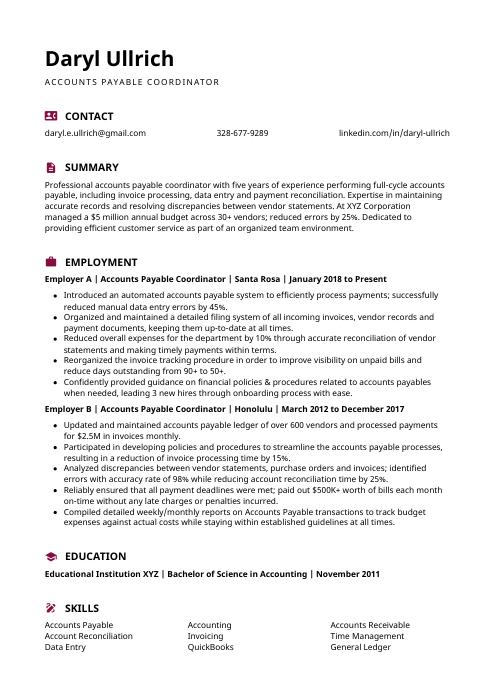

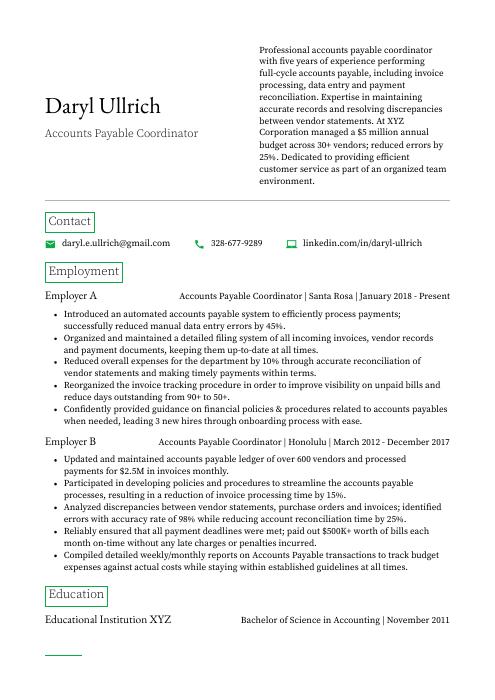

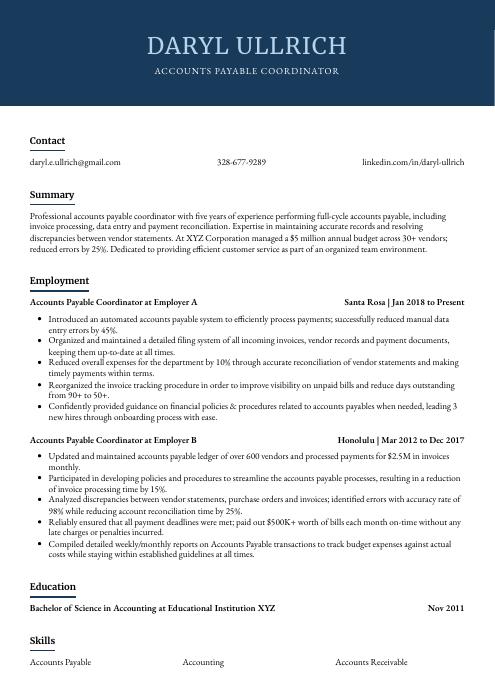

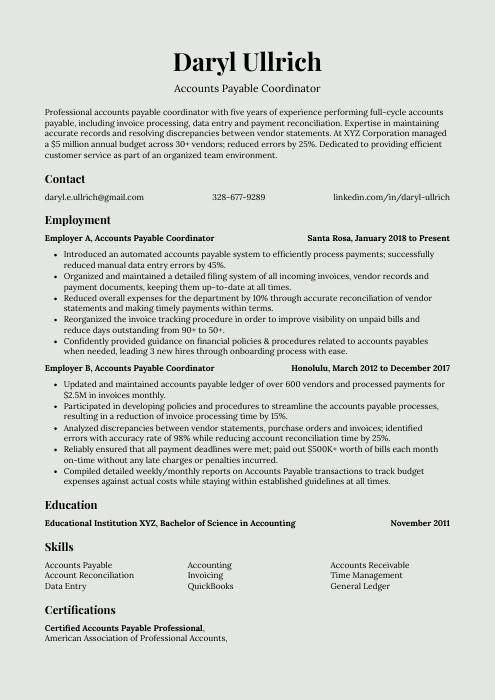

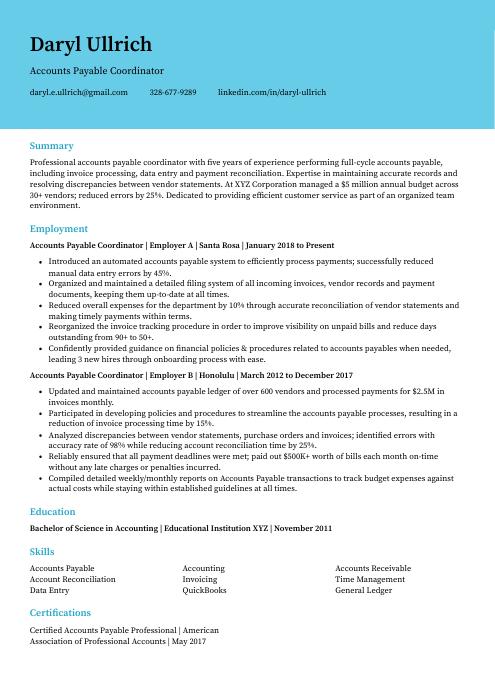

Daryl Ullrich

Accounts Payable Coordinator

[email protected]

328-677-9289

linkedin.com/in/daryl-ullrich

Summary

Professional accounts payable coordinator with five years of experience performing full-cycle accounts payable, including invoice processing, data entry and payment reconciliation. Expertise in maintaining accurate records and resolving discrepancies between vendor statements. At XYZ Corporation managed a $5 million annual budget across 30+ vendors; reduced errors by 25%. Dedicated to providing efficient customer service as part of an organized team environment.

Experience

Accounts Payable Coordinator, Employer A

Santa Rosa, Jan 2018 – Present

- Introduced an automated accounts payable system to efficiently process payments; successfully reduced manual data entry errors by 45%.

- Organized and maintained a detailed filing system of all incoming invoices, vendor records and payment documents, keeping them up-to-date at all times.

- Reduced overall expenses for the department by 10% through accurate reconciliation of vendor statements and making timely payments within terms.

- Reorganized the invoice tracking procedure in order to improve visibility on unpaid bills and reduce days outstanding from 90+ to 50+.

- Confidently provided guidance on financial policies & procedures related to accounts payables when needed, leading 3 new hires through onboarding process with ease.

Accounts Payable Coordinator, Employer B

Honolulu, Mar 2012 – Dec 2017

- Updated and maintained accounts payable ledger of over 600 vendors and processed payments for $2.5M in invoices monthly.

- Participated in developing policies and procedures to streamline the accounts payable processes, resulting in a reduction of invoice processing time by 15%.

- Analyzed discrepancies between vendor statements, purchase orders and invoices; identified errors with accuracy rate of 98% while reducing account reconciliation time by 25%.

- Reliably ensured that all payment deadlines were met; paid out $500K+ worth of bills each month on-time without any late charges or penalties incurred.

- Compiled detailed weekly/monthly reports on Accounts Payable transactions to track budget expenses against actual costs while staying within established guidelines at all times.

Skills

- Accounts Payable

- Accounting

- Accounts Receivable

- Account Reconciliation

- Invoicing

- Time Management

- Data Entry

- QuickBooks

- General Ledger

Education

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

Certifications

Certified Accounts Payable Professional

American Association of Professional Accounts

May 2017

1. Summary / Objective

Your resume summary should be a brief introduction to who you are and why you make an excellent accounts payable coordinator. In this section, highlight your experience with accounting software, the number of years in the field, any certifications or awards that demonstrate your expertise in finance and accounting principles. Also mention how well-versed you are at managing vendor relationships and resolving discrepancies quickly.

Below are some resume summary examples:

Energetic accounts payable coordinator with 5+ years of experience in financial services. Skilled at setting up accounts, verifying invoices and data entry. Successfully managed the accounts receivable process for a large company while achieving an average payment turnaround time of less than one week. Experienced in building relationships with vendors to ensure timely payments and maintain quality customer service standards.

Accomplished accounts payable coordinator with 5+ years of experience managing accounts receivable and payable for a variety of companies. Proven track record in streamlining the entire AP process, from invoice entry to payment processing. At ABC Company, improved time-to-pay by 25% while reducing costs associated with late payments by 10%. Seeking to leverage expertise at XYZ Corporation as an Accounts Payable Coordinator.

Passionate accounts payable coordinator with 7+ years of experience in payroll, accounts receivable/payable, bank reconciliation and financial reporting. Looking to join ABC Corporation as an Accounts Payable Coordinator to utilize my strong accounting skillset and knowledge of QuickBooks Enterprise Solutions. Key achievements include reducing invoice processing time by 28% while ensuring accuracy and compliance.

Seasoned accounts payable coordinator with 8+ years of experience in accounts receivable and billing. Adept at managing payments for multiple vendors, reconciling discrepancies, and keeping accurate records. At XYZ Corporation managed the accounts payable process for over 200 vendors while reducing invoice processing time by 15%. Streamlined procedures to save an estimated $30K per year in administrative costs.

Detail-oriented accounts payable coordinator with 6+ years of experience managing accounts payables and receivables in a fast-paced environment. Skilled at developing efficient processes, streamlining workflow to reduce costs, and maintaining accurate records for over 300 vendors. At XYZ Company, reduced late payment fees by 50% through implementing an automated system that improved the accuracy of payments.

Determined accounts payable coordinator with 5+ years of experience in accurate and efficient management of invoices. Expertise in maintaining vendor relations, processing payments, handling discrepancies within time constraints, and ensuring compliance to deadlines. Looking forward to leveraging my knowledge in accounts payable at ABC Company for improved financial operations.

Hard-working accounts payable coordinator with 8+ years of experience ensuring the timely and accurate payment of invoices. Highly organized, detail-oriented, and able to handle accounts totaling up to $8M per month. Achieved significant efficiency gains by streamlining invoice processing for ABC Corp., resulting in an estimated savings worth $200K annually.

Well-rounded accounts payable coordinator with 8+ years of experience in the financial services industry. Seeking to join ABC Financials, where I can utilize my expertise in accounts reconciliation and verification processes to drive successful outcomes. Proven track record includes improving payment accuracy by 48% and reducing deductions owed by 18%.

2. Experience / Employment

The employment (or experience) section is where you talk about your work history. It should be written in reverse chronological order, meaning the most recent job is listed first.

Stick to bullet points for this section; doing so allows the reader to quickly take in what you have to say. When writing out each point, make sure that it includes detail and quantifiable results if possible.

For example, instead of saying “Processed invoices,” you could say, “Accurately processed 200+ invoices per week within a 24-hour turnaround time.”

To write effective bullet points, begin with a strong verb or adverb. Industry specific verbs to use are:

- Reconciled

- Processed

- Audited

- Monitored

- Resolved

- Analyzed

- Generated

- Updated

- Scheduled

- Calculated

- Prepared

- Organized

- Reported

- Reviewed

Other general verbs you can use are:

- Achieved

- Advised

- Assessed

- Compiled

- Coordinated

- Demonstrated

- Developed

- Expedited

- Facilitated

- Formulated

- Improved

- Introduced

- Mentored

- Optimized

- Participated

- Presented

- Reduced

- Reorganized

- Represented

- Revised

- Spearheaded

- Streamlined

- Structured

- Utilized

Below are some example bullet points:

- Optimized existing accounts payable processes to improve company efficiency and reduce costs by 15%.

- Spearheaded the successful implementation of a new accounts payable system, leading to improved accuracy in payments with no discrepancies reported during audits.

- Effectively managed over 500 vendor invoices per month across multiple departments; reduced payment turnaround time from 10 days to 5 days on average.

- Revised internal controls for accounts payables to increase visibility into overall financial status and facilitate accurate budgeting decisions each quarter; saved $6,000 annually in administrative expenses as a result.

- Formulated policies and procedures for auditing supplier statements and reconciled them against invoice records every month; identified discrepancies that resulted in an additional recovery of $10,000 this year alone.

- Reported on accounts payable reconciliations and provided accurate financial updates to management weekly, resulting in 8% decrease in outstanding payments.

- Successfully managed a high-volume of vendor invoices (over 400 per month) and ensured that all transactions were documented properly according to company policies.

- Generated up to 90 timely payment checks for vendors every week with 100% accuracy; saved the company at least $4,500 annually due to reduction of late fees on overdue bills.

- Scheduled bimonthly meetings with department heads to review open purchase orders and unpaid invoices; successfully identified opportunities for cost savings amounting up $7,000 last year alone.

- Presented comprehensive analysis of cash flow statements during monthly board meetings which helped senior executives make informed decisions regarding budgeting & forecasting expenses accurately each quarter.

- Utilized accounting software to process and manage accounts payable transactions of over $2 million monthly; minimized data entry errors by 35%.

- Prepared invoices, payment requests, disbursements and other financial records with accuracy; ensured that all payments were made on time according to company policies.

- Processed vendor payables for 200+ vendors within a given month in accordance with best practices and established procedures; improved accounts receivable management by 20%.

- Streamlined the accounts payable workflow from invoice processing to payment authorization through automation tools such as SAP & QuickBooks ProAdvisor; increased efficiency by 30% while reducing costs significantly.

- Thoroughly analyzed purchase orders, vendor contracts, invoices and other documentation prior to entering into ERP systems ensuring accurate tracking of expenses against budget allocation plans resulting in an 8% reduction in operating costs annually.

- Resolved and processed over 500 accounts payable inquiries from vendors, reconciling invoices and resolving discrepancies within 48 hours.

- Structured an efficient system for processing high volumes of vendor payments to ensure timely payment of all invoices; reduced overdue payment days by 40%.

- Accurately maintained the accounts payable ledger with up-to-date information on purchase orders, invoices and payments; increased accuracy in accounting entries by 95%.

- Reviewed new supplier contracts prior to approval to identify potential issues such as hidden fees or additional costs; successfully identified $17,000 worth of cost savings opportunities over 6 months.

- Demonstrated strong attention to detail when verifying expense reports & credit card statements against actual transactions posted on the ledgers; improved expense report compliance rate by 35%.

- Audited and reconciled over 500 accounts payable transactions on a monthly basis, ensuring that all invoices and payments were accurate and up to date.

- Monitored and tracked payment deadlines for $200,000 worth of vendor contracts each month while keeping the Accounts Payable system updated with the latest changes in billing information; saved 10 hours of manual data entry every quarter.

- Expedited resolution process for any discrepancies or issues relating to vendors’ bills by liaising directly with internal stakeholders as well as external suppliers; resolved 90% of AP-related queries within 24 hours.

- Represented company at various supplier meetings, successfully negotiating cost reductions from 20+ vendors resulting in an average annual saving of $12,500 per year on supplies & services purchased from them.

- Independently managed end-to-end accounts payable operations such as receiving & coding invoice documents (including PO numbers), tracking expenses against budget forecasts and processing vendor payments within two weeks after due dates.

- Developed and implemented an effective accounts payable system to ensure timely payment of vendor invoices and bills, reducing overdue payments by 25%.

- Improved cash flow management processes through accurate reconciliation of monthly transactions for 3 separate departments; generated a net savings of $5,000 in the last financial year.

- Facilitated seamless communication between vendors and finance team regarding any discrepancies on invoices or other related documents.

- Actively monitored accounts receivable balances to identify outstanding items and resolve them within company policy guidelines; reduced customer debt levels by 10%.

- Mentored junior staff members on accounting procedures, such as coding purchase orders & processing supplier statements; achieved 95% accuracy rate in all tasks conducted during this period.

- Calculated payments due to vendors and suppliers, ensuring accuracy of purchase orders and invoices; reconciled accounts payable transactions with the general ledger for over 1,500 vendors monthly.

- Assessed discrepancies in vendor statements against internal records for payment processing & billing purposes; identified $25K+ worth of errors during spot checks that were rectified within 10 days.

- Coordinated payments to be made via check or electronic transfer on a weekly basis; reduced late payments by 50% through timely submission of all approved invoices before deadlines each month.

- Reconciled accounts receivable data from multiple sources such as daily sales reports, customer deposits & credit card batches while verifying cash balances in bank account reconciliations on a regular basis.

- Competently managed the full cycle A/P process including invoice entry into accounting software packages using ERP systems; improved efficiency by 25%.

3. Skills

Skill requirements will differ from employer to employer – this can easily be determined via the job advert. Organization ABC may require the candidate to have experience with accounts payable software such as Oracle, whereas Organization XYZ may want someone who is familiar with QuickBooks.

Therefore, you should tailor your skills section of your resume according to each job that you are applying for. This will be especially important if employers are using applicant tracking systems (ATS) – these computer programs scan resumes for certain keywords before passing them on to a human.

In addition to listing relevant qualifications here, it’s also beneficial to discuss them in more detail elsewhere in the document; this could include the summary or work experience sections.

Below is a list of common skills & terms:

- Access

- Account Management

- Account Reconciliation

- Accounting

- Accounts Payable

- Accounts Receivable

- Accruals

- Analysis

- Auditing

- Bank Reconciliation

- Bookkeeping

- Customer Satisfaction

- Data Entry

- Finance

- Financial Accounting

- Financial Analysis

- Financial Reporting

- Financial Statements

- Forecasting

- General Ledger

- Human Resources

- Invoicing

- Journal Entries

- Microsoft Outlook

- Payroll

- Process Improvement

- QuickBooks

- SAP

- Spreadsheets

- Team Leadership

- Teamwork

- Time Management

4. Education

Mentioning your education on your resume will depend on how far along you are in your career. If you just graduated and have no prior experience, include an education section below your resume objective. However, if you have been working as an accounts payable coordinator for years with plenty of different responsibilities to showcase, omitting the education section is perfectly acceptable.

If including a formal education section is necessary, try to mention courses and subjects related to the accounts payable role you are applying for.

Bachelor of Science in Accounting

Educational Institution XYZ

Nov 2011

5. Certifications

Certifications demonstrate to employers that you have the knowledge and expertise in a particular field. When applying for jobs, it is important to include any certifications or professional development courses you have taken as they can be an indication of your commitment to staying up-to-date with industry trends.

Including these credentials on your resume will help demonstrate that you are qualified for the job and could give you an edge over other applicants who do not possess such qualifications.

Certified Accounts Payable Professional

American Association of Professional Accounts

May 2017

6. Contact Info

Your name should be the first thing a reader sees when viewing your resume, so ensure its positioning is prominent. Your phone number should be written in the most commonly used format in your country/city/state, and your email address should be professional.

You can also choose to include a link to your LinkedIn profile, personal website, or other online platforms relevant to your industry.

Finally, name your resume file appropriately to help hiring managers; for Daryl Ullrich, this would be Daryl-Ullrich-resume.pdf or Daryl-Ullrich-resume.docx.

7. Cover Letter

Including a cover letter in your job application adds a personal touch. It is an opportunity to demonstrate that you have the right skills and experience for the role, as well as help you stand out from other applicants.

A typical cover letter includes 2 to 4 paragraphs of information that isn’t found in your resume. You can use it to explain why you’re applying for the position and how qualified you are for it. Even if a job listing doesn’t require one, writing a thoughtful cover letter could make all the difference when vying for a spot on their team!

Below is an example cover letter:

Dear Rod,

I am interested in the Accounts Payable Coordinator position at your company. With more than 10 years of experience in accounts payable and a proven track record of streamlining processes to increase efficiency, I am confident that I can make a positive contribution to your team.

In my current role as Accounts Payable Coordinator at [company name], I oversee all aspects of the accounts payable process for a team of five accounting professionals. I have successfully implemented new systems and procedures that have improved our overall accuracy rate by 15%. In addition, I have developed strong relationships with vendors which has resulted in more favorable payment terms and discounts.

I am highly skilled in data entry and processing invoices, and I have an excellent eye for detail. My ability to multitask and prioritize tasks is crucial in this fast-paced environment, and I am able to meet deadlines while maintaining a high level of accuracy. My interpersonal skills are also an asset as they allow me to effectively communicate with vendors and other members of the accounting team.

I believe that my skills and experience would be an asset to your organization, and I look forward to discussing how I can contribute to your team’s success. Thank you for your time, consideration, and opportunity.

Sincerely,

Daryl

Accounts Payable Coordinator Resume Templates

Cormorant

Cormorant Pika

Pika Indri

Indri Axolotl

Axolotl Jerboa

Jerboa Fossa

Fossa Gharial

Gharial Kinkajou

Kinkajou Hoopoe

Hoopoe Numbat

Numbat Echidna

Echidna Quokka

Quokka Bonobo

Bonobo Saola

Saola Dugong

Dugong Ocelot

Ocelot Rhea

Rhea Markhor

Markhor Lorikeet

Lorikeet Rezjumei

Rezjumei